COVID-19 Bulletin: August 19

August 19, 2021 • Posted in Daily BulletinMore news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices extended a streak of losses to five days Wednesday, falling to their lowest levels since May. Energy futures were down further in mid-day trading today, with WTI down 4.0% at $62.87/bbl and Brent down 3.6% at $65.76/bbl. Natural gas was 2.4% lower at $3.76/MMBtu.

- The American Petroleum Institute reported a crude draw of 1.16 million bpd last week, roughly in line with analyst expectations, and domestic crude stockpiles dropped to 435.5 million barrels, the lowest level since January 2020 as U.S. fuel demand rebounds alongside the American economy.

- China’s exports of gasoline, diesel and jet fuel are expected to drop by a fifth for the rest of the year after Beijing cut second-half export quotas for producers by as much as 73%.

- A Wednesday ruling in federal court has temporary halted ConocoPhillips’ planned $6 billion Willow oil development project in Alaska over problems with the company’s environmental analysis for the site.

- Construction of the controversial Russia-backed Nord Stream 2 pipeline is nearing 100% completion with the project due to begin pumping oil through Ukraine and into Germany by Monday.

- India has started selling crude reserves to state-run oil companies at a discount to prices set by producer countries, part of an effort to clear federal storage space for leasing.

- The Asian price for thermal coal is approaching an all-time high, up 106% so far this year, driven by soaring electricity demand and high natural gas prices.

- Solar power generation in the EU reached record levels in June and July, representing 10% of electricity produced in the bloc.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Tropical Storm Grace evolved into a hurricane Wednesday after drenching earthquake-stricken Haiti with heavy rain and flash floods. The storm is expected to strike Mexico’s Yucatan Peninsula today.

- More than 30 people are missing in Haywood County, North Carolina, following floods caused by Tropical Depression Fred. The storm will continue moving northeast today, dumping rain in parts of Pennsylvania, New Jersey and New York.

- Tropical Storm Henri is expected to strengthen into a hurricane as it moves off Bermuda’s coast and heads west toward New England and eastern Canada.

- California’s Dixie Fire became the first in state history to crest the Sierra Nevada mountain range, expanding to 635,730 acres Wednesday with just 33% containment. Another California blaze, the Caldor Fire of El Dorado County, grew to 30,000 acres Wednesday while forcing tens of thousands to evacuate.

- Minnesota’s Greenwood Fire has tripled in size to more than 3,200 acres since Sunday.

- Closed portions of China’s Ningbo port, the world’s third-busiest, will begin reopening Friday barring additional COVID-19 outbreaks among workers.

- Employment in the U.S. warehouse and storage industry rose to a new high of 1.44 million workers in July, largely a result of the spike in e-commerce demand during the pandemic.

- Car sales at U.S. dealerships are predicted to rise in the second half of the year, rebounding slightly from disruptions caused by the global chip shortage in the first several months of 2021.

- Cargo volumes at the Port of Antwerp rose 5.2% in the first seven months of 2021 compared to the same time last year, a record increase.

- The U.S. retaliated in kind after China limited passenger air carriers from the U.S. to fly at 40% capacity when several passengers arriving from San Francisco to Shanghai were infected with COVID-19.

- Walmart has begun chartering ships to ensure it has enough capacity to meet demand for peak season, the company announced.

- Global food prices rose 31% in July compared to the same time last year, the United Nations reports, citing pandemic-induced disruption to global supply chains and more instances of extreme weather.

- Recent frost in Brazil’s coffee fields could decrease production by 4% next season, forecasts show.

- British fast-food chain Nando’s will temporarily close 40 locations due to shortages of chicken.

- Cybersecurity flaws in a Blackberry operating system could pose privacy threats or allow outsiders to disable the technology, a risk to a wide range of products including cars and medical equipment.

Domestic Markets

- The U.S. reported 137,815 new COVID-19 cases and 1,145 virus deaths Wednesday.

- The U.S. will start offering third COVID-19 booster shots to fully vaccinated people on Sept. 2, an accelerated response to fears over the highly contagious Delta variant, which now accounts for nearly 100% of new infections in the nation and could be more resistant to currently available vaccines.

- Six states report that breakthrough COVID-19 infections in fully vaccinated people now account for one-fifth of all new cases.

- U.S. states with low COVID-19 vaccination rates, particularly Florida and Texas, are rushing to provide antibody treatments to people with severe symptoms, hoping to keep hospitals from being overwhelmed after a 58% national rise in virus patients the past two weeks.

