COVID-19 Bulletin: April 1

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices slid 7% Thursday after the White House unveiled a plan to release 1 million bpd of strategic crude reserves each day for six months starting in May, the third release in the past half-year.

- The 31 member nations of the International Energy Agency agreed to a coordinated release of emergency oil stockpiles without specifying volumes, joining the U.S. in tapping crude reserves to calm markets and ease price spikes.

- In late-morning trading today, WTI futures were down 0.3% at $99.96/bbl and Brent was up 0.2% at $104.90/bbl, with each benchmark down about 11% for the week. U.S. natural gas was up 1.7% at $5.74/MMBtu.

- Last quarter, WTI (+34%) and Brent (+38%) each posted their highest percentage gains since the second quarter of 2020.

- OPEC+ decided yesterday to stick to a modest output increase of 432,000 bpd in May, rejecting broad calls for more crude.

- New monthly data shows U.S. oil output fell 2% in January to 11.4 million bpd, a five-month low. The White House is calling for legislation that would penalize oil drillers when federal drilling leases go unused.

- The share price of Occidental Petroleum doubled last quarter, making it the top performing company in the S&P 500.

- New Fortress Energy unveiled plans to build the U.S.’s first offshore LNG export facility within the next 12 months, a bid to take advantage of lower construction costs and faster deployment despite smaller capacity than onshore peers.

- Ascent Resources, one of the largest privately held U.S. natural gas producers, announced plans to go public with a potential $6 billion valuation.

- More oil news related to the war in Europe:

- Russia’s initial deadline for Europe to start purchasing energy exports in rubles came and went yesterday, without any EU nation signaling a supply emergency. Even with a new Russian decree setting the deadline as today, natural gas flows to Europe remain steady.

- Lured by steep discounts, India has bought at least 13 million barrels of Russian crude since late February, compared to only 16 million barrels purchased in all of 2021.

- Activists blocked two Russian tankers carrying 100,000 tonnes of oil from unloading in Denmark yesterday.

- German energy firm EnBW plans to buy 3 billion cubic meters of LNG per year once a new terminal is constructed in Stade by 2026.

- Spain and Portugal are asking European regulators to approve a price cap for natural gas and coal used by power plants.

- Japan says it is not abandoning its LNG project in the Russian Arctic despite investments being frozen last week over Western sanctions.

- South Africa is cutting its fuel tax by 40% for three months to quell rising prices, with lost revenues expected to be made up through a sale of strategic oil reserves.

- Singapore is raising electricity prices by 10% over the next three months to help cover surging costs for gas imports.

- TotalEnergies and U.S.-based Sempra Energy have agreed to expand their collaborations on new LNG and wind projects for European consumption.

- Sales of gas-to-ethanol conversion kits are soaring in France as people scramble for cheaper transportation fuel.

- British regulators delayed plans to block two fracking wells in the nation’s northwest until next year.

- CNOOC, China’s biggest offshore producer, hopes to garner $5.5 billion in a stock sale next month to fund more drilling.

- Vitol Group, the world’s biggest independent oil trader, posted record net profits of just over $4 billion last year, up from $3.2 billion in 2020.

Supply Chain

- The number of ships waiting to load or discharge at Shanghai’s port skyrocketed to more than 300 this week, a near fivefold increase in the past 2.5 weeks, according to VesselsValue.

- Volkswagen is suspending some Shanghai production until April 5 due to the city’s strict pandemic lockdowns.

- There were 39 container ships awaiting berths at the ports of Los Angeles and Long Beach last week, fewer than 40 vessels for the first time since September of last year.

- Container throughput at Canada’s Port of Vancouver rose 6% last year, including a 56% increase in empty outbound boxes.

- Container volume at the Port of Houston was up 37% in February compared with February 2021.

- Container lines coping with sliding Asia-North America rates are seeking short-term contracts with smaller shippers.

- Operating profit at Orient Overseas Container Line rose seven-fold last year as high freight rates offset flat volumes.

- Waterways connecting the Great Lakes to the St. Lawrence Seaway opened for the freight shipping season.

- The owner of the giant container ship stuck in Chesapeake Bay the past two weeks is seeking to make owners of on-board cargo share in the surging cost of the disruption.

- Orders for new ships at Chinese shipyards fell 17% in January and February.

- Labor negotiations between 22,000 West Coast dockworkers and their employers will begin May 12 ahead of contract expirations on July 1.

- The Supreme Court temporarily blocked New Jersey from leaving the two-state agency that fights crime at the Port of New York and New Jersey.

- Apple is exploring alternative chip suppliers, including its first potential supplier from China, after a batch of output from Japan’s Kioxia Holdings Corp. was contaminated last month and exposed weaknesses in the tech giant’s supply chain.

- Ford and GM are suspending some Michigan production next week due to the continued shortage of computer chips. Across the globe, supply shortages are expected to slow vehicle sales to 12.7 million this quarter from 15 million the same time last year, according to J.D. Power.

- The rise in diesel fuel prices could cost independent truckers up to $120,000 a year and cause increased bankruptcies.

- Beginning Sunday, the U.S. Postal Service will begin imposing “dimensional” surcharges for large and non-standard packages as well as those where shippers fail to mark the package size.

- The S&P GSCI, a benchmark tracking the prices of commodities futures from precious metals to livestock, climbed 29% in the first quarter, its biggest gain since 1990.

