COVID-19 Bulletin: April 20

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil futures were lower in mid-day trading today, with the WTI down 1.3% at $62.55/bbl and Brent 0.9% lower at $66.46/bbl. Natural gas was 0.9% lower at $2.73/MMBtu.

- India is laying the groundwork for building many new coal-fired power plants, shunning increased global focus on environmental impacts of the fuel.

- Texas, center of the U.S. oil industry, now leads the nation in renewable energy, which is driving a green jobs boom in the state.

- Amazon is building its presence in the renewables industry, announcing nine new utility-scale projects, including a 350 MW wind farm off the coast of Scotland, making it the largest corporate buyer of renewable energy.

- The International Energy Agency projects that global carbon emissions will increase 4.8% this year, the biggest increase since 2010, after falling during the pandemic.

- Yesterday, Exxon proposed a $100 billion, publicly/privately financed project to capture carbon emissions from Gulf Coast petrochemicals plants and store them deep beneath the Gulf.

- Forestry company SilviaTerra has established a Natural Capital Exchange where carbon emitters can buy carbon credits by paying Southern pine growers not to harvest trees.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- The strongest typhoon ever recorded for the month of April touched down in the Philippines yesterday, prompting the evacuation of more than 100,000 people from coastal areas.

- Imported TEUs grew by almost 51% year over year across the U.S. in March, typically an off-peak season, led by higher imports from China and Vietnam.

- The United Nations is pushing regulators to scrutinize a prolonged period of record freight rates and poor on-time performance, along with demanding that governments clamp down on liner attempts to coerce market conditions.

- Global port bottlenecks and delays caused by the week-long blockage of the Suez Canal could end in early June in Europe, analyst firm Sea-Intelligence predicts.

- China, a ray of hope for the rebounding auto industry, is facing production cuts from its biggest automaker due to continued effects of the global semiconductor chip shortage.

- Chipmaker Renesas Electronics expects to restore lost production capacity at its fire-damaged plant by the end of May.

- Building new semiconductor chip capacity could take years, while shorter-term fixes, including manufacturing changes and opening up spare capacity, are not expected to aid the world’s current chip shortage until next year at the earliest.

- An index for freight market conditions in March posted an annual gain of 10% and a monthly gain of 4.1%, indicating favorable inventory levels and consumer trends.

- Signs point to a “super-cycle” for the dry bulk market with demand increasing by up to 10.1% this year.

- A global supply chain logjam has hit AGCO, one of the world’s largest farm machinery makers, just as farmer demand heats up amid rising grain prices and a nascent planting season in the Northern Hemisphere.

- Harley-Davidson, one of the highest-profile casualties of recent U.S. trade disputes, is now facing an import tariff of 56% on products going to the EU.

- Foxconn, the world’s largest electronics manufacturer, finally inked a scaled-back deal to start mass production at a Wisconsin plant mired in years of delay.

- Canadian National Railway announced a $30 billion bid to acquire Kansas City Southern, a 21% premium over Canadian Pacific’s recent offer to acquire the company.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

