COVID-19 Bulletin: February 12

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- A nine-day rally in oil prices ended yesterday, with the WTI falling below $58 on concerns about the economic recovery and the outlook for crude demand. OPEC predicts oil demand will rise by 5.8 million bpd in 2021, an estimate revised down by 100,000 bpd from the previous month.

- Crude prices were higher in mid-day trading with the WTI up 2.5% at $59.69/bbl and Brent up 2.5% at $62.69/bbl. Natural gas was 2.4% higher at $2.94/MMBtu.

- The recent rise in oil prices has dampened speculative buying, draining oil storage facilities and driving storage fees down by half since their peak earlier in the pandemic.

- Royal Dutch Shell announced plans to boost nature-based carbon offsets and carbon capture and storage technology, part of a plan to eliminate net carbon emissions by 2050.

- Saudi Aramco is preparing a financing package of up to $10 billion to offer to buyers of its pipeline business unit, likely an effort to extract value from assets amid lower oil prices.

- S&P lowered its credit ratings on Exxon, Chevron and ConocoPhillips.

- Mini, modular nuclear reactors could be a significant key to a return of the nuclear power industry, which has been shrinking for decades.

Supply Chain

- U.S. chipmakers sent a letter to the White House requesting federal dollars to incentivize semiconductor manufacturing.

- American autonomous-vehicle startup PlusAI Inc. raised $200 million from investors, including top Silicon Valley and automotive firms, to begin mass producing self-driving systems that can be retrofitted onto semitrucks.

- E-commerce warehouse productivity could improve by a fifth over the next three years, a result of greater automation that speeds order accuracy and processing.

- Logistics giant XPO posted record quarterly revenue of $4.67 billion in Q4, beating analyst expectations.

- Uber’s freight business is growing but remains unprofitable, with sales rising 43% to $313 million compared to the year before.

- Kellogg is citing production snags similar to the early days of the pandemic that have caused the food maker to run short of Frosted Flakes, Morningstar Farms meat alternatives and Corn Flakes.

- Logistics conditions remain strained, with trucking demand exceeding availability, continuing congestion at ports, and backlogs at warehousing and packaging facilities due in part to operating challenges related to the pandemic. Shipping containers are in short supply, with demurrage charges rising. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

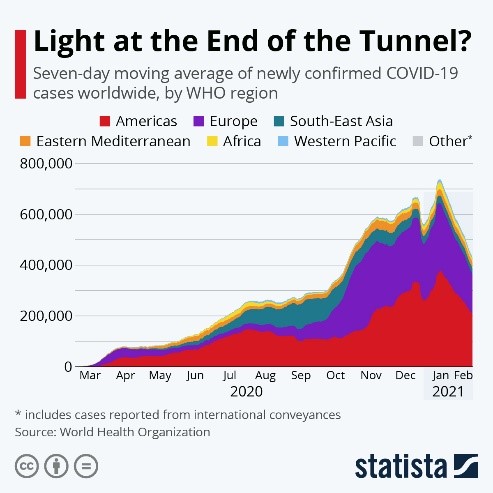

- Yesterday, there were 105,353 new COVID-19 cases in the U.S. and 3,877 fatalities.

- The U.S. suffered a deadly winter, with half of all COVID-19 fatalities since the beginning of the pandemic coming after Nov. 1. Death rates had a disproportionate effect on the elderly, who accounted for roughly a third of the total.

- COVID-19 hospitalizations in the U.S. fell below 77,000 as of Wednesday, the lowest total since Nov. 19.

- Ohio lifted a statewide curfew after COVID-19 hospitalizations remained under 2,500 for more than seven consecutive days.

- COVID-19 can affect the entire nervous system and may cause transverse myelitis, a rare spinal cord condition.

- Poor funding of Alabama county health departments over the years is causing the state to fall behind on COVID-19 vaccinations, with just 10,013 doses administered per 100,000 people as of Tuesday, the lowest in the nation.

- Los Angeles is closing a mass-vaccination site at Dodger Stadium this weekend due to a lack of supply.

- Nearly 6,500 pharmacies in all 50 states, including CVS, Walmart and regional grocers, will get 1 million COVID-19 doses from the federal government starting Thursday.

- AstraZeneca will double output of its COVID-19 vaccine to roughly 200 million doses per month by April.

- COVID-19 vaccines could become available to the general U.S. public by April.

- Drugmakers are searching for new ways to test the next round of COVID-19 vaccines as more people are unwilling to get placebos during large-scale clinical trials.

- Amazon hired employees of a COVID-19 testing startup to help curb outbreaks among its workers, including developing an in-house lab to test samples.

