COVID-19 Bulletin: April 1

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Crude futures were higher in mid-day trading today, with the WTI up 2.3% at $60.50/bbl and Brent 1.9% higher at $63.93/bbl. Natural gas was 2.3% higher at $2.00/MMBtu.

- OPEC+ lowered its forecast for this year’s growth in oil demand by 300,000 bpd to 5.6 million bpd, reflecting concerns about the effect of new pandemic lockdowns.

- Cumulative excess production of OPEC+ rose to 3 million bpd through February, up from 2.8 million bpd in January.

- Prior to this week’s slight decline, U.S. gas prices increased for 17 consecutive weeks, the longest streak of gains since 1994.

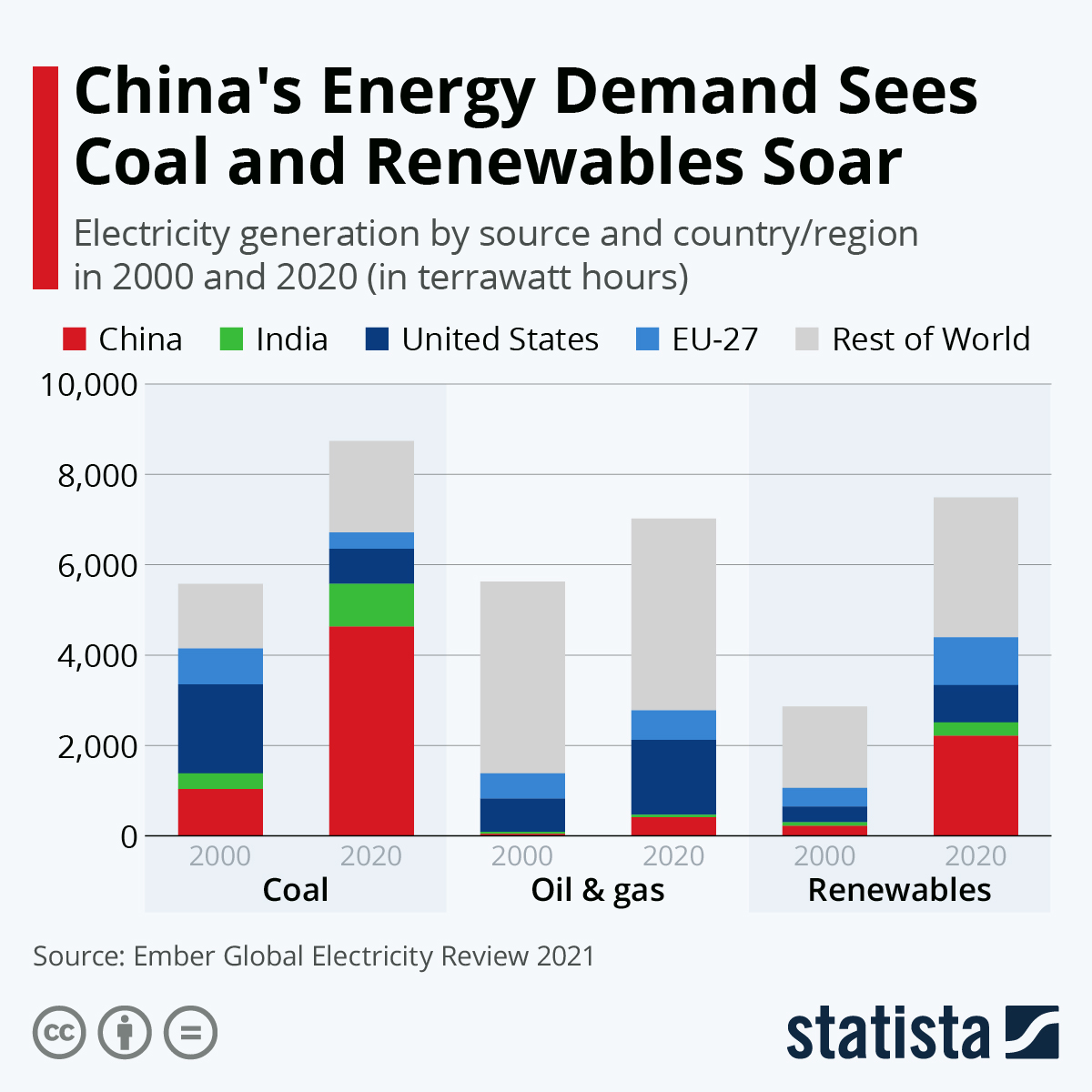

- China’s coal-fired power generation increased 1.7% last year, the only increase among G-20 nations.

