COVID-19 Bulletin: November 23

November 23, 2021 • Posted in Daily BulletinMore news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose Monday from recent losses, despite reports that the world’s largest economies could announce a coordinated release of strategic crude reserves as soon as today.

- This morning, the U.S. said it will release 50 million barrels of crude from its strategic energy reserve, joining China, India, Japan, South Korea and the U.K. in releasing stockpiles. OPEC+ also is considering a production boost, delegates say.

- Energy futures rose on the news in recognition that the 50-million barrel release amounts to only two-and-a-half days of consumption. In late morning trading, WTI was up 1.6% at $78.00/bbl and Brent was 2.2% higher at $81.44/bbl. U.S. natural gas was 4.6% higher at $5.01/MMBtu.

- Record wholesale energy prices forced Bulb, Britain’s seventh largest supplier, to enter “special administration” status that will support the firm with taxpayer dollars while alternative providers can be found for its estimated 1.7 million customers. Two other British energy suppliers ceased trading last week, forcing their 35,500 domestic consumers under an emergency “Supplier of Last Resort” policy.

- With high gas prices prompting more European power producers to burn coal for electricity, the benchmark price for the bloc’s carbon permits hit a record $79.79 per tonne Monday.

- Saudi Arabia remained China’s top oil supplier in October for the 11th month in a row, with exports up nearly 20% from the same time last year.

- Indian multinational conglomerate Reliance Industries scrapped plans to sell a 20% stake in its oil-to-chemicals business to Saudi Aramco for $15 billion.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Heavy snowfall in the Pacific Northwest is expected to last throughout the week, disrupting trucking operations in the U.S. Northwest and British Columbia, Canada.

- Canada’s Port of Vancouver will resume operations under the direction of an emergency advisory group after severe weather disrupted much of the region’s logistics last week. Rail service to the port could restart as soon as today as workers scramble to repair flood-damaged lines, while some nearby highways have reopened. The congestion pushed up lumber prices 44% the past week.

- Southern California port volumes totaled 852,287 TEUs in October, down 6% from the same time last year while still on track for a yearly record.

- Hong Kong’s Cathay Pacific Airways could follow FedEx in moving some pilots off the island due to extremely strict COVID-19 quarantine rules that threaten the airline’s cargo operations.

- John Deere expects its recently ended month-long employee strike to slash production up to 15% over the next two quarters.

- Home products maker Tupperware will idle several factories due to lower-than-expected demand that has bloated inventory levels.

- The National Retail Federation predicts U.S. holiday sales will rise 10.5% this year to a record, outpacing last year’s 8.2% increase over 2019.

- Several of the largest U.S. retailers will close on Thanksgiving this year, extending a pandemic-initiated practice that could help retain labor, limit the spread of COVID-19 and boost e-commerce sales.

- BMW is expanding its South Carolina operations with the construction of a $100 million logistics center next to a nearby manufacturing site, set to open in mid-2022.

- Volkswagen is requiring vaccinated workers in Spain to sit separately from unvaccinated workers, a bid to avoid service disruptions caused by preventable spreading of COVID-19.

- Samsung is expected to announce plans later today for a $17 billion advanced chip-making plant in Taylor, Texas, to go live at the end of 2024.

- The value of South Korean exports rose 27.6% in November on surging orders for semiconductor chips, while the value of imports surged 41.9% on higher prices for crude oil and gas.

- CMA CGM’s third-quarter revenue more than doubled from last year to $12.5 billion despite slightly lower shipping volumes. The French line expanded capacity 5.9% annually in September with the addition of 62 ships and eight airplanes.

- MSC announced the purchase of two more 5,000-teu vessels yesterday, bringing its total order book since last August to 120 containerships.

- DHL has placed its single largest order for nine Boeing converted freighters to expand long-haul air cargo capacity and meet a surge in demand.

- Maersk has issued $566 million in green bonds, an industry first, to finance a series of eight large containerships capable of operating on carbon-neutral methanol by 2023.

- New Jersey’s efforts to withdraw from a bistate oversight commission on the New York and New Jersey waterfront, the busiest East Coast port, were boosted after the U.S. Supreme Court declined to hear a challenge to the move.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

Domestic Markets

- The U.S. reported 157,580 new COVID-19 infections and 1,226 virus fatalities Monday. The nation is averaging roughly 92,000 new cases per day, a 16% increase from last week, while new virus patients in at least 15 states are taking up more ICU beds than a year earlier.