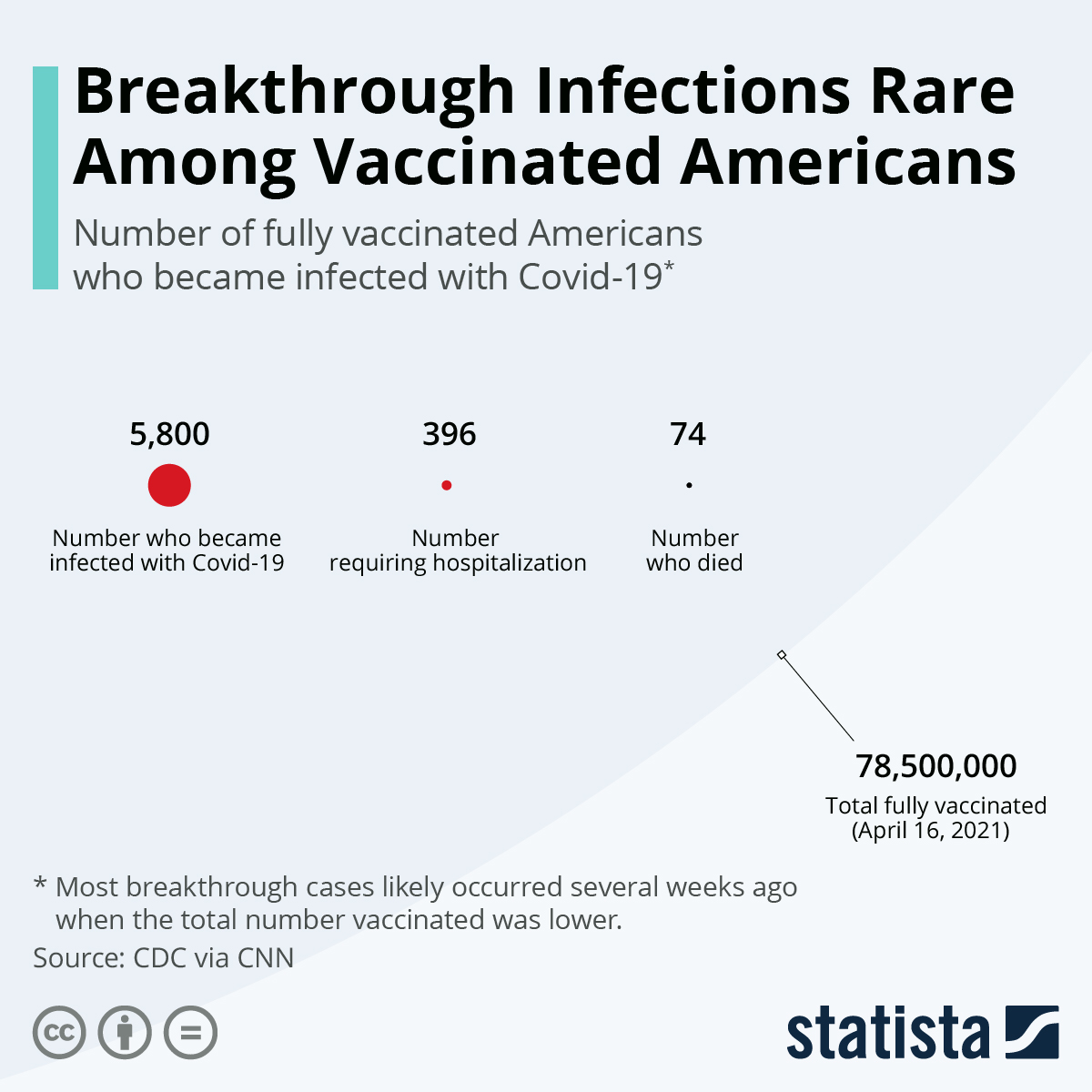

- There were 67,933 new COVID-19 cases and 477 deaths in the U.S. yesterday. Over 211 million vaccine doses have been administered, with 23.7% of the population fully vaccinated.

- Average daily COVID-19 cases are increasing in 36 states this week, with the national infection rate rising to 21.2 per 100,000 people from 19.8 last week. Young people who have not been vaccinated make up an increasing portion of infections, as more virulent variants accelerate the spread.

- Americans can now buy at-home, over the counter COVID-19 testing kits for under $25. The device made by Abbott Laboratories has been distributed to retailers across the country, including CVS, Walgreens and Walmart.

- Women are outpacing men in getting vaccines, with 54.3% of eligible women in the U.S. receiving shots versus just 45.7% of eligible men.

- The CDC is investigating a few additional cases of severe adverse reactions possibly linked to the Johnson & Johnson COVID-19 vaccine.

- U.S. regulators ordered Emergent BioSolutions to stop producing Johnson & Johnson COVID-19 vaccines at a Baltimore facility where 15 million doses recently had to be discarded over a manufacturing issue.

- The State Department warned people against international travel and said it will soon issue Level 4 “do not travel” classifications for 80% of the world’s nations.

- Hunkered down at home, a significantly higher percentage of Americans are suffering injuries related to renovation projects, yard work and moving.

- Following a year of closures at restaurants, stadiums and cinemas, Coca-Cola’s sales volumes reached pre-pandemic levels for the first time in March.

- Ford will begin giving COVID-19 vaccines to employees at facilities in Michigan, Missouri and Ohio.

- As demand picks up, United Airlines is adding flights to European destinations starting in July, while also requiring passengers to show COVID-19 testing and vaccine documents.

