COVID-19 Bulletin: October 25

October 25, 2021 • Posted in Daily BulletinMore news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose Friday but finished flat for the week, retreating from multi-year highs on news of easing coal and gas shortages in China, India and Europe that had boosted demand for oil products.

- Futures were higher in late morning trading, with WTI up 0.8% at $84.43/bbl and Brent up 1% at $86.37/bbl. U.S. natural gas was up 10.2% at $5.82/MMBtu.

- Saudi Aramco, the world’s biggest exporter of oil, set a goal to reach net-zero emissions from its operations by 2050, a target that excludes emissions from customers burning its crude.

- Gas prices in California have reached 10-year highs, new data shows.

- China has inked three massive LNG deals with U.S. exporter Venture Global, effectively doubling the nation’s LNG imports from the U.S. through the next 20 years.

- Coal futures in China had their worst week in five months, dropping roughly 15%, as the nation’s government gave free reign to miners to increase production and meet surging demand.

- The largest power generating company in India is looking for bids to import at least 1 million tons of coal for the first time in two years, as an energy crisis has depleted coal stocks in the country.

- Shell will resume operations next month at an offshore facility knocked offline by Hurricane Ida, restoring transfers of oil and gas from three major fields for processing at onshore terminals.

- Top oil field services firm Schlumberger reported better-than-expected third-quarter profits, capitalizing on a worldwide rig count of 1,448 at the end of the quarter compared to just 1,019 a year earlier.

- The S&P 500 energy sector has rebounded 54% this year, more than doubling the index’s 21% climb.

- The White House is set to impose tougher methane rules on oil and gas production as well as stricter vehicle emissions limits by the end of the year, part of a plan to cut domestic emissions 50% below 2005 levels by 2030.

- South Africa is hoping to secure more than $27.6 billion of electricity infrastructure financing as part of its shift from coal to cleaner energy.

- China announced plans to have non-fossil energy consumption exceed 80% of its total mix by 2060, coinciding with the nation’s carbon-neutral deadline.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- A powerful Pacific storm is set to drench California with rain until Tuesday, prompting evacuations over fears of mudslides in wildfire-scorched areas.

- Category 1 Hurricane Rick made landfall in northwestern Mexico this morning, the fifth Pacific storm to touch down in the nation this season.

- U.S. lawmakers indicate a deal could be reached on a $1 trillion infrastructure package by the end of the week before current highway funding expires Sunday.

- Eighty container vessels are now waiting off the ports of Los Angeles and Long Beach, a record. Shippers turning away from Southern California in favor of alternative gateways are running into even more logjams due to a broad shortage of trucking, rail and warehouse capacity.

- California’s governor ordered state agencies to propose new measures aimed at alleviating congestion at the state’s ports.

- U.S. warehouse availability dropped to record lows in the third quarter, with demand exceeding supply by 41 million square feet as vacancy rates dropped from 4.3% to 3.6%. Vacancy rates fell to 1% in the Los Angeles area.

- A lack of truck drivers, equipment and warehouse workers is causing congestion at main U.S. rail yards, forcing operators including CSX and Union Pacific to turn down business despite skyrocketing demand.

- The National Association of Wholesaler-Distributors is seeking a delay in the government’s Dec. 8 deadline for employees of government contractors to be vaccinated, citing fears the mandate will aggravate supply chain congestion.

- Singapore is opening an under-construction port terminal to container storage and hiring 2,500 more workers in a bid to ease congestion and operate as a “catch-up” port to help regional supply chains.

- U.S. grain transports by barge rose 38% last week from the week prior, marking a significant milestone in the recovery from the effects of Hurricane Ida.

- Israeli shipping line ZIM has added seven secondhand container ships to its fleet for roughly $320 million.

- Amazon has opened a 350,000-square-foot facility for warehousing robotics manufacturing, research and development.

- Volvo’s North American truck orders rose by 75% in the third quarter from a year ago while deliveries increased by 67%, as the company warned component shortages could slow production the rest of the year.

- Appliance-maker Whirlpool expects a shortage of dishwashers and refrigerators to stretch well into 2022, as the company cut projected revenue growth for the year to 13% from 16%.

- Big corporate brands including P&G, Nestle and Verizon have reported little to no drop in demand after raising prices due to inflationary pressures, saying they plan to continue price hikes and pushing consumers to more expensive products into 2022. P&G is using alternative suppliers and reformulating products to overcome material shortages and keep shelves stocked.

- Luxury fashion brand Hermes is expected to produce 20,000 fewer handbags this year compared to before the pandemic, a result of supply chain disruption and raw material shortages.

- Southwest Airlines will cut 8% of planned flights in the fourth quarter due to staffing shortfalls.

- Mastercard is launching a new financing tool with British supply chain specialist Demica, a bid to open availability to more working capital for small companies.

- Amid a severe shortage of commercial truck drivers, the U.K. is significantly loosening rules on training. The nation also is expected to need an additional 12 million square feet of urban distribution space by 2025.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

- Our Logistics team reports the following:

- Bulk trucking capacity is very limited as demand is exceeding supply.

