COVID-19 Bulletin: May 5

May 5, 2021 • Posted in Daily BulletinHello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

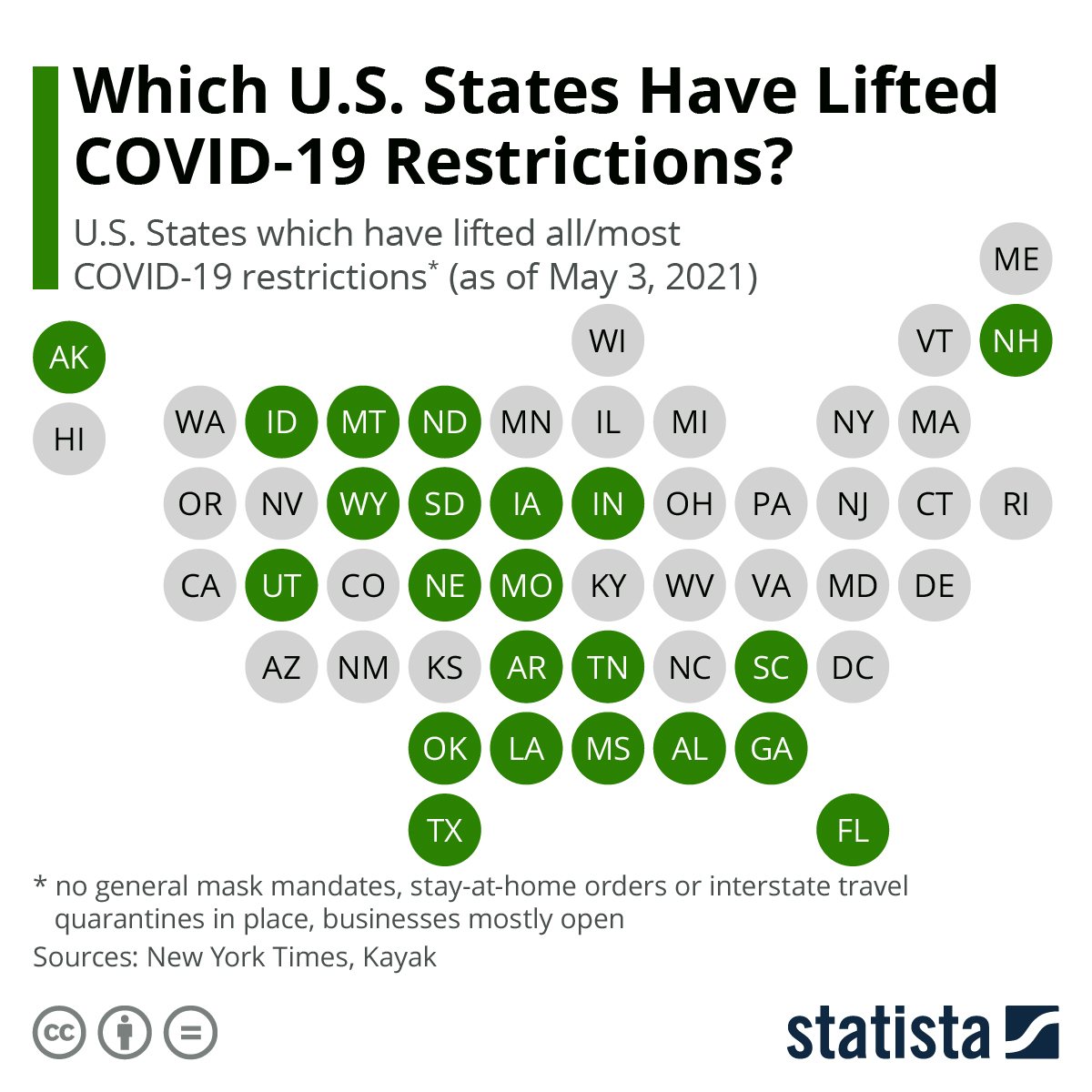

- Oil prices rose nearly 2% on Tuesday on news of more U.S. states easing lockdowns and the EU opening up summer travel to fully vaccinated tourists. Crude futures were higher in mid-day trading today, with the WTI up 0.7% at $69.37/bbl and Brent 1.2% higher at $69.69/bbl. Natural gas was 0.4% lower at $2.96/MMBtu.

