COVID-19 Bulletin: October 22

October 22, 2021 • Posted in Daily BulletinMore news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices finished lower on Thursday, with WTI posting its first loss in six sessions on forecasts of a warmer winter season. U.S. natural gas prices extended their decline as well, down 19% from a 13-year high reached earlier this month.

- Futures were higher in late morning trading, with WTI up 0.6% at $82.96/bbl and Brent up 0.5% at $54.99/bbl. U.S. natural gas futures were 2% higher at $5.22/MMBtu.

- Stockpiles at the U.S.’s largest crude depot in Cushing, Oklahoma, are quickly approaching critically low levels, a stark contrast to last year when a pandemic-induced glut of oil prompted traders to store the fuel on marine tankers.

- U.S. gas prices are averaging $3.28 per gallon, up 10 cents from a month ago and 44% from last year, with analysts expecting prices to remain high for at least another six months. The White House warned that Americans should expect high gas prices to continue into next year, while U.S. antitrust regulators have extended the approval process for at least five oil and gas mergers and acquisitions the past three months in an effort to keep prices down.

- The World Bank is warning that energy prices will continue to rise through the first half of 2022 after surging more than 80% in 2021, posing greater inflationary risks for economies across the globe.

- Chinese diesel stockpiles are estimated to be at their lowest in a year, as the nation works to boost imports and limit consumption.

- Israel is mulling plans to build a $200 million onshore pipeline to Egypt by 2023 to help boost its natural gas exports.

- Ethanol sales are expected to hit record highs in France this year and next as car owners purchase more high-ethanol E85 amid soaring prices for gasoline.

- Exxon Mobil is planning to expand carbon capture and storage at its Wyoming facility by 16% annually, equating to roughly one million metric tons.

- France will give low-income earners a 100-euro monthly payment to help offset surging energy costs.

- Three retail electricity suppliers in Singapore have halted operations the past week, as the city-state’s government mulls emergency measures to combat skyrocketing fuel prices.

- South Africa is hoping to secure more than $27.6 billion in financing for electricity infrastructure as part of a shift away from coal, which now accounts for roughly 80% of the nation’s power generation.

- A new report suggests the plastics industry could emit more pollutants than the coal industry by the end of the decade.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Two-thirds of the U.S. will see above average temperatures from December through February, while the Pacific Northwest and southern Alaska will likely get colder than usual, changes brought by the La Niña climate pattern.

- California’s Caldor Fire has been fully contained after burning more than 221,000 acres over a two-month period.

- With a glut of shipping containers overflowing into residential neighborhoods, California’s governor issued an executive order calling on state agencies to find public and private space to store them as congestion mounts at ports and shipping terminals.

- The Port of Los Angeles handled 903,865 TEUs in September, its busiest month on record, bringing year-to-date cargo volume to more than 8.2 million TEUs, a 26% increase compared to last year. The head of Long Beach’s port, meanwhile, said Americans should buy their holiday gifts early this year as shipping backlogs will persist into 2022.

- In August, the Ports of New York and New Jersey, Virginia, Charleston and Savannah handled a combined 900,326 imported TEUs, up nearly 11% compared with August 2020.

- New data shows record-high sea freight rates are beginning to price out low-value cargo from the market.

- Union Pacific saw profit rise to $1.67 billion in the third quarter, a 23% rise from a year ago despite total shipment volumes remaining flat, an effect of higher rates. The railroad announced that it will expand hours at its California facility near the Port of Los Angeles to help clear backlogs and align with the port’s new 24/7 operations.

- Transpacific cargo flights are costing as much as $2 million, nearly triple pre-pandemic levels.

- The energy crunch in Europe and Asia has pushed spot rates for LNG carriers above $260,000 per day on key routes, up 7% from a week ago.

- Analysts predict trucking capacity will remain tight through the end of the year, further increasing rates in the truckload and less-than-truckload markets.

- Prices for late model commercial trucks are up 85% through the first nine months of 2021.

- Nissan Motor will shrink planned global production for October and November by 30% on continued effects of the global chip shortage.

- Leading U.S. chipmaker Micron Technology is in talks with governments in Japan, Taiwan and Europe about expanding its manufacturing footprint as part of a $150 billion, 10-year investment plan.

- Chipmaker Intel reported lower-than-expected sales growth in the third quarter, citing component shortages hampering its production capacity and Chinese regulatory crackdowns on video gaming.

- Needed medications are the latest casualty of supply chain disruption, with pharmacists increasingly reporting that wholesalers are low on critical supplies.

- Consumer brands Unilever and WD-40 were the latest to warn this week that higher inflation caused them to increase product prices by as much as 4% in the latest quarter.

- A ransomware attack earlier this month has disrupted operations at Chicago candy maker Ferrara ahead of the crucial holiday season, with the firm’s production only able to resume in select facilities amid widespread system failures.

