COVID-19 Bulletin: April 13

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Crude futures were higher in early trading today, with the WTI up 0.7% at $60.10/bbl and Brent 0.6% higher at $63.65/bbl. Natural gas was up 2.6% at $2.63/MMBtu.

- U.S. oil production is still roughly 2 million bpd below pre-pandemic levels seen in January 2020.

- Crude reserves in top international oil companies have dropped nearly 25% over the past 10 years, posing a challenge to future production and earnings.

- Saudi Aramco has reached an agreement with a consortium led by U.S. EIG Global Energy Partners to sell a 49% stake in Aramco Oil Pipelines Co., a new entity formed to trade the rights to 25 years of rate payments for crude transport across Aramco’s pipeline network.

- Total and China’s CNOOC entered agreements with the governments of Uganda and Tanzania for the construction of a $3.5 billion pipeline that will carry Ugandan oil to the Tanzanian coast for international export.

- A new study led by researchers at Cornell University and Utah State University showed that microplastics can get picked up by jet streams and remain airborne for up to six and a half days before they drop, leaving deposits around the world.

- Denmark announced plans to purchase 100 electric trains from France’s Alstom to replace its diesel-powered trains.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- More news on the global semiconductor shortage:

- The White House is not prepared to issue any directives based on its meeting yesterday with more than 20 top U.S. executives over the global semiconductor shortage. At least $50 billion in funding was allocated to the industry in the recently unveiled $2.25 trillion infrastructure plan.

- Intel announced plans to begin making chips for car plants in the next six to nine months.

- The global microchip shortage is continuing to wreak havoc across the auto industry, with General Motors hardest hit, reporting more than 73,500 vehicles taken out of production schedules.

- Mitsubishi Motors will cut production by a combined 7,500 vehicles at three plants in Japan and Thailand in April, a result of the global chip shortage.

- Global container volumes rose 15.8% in February from the year-ago period, a higher-than-expected increase in a traditionally slow month.

- Roughly 98% of retailers in a survey say they have been affected by port congestion or other shipping delays. With major terminals in Europe and North America facing continued backlogs, some experts predict the congestion has reached a “high plateau.”

- Maersk is forecasting disruptions from the blockage of the Suez Canal to extend into the second half of May.

- The U.S. administration indicated potential support for a 5-cent hike in the gas tax or a user fee for electric vehicles to help pay for its massive infrastructure plan.

- A drop in rail service levels caused in part by precision scheduled railroading forced leading potato supplier Lamb Weston to shift business from rail to spot-market trucking, resulting in a spike in costs and drop in quarterly earnings.

- A rebound in steel, coal and grain trading has led to a rally in dry bulk freight rates.

- China’s trade surplus with the U.S. fell to $21.4 billion in March from $23 billion in February amid continuing trade tensions between the countries.

- Warehouse development in the U.K. is expected to double this year.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- There were 70,234 new COVID-19 cases and 467 deaths in the U.S. yesterday. Over 189 million vaccine doses have been administered, with 20.6% of the population fully vaccinated.

- The U.S. seven-day average of new COVID-19 cases rose to 70,040 Sunday compared to a 14-day average of 66,766, indicating cases are rising.

- A surge in COVID-19 infections in the Northeast and Upper Midwest has experts unsure as to why the virus is spreading to some parts of the country and not others.

- The federal government is sending more COVID-19 tests and therapeutics to Michigan after the governor requested resources to combat surging COVID-19 cases of more than 7,300 per day. The head of the CDC urged the state’s administration to “close things down” amid the spike.

- Florida reported nine COVID-19 deaths yesterday, the first single-digit toll since September.

- Younger people who haven’t been vaccinated against COVID-19 comprise the largest portion of resurgent cases in at least five states.

- While the U.K. variant of COVID-19 — now the dominant strain in the U.S. — is more infectious than other mutations, it is not more likely to cause severe symptoms, a study found.

- U.S. federal health agencies are urging states to pause use of Johnson & Johnson’s single-dose COVID-19 vaccine following reports of six women developing blood clots shortly after receiving a dose.

- After receiving the required number of shots, immunity from COVID-19 is expected to last at least six months, but likely much longer.

- The U.S. budget deficit hit $660 billion, the highest on record for the month of March, fueled by the distribution of direct stimulus checks to many Americans. For the first half of the fiscal year, the deficit exceeded $1.7 trillion, nearly twice the previous half-year record.