- The U.S. administration indicated it would not reimpose pandemic lockdowns despite rising COVID-19 cases across the nation.

- Michigan now accounts for roughly 10% of all new COVID-19 cases in the U.S.

- COVID-19 cases in New York rose 28% week over week, while the state’s virus positivity rate hit its highest level since April. Beginning Tuesday, Erie County, New York, is reimposing a mask mandate for indoor public spaces for all residents over two years old.

- Florida reported its first weekly increase in COVID-19 cases since August, as companies in the state grapple with whether to impose vaccine mandates amid starkly contrasting orders from the state and federal government.

- Children aged 5 to 9 had the highest per-capita rate of new COVID-19 infections in Massachusetts the past two weeks.

- COVID-19 hospitalizations in Maine are at their highest of the pandemic, as officials consider mandating vaccines for public school students. A majority of the state’s vaccine doses administered Sunday were booster shots, data shows.

- Idaho hospitals have mostly ended rationing care following a recent decline in COVID-19 infections.

- Pfizer’s COVID-19 vaccine was 100% effective in children aged 12 to 15 four months after they received a second dose, new data shows.

- Children as young as six months old could be eligible to get a COVID-19 vaccine by spring of 2022, the White House said.

- Roughly 17% of all U.S. adults have received a COVID-19 booster dose, new data shows.

- More than 95% of the U.S.’s 3.5 million federal workers received at least one COVID-19 vaccine dose by the White House’s Sunday deadline.

- At least 10,000 active-duty marines have yet to be vaccinated against COVID-19 ahead of a Nov. 28 deadline, the worst compliance rate in the U.S. Armed Forces.

- Roughly 1 in 6 Rhode Island households are facing food insecurity, a number expected to increase as federal pandemic aid for low-income families begins to expire.

- Standardized test scores suggest American children have suffered a devastating loss of learning during the pandemic, a result of months of remote classes and the loss of critical in-person socialization.

- Doctors and hospitals are calling for expanded “telehealth” allowances from state governments after the practice helped patients avoid COVID-19 exposure and alleviated pressure on overtaxed healthcare workers during the pandemic.

- The White House will invest $1.5 billion in COVID-19 emergency funding to hire more healthcare workers in low-income and underserved communities.