- Wearable fitness technology that warns employees of harmful lifting and bending postures reduced Frito-Lay’s lost work time by 67% year over year during the summer.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

- Our Logistics team reports the following:

- Bulk trucking capacity is very limited as demand is exceeding supply.

- Dry van (full, partial and less-than-truckload) capacity is very limited as demand exceeds supply.

- Port congestion continues to be very problematic, delaying deliveries of imported containers.

- Packaging and pulverizing/grinding production challenges persist as demand is exceeding supply

Domestic Markets

- The U.S. reported 80,072 new COVID-19 infections and 1,903 virus fatalities Thursday.

- COVID-19 fatalities in Wyoming have surged to their highest levels since the start of the pandemic.

- COVID-19 hospitalizations in Idaho have dropped 27% since Sept. 24 despite daily new infections still hovering around 1,000.

- Iowa averaged 986 COVID-19 cases per day the past week, a 15% drop from the prior week.

- Oregon’s COVID-19 fatalities are 10% higher than officially recorded due to a computer error in the state’s monitoring system.

- State employees in Ohio could get up to $1,000 in bonus payments for being vaccinated against COVID-19, a program set to cost the state nearly $6 million.

- Before the pandemic, tourists visiting New York City spent $47 billion annually, supporting more than 280,000 jobs, a number slashed to less than $24 billion in forecasts for 2021.

- The CDC authorized extending COVID-19 boosters to Americans who got Moderna or Johnson & Johnson’s vaccine and said anyone eligible for a third dose can get a different brand from the one they received initially.

- New data from Pfizer shows a booster shot of its COVID-19 vaccine was 95.6% effective in preventing symptomatic disease, effectively restoring full protection against the virus. The company also reported its two-dose regimen was more than 90% effective in teens aged 12-18.

- Pandemic lockdowns have all but eliminated cases of the flu the past 18 months, with one influenza virus strain even being wiped out entirely, new research shows.

- Apple will require unvaccinated employees to undergo daily COVID-19 testing starting Nov. 1.

- Shares of U.S. tech giants exposed to digital advertising were hit hard Thursday after Snapchat’s parent company warned customers are cutting back sharply on ad spending.

- U.S. existing-home sales smashed analyst projections for September, rising 7% to an annualized 6.29 million contract closings, the most since September 2020.

- Quest Diagnostics raised its full-year profit outlook from $13.50 to $13.90 per share after posting strong quarterly results amid high demand for COVID-19 tests.

- American Airlines’ third-quarter revenue nearly tripled from a year ago to $8.97 billion while total losses came in at a lower-than-expected $641 million. The airline predicts the spread of COVID-19 and higher fuel costs will extend losses into the fourth quarter.

- Wendy’s is partnering with Berry Global and LyondellBasell on a new cup made from recycled plastic that could divert up to 10 million pounds of plastic waste from landfills over the next two years.

- Ford’s new Maverick tiny truck, a hybrid, has nearly sold out for the 2022 model year, with the automaker expected to halt taking reservations until next summer.

International Markets

- The U.K. reported more than 52,000 new COVID-19 cases Thursday, the most since July, along with 115 virus deaths. The nation’s virus positivity rate is up 35% the past two weeks, with the country averaging more than 45,000 new cases per day.

- Beijing closed schools, cancelled flights and initiated mass testing after four COVID-19 infections were detected.