- Florida reported more than 21,000 new COVID-19 infections in the past 24 hours along with 16,832 total hospitalizations, pushing state ICUs to capacity. Meanwhile, the state’s largest school district imposed a new mask mandate in defiance of the governor’s recent order, joining at least two other districts mandating masks.

- Up to 98% of hospitalized COVID-19 patients in Texas hospitals are unvaccinated at the start of what could become the state’s worst virus surge yet, officials report. A Texas school district made face masks part of its dress code in order to circumvent a recent order from the governor banning mask requirements, a move that has also sparked student lawsuits.

- Alabama reported it is completely out of ICU beds in the state, while hospitals in Idaho have turned to a “crisis standards of care” task force.

- Georgia reported 4,257 new COVID-19 infections Tuesday, bringing the state’s total infection count to more than 1 million since the start of the pandemic.

- Total COVID-19 hospitalizations in New York have climbed to 1,888, a 135% surge over the past 17 days. A group of small businesses have filed a lawsuit against New York City seeking an injunction to halt a vaccine mandate for indoor venues that went into effect Tuesday.

- More than 66% of Virginia’s population is now fully vaccinated against COVID-19, as the state reported 2,552 new infections Wednesday, up more than 300 from the day before.

- Washington state extended a COVID-19 vaccine mandate to all public and private school teachers, the first state to take the measure. In a similar first, a school district in Los Angeles issued a vaccine requirement for all eligible students.

- California will require proof of COVID-19 vaccination or a negative test at indoor events with more than 1,000 people.

- Chicago and New Mexico are reimposing indoor mask mandates regardless of a person’s vaccination status.

- The White House will require all nursing home staff to be fully vaccinated against COVID-19 in order for facilities to receive Medicare and Medicaid funding.

- First-time jobless claims fell for the fourth straight week last week to 348,000, down 29,000 from the previous week.

- South Carolina’s Clemson University imposed a new mask mandate following a state supreme court ruling allowing the measure.

- Los Angeles County, the nation’s largest, will require face masks at large outdoor concerts and sporting events of more than 10,000 people.

- Insurance company Cigna will require all U.S. workers to be fully vaccinated against COVID-19 by Sept. 7.

- Norwegian Cruise Line is extending its COVID-19 vaccination requirement through the end of 2021.

