COVID-19 Bulletin: May 21

May 21, 2021 • Posted in Daily BulletinHello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices were higher in mid-day trading Friday, with the WTI up 2.7% at $63.63/bbl and Brent up 2.2% at $66.57/bbl. Natural gas was down 0.5% at $2.91/MMBtu.

- The global oil market is showing signs of improvement, with demand rising to 95 million bpd and potentially increasing to 106 million bpd by 2030.

- U.S. gasoline prices are surging, prompting oil refineries to boost production.

- Iranian leaders expect U.S. sanctions to be removed as the countries approach a return to a nuclear agreement through indirect talks, potentially allowing Iran to produce and export more oil. Indian oil refiners are planning to hold back on spot crude purchases this year in anticipation of the decision.

- Qatar slashed its liquified natural gas (LNG) prices as it moves forward with a $29 billion expansion project to increase LNG exports by 50%.

- The surging price of staple crops for biofuels is complicating efforts to source more clean energy from ethanol and renewable diesel.

- Cryptocurrency investors are reopening retired fossil fuel power plants to support energy intensive mining for new coins.

- Design improvements and material technology advances have significantly improved the efficiency of wind turbine blades.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Experts are warning that the recent surge of COVID-19 infections across Asia could affect supply chains and cause inflation to rise faster than expected.

- Nissan is halting production of three vehicle models in June due to the global semiconductor chip shortage.

- Samsung Electronics could begin construction on a new $17 billion chip plant in Austin, Texas, by the third quarter of this year, with hopes it will be fully operational by 2024.

- Ford Motors announced plans to form a joint venture with one of its battery suppliers to build two new factories in North America to produce batteries for 600,000 electric vehicles per year.

- Germany’s BASF is one of several companies looking to Canada for its next electric vehicle battery plant, spurred by $6.6 billion in federal clean tech dollars meant to incentivize production.

- The Electric Vehicle Metal Index, which tracks the value of battery metals in newly registered passenger electric vehicles around the world, surged to a record in March, up 85% from February.

- Cargo ship CMA CGM Marco Polo, with the capacity to carry 16,000 20-foot containers, set a record yesterday, becoming the largest ship to ever call on the U.S. East Coast after arriving at the Port of New York and New Jersey.

- Shell New Energies is partnering with Daimler Truck to supply the company with hydrogen-refueling stations between its green hydrogen production hubs at the Port of Rotterdam in the Netherlands and in Cologne and Hamburg in Germany. The truck company plans to have zero-emission vehicles make up 60% of its sales by 2030 and 100% by 2039.

- The skyrocketing price of lumber has pushed the costs of pallets up 400%.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports primarily due to increased volume of ships and containers. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- The seven-day average of new U.S. COVID-19 infections fell to 30,300, the lowest level since mid-June of last year.

- The nation recorded 30,141 new cases on Thursday and 665 deaths. Over 279 million vaccine doses have been administered with 39% of the population fully vaccinated.

- COVID-19 caused a spike in overall U.S. deaths in 2020, reversing a 90-year trend of falling death rates.

- New research shows that COVID-19 deaths in the U.S. may be underestimated by up to 20%, with testing shortages, overwhelmed healthcare systems and a lack of familiarity with the clinical manifestations of COVID-19 leading to significant underreporting.

- The White House’s top medical adviser says that mask guidance in the U.S. needs to be “cleared up” after people wrongly interpreted the CDC’s latest guidance to mean masks are no longer needed.

- U.S. land borders with Canada and Mexico will remain closed to non-essential travel until at least June 21, U.S. and Canadian officials said.

- Two cases of a highly infectious COVID-19 variant first discovered in India have been detected in Dallas.