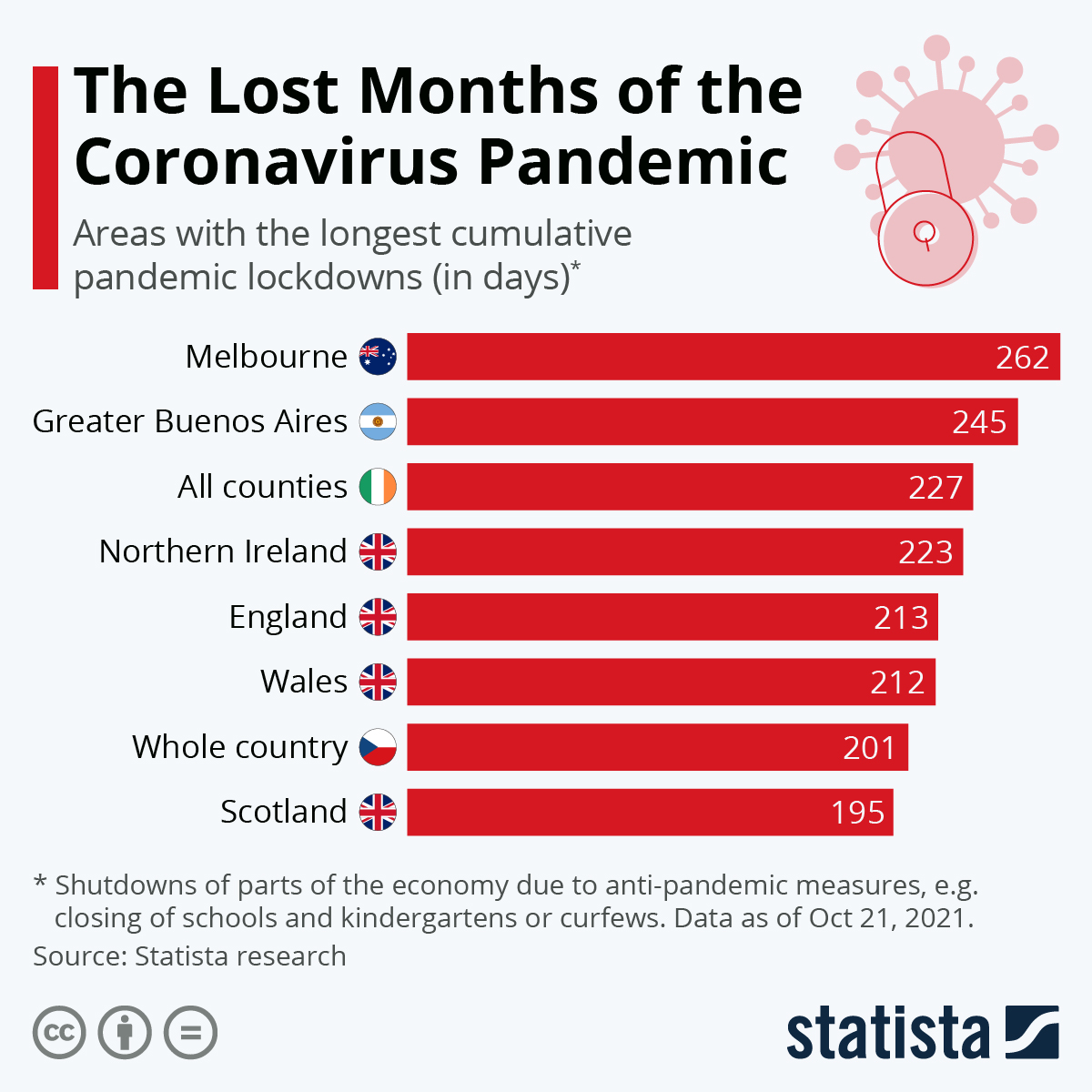

- Melbourne, Australia’s second most populous city, has emerged from its 262-day lockdown after fully inoculating more than 70% of its population against COVID-19.

- New Zealand reported 102 new COVID-19 infections Thursday, its second record in three days.

- An Irish city with 99.7% of adults fully vaccinated against COVID-19 is currently seeing the nation’s highest virus infection rate, more than three times the national average.

- COVID-19 infections are on the rise in several Caribbean countries, with new cases up 40% in the Dominican Republic and Barbados the past week.

- Russia is the latest country to report cases of a COVID-19 Delta variant “sub-mutation” that is believed to be 10% more contagious than the original Delta strain.

- Ukraine reported 22,415 new COVID-19 infections and 546 virus deaths yesterday, both records, as only 15% of the nation’s population is vaccinated.

- Morocco has suspended flights to and from the U.K., the Netherlands and Germany due to higher risk of COVID-19 spread.

- Thailand will stop using China’s Sinovac COVID-19 vaccine once it runs out of current supply, officials announced. The country also made plans to end quarantine requirements for travelers from 46 countries to boost its tourism.

- Tokyo and Osaka will lift pandemic restrictions on restaurants and bars for the first time in 11 months next week following a steady drop in COVID-19 infections throughout Japan.

- Poland became the latest nation to authorize COVID-19 boosters, permitting the shots for everyone over age 18.

- Canada is creating a digital COVID-19 vaccination certificate for domestic and international travel.

- Southern hemisphere countries are 500 million vaccine doses short of reaching 40% full vaccination rates by the end of the year, the World Health Organization said.

- India’s Serum Institute, the world’s largest vaccine manufacturer, could begin exporting COVID-19 shots again to low-income nations as early as next month.

- The World Health Organization estimates between 80,000 and 180,000 healthcare workers have died from COVID-19 since January of 2020.

- The EU’s drug regulator is delaying consideration of Russia’s Sputnik V COVID-19 vaccine until the first quarter of next year and expected to soon make a decision on Moderna’s vaccine as well as a new antiviral pill made by Merck.

- Defaults by Chinese property developers are rising quickly as the country’s housing market continues to slump, triggering the worst sell-off in a decade.

- Private-sector activity in the euro area is the weakest since April, with the growth of manufacturing output in both France and Germany deteriorating sharply, purchasing managers report.

- The U.K. spent $95 billion paying the wages of workers by the time its furlough program came to an end last month, pushing the nation’s budget to its highest level in 70 years.

- Italy is delaying planned new taxes on plastics and sugary drinks until 2023, citing economic factors stemming from the pandemic.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.