- Dry van (full, partial and less-than-truckload) capacity is very limited as demand exceeds supply.

- Port congestion continues to be very problematic, delaying deliveries of imported containers.

- Packaging and pulverizing/grinding production challenges persist as demand is exceeding supply

Domestic Markets

- The U.S. reported 16,796 new COVID-19 infections and 141 virus fatalities Sunday.

- Montana currently has the highest number of COVID-19 cases per capita in the U.S.

- New CDC data shows Vermont had the fastest-growing COVID-19 case rate in the country over the past two weeks, with cases rising 10% in the past seven days and 39% in the last 14 days.

- The number of COVID-19 patients in Wyoming hospitals hit a record high late last week at 249.

- COVID-19 infections in rural areas of Georgia are more than twice as high as the state’s urban areas.

- The White House’s top medical adviser expects vaccines to be available for children as young as age 5 in the first half of November.

- A new study suggests that COVID-19 can damage brain cells, perhaps explaining the 84% of victims who suffer neurological symptoms from the virus.

- New CDC data shows that individuals fully vaccinated against COVID-19 have a lower mortality rate and are less likely to die from other diseases compared to unvaccinated people.

- The CDC indicated it may eventually change the definition of “fully vaccinated” to include only those who have received a COVID-19 vaccine booster.

- Adobe employees who do not get vaccinated against COVID-19 in time for the federal government’s Dec. 8 deadline will be put on unpaid leave.

- The Federal Reserve is on track to end its pandemic-induced monthly asset purchases by mid-2022, the central bank chairman said, as the Secretary of the Treasury expects inflation to remain high through the middle of next year.

- The U.S. composite purchasing managers index rose to a three-month high of 57.3 in October, driven by an increase in service-sector activity and hiring. Manufacturing activity slowed with firms reporting longer delivery times.

- Billed business on American Express cards soared to a record $280 billion in the third quarter, with consumers spending significantly more on goods and services, up 18% from a year ago and 19% from 2019.

- The supply of entry-level housing in the U.S. is near a 50-year low, resulting in bidding wars on properties and more young people cut out of wealth growth opportunities of home ownership. Meanwhile, home-price appreciation slowed for a second straight month in September, indicating a cool down in the nation’s hot housing market.

- The U.S. is seeing the lowest labor-force participation rates among women since the 1970s, as labor shortages and facility closures in the childcare sector put greater loads on working parents.

- Pet care costs have increased sharply during the pandemic, with 35% of pet owners reporting spending more money on their pets in the past 12 months compared to a year earlier.

- Toymaker Mattel expects sales to grow by 15% in 2021, several percentage points higher than earlier predictions on forecasts of smaller-than-expected shipping disruptions and a strong holiday shopping season.

- Completely switching U.S. power generation to renewable sources could cost between $7.8 and $13.9 trillion over the next 30 years, researchers predict.

- A leading U.S. broker will begin offering improved terms on directors-and-officers liability insurance policies for companies deemed to have superior environmental, social and governance practices.

International Markets

- Europe is experiencing rising COVID-19 infection rates, with higher case counts for the past three weeks and Eastern Europe, where vaccination rates are lowest, suffering the worst.

- COVID-19 infections in Poland are up 90% week over week.

- Russia reported 37,930 new COVID-19 cases Monday, a record, along with 1,069 virus-related fatalities, as six of the nation’s regions began imposing curbs.

- If Austrian COVID-19 hospitalizations continue to rise, the country is considering imposing a lockdown for unvaccinated people.

- The U.K. reported 49,928 new COVID-19 cases Friday, its tenth consecutive day of cases above 40,000, as the country’s prime minister maintained lockdowns will not be reimposed. A highly contagious Delta variant “sub-mutation” now accounts for 6% of new infections in the nation, a worrying trend among health experts who say the country could see a severe wave this winter.

- New Zealand suffered its second highest daily COVID-19 infection rate Monday. More than 90% of New Zealanders over the age of 12 are fully vaccinated against COVID-19, among the highest inoculation rates in the world.

- An outbreak of 26 COVID-19 infections in China spread to 11 provinces the past week, with more cases expected to be reported in the coming days as local governments begin imposing pandemic restrictions.

- Singapore will restrict unvaccinated people from going to the office as the city-state begins to relax pandemic restrictions.

- China has started offering COVID-19 booster shots to all adults, as the nation tries to ramp up inoculation rates ahead of the Winter Olympics planned for February in Beijing.

- Canada is stocking up on COVID-19 vaccine doses in preparation for the shots’ approval for children as young as age 5. Meanwhile, the country rescinded its official warning against non-essential foreign travel, citing high vaccination rates.

- Growth in eurozone business activity slowed in October as firms faced surging costs due to supply chain constraints, with a composite purchasing managers index falling to a six-month low of 54.3. In France, manufacturing activity fell the sharpest since the beginning of the pandemic, while business activity in Germany fell to an eight-month low with selling prices accelerating at the fastest pace in two decades.