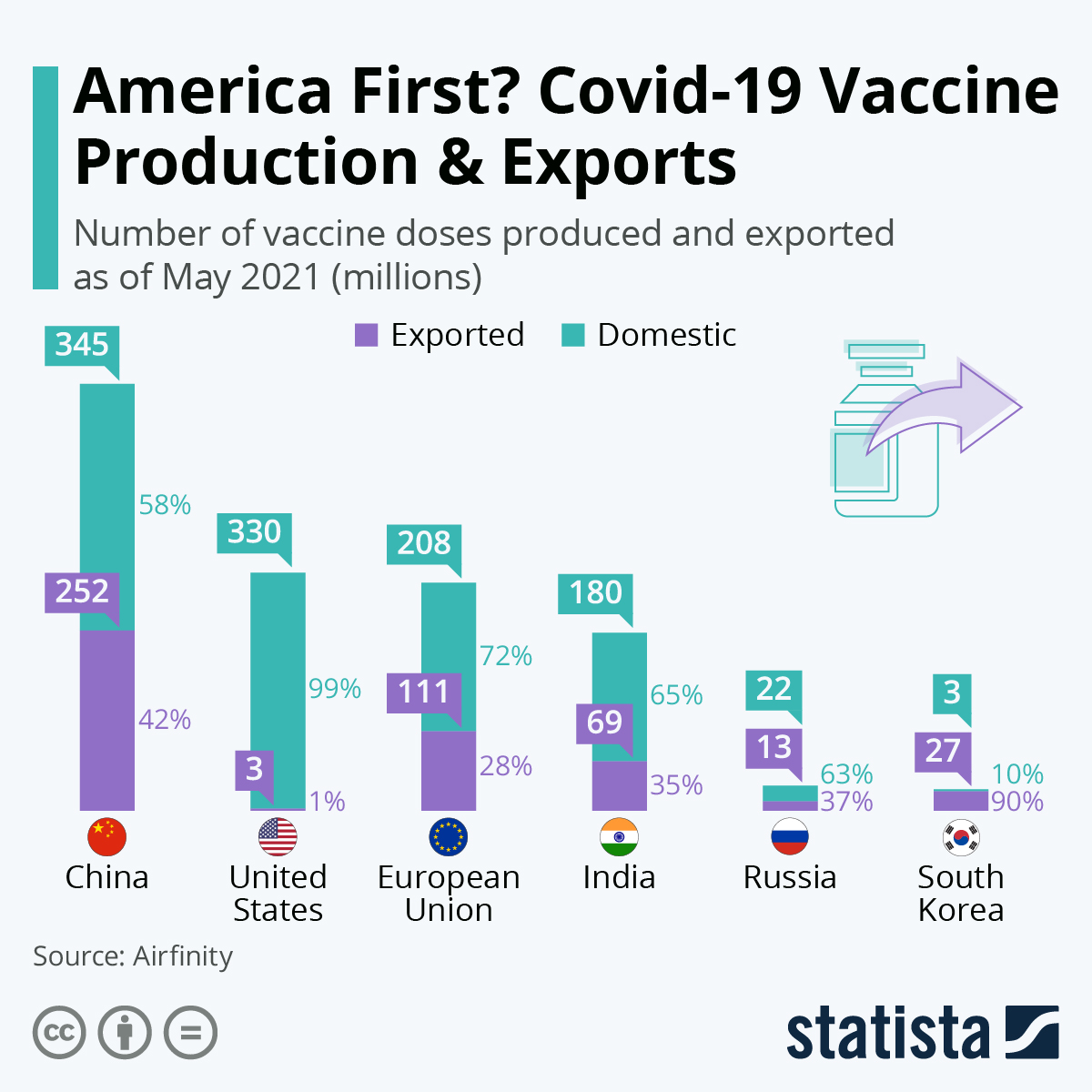

- Moderna has begun exporting some if its COVID-19 vaccine doses from the U.S. to other countries, part of the country’s recent plan to share additional doses of its shots abroad. The U.S. also sent 1.2 million COVID-19 vaccine doses to Mexico yesterday.

- Oregon’s lifting of its mask mandate comes with a caveat: businesses, workplaces and houses of worship must verify people’s vaccination status before they enter buildings without a mask, the first state to make such a requirement.

- Iowa’s governor signed a law banning local governments and schools from setting mask mandates.

- Maine will end most of its indoor mask mandate starting Monday.

