COVID-19 Bulletin: March 11

March 11, 2021 • Posted in Daily BulletinHello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Gasoline consumption has increased to its highest level since November, reducing inventories and helping to boost oil prices. Crude was higher in mid-day trading today, with the WTI up 2.2% at $65.83/bbl and Brent 2.3% higher at $69.44/bbl. Natural gas was 1% lower at $2.67/MMBtu.

- Saudi Arabia’s oil exports fell only 300,000 bpd in February, raising questions about the country’s pledge to cut production by a million bpd through April.

- China’s imports from Iran are on pace to double this month, causing congestion at some ports, as other countries shun Iranian oil for fear of violating U.S. sanctions against the country.

- S&P Global Platts has suspended its overhaul of the Brent crude calculation after pushback from the shipping industry over how the firm planned to handle shipping costs.

- About 120,000 jobs were lost in the U.S. oil and gas industry last year due to demand slumps caused by the pandemic.

- The White House is backing a 120-mile natural gas pipeline from Pennsylvania to New Jersey to meet growing energy demand in the Northeast.

- Ballard Power Systems signed a deal with the Canadian Pacific Railway on Tuesday to convert diesel locomotives to hydrogen-powered fuel cells.

- Solar generation has grown 15-fold in California in the past decade to become the second largest power source while disrupting the industry’s demand cycles and pricing structure.

- The Interior Department granted environmental approval for the largest U.S. offshore windfarm to date; the Vineyard Windfarm off Martha’s Vineyard will commence operation in 2023 with enough power for 400,000 homes.

- New wind installations rose 58% last year, adding 90 gigawatts to the global power grid, with General Electric becoming the leading installer of wind turbines in the world.

- BP entered a deal with Clean Energy Fuels to set up renewable natural gas facilities at farms and agricultural sites to capture carbon emissions and convert them to fuel. BP’s trading arm earned $4 billion last year despite the oil and gas downturn, funds it is using to help finance its pivot to renewables.

- Weather-related power failures are causing more Americans to invest in microgrids, a self-sufficient energy system that enables consumers to convert natural gas, wind or solar energy into electricity.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- A lack of available shipping containers paired with bottlenecks at ports on the West Coast is leading to a shortage of cheese and several other household goods at Costco.

- Lineage Logistics LLC, the largest refrigerated-storage company in the world, is investing heavily to expand, while Maersk is considering a $1 billion sale of its refrigerated container business as demand for the cold storage units surges during the pandemic.

- Union Pacific is adding a peak-season surcharge on low-volume shippers in California.

- Freight carrier Knight-Swift Transportation will add 6,000 trailers to its fleet next year but only a limited number of new tractors.

- DHL’s fourth-quarter operating profit jumped 56% on elevated peak-season volumes.

- If the ocean shipping industry is to comply with the Paris Accord, at least 5% of fuel used by 2030 must be carbon neutral.

- Volkswagen truck unit Scania faces a possible shutdown due to the global shortage of computer ships.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- Reported COVID-19 infections in the U.S. were higher for the second day in a row yesterday, with 58,611 new cases and 1,564 deaths. Over 95 million vaccine doses have been administered, with 9.92% of the population fully vaccinated.

- Despite falling COVID-19 case trends nationally, eight states — Colorado, New Jersey, Rhode Island, Vermont, Alaska, South Dakota, Tennessee and Michigan — have experienced rising infections over the past two weeks.

- The U.S. is getting 100 million more doses of Johnson & Johnson’s one-shot COVID-19 vaccine, making it more likely every American will have access to a shot by the end of May.

- States could start dramatically expanding access to COVID-19 vaccines following increased deliveries from the federal government.

- As many as one in five Americans may not take a COVID-19 vaccine, according to a Census Bureau survey at the beginning of March.

- Women report more severe side effects from vaccines than men.