- OPEC oil production stayed mostly flat from March to April, rising by just 50,000 bpd to 25.3 million bpd.

- The Tennessee Valley Authority confirmed plans to close its four remaining coal plants by 2035, saying the assets have reached the end of their lifecycle.

- Wyoming has created a legal fund to back its dwindling coal industry, threatening to sue other states that block its coal exports or cause its coal-fired plants to shut down.

- Ware2Go, a UPS subsidiary that provides on-demand fulfillment and warehousing, announced a carbon emission offset program for customers shipping parcels by truck or air cargo within its network.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Ford reported a 6% drop in first-quarter vehicle sales to dealerships, citing impacts from the global semiconductor chip shortage.

- Despite the global semiconductor shortage, new-vehicle retail sales for April 2021 were the highest ever recorded for the month, gaining 110% from the same time last year to more than 1.32 million units sold.

- Taiwanese chipmaker TSMC expects that it will take up to two months to catch up to customer demand for auto chips, as the company hopes to fulfill minimum deliveries by late June.

- The U.S. Commerce Secretary is calling for increases in domestic production of computer chips, a bid to ease supply chain bottlenecks and break free from the country’s dependence on Chinese suppliers.

- Supply chain disruptions are leaking into stock valuations of solar companies, as investors fear the global chip shortage and rising freight rates will impact 2021 margins.

- With surging rates and persistently high consumer demand, it is boom time for container leasing companies such as Triton, which has ordered 890,000 TEUs worth this year, a roughly $2.6 billion investment.

- A new study from the National Biodiesel Board showed that replacing ultra-low sulfur diesel with 100% biodiesel in freight trucks can have positive impacts on both the environment and personal health, such as decreased cancer risk, fewer premature deaths and reduced asthma attacks.

- Adidas, a frontrunner in supply chain verification technology, uses Radio Frequency Identification to ensure the legitimacy of returned goods, which it resells or recycles to further sustainability.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