- Clean Planet Energy released details of two new ultra-clean fuels that can be used in any ship or vessel as an alternative to fossil fuels in the marine industry. The two fuels are produced using non-recyclable waste plastics and can reduce CO2e by over 75%.

- Exxon and Porsche will collaborate to develop and test biofuels, renewables and lower-carbon synthetic eFuels.

- Exxon told employees it plans to restore their retirement match and that there are no plans for further staff reductions this year.

- Despite higher module prices and supply chain constraints, 180 gigawatts of solar energy are projected to be deployed globally this year, with installs in China, the U.S. and India expected to be particularly strong.

- Several major companies are racing to develop small, modular nuclear reactors that can fit into existing fossil fuel sites as countries seek carbon-neutral power by 2050.

- Morgan Stanley estimates that the rising use of electric vehicles will require $500 billion of power grid investments in Europe and the U.S. through 2040.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- The White House unveiled a $2.25 trillion, eight-year infrastructure package yesterday, which includes hundreds of billions for building and repairing roads, bridges, mass transit, schools and other infrastructure.

- Roughly $628 billion would go toward boosting the market for electric vehicles, renewable power and advanced clean energy technologies, while stripping subsidies for fossil fuels.

- More than $300 billion would go toward drinking-water infrastructure, expanding broadband access and upgrading electric grids.

- The plan would modernize roughly 20,000 miles of highways and roads, along with more than 10,000 bridges, boosting demand for asphalt, a plus for the fossil fuels sector.

- Roughly $50 billion would go toward production incentives and research and design in the American semiconductor industry.

- $16 billion would be earmarked for laid-off oil field workers to plug abandoned wells across the nation.

- Funding for the plan would come from raising the U.S. corporate tax rate to 28% from 21% and increasing taxes on corporate foreign earnings.

- The global semiconductor shortage continues to affect production:

- Production of nearly 1.3 million global light vehicles has been affected in the first quarter, an upwardly revised estimate from data firm IHS Markit.

- Ford will halt production for two weeks in April at a plant in Dearborn, Michigan, and one week on the truck side of its Kansas City, Missouri, assembly plant.

- Apple supplier Foxconn expects a global shortage of electronics components to last until next year.

- Taiwan Semiconductor Manufacturing will spend $100 billion over the next three years to expand its chip fabrication capacity.

- Reinsurance market Lloyd’s of London is facing more than $100 million in losses due to the six-day blockage of the Suez Canal, its chairman said.

- An ongoing labor dispute has caused shipping volumes at the Port of Montreal to drop 1.8% amid fears of a possible strike.

- The World Trade Organization forecasts global merchandise trade will grow by 8% this year after a fall of 5.3% in 2020.

- International Seaways and Diamond S Shipping announced plans to merge and form the world’s second largest U.S.-listed tanker company by vessel count.

- Kimberly-Clark will raise prices on products including Scott toilet paper, tissues and diapers in the U.S. and Canada to offset rising commodity costs. A spate of companies have announced similar moves in recent weeks, including General Mills, Hormel Foods and J.M. Smucker Co.

- The U.S. Department of Transportation’s Maritime Administration awarded $230 million in new grants for port projects.

- Seaspan is continuing an aggressive fleet expansion, ordering six new container ships with capacity for 15,500 20-foot containers each, increasing its fleet by 37 new ships since December.

- The pandemic has prompted more companies and brands to phase out less popular items to free up shelf and warehouse space, simplify manufacturing and better support consumer demand.