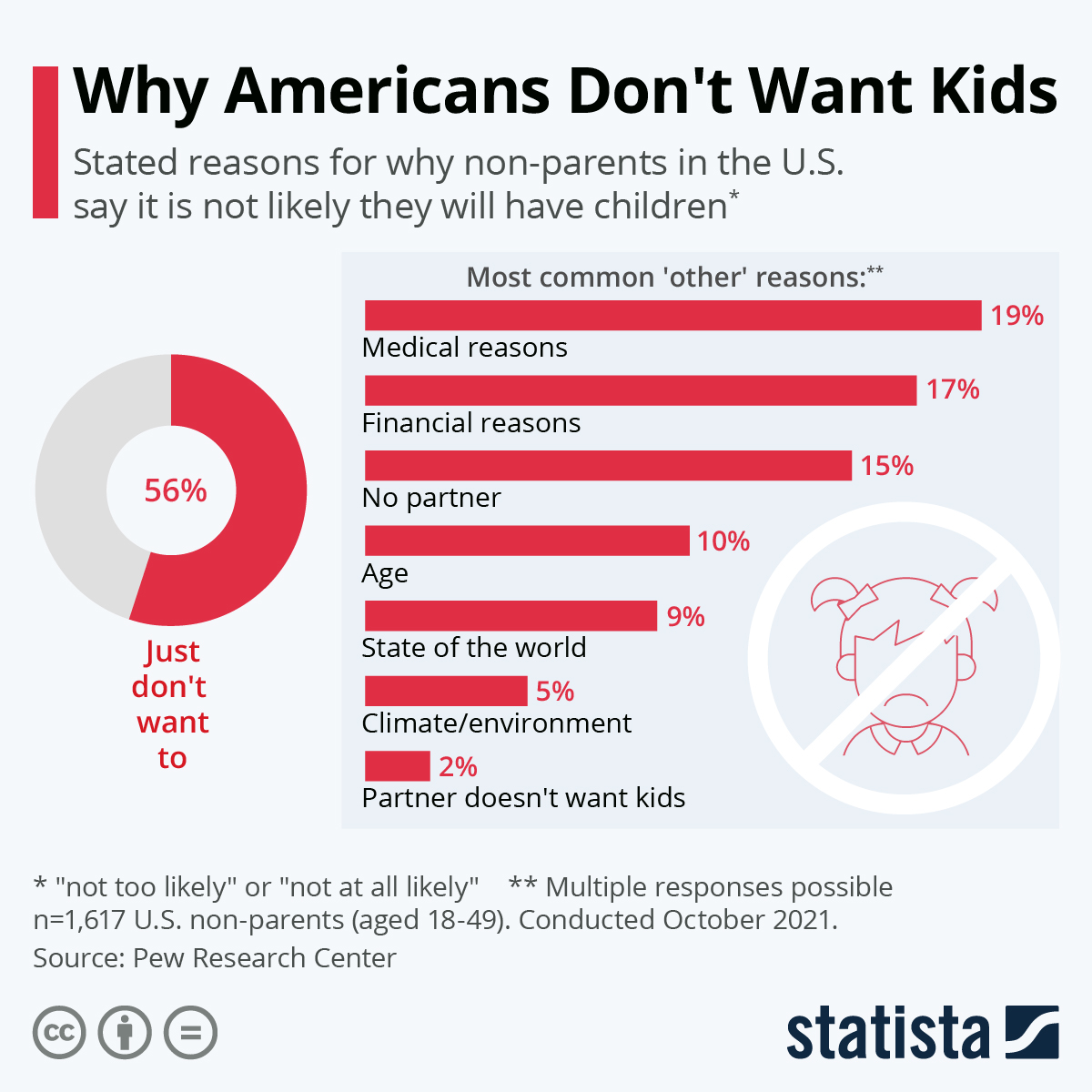

- Roughly 44% of Americans aged 18 to 49 say they will likely never have children, up from 37% in 2018, corroborating recent data showing a significant drop in birth rates during the pandemic.

- U.S. existing home sales rose 0.8% in October to an annual rate of 6.34 million units, the highest since January as the market surges toward its strongest year of sales since 2006.

- The TSA screened 2.24 million travelers last Friday, the most since the start of the pandemic, with officials expecting more than 20 million passengers during Thanksgiving compared to 26 million in 2019.

- Ford and Amazon-backed electric-vehicle maker Rivian have scrapped plans to jointly develop a new electric vehicle model, executives said.

International Markets

- Germany’s COVID-19 positivity rate set new records nearly every day for the past two weeks amid the nation’s worst-ever virus wave, with cases rising 50% week over week to more than 47,000 reported Monday. The nation’s supplies of virus test kits and vaccines are shrinking, officials say.

- France’s seven-day average of new COVID-19 cases jumped to 17,153 on Saturday, nearly double the week prior, as signs point to an emerging fifth wave.

- Greece is now barring unvaccinated people from all indoor public spaces.

- Slovakia has the world’s highest per-capita COVID-19 rate as officials consider imposing a strict, three-week lockdown.

- The EU is ramping up its regulatory process for COVID-19 boosters in a bid to limit the most recent wave of infections.

- Protests against reimposed lockdowns in Europe’s largest cities have turned violent and led to arrests in recent days.

- Kenya will require proof of COVID-19 vaccination for access to schools, public transit and most indoor public spaces.

- India reported just 7,579 new COVID-19 cases Monday, its lowest single-day count in 18 months.

- New COVID-19 cases in the financial and tech hub of Singapore dropped to their lowest in two months yesterday.

- Australia announced the first loosening of foreign travel restrictions in more than 20 months, allowing skilled workers and international students to reenter the nation starting in December.

- New Zealand is starting a new “living with COVID” strategy that will allow access to indoor public spaces even when infection counts are high, officials say.