- Prices charged by wholesale suppliers in the U.S. rose in March at the fastest pace in a decade.

- Consumer prices rose a higher-than-expected 0.6% in March versus February and 2.6% compared with March 2020.

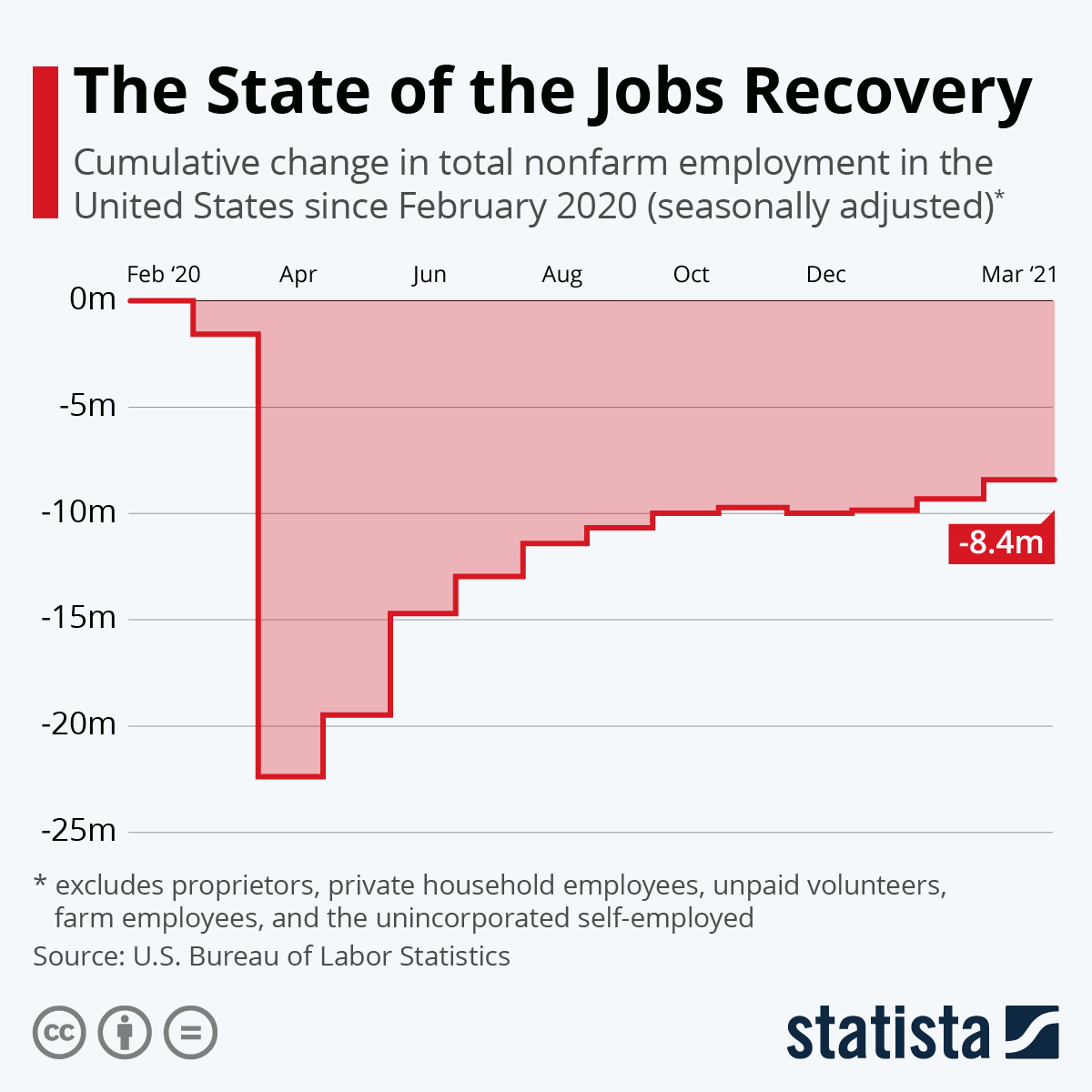

- Over 900,000 jobs were created in the U.S. in March, more than expected as the economic recovery gains momentum:

- Salesforce will start allowing employees with COVID-19 vaccinations to return to offices, making it one of the first major U.S. firms to prioritize vaccinated workers for preferential treatment.

