COVID-19 Bulletin: April 15

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose nearly 5% Wednesday on higher crude demand outlooks from OPEC and the International Energy Agency, along with a crude draw of 5.9 million barrels for the week ending April 9.

- Crude futures were higher in mid-day trading today, with the WTI up 0.2% at $63.30/bbl and Brent 0.4% higher at $66.82/bbl. Natural gas was 2.0% higher at $2.67/MMBtu.

- Canada’s crude oil imports fell by 20% in 2020 due to lower demand during the pandemic, as the U.S. supplied nearly four out of every five barrels of oil to the country.

- The U.S. power sector has reduced emissions by 52% from levels projected 15 years ago, a lab study from Berkeley shows.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Just as the months-long logjam of cargo ships in Southern California is showing signs of easing after the busiest March on record, truck drivers at the ports of Los Angeles and Long Beach went on strike against Universal Logistics Holdings over alleged illegal firings and denial of back pay.

- Union Pacific is raising rates on intermodal rail shipments in California, comparable to levies added during the peak season.

- Ford is extending shutdowns or production curtailments at plants in Michigan, Missouri and Ohio, including F-150 facilities, due to the global shortage of semiconductors.

- U.S. seaborne imports of leisure products climbed 168.3% in March year over year, while home furnishings imports rose 136.5%.

- The U.S. Senate will take up some sections of the White House’s $2.25 trillion infrastructure bill starting next week.

- Europe-bound shipments from China, which surpassed the U.S. as Europe’s largest trading partner last year, are increasingly moving through a new trade corridor of railroads, seaports and air hubs in Europe’s neglected areas with support of Chinese investment.

- Major U.S. trucking firms are boosting pay as they scramble to hire more drivers amidst surging demand and the tightest labor market in decades.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- There were 75,375 new COVID-19 cases and 956 deaths in the U.S. yesterday. Over 194 million vaccine doses have been administered, with 21.2% of the population fully vaccinated.

- COVID-19 cases are trending higher in 37 states this week.

- More than 4,000 COVID-19 patients are hospitalized in Michigan, exceeding the peak of last April, as health officials brace for the worst coronavirus spike of the pandemic, fueled by the dominance of the highly infectious U.K. variant.

- A novel study comparing the first dose of AstraZeneca’s shot to Pfizer’s shot in elderly people found strong and broadly similar antibody responses.

- The CDC has identified roughly 5,800 COVID-19 infections among the more than 66 million Americans who have completed a full course of vaccination, translating to 0.008%.