- Demand for warehouses of at least 200,000 square feet hit a record in North America last year.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

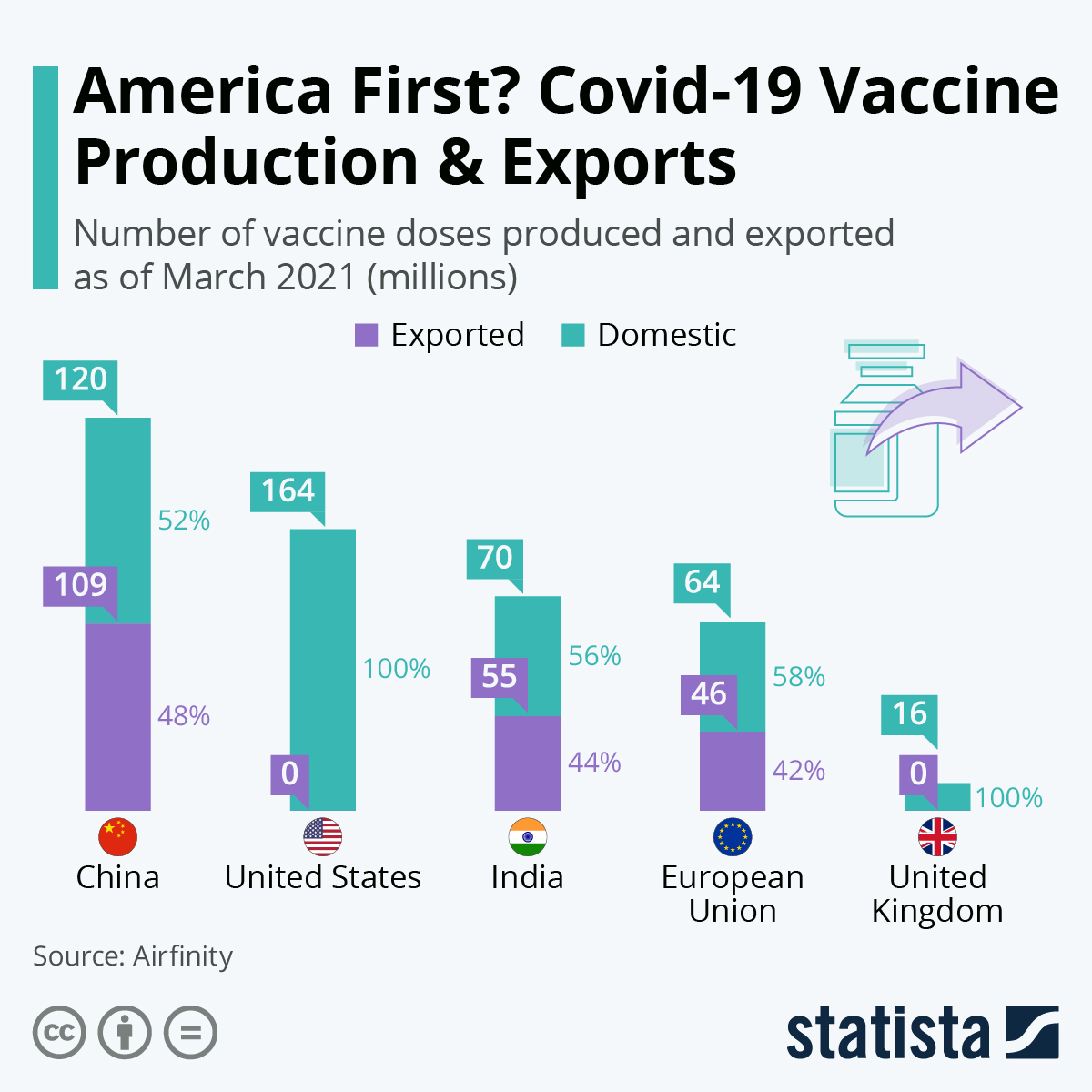

- There were 67,029 new COVID-19 cases and 1,076 deaths in the U.S. yesterday. Over 150 million vaccine doses have been administered, with 15.7% of the population fully vaccinated.

- Despite roughly 30% of Americans having received at least one COVID-19 shot, the seven-day national case count average has increased from 53,000 cases per day to more than 65,000 cases per day in a matter of weeks.