- Moderna began human testing on a modified vaccine that will target the South African strain of COVID-19. Several other companies are working on a “multivariant” shot to target multiple virus mutations at once.

- Federal regulators relaxed bans on nursing home visits as widespread vaccination sharply reduced COVID-19 cases and deaths among residents.

- A new antibody drug to treat COVID-19 reduced hospitalizations and deaths from the virus by 85% in a clinical trial.

- Two COVID-19 antibody treatments from Eli Lilly were found to be more effective with lower doses, potentially stretching the drugs’ supply.

- House lawmakers approved a $1.9 trillion pandemic relief bill yesterday. The legislation, which includes $1,400 in direct payments to many Americans, is expected to be signed by the president Friday. The economic stimulus could jolt the U.S. into 5.9% GDP growth this year, the fastest in four decades.

- Passage of the new stimulus legislation prompted American Airlines to cancel furloughs for 13,000 employees, with the CEO telling workers their furlough notices were “happily canceled — you can tear them up!”

- The Dow Jones Industrial Average closed at a record high on Wednesday after new economic data showed a lower-than-feared rise in interest rates. A 6.4% increase in gas prices accounted for the bulk of a seasonally adjusted 0.4% rise in U.S. consumer prices last month.

- The federal budget deficit rose 68% in the five months ended Feb. 28 to over $1 trillion.

- Tax revenues for U.S. states were roughly flat in 2020 from the year before, contrary to projections for major declines.

- College undergraduate enrollment fell 4.5% in the Spring semester, including a 16% drop in foreign students.

- Citigroup is having its in-office employees take rapid at-home COVID-19 tests, the latest in a string of companies embracing regular, sometimes daily testing before vaccines become widely available.

- Chinese prices for lithium carbonate, considered a bellwether of the electric vehicle supply chain, have surged 68% since the start of the year.

- Boeing’s cost for the safety issues with its 737 Max jet, now totaling over $21 billion, will continue to grow, making it the costliest airline crisis in history.

- Roughly 527 of AMC’s 589 domestic movie theaters have reopened, including those in New York City.

- Campbell Soup, in reporting a 5% revenue increase in its latest quarter, lowered its outlook for the remainder of the year based on increasing vaccinations and the reopening of the economy.