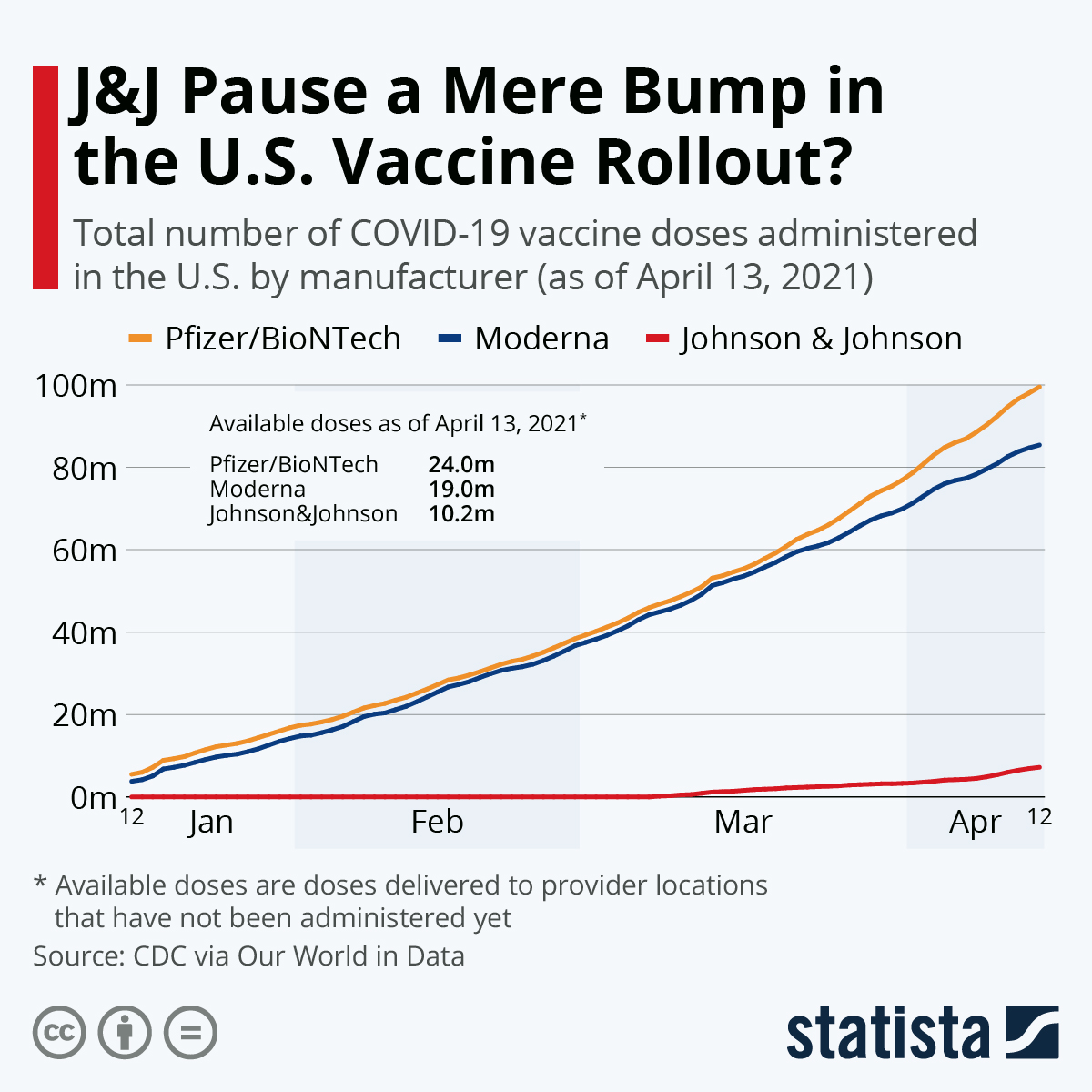

- Vaccination sites across the U.S. canceled tens of thousands of appointments due to the pause in use of Johnson & Johnson’s COVID-19 vaccine. The shot’s extremely rare blood clot issue could increase hesitancy in the U.S. inoculation campaign.

- The federal government’s recommendation to pause using Johnson & Johnson’s vaccine will remain in place after an advisory panel put off a vote on how to move forward with the shots.

- A new study from the University of Oxford says that the risk of blood clots is significantly higher in those with COVID-19 than among those who have received a vaccine.

- Moderna plans to have a COVID-19 booster vaccine ready for Americans by fall of this year.

- A growing number of colleges are requiring students to receive a COVID-19 vaccine before returning to campus in the fall.

- First-time jobless claims fell to 576,000 last week, the smallest weekly gain of the pandemic.

- U.S. retail sales surged a better-than-expected 9.8% in March from February and 27.7% over March of last year.

- U.S. import prices increased 1.2% in March on higher costs of petroleum products and tight supply chains, a sign that inflation is picking up.

- New-business applications rose 3.4% to 440,165 in March, a modest rebound compared to a 13% drop the previous month.

- The chairman of the Federal Reserve noted that the central bank will begin to slow the pace of bond purchases well before raising interest rates.

- Major banks on Wall Street posted record quarterly revenues on a burst of companies entering the public markets and a flood of new equity investment, particularly from individuals.

- Dollar General is ramping up hiring by 20,000 employees this spring in response to a quickening economic recovery in the U.S.

- U.S. grocery sales rose by 11% in 2020, more than triple the growth of the previous two years.

- Uber set a return-to-office date of Sept. 13 for many of its employees, becoming one of the first major U.S. tech companies to schedule a timeline.

- Rising COVID-19 rates in Michigan prompted Ford to extend its July office reopening until October.

- U.S. demand for single-family homes exceeds supply by nearly 4 million houses, according to the Federal Home Loan Mortgage Corp.

- A new study published by the CDC shows that the risk of COVID-19 exposure on an airline drops by up to 50% when the middle seat is left vacant.

- A surge in travel is colliding with a shortage of rental cars, the result of rental-car companies selling hundreds of thousands of vehicles to survive the pandemic.

- General Motors will restart production at its Tennessee plant one week earlier than planned, citing an improvement in the supply of semiconductors.

- Ford will begin putting hands-free highway driving technology in some of its pickup truck and Mustang models later this year.

- Audi unveiled a new entry-priced electric SUV hoping to be a worthy competitor of Tesla’s Model Y.

- Mazda has introduced its first electric vehicle for the U.S. market, with plans for it to debut in California this fall and expand into other states in 2022.