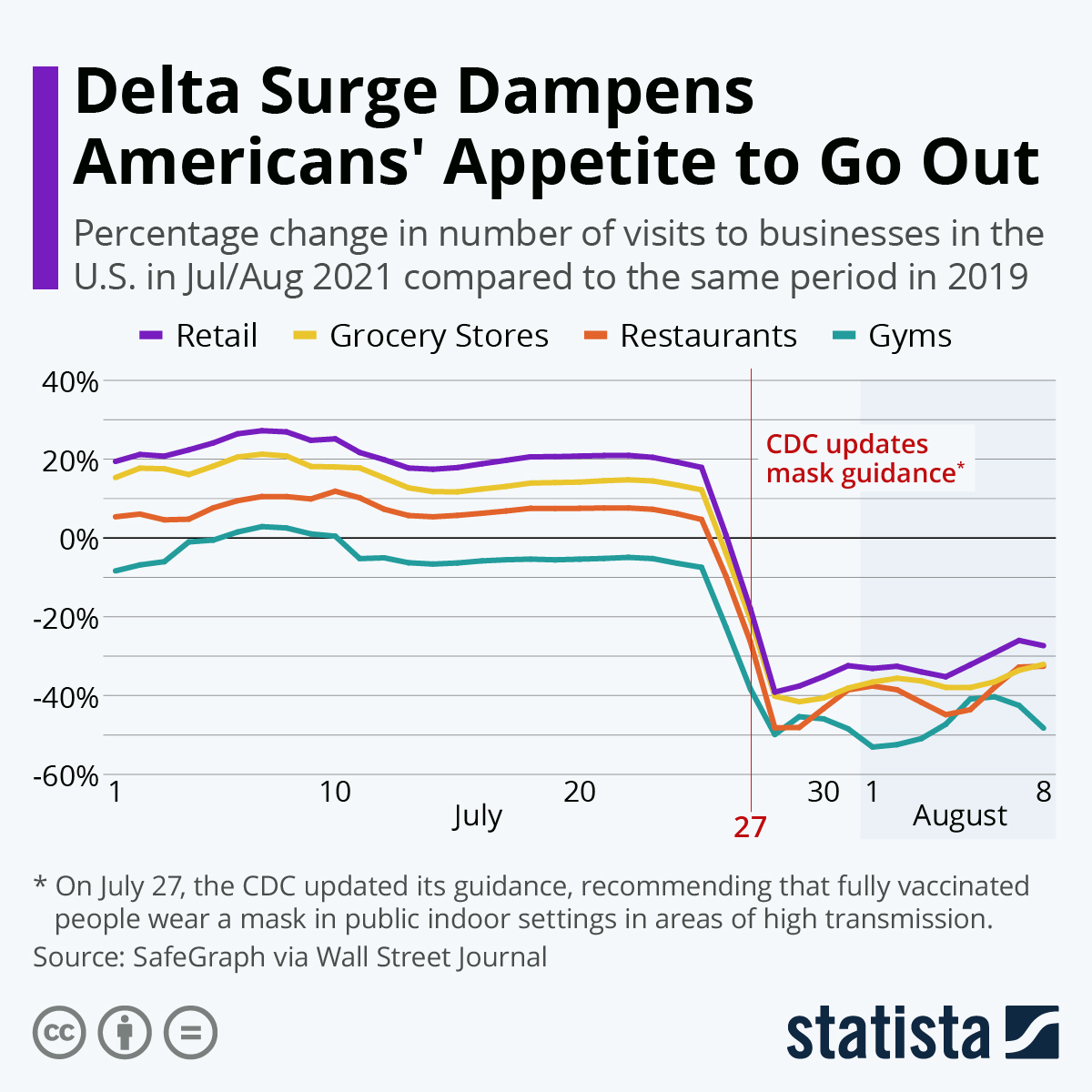

- The U.S.’s recent surge in COVID-19 has hurt the restaurant industry’s rebound…