- The trend is exemplified in New York, which recently expanded vaccine eligibility but saw its seven-day average of new cases double from 5,000 to roughly 10,000 in the last week.

- The highly infectious U.K. variant of COVID-19 is now responsible for 26% of cases in the U.S., potentially explaining the rise in infections.

- A Houston hospital system became the first in the nation to require all its 26,000 employees to get a COVID-19 vaccine.

- Results from Pfizer/BioNTech’s COVID-19 vaccine trial showed that the regimen proved to be 91.3% effective at protecting against symptomatic COVID-19 at least six months after the second dose.

- Up to 15 million doses of Johnson & Johnson’s COVID-19 vaccine were thrown out after a manufacturing error caused contamination.

- COVID-19 was the third-leading cause of death in the U.S. last year, contributing to a 15.9% increase in the national mortality rate from 2019.

- As many as 160,000 people in North Carolina and Tennessee will get month-long supplies of at-home COVID-19 testing kits, part of a federal study to see whether self-administered testing can reduce community spread of the virus.

- First-time U.S. jobless claims jumped by 61,000 to 719,000 last week, higher than expected.

- Citing unusual travel patterns due to the pandemic, airlines are posting “placeholder” flight schedules that can be booked but will potentially change as the travel date gets closer.

- Some staff at Google will start returning to offices over the next month, although the move will be optional for employees until at least September.

- Apple announced plans to build a battery-based renewable energy storage facility in Central California that can store 240 megawatt-hours of energy, enough to power 7,000 homes for one day.

International

- Over 66,500 Brazilians died from COVID-19 in March, more than double the previous monthly record as the country’s healthcare system falls under increasing strain.

- French schools will close for three weeks as part of the nation’s third national lockdown imposed yesterday to contain rising COVID-19 cases.

- Italy extended its pandemic restrictions and made COVID-19 vaccinations mandatory for all health workers.

- The seven-day average for new COVID-19 cases in India surged to 59,326 Wednesday, the highest since October.

- Austrian provinces are joining Vienna in extending strict pandemic restrictions through Easter.

- Belgian hospitals must reserve 60% of their ICU beds for COVID-19 patients as a third wave of infections grips the country.

- Sweden is postponing planned easing of COVID-19 restrictions until May 3.

- Despite posting record daily COVID-19 cases, Greece is easing some pandemic curbs to relieve people’s fatigue, including allowing small retail shops to open.

- Five European countries that declined an allotment of the Pfizer/BioNTech COVID-19 vaccine in favor of the more cost-effective AstraZeneca dose are the slowest in the bloc to administer vaccines, after the company delivered just 25% of its committed doses in the first quarter.

- Toronto, Canada, is returning to a lockdown on Saturday, with increased restrictions on stores, gyms, restaurants and hair salons for 28 days.

- The next coronavirus surge in the Americas could be worse than previous waves, as at least one of three highly contagious virus mutations have been identified in 32 regional countries.

- The European Union’s total vaccine imports are expected to be significantly lower than initially planned.

- Russia will begin giving COVID-19 vaccines to animals to stop the spread of virus mutations.

- Average home prices across the world’s major cities rose 5.6% in the fourth quarter of 2020, up from a 3.2% gain in the year-ago period.

- Banking officials in Canada are concerned about rising household debt as housing prices jumped 25% in February compared to a year earlier.

- Mexico’s economy is expected to reach pre-pandemic levels by the beginning of 2022, as the nation’s finance ministry ups growth estimates from 4.6% to 5.3% for this year.

- Brazil’s unemployment rose to 14.2% in January, the first gain in four months and slightly higher than analyst expectations.

- Growing exports to the U.S. boosted Vietnam’s economy to 4.5% growth in the first quarter.

- Volkswagen is buying green energy credits from Tesla in China to meet local environmental requirements.

Our Operations

- M. Holland will be closed tomorrow (Good Friday) in observance of the Easter holiday. We wish all subscribers a safe and happy holiday weekend.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- M. Holland is proud to be named among the Plastics News Best Places to Work again this year. We also were recently named among the Best Places to Work by Crain’s Chicago Business.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.