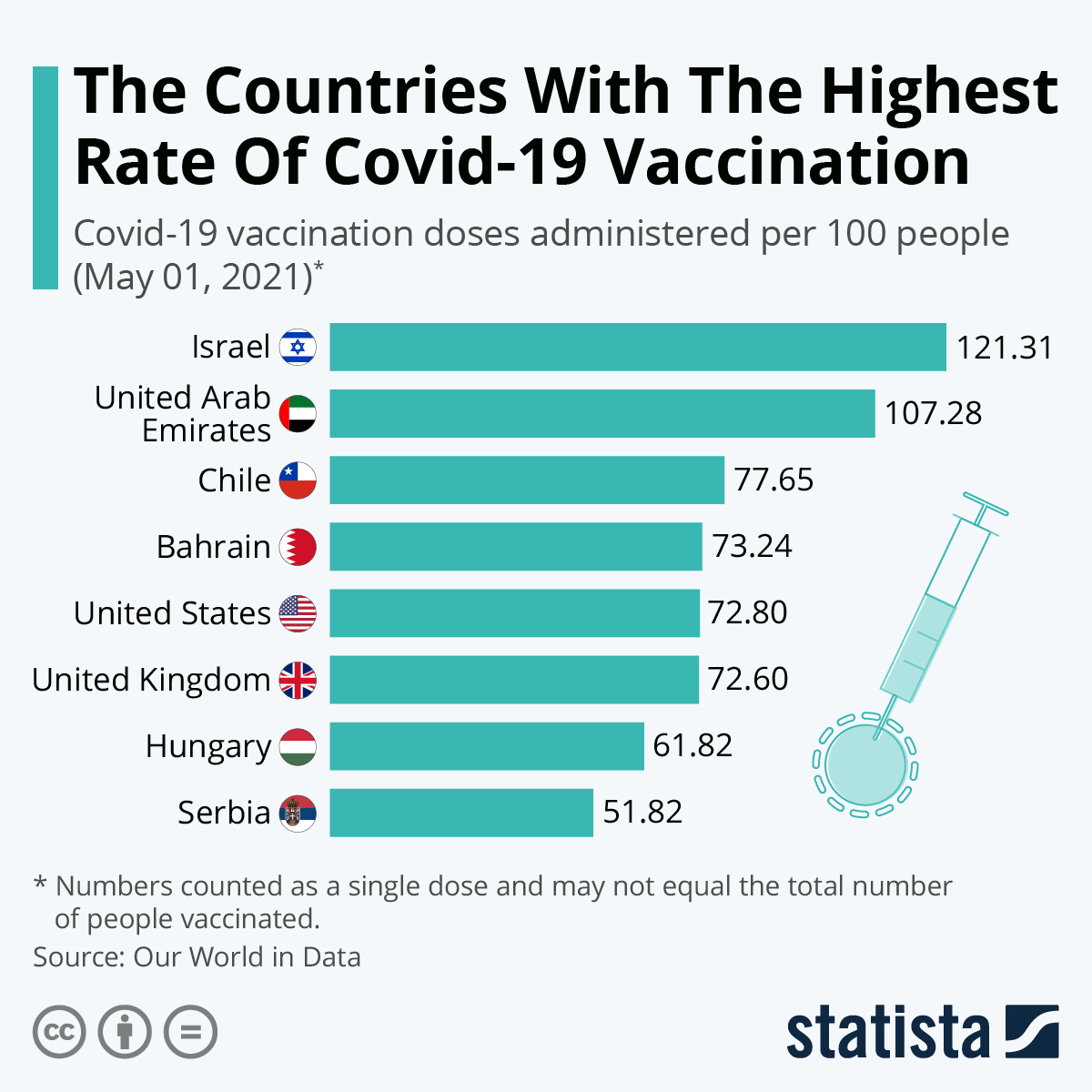

- There were 40,733 new COVID-19 cases and 933 deaths in the U.S. yesterday. Over 247.7 million vaccine doses have been administered with roughly 30% of the population fully vaccinated.

- Washington state is experiencing a fourth COVID-19 wave, with cases rising since March and younger patients dominating hospitalizations.

- Oregon indefinitely extended social distancing and mask rules for businesses in the state.

- The rate of COVID-19 vaccinations in the U.S. is slowing down, with the number of people receiving their first dose declining in 47 out of 50 states. U.S. demand for COVID-19 vaccines has fallen by roughly 30% in recent weeks, CVS reports.

- Children now account for more than one-fifth of new COVID-19 cases in the U.S., up from 3% at the same time last year.

- The FDA could authorize Pfizer/BioNTech’s COVID-19 vaccine for children as young as 12 by next week, while the drugmaker expects to seek approval for the vaccine in those aged 2-11 by September.

- The White House announced a plan to redistribute unordered COVID-19 vaccine supplies by sending more doses to states with higher demand, breaking with the nation’s existing vaccine rollout in the hope of giving 70% of adults at least one shot by July 4.

- Moderna has begun testing lower doses of its COVID-19 vaccine in an effort to increase available supply.

- Los Angeles reported no new COVID-19-related deaths on Monday for the second day in a row.

- New Orleans is eyeing a summer travel boom amid low virus positivity rates and more than half of residents getting at least one COVID-19 vaccine shot.

- Hawaii’s all-important travel industry is showing early signs of a rebound, with hotel occupancy rates rising 12% last week from the same time last year.

- The Chicago Auto Show is set to take place at the city’s convention center in July, the first large convention to be held in Illinois since the beginning of the pandemic.

- The Seattle Mariners became the latest major league sports team to offer COVID-19 vaccines to eligible fans at a game yesterday.

- Walmart and Sam’s Club are starting to offer walk-up COVID-19 vaccinations in addition to scheduled appointments at pharmacies nationwide.

- The Miami International Airport has set up a vaccination center for workers and travelers.

- Nearly half of adults say they are anxious about returning to in-person activities, regardless of whether they have been vaccinated or not, a new study shows.

- Private payrolls increased by 742,000 jobs in April, with growth across economic sectors, but fell below economist expectations.

- The speed of the U.S. economic recovery is bringing to light stark economic inequalities, with those in low-income communities generally left behind by the current boom in hiring.

- The pandemic has changed the ways that many industries operate, with employers turning to automation to perform certain tasks instead of calling back workers or hiring new ones.

- With the widespread use of remote learning during pandemic lockdowns, unexpected snow days for school children may cease to exist.

- With restaurants reopening across the country, Americans are consuming more cheese than expected, driving prices of the dairy commodity up 18% since early January.

- The U.S. trade deficit jumped to a new record in March, increasing by 5.6% to $74.4 billion amid persistently high consumer demand.