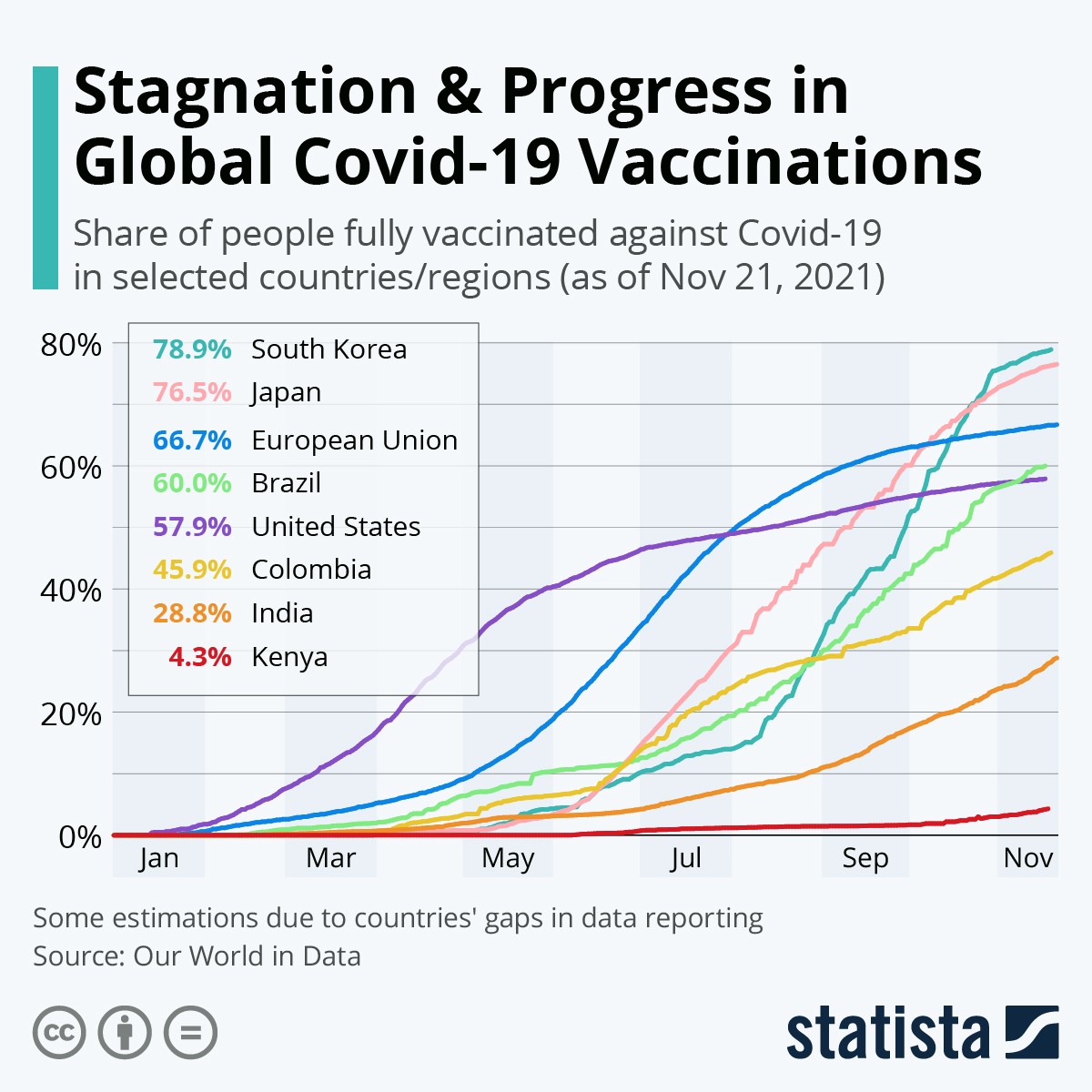

- COVID-19 vaccine rates in low-income nations continue to remain significantly behind those of wealthy nations, new data shows.

- Euro-area business activity unexpectedly quickened this month, with IHS Markit’s purchasing managers index rising to 55.8 from 54.2 the previous month.

- German producer prices rose 18.4% in October from a year earlier, the fastest pace in seven decades.

- JPMorgan Chase started reimbursing Hong Kong staff $5,000 for mandatory quarantine stays on their return from some international trips, a potential trendsetting move amid continued global pandemic conditions.

- British Airways’ transatlantic bookings are approaching pre-pandemic levels following the recent ending of U.S. international travel restrictions. British officials have indicated they will not further loosen air travel restrictions until at least January.

- Canadian budget airline Lynx Air ordered 46 Boeing 737 MAX aircraft to be delivered over the next seven years in anticipation of an expected rebound in leisure travel.

- The CEO of GM Mexico, reacting to the government’s prioritization of the state-owned energy industry, warned that automobile investments in the country could wane without a favorable commitment to renewable energy.

- The U.K. will require all newly constructed homes and buildings to include electric-vehicle charge points, as the nation makes significant policy moves behind its pledge to eliminate sales of new gas-powered cars by 2030.

At M. Holland

- M. Holland’s U.S. and Puerto Rico offices will be closed Thursday, Nov. 25 and Friday, Nov. 26 in observance of the Thanksgiving holiday.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.