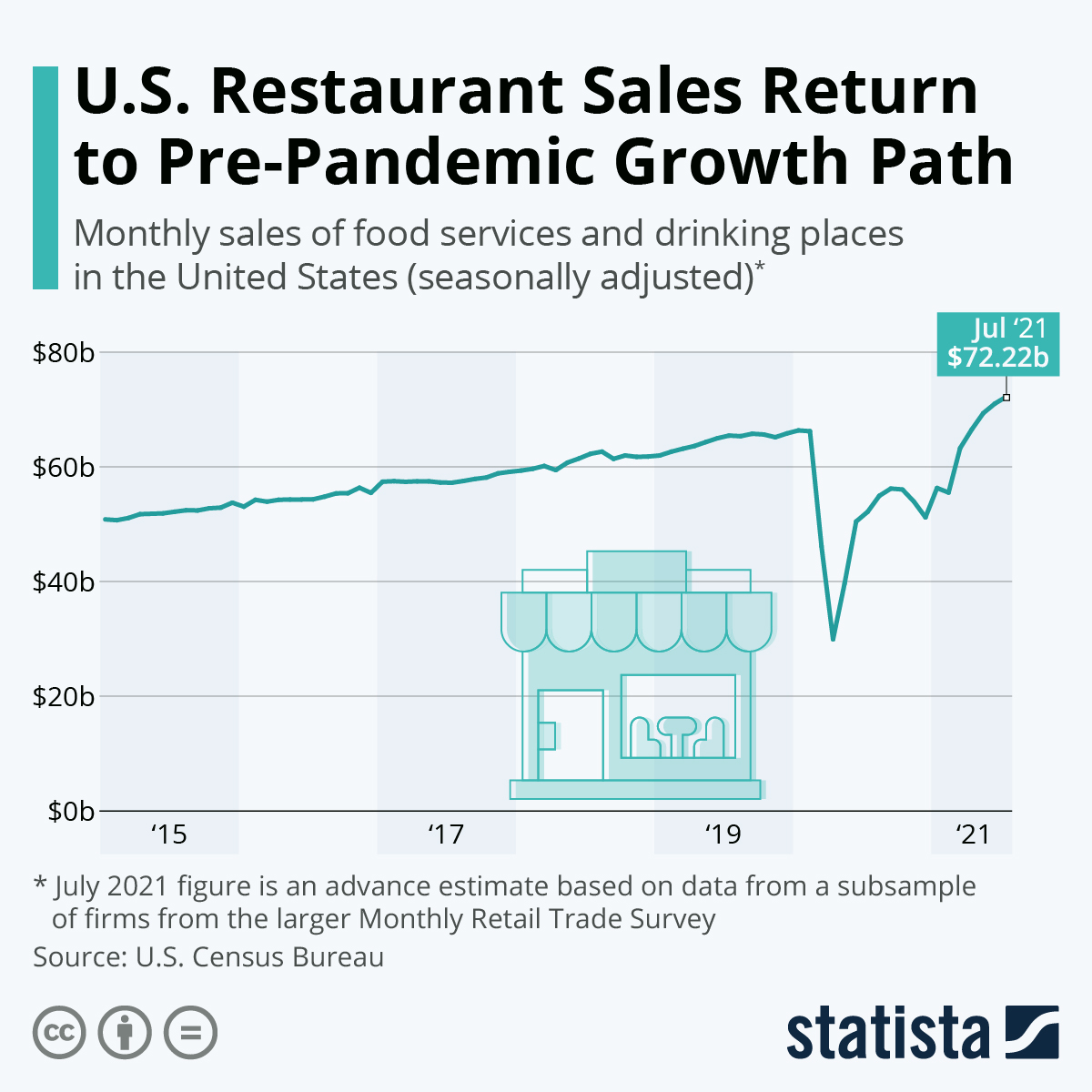

…at a time when restaurant sales had just returned to pre-pandemic growth:

- T.J. Maxx saw same-store sales rise 18% in the second quarter from pre-pandemic levels, while sales at its HomeGoods segment rose 36%, exceeding market estimates.

- Same-store sales at Target rose 8.9% year over year in the three months ended July 31, topping expectations, while digital sales rose just 10% for the quarter compared to 195% for the same time last year.

International Markets

- Japan reported 23,917 new COVID-19 cases Wednesday, a record, as half the country’s population has received at least one dose of a COVID-19 vaccine.

- India administered a whopping 9 million COVID-19 vaccine doses yesterday, as new daily cases in the nation dipped to a five-month low of just 25,166.

- Australia reported 754 new COVID-19 infections today, a record, with the New South Wales state accounting for the bulk of cases. Health officials in Sydney have begun administering COVID-19 vaccines to thousands of teenagers over concerns that the age group is increasingly vulnerable to infection from the Delta variant.

- The U.K. reported 33,904 new COVID-19 cases Wednesday, a rise of 7.6% compared to the week prior and its highest daily count since July 23.

- Excess fatality rates in South Africa suggest up to 80% of its population could have already contracted COVID-19.

- Mexico recorded 28,953 new COVID-19 cases yesterday, its second record high in the past week. Mexico’s health regulator granted emergency use authorization for Moderna’s COVID-19 vaccine.

- Australia’s Qantas Airways will require all of its employees to be fully vaccinated against COVID-19.

- New data out of Israel shows that a third dose of the Pfizer/BioNTech COVID-19 vaccine was highly effective in preventing infection against the Alpha, Beta and Delta variants of COVID-19 in people over age 60.

- The World Health Organization (WHO) maintained its stance that COVID-19 booster shots are not widely needed at the moment, arguing global priority should be to give two vaccine doses to more vulnerable populations first. WHO officials said countries with low vaccination rates are the primary drivers of Delta variant surges worldwide.

- The Central Bank of Sri Lanka became the first Asian bank to raise interest rates since the pandemic began, a bid to stem inflationary pressure and high imports.

- Home prices in the U.K. rose 13.2% in June compared to the same time last year, the fastest rate since 2004 as the country phased out a tax break on property purchases.

- Volkswagen’s Mexico unit reached an agreement with a workers’ union on salaries, staving off further disruptions to the country’s automotive production.

- Switzerland could pass a bill by mid-2022 that would require companies to disclose all environmental impacts and financial climate risks in their products and operations.

- Indonesia will begin converting some gas-powered motorcycles to electricity as part of a boosted governmental effort to provide cleaner forms of transportation.

At M. Holland

- Matt Zessin, our Automotive Market Manager, was interviewed about materials trends for electric vehicles on the Automotive News Daily Drive podcast, accessible here.

- What’s the outlook for plastics supply and the global supply chain? Join us for our next Plastics Reflections Web Series. Our distinguished panel will include guests from Business Publishing International, MTS Logistics and LyondellBasell. Register here for the event on Thursday, Aug. 26 at 1:00 pm CT/2:00 pm ET.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.