- Uber posted record bookings in March, up 9% month over month, on a rebound in ride-hailing operations and a significant boost in its food-delivery unit, which saw business more than double year over year. Uber is now offering increased sign-up bonuses for drivers to keep up with demand.

- Nissan-backed autonomous driving startup WeRide received a permit to test two completely driverless passenger vehicles on California’s public roads.

- Silicon Valley startup Nuro is partnering with Domino’s Pizza to begin delivering pizzas using its autonomous vehicles as part of a pilot program being launched in Houston.

- Global PC sales jumped more than 55% year over year in the first quarter, despite component shortages and supply chain challenges.

- Microsoft will buy artificial intelligence company Nuance Communications, a bet on the growing demand for digital tools within the healthcare industry.

- After a three-decade partnership, McDonald’s is closing most of its outlets in Walmart stores, as consumers minimize in-store dining and fast-food shifts to drive-throughs.

- Two of California’s famous movie theater chains are shutting down, a reminder of the pandemic’s continued effect on the industry despite increasing vaccinations.

- A new report from Lux Research predicts that the 3D printing market will reach $51 billion by 2030, driven by more rampant use of the technology in the production of prototypes and one-off parts.

International

- The World Health Organization is sounding the alarm on recent spikes in global COVID-19 cases, with more than 4.4 million infections reported over the last week.

- Canada now is suffering more new COVID-19 cases per capita than the U.S., a first. Doctors in Ontario are expected to have to decide who can receive intensive care treatment as the number of coronavirus patients overwhelms hospital resources, while schools in the region switched to remote learning.

- India plans to fast-track approvals for COVID-19 vaccinations from other countries to control a rising surge in infections. The country reported 161,736 new COVID-19 cases and 879 deaths today, up more than four times the daily average in January.

- Japan’s western region of Osaka, site of the upcoming summer Olympics, reported nearly 1,100 new COVID-19 infections Tuesday, a record, largely caused by the highly contagious U.K. variant as officials imposed new lockdowns.

- Russia suspended most air travel with Turkey over the latter nation’s rising outbreaks.

- With nearly three-quarters of the population having antibodies against COVID-19, the U.K. may have already achieved herd immunity against the virus.

- Eastern European countries are beginning to ease lockdown restrictions despite suffering among the world’s worst outbreaks of COVID-19 throughout the pandemic.

- Germany’s federal government sought emergency powers from parliament to enforce a national lockdown after some states ignored recently imposed restrictions to curb a spike in infections.

- Johnson & Johnson began delivering its single-shot COVID-19 vaccine to the EU yesterday.

- The EU’s health commissioner asked health ministers from other countries to provide data on side effects from AstraZeneca’s COVID-19 vaccine to develop a coordinated approach in administering the vaccine across the bloc.

- Ireland joined a swath of countries limiting AstraZeneca’s COVID-19 shot to those over age 60.

- Australia is expecting its COVID-19 vaccine campaign to be delayed by months over concerns about side effects from AstraZeneca’s shots. The nation recently declined to purchase Johnson & Johnson’s vaccines for similar reasons.

- Due to supply shortages, drugmaker Novavax pushed back its timeline for producing 150 million COVID-19 vaccine doses per month, now saying it will not reach that goal until the third quarter.

- The International Monetary Fund is shooting for this summer to distribute roughly $650 billion in monetary reserves, a move expected to help middle-income countries that need to refinance debt.

- China’s exports grew at a robust pace in March, up 30.6% from a year earlier, while import growth surged to the highest level in four years. The nation’s first-quarter auto sales rebounded to pre-pandemic levels.

- Business sentiment improved in Canada, with 64% of businesses saying sales were at or above pre-pandemic levels.

- Canada added 303,000 jobs in March despite bracing for more pandemic lockdowns.

- The Canadian government is giving Air Canada access to nearly $5 billion in funds to help the airline combat a collapse in traffic.

- An index measuring business conditions in Australia hit a record in March, alongside spikes in indices measuring business sentiment and employment.

- Singapore state investor Temasek Holdings and BlackRock, the world’s largest asset manager, partnered to invest roughly $600 million in firms with products and technologies that reduce carbon emissions.

Our Operations

- Our next Plastics Reflections Web Series is Tuesday, April 20 at 1:00 pm CT. This webinar focused on Driving Sustainability Action in the Plastics Industry will feature panelists from Business Publishing International (BPI), Danimer Scientific, Coca-Cola and M. Holland. Click here to learn more and register.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.