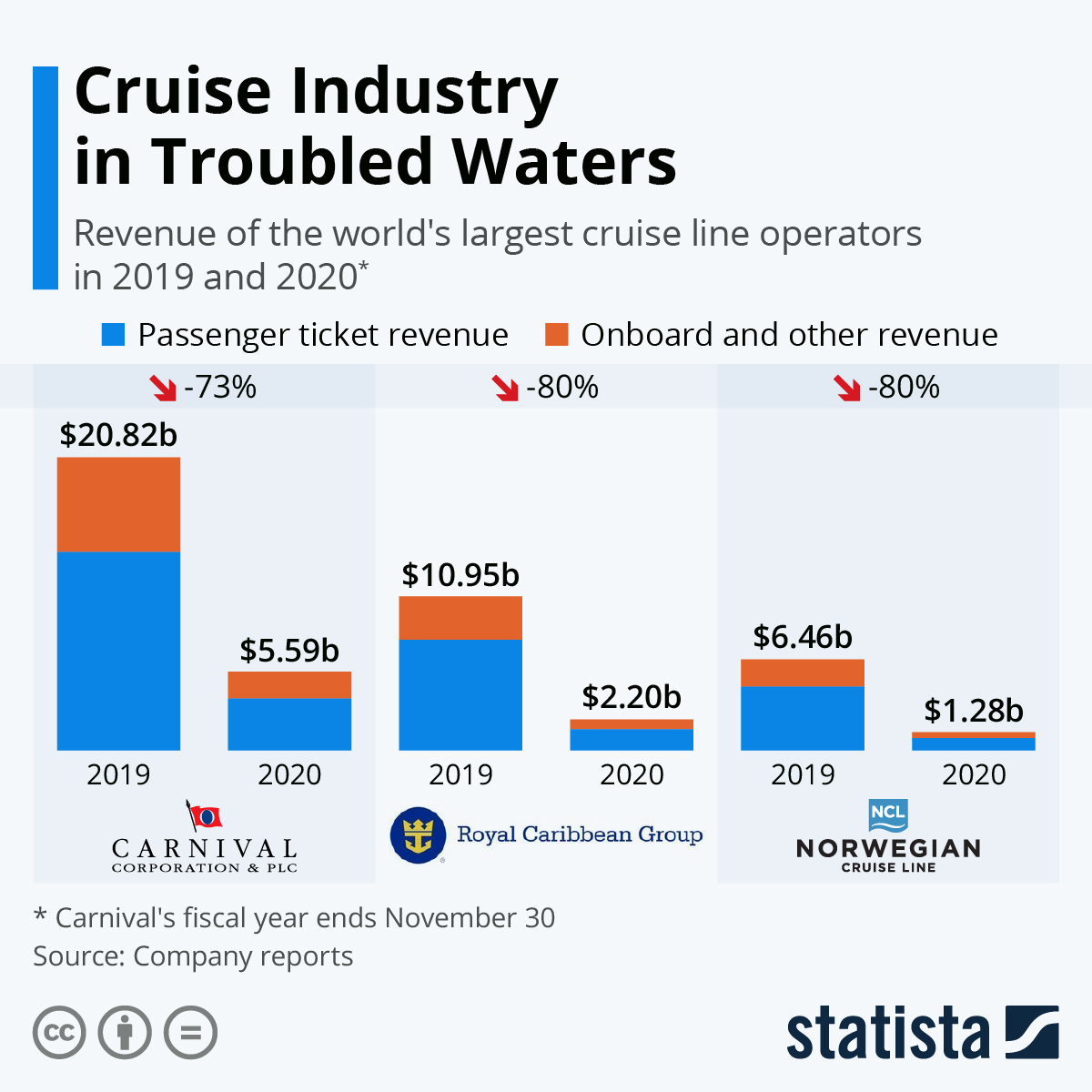

- Royal Caribbean joined other major cruise lines in suspending its resumption of sailings until June.

- Work-from-home is driving changes in laptop design, with emphasis on improved video and audio, better wireless, multiple device/screen connectivity, and background noise reduction.

- Touchless elevators are emerging in the pandemic era equipped with voice controls, touchless keypads, foot controls, hand-swipe pads and hailing apps.

- While the rise in demand for electric vehicles is positive for limiting climate emissions, it is also sparking environmental concerns about mining for minerals such as cobalt and nickel used in batteries.

International

- Brazil has overtaken the U.S. as the country with the most daily COVID-19 cases and deaths. The nation reported more than 1,900 fatalities Tuesday, a record, as the largest city prepares to go into strict lockdown.

- Denmark suspended the use of AstraZeneca’s COVID-19 vaccine on concerns its side effects could include deadly blood clots.

- Chile is set to become the first developing country to achieve herd immunity against COVID-19, as more than 22% of its 19 million people have received shots.

- Fewer Hong Kong residents are showing up to get COVID-19 vaccines from China’s Sinovac Biotech amid reports of side effects.

- Tesla tripled its deliveries of Model Y electric SUVs in China in February.

- Global tourism faces a slow and uneven recovery in the face of continuing border controls and restrictions:

- U.K. international banking giant HSBC, under pressure from major investors, will submit a resolution to a vote of shareholders on ending financing to the fossil fuel industry by 2040.

Our Operations

- Throughout the week, Mployees have been sharing their thoughts on International Women’s Day 2021. Check out messages from them across LinkedIn, Twitter and Facebook.

- Visit our new 3D Printing e-commerce site.

- Listen to M. Holland’s 2021 Market Trends Podcast Series episodes featuring insight from our Market Managers.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.