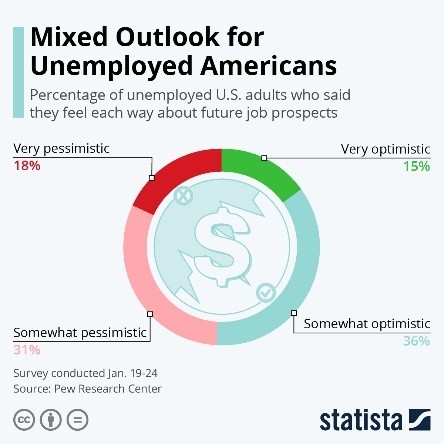

- Though new jobless claims fell slightly last week, nearly 20 million people continue to collect unemployment checks.

- Details of the next COVID-19 relief package are expected to be finalized by the end of the month.

- The federal budget deficit is projected to be $2.3 trillion in fiscal year 2021, smaller than the $3.13 trillion shortfall of last year but still larger than any previous deficit before the pandemic.

- U.S. debt is on track to hit a record 107% of GDP by 2031 as deficits soar over the next decade, though not as much as officials forecast last summer.

- The American economy showed signs of an uptick in January with a slight rise in small- and medium-sized business hiring and improved traffic to retail stores.

- Return-to-office dates at many large companies are getting pushed back to September or beyond, indicating another year’s worth of remote work.

- Deployments of single-aisle aircraft dropped 15% from early January to early February, as the number of airliners in service has plunged since the beginning of the year.

- Millennials are increasingly leaving crowded urban areas to purchase inexpensive and often historical dream homes in far-flung places.

- The U.S. median home price climbed 14.9% to $315,000 in the fourth quarter, the biggest surge going back to 1990. The rise marked the second consecutive quarter of gains in every metro area as the market continues its upward climb.

- Heineken is cutting 10% of its workforce due to pandemic-related pressures that have dropped sales of the beer at bars, restaurants and events.

- Lockdowns and constrained social interaction boosted U.S. toy sales by 16% last year to more than $25 billion.

International

- January saw a marked decrease in the number of COVID-19 infections globally:

- Thirteen Mexican states are designated “red” until Feb. 14, with only essential activities allowed.

- Portugal extended a nationwide lockdown until March 1 on Thursday amid continuing pressure on overstretched hospitals.

- Kenya is moving forward with a plan to inoculate citizens against COVID-19 using AstraZeneca/Oxford’s vaccine, dismissing concerns over the shot’s efficacy. More broadly, the African Union also backed the shots, but said they will be used primarily in areas without high rates of the highly contagious South Africa virus mutation.

- More than 40% of Britons are struggling financially or suffering poor health because of the pandemic.

- The European Commission downgraded forecasts of economic recovery in the euro zone this year, predicting a 3.8% growth rate because of continuing lockdowns and COVID-19 variants. The recovery might not be enough to offset the high rate of company bankruptcies expected once government liquidity support of almost $2.8 trillion finally winds down.

- With many shops, restaurants and leisure facilities shut down through February, Switzerland’s economy is on pace to contract 0.7% this quarter, officially sliding into recession after December’s 0.6% contraction.

- China’s consumer-price index fell 0.3% in January from a year earlier, while factory-gate prices began to reflate after 11 months of declines, with a 0.3% increase in the producer-price index.

- Europe’s vital tourism industry is facing a second dismal year as economic uncertainty mounts and vaccination rollouts stumble.

- The European Union is continuing a ban on “use it or lose it” airline rules for airport landing rights, expecting the pandemic travel slump to continue through the summer.

- Bombardier is ceasing production of its iconic Learjet, with the loss of 1,600 jobs.

- Germany is planning a further $1.1 billion bailout for airports.

- After falling 13.9% in 2020, French exports of wine and spirits are set to take further losses in the hundreds of millions due to U.S. tariffs.

- The European Union will need 1 million public charging points for electric vehicles by 2024 to meet expected demand.

- Debit and credit card purchases in the U.K. rose 8 percentage points last week, a sign of boosted consumer confidence. The nation saw the economy shrink 9.9% last year, suffering its worst recession since 1709.

- A London organization that writes accounting rules for over 140 countries will propose new climate-disclosure rules later this year, leading the way to new international standards for sustainability and a reduction in greenwashing.

- Mexico’s ban on single-use plastics has left women facing a shortage of sanitary products featuring plastic applicators.

Our Operations

- Our 3D Printing business unit has launched a new e-commerce site. Access the new site here.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.