- Self-driving startup Aurora Innovation will begin testing autonomous vehicles on a 600-mile route on one of the nation’s busiest freight thoroughfares between Forth Worth and El Paso.

- The U.S. administration awarded $2.7 billion of last year’s historic infrastructure dollars to hundreds of new projects to improve ports and waterways, officials announced Tuesday.

- More supply chain news related to the war in Europe:

- The latest round of U.S. sanctions on Russia includes penalties on Mikron, Russia’s biggest chipmaker and largest exporter of microelectronics.

- Titanium shortages stemming from lost Russian shipments are hurting Airbus’ ambitious expansion plans.

Domestic Markets

- The U.S. reported 46,425 new COVID-19 infections and 755 virus fatalities Thursday. Hospitalizations are down 32% over the past two weeks.

- Employers added 431,000 jobs in March, the 11th consecutive month of more than 400,000 new jobs, lowering the unemployment rate from 3.8% to 3.6%.

- New research on American teens was consistent with studies showing that, across all age groups, COVID-19 vaccines offer limited preventive power against the Omicron variant but are effective in preventing severe illness and death.

- The U.S. Senate reached tentative agreement on a $10 billion package of additional pandemic relief funding.

- A Fed-preferred gauge of U.S. inflation rose 5.4% in March from a year ago, the biggest jump in 40 years. Meanwhile, growth in consumer spending slowed to a sluggish 0.2% pace in February, down from 2.7% the previous month.

- A new survey suggests New York City employees will spend 49% less time in the office post-pandemic and spend far less money in the city.

- The White House is making another 35,000 seasonal-worker visas available for this summer, a bid to help alleviate persistent labor shortages.

- Rising food inflation is taking a severe toll on U.S. food banks and pantries, already stretched thin by underfunding and low donations.

- Sales at Walgreens beat expectations in the latest quarter, rising on Omicron-induced demand for viral testing and vaccinations.

- Shares of computer makers and suppliers, including AMD, HP and Dell, dropped sharply yesterday on fears that the pandemic boom in PCs will soon subside.

- The influential U.S. House Oversight Committee will hold a hearing next Tuesday to push the U.S. Postal Service to buy more electric vehicles.

- Unionization votes for some Amazon workers in Alabama and New York drew nearer to conclusion Thursday and suggested potential gains for labor organizers.

- Keurig Dr. Pepper plans to test using fully recyclable and compostable paper bottles later this year in the U.S.

- Electrolux introduced a new washing machine filter it asserts will capture 90% of microplastics released from synthetic clothing when laundered.

International Markets

- COVID-19 hospitalizations in London are at a two-month high.

- In a rare move, officials in Shanghai acknowledged that the city was not adequately prepared for its most recent surge of Omicron, as yesterday’s cases declined slightly from a mid-week high and officials locked down the remainder of the city this morning.

- Shanghai began censoring social media videos of residents sharing their frustrations with strict lockdowns.

- South Korea’s new COVID-19 cases fell below 300,000 yesterday, a sharp contrast to the more than 620,000 daily infections reported just two weeks ago.

- The land border separating Malaysia and Singapore, one of the busiest thoroughfares in the world, reopened today for the first time in two years.

- Despite a recent rise in COVID-19 infections, Germany plans to scale back its quarantine mandate for those infected, while the German parliament failed to pass a government proposal to impose a vaccine mandate.

- Euro-area inflation surged past market expectations to 7.5% in March, the fifth straight monthly record driven by higher energy costs:

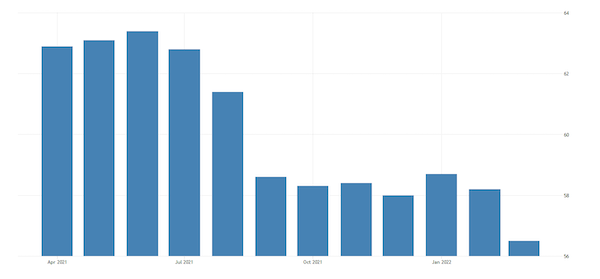

- A purchasing managers index of eurozone manufacturing activity also was down in March, signaling slowing growth:

- Factory orders picked up in Japan in March as COVID-19 infections declined, but export orders slid due to lockdowns in China and the war in Ukraine.

- More news related to the war in Europe:

- S&P Global forecasts a loss of up to $35 billion in the specialty insurance market due to fallout from the invasion, with at least half coming from leased aircraft taken over by Russian airlines.

- A U.S. bill to strip Russia of its favored trade status has stalled in the Senate.

- Russia’s Purchasing Managers Index slumped to 44.1 in March from 48.6 in February as economic sanctions take a bite from economic activity.

- Electric vehicles were the main focus of the Bangkok International Motor Show this week, as surging fuel prices and a 15% government subsidy boost demand in Thailand.

- A British materials supplier claims to have developed a new plasterboard made from agricultural waste and a binding agent that absorbs CO2, eliminating the need for emissions-intensive gypsum.

- The United Nations formed a new panel of experts to analyze net-zero goals of companies and governments in a bid to prevent deceptive greenwashing.

- Canada will require all new passenger car sales to be zero-emissions models by 2035, officials said Thursday.

- BP plans to invest about $1.3 billion in electric vehicle charging infrastructure in the U.K.

- Volkswagen is recalling over 100,000 electric vehicles from several of its brands across the globe due to the risk of battery fires.

At M. Holland

- In case you missed it, watch M. Holland’s Plastics Reflections webinar about the current and future state of the North American plastics industry. Click here to access the recording.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.