- A condiment shortage caused by the pandemic’s shift to takeout food has sprung a secondary market for a new hot commodity: ketchup packets.

International

- For the first time, India recorded more than 200,000 new COVID-19 infections, as the financial hub of Mumbai went under lockdown at midnight.

- Sao Paulo, Brazil’s most populous state, warned that it could soon run out of medical resources, particularly intubation drugs, to care for seriously ill COVID-19 patients.

- Chile and Romania joined the ranks of countries with more than 1 million COVID-19 infections.

- The highly infectious Brazilian variant of COVID-19 is showing signs of new mutations that could further help it resist vaccines.

- Singapore has recorded its first new COVID-19 cases since March 25.

- Thailand recorded more than 900 new COVID-19 cases for the third day in a row.

- Japanese officials will consider canceling this year’s Olympic Games in Tokyo if COVID-19 cases continue to spread.

- Cambodia’s premier declared the nation is “on the brink of death” as the nation imposed a strict lockdown to curb soaring COVID-19 infections.

- Healthcare systems throughout Asia are being strained by rising COVID-19 infection and hospitalization rates.

- COVID-19 deaths in Europe have exceeded 1 million, more than a third of the world total.

- France reported over 43,000 new COVID-19 cases yesterday, moving the seven-day average in the country above 40,000 for the first time this year.

- The number of confirmed COVID-19 cases in Germany jumped by 29,426 yesterday to 3.073 million, the biggest increase since January.

- Turkey reported nearly 63,000 new COVID-19 cases on Wednesday, a record.

- European regulators will issue a final decision on the use of Johnson & Johnson’s COVID-19 vaccine sometime next week, after signaling that the benefits of the shot probably outweigh its risks.

- After suspending use of Johnson & Johnson’s vaccine over blood clot concerns, South Africa said the down payments it made for the shots are non-refundable. As the government awaits data from the U.S. and Johnson & Johnson to decide whether to continue its use, South African regulators found no major safety concerns with the vaccine.

- Italy suspended the use of roughly 184,000 of Johnson & Johnson’s COVID-19 vaccine shots following the U.S.’s announcement on Tuesday.

- Greece will lift quarantine restrictions starting next week for vaccinated travelers from the EU and five other countries.

- The EU formally agreed to launch COVID-19 travel passes by this summer, a move expected to provide easier travel between the 27 EU member states.

- Lithuania is rolling out a national digital COVID-19 passport by early May, allowing vaccinated people to bypass restrictions on dining indoors, attending sports events and holding large parties.

- Switzerland will further ease pandemic restrictions next week, allowing restaurants to reopen outdoor terraces, sports events to have audiences, and theaters and concert venues to readmit guests.

- The International Monetary Fund is urging euro zone nations to provide additional fiscal stimulus of 3% of GDP in 2021-2022 to boost economic growth.

- Economic growth in Germany is expected to hit 3.7% this year, a downward revision due to a longer than expected COVID-19 lockdown.

- Despite a 10% decline in total production in the U.K. last year, British workers’ average hourly output rose 0.4%, a sign of the pandemic’s disproportionate impact on lower-paid jobs.

- Core machinery orders in Japan fell the most in nearly a year in February, concerning officials who hoped that more investment in plants and equipment would help the world’s third-largest economy rebound quicker.

- A newly created battery industry group in Japan is seeking increased government support to combat the growing market power of China, the U.S. and Europe.

- Nikola, IVECO and OGE are partnering to create infrastructure for refueling hydrogen-powered fuel-cell electric vehicles in Germany.

- Irish ultralow-cost airline Ryanair will receive its first Boeing 737 MAX jet following the aircraft’s two-year grounding.

- Air Canada will begin purchasing aircraft from Boeing and Airbus again after gaining funding in a government aid package.

- Brazil, seeking $1 billion in foreign aid to preserve the Amazon rainforest, must show that it can reduce deforestation before Norway, the top donor in the past, will resume payments.

Our Operations

- Our next Plastics Reflections Web Series is Tuesday, April 20 at 1:00 pm CT. This webinar focused on Driving Sustainability Action in the Plastics Industry will feature panelists from Business Publishing International (BPI), Danimer Scientific, Coca-Cola and M. Holland. Click here to learn more and register.

- M. Holland is the headline sponsor for AMI’s Thermoplastic Concentrates & Masterbatch Virtual Summit on April 26-29. Christopher Thelen, Regulatory Specialist for M. Holland, will be speaking on Monday, April 26 at 8:00 am CT.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.