- The four biggest U.S. banks used an unprecedented 15% gain in deposits last year primarily to increase their cash reserves and securities holdings rather than for funding new loans.

- Procter & Gamble will raise prices on a variety of consumer goods in the fall due to rising raw material and logistics costs.

- Facing heightened stakeholder pressure, Toyota shifted its climate stance, announcing a review of its lobbying and greater transparency on company-wide environmental goals. The company also set plans to produce 15 new electric vehicle models globally by 2025.

International

- India posted a record 273,810 new COVID-19 cases on Monday, as officials opened the nation’s vaccine eligibility to everyone over age 18. New Delhi, the nation’s capital, is under a strict six-day lockdown, while vaccine manufacturer Bharat Biotech will increase its annual production of its COVID-19 shot to 700 million doses.

- Britain is banning most travel from India after detecting more than 100 cases of a “double-mutation” variant first identified in the country.

- Confirmed COVID-19 deaths in Mexico surpassed 210,000, the third highest in the world behind the U.S. and Brazil, while officials say the real number could be 60% higher.

- The Netherlands, experiencing its highest COVID-19 infection and hospitalization rates since January, will begin lifting lockdown measures next week under intense public pressure.

- Schools in Buenos Aires, Argentina’s capital, will open despite a federal order requiring two weeks of remote learning due to a surge in COVID-19.

- American Airlines is cutting flights to several South American destinations following declining demand amid a surge of COVID-19 cases in the region.

- Japan is prepping to declare a third state of emergency in Tokyo and Osaka due to rising COVID-19 cases, raising doubt about the 2021 Summer Olympic Games.

- COVID-19 infections in Thailand dropped to 1,390 on Monday, a positive sign after a run of record daily highs.

- After experiencing the world’s worst COVID-19 surge per capita, Portugal is gradually coming close to fully reopening its economy.