- The U.S. Treasury Secretary walked back comments suggesting the nation’s central bank raise interest rates to keep inflation down, as concerns mount over rising asset prices and federal spending.

- After watching their receivables mount last year, vendors of apparel and other consumer goods started requiring payment upon delivery of goods or even in advance, a trend that threatens to dampen the current rebound for U.S. retailers.

- The number of people receiving Social Security increased by just 900,000 to 46.4 million in March, the smallest year-over-year gain in more than a decade.

- The birthrate in the U.S. last year was the lowest in over 40 years, according to the CDC.

- U.K.-based electric vehicle manufacturer Arrival has inked a deal with Uber to develop an electric vehicle for ride-hailing across Europe and the U.K. Uber also announced a partnership with startup GoPuff to expand its grocery delivery service across 95 U.S. cities this summer.

- Lyft reported an 8% increase in active riders in the first quarter from the same time last year, while the company’s revenues were significantly lower.

- Ford reported a nearly 65% sales gain in April compared with the prior-year period but has just a 35-day supply of inventory, down from 120 days last year.

- Stellantis is withdrawing from an emissions credit sharing agreement with Tesla, a blow to the electric car maker, which derives more revenue and income from the sale of emission credits than its net income under GAAP rules.

International

- Total COVID-19 cases in India topped 20 million since the start of the pandemic yesterday, as the nation reported more than 357,000 new daily infections. The nation recorded record deaths yesterday for the fourth straight day and accounted for a quarter of global fatalities last week.

- Health officials warn the country’s death toll could double from its current level of 222,408 in the coming weeks. By comparison, the U.S. has the largest number of fatalities at 578,000.

- Economists fear the nation’s expected economic growth could significantly dip to below 10% due to rising case counts. In April, industrial output in the nation grew at the slowest pace since August.

- Indian hospitals report a scarcity of medical supplies and recently requested courts to order the government to step in and offer support.

- Authorities indefinitely suspended the nation’s cricket league as more players start testing positive for the virus.

- Eli Lilly is supplying India with 400,000 tablets of an arthritis drug that has been shown to be effective in treating some of the worst COVID-19 symptoms.

- The United Arab Emirates is the latest country to extend a ban on flights from India.

- India’s foreign minister has been forced to participate virtually at the first in-person G-7 meeting in two years after members of the nation’s delegation tested positive for COVID-19.

- COVID-19 cases in Nepal are up 57-fold in the past month and the test positivity rate is up to 44% as the catastrophic coronavirus spike in India spreads to neighboring countries.

- The founders of BioNTech expect COVID-19 to continue spreading globally until mid-2022 and are encouraging countries to mix and match vaccines from different manufacturers to speed up inoculations.

- Daily COVID-19 infections across the EU have been trending down since early April, a result of quickening vaccine rollouts.

- Alberta, Canada, is tightening restrictions in the face of a COVID-19 surge that threatens to overwhelm its hospitals.

- Governors of nine Japanese prefectures are calling for the postponement or cancellation of the upcoming Tokyo Olympic Games if the nation’s recent surge of COVID-19 can’t be curbed.

- Thailand launched a campaign to vaccinate 50,000 people in a crowded Bangkok district as the country tries to stop a third wave of COVID-19.

- Singapore will impose tighter measures on social gatherings and border crossings after foreign virus mutations were reported to have spread.

- Vietnam has started keeping people in quarantine longer than the stated policy of 14 days after three COVID-19 patients were found with a virus mutation first detected in India.

- South Korea’s government will take measures to ramp up domestic COVID-19 vaccine production, as the nation awaits a delivery of 14 million vaccine doses to help curb an expected third wave of the virus.

- The World Health Organization is mulling the approval of two of China’s COVID-19 vaccines for emergency use, hoping to expand distribution to lower-income nations through the COVAX initiative.

- The Philippines has approved Moderna’s COVID-19 vaccine for emergency use.

- Tourism representatives from the world’s 20 major economies favor creating vaccine passports to help boost travel and tourism amid the pandemic, as the industry saw its contribution to global output fall by 49% last year after a loss of more than 62 million jobs.

- The International Monetary Fund is sounding the alarm on potential trade wars if countries are not able to agree on global rules for corporate-income taxation.

- The EU temporarily suspended efforts to ratify an investment agreement with China, citing sanctions the country placed on EU officials.

Our Operations

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.