- Maryland and New York announced special lotteries to encourage reluctant citizens to get vaccinated, following in the footsteps of Ohio, which saw a 28% jump in vaccinations after establishing a vaccination drawing.

- New research published in the New England Journal of Medicine shows that COVID-19 vaccines are offering significant protection to nursing home residents, with only 0.3% contracting the virus after receiving a second dose.

- It could still be many months before researchers determine how long immunity from COVID-19 lasts following the vaccine.

- The U.S. Treasury Secretary proposed a 15% global minimum income tax for corporations.

- A new poll suggests two-thirds of Americans would prefer continuing to receive some of their healthcare remotely, as lawmakers push to extend telehealth emergency measures implemented during the pandemic.

- The surging U.S. housing market has left many Americans unable to afford a home, with the Case-Shiller U.S. National Home Price NSA Index reporting a 12% annual gain in February. The market is prompting homebuilders to suppress orders and move away from fixed prices, saying they are overwhelmed by labor shortages and rising construction costs.

- Private jet company Wheels Up increased its membership by 56%, with the company reporting a 68% jump in revenue in the first quarter as travelers flocked to private planes to avoid the health risks of commercial flying.

- Hand sanitizers, a prized commodity a year ago, are now clogging store shelves, forcing retailers to offer promotions.

- The U.S. was in the top 10 for countries with the most amount of plastic waste per capita and second for single-use plastics production, according to a new report from the nonprofit Minderoo Foundation.

International

- India reported 259,591 new COVID-19 cases Friday alongside 4,209 virus deaths.

- Health experts fear that India’s ban on exporting COVID-19 vaccines could bring the pandemic back to uncontrollable levels in other parts of the world and are calling on wealthier countries to share their doses.

- The country’s health authorities are urging states to declare a rare COVID-related “black fungus” infection an epidemic as cases of the condition rise to the thousands, potentially due to steroids used to treat virus patients.

- Indian drug vial maker Schott Kaisha is expecting vial sales to more than triple as vaccine production continues.

- Pfizer/BioNTech’s COVID-19 vaccine could be up to 75% effective against the highly infectious Indian strain of the virus, while Moderna’s vaccine has also been shown to be highly effective.

- Brazil reported its first case of the COVID-19 variant first found in India.

- After recording only 1,290 COVID-19 cases and 12 deaths during the entire pandemic, Taiwan saw an alarming rise in cases last week, averaging between 200-350 new infections per day amid tighter restrictions.

- Europe has recorded a 60% drop in COVID-19 infections over the past month.

- The U.K. reported 2,874 new COVID-19 cases in one day, its highest number since April 19.

- EU negotiators reached an agreement on a free, digital COVID-19 vaccine certificate that will permit travelers to enter member states without quarantining, while the G-7 nations plan to meet next month to discuss setting up a framework for global vaccine certificates.

- New public health data from the U.K. show that two doses of AstraZeneca’s COVID-19 vaccine is up to 90% effective against symptomatic disease.

- Turkey has reached a deal with Pfizer/BioNtech for an additional 60 million doses of COVID-19 vaccines, with the country ambitiously aiming for herd immunity by August.

- A Brazilian pharmaceutical company has produced its first batch of Russia’s Sputnik V COVID-19 vaccine, with plans to export the doses to other countries in South America since it has not yet been approved domestically.

- Japan’s vaccine rollout will quicken following approval of shots from Moderna and AstraZeneca.

- Paris’s Eiffel Tower will reopen July 16 following several months of pandemic-induced closure.

- Globally, countries that primarily use mRNA vaccines such as Pfizer/BioNTech and Moderna are showing greater impacts on reducing virus spread than countries using traditional viral vector shots.

- Consumer confidence in the U.K. is at a pandemic high this month. Retail sales in the country in April jumped 9.2% over March’s level.

- Honda announced plans to have at least four new electric motorcycles and scooters on the market by 2024, alongside a swappable electric bike battery for other electric vehicle models from Yamaha, Suzuki and Kawasaki.

- Turkey’s import ban on plastic waste will take effect in 45 days as the nation seeks to make good on its goal of zero waste importation.

Our Operations

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.