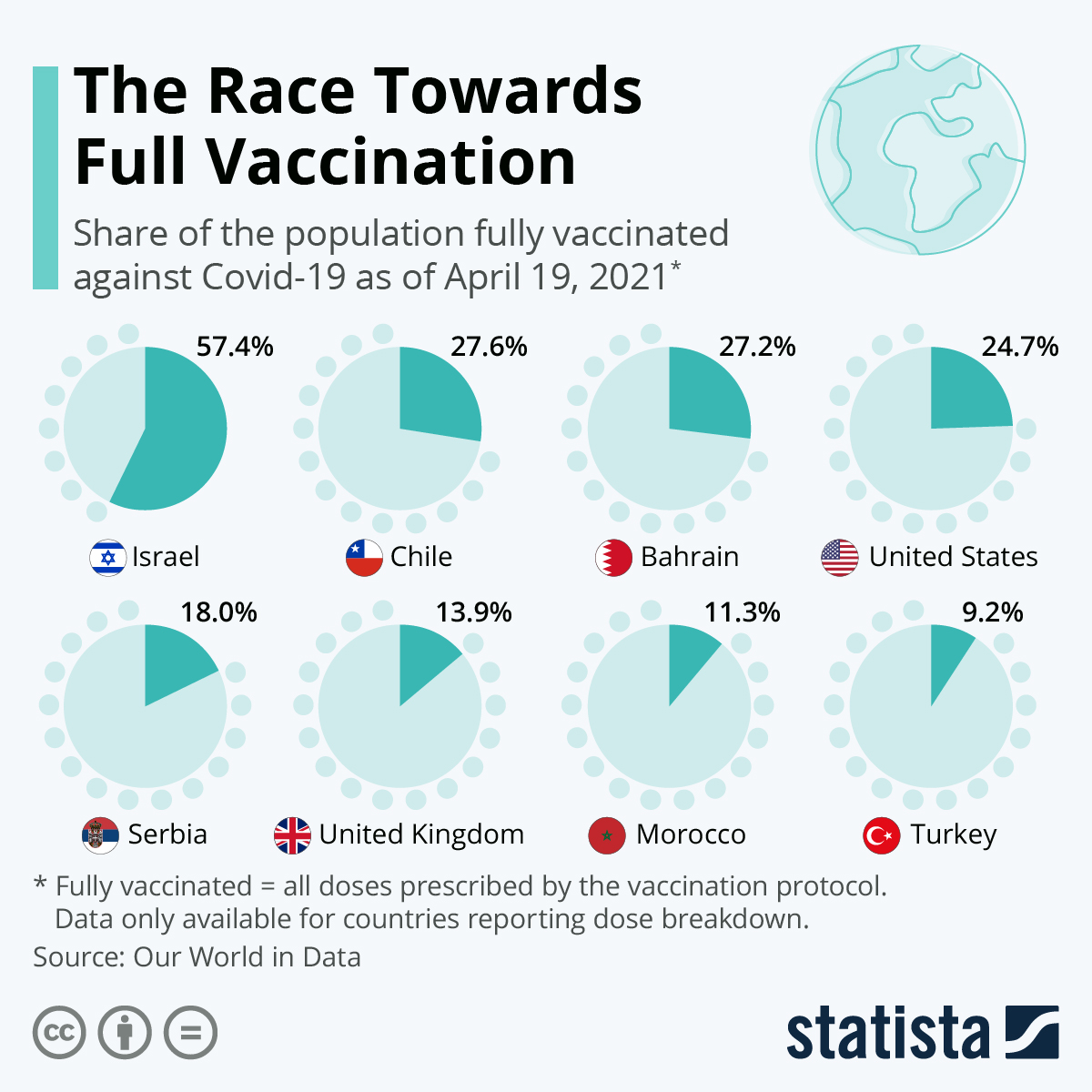

- Israel, the U.K. and Chile have been leaders in inoculating the bulk of their populations, but with starkly different results…

- Following the success of its vaccination drives, Israel and Britain are exploring opening a “green travel corridor” to allow business and tourism between the two countries.

- Italy announced plans to reopen the country to visitors in mid-May, hoping it will throw a lifeline to the nation’s tourism industry.

- On Monday, Greece began letting in tourists from the EU, the U.S., Britain and other countries, with a formal tourism opening set for May 14.

- As vaccine production ramps up across the EU, the bloc plans to have enough vaccine doses to cover 70% of its adult population by the end of the summer.

- The World Health Organization threw its weight behind a policy that would not require travelers to show proof of COVID-19 vaccination.

- Frustrated with the pace of COVID-19 vaccine rollouts in the EU, Austria made the decision to only use Russia’s Sputnik V shot once it is approved by regulators.

- After months of stalled COVID-19 vaccine rollouts, Australia expanded eligibility to those over age 50.

- People who have had COVID-19 will be purposely reinfected with the virus as part of a British “challenge trial” examining immune responses.

- In a reversal, China announced it will allow travel entry to those who have received COVID-19 vaccines from the U.S. after previously stating it would only allow entry to those who received Chinese vaccines.

- China’s total population could begin falling in the next few years, spurred by a significant drop in newborns during the pandemic and an established policy limiting families to two children.

- Profits at China’s state-owned enterprises tripled in the first quarter of 2021 to an all-time high for the period, a sign of strong economic recovery.

- Japan’s economy showed signs of a quickened rebound with exports rising 16.1% in March from the year-ago period, led by a surge in China-bound shipments.

- Brazil’s economy picked up steam just before a record-setting second wave of COVID-19, with a leading GDP index rising 1.7% in February, its 10th consecutive monthly rise.

- Canada’s hot housing market is showing no signs of slowing, with housing starts rising 21.6% in March compared to the previous month, a record.

- British economic activity is picking up, with an 87.8% jump in traffic at stores last week following the reopening of non-essential businesses. More than half of job losses in the country during the pandemic have been among those under 25 years of age.

- French winemakers have appealed to the government to prioritize wine tasters for COVID-19 vaccines as one-third of those infected report losing their sense of taste and smell.

- Chinese tech giant Baidu predicts its homegrown autonomous driving system will be used in up to 1 million new cars in the next three to five years.

- BMW is planning for one-fourth of its Chinese sales to be fully electric vehicles by 2025, up from a 4% share of sales in 2020. Separately, the company reported pre-tax earnings climbed 370% during the first quarter.

- Canada increased its push on progressive climate change measures, bumping up a target to cut emissions by 2030 to 36% below 2005 levels and issuing the country’s first green bonds.

Our Operations

- M. Holland is the headline sponsor for AMI’s Thermoplastic Concentrates & Masterbatch Virtual Summit on April 26-29. Christopher Thelen, Regulatory Specialist for M. Holland, will be speaking on Monday, April 26 at 8:00 am CT.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.