- Business activity in the U.K. rose in October, surprising analysts even as firms saw the largest increase in costs on record.

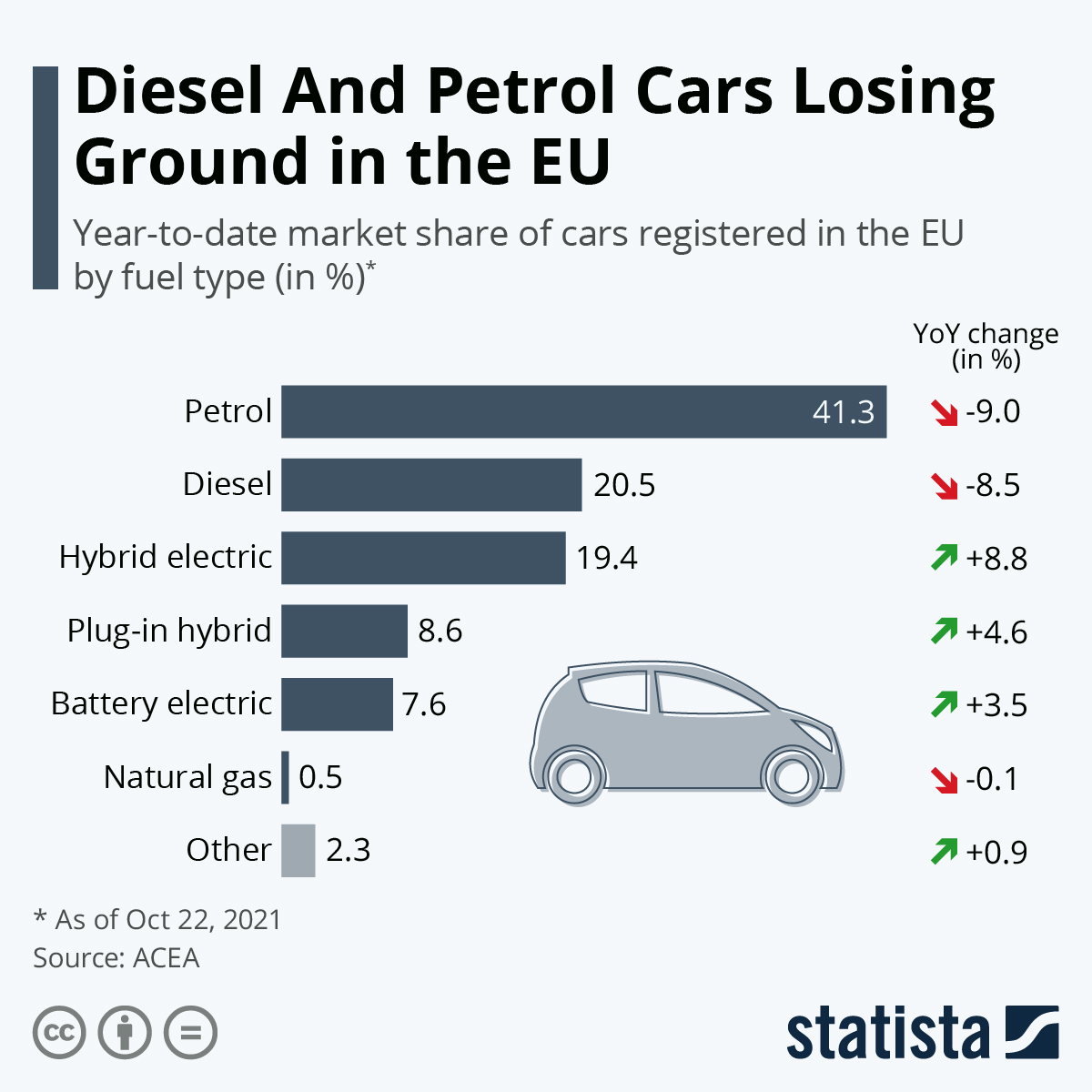

- Aston Martin is the latest luxury carmaker in Europe and the U.K. to accelerate electric vehicle initiatives, joining Rolls-Royce, Bentley and others, as the U.K. government presses to phase out the sale of fossil-fuel vehicles by 2030.

- Factory activity in Japan rose in October from the previous month, while the nation’s services sector expanded for the first time in 21 months after a broad easing of pandemic restrictions.

- China’s retail sales rose 4.4% in September from a year ago, well below the 8% pace for the full year of 2019, as consumption in the nation falters. The nation’s economy could slow faster than global investors predict amid real estate debt pressures and increased government regulation of several industries.

- The value of land sales in China dropped 11.2% to $89 billion in September, the second consecutive monthly decline from a year ago.

- Climate negotiators from nearly every country will gather in Scotland for two weeks in early November with the hope of creating a new agreement on cutting global emissions and financially supporting environmental measures.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.