COVID-19 Bulletin: April 27

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Crude futures were higher in mid-day trading today, with the WTI up 0.8% at $62.39/bbl and Brent 0.4% higher at $65.91/bbl. Natural gas was 2.2% higher at $2.85/MMBtu.

- OPEC+ has maintained its forecast for growth in oil demand this year while warning that the current trajectory of COVID-19 in India and elsewhere poses a risk to the numbers.

- U.S. oil and gas operators are expected to post billions in first-quarter losses after locking in low contract prices during last year’s slump and missing out on a subsequent price rally.

- After falling below 1 million bpd last week, Libya’s oil production could be set for recovery above that level, as the nation’s state-owned oil company lifted a force majeure on Monday.

- France oil major Total declared force majeure on its $20 billion liquified natural gas project in Mozambique following recent militant attacks in towns close to the site.

- Saudi Aramco is in early talks over the sale of part of its vast natural gas pipeline network, the latest in a series of moves by the state-owned energy producer to free up cash and draw international investors.

- Saudi Arabian government officials predict the country could save roughly $200 billion over the next ten years by switching from crude oil to natural gas and renewables for electricity production.

- BP is making its first foray into the retail power business, applying to California, Illinois, Ohio, Pennsylvania and Texas to supply residential customers with electricity generated from wind, solar and natural gas.

- Sweden-based Lundin Energy claims to have sold the world’s first certified crude oil produced with net-zero emissions from an oilfield offshore Norway.

- After reporting a strong first-quarter earnings rebound, BP said it will resume share buybacks.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Dockworkers at the Port of Montreal, on an overtime strike since mid-April, plan to begin a general strike on Monday, which would effectively shut down the port.

- The International Longshoremen’s Association is suing the U.S. Maritime Alliance and Hapag-Lloyd for the alleged use of non-union labor at the Port of Charleston’s new container terminal, the first new container terminal built in the U.S. in a decade.

- Import TEUs grew by almost 51% year over year across the U.S. in March, prompted by a surge of off-peak imports from China (177%) and Vietnam (75%).

- U.S. port congestion is prompting calls for 24/7 operations, which would require coordination by all participants in the supply chain.

- The global shipping fleet is expected to grow 3.4% annually in the near term due to a strong rebound from last year’s 26-year low in deliveries.

- The loss of ocean capacity resulting from carrier schedule changes after the Suez Canal blockage is expected to stretch into June, according to Sea-Intelligence.

- The percentage of the global containership fleet commercially idle and not in dry dock has fallen to just 0.8% amid a charter supply squeeze.

- Shipper MPC, which was recently able to rebound from near-bankruptcy toward becoming debt-free by 2023, expects the red-hot container shipping market to last for two more years.

- Asian suppliers say the global semiconductor shortage is spreading to manufacturers of smartphones, televisions and appliances.

- Driven by the growth of e-commerce, warehouse demand exceeded supply in Q4 of 2020 and early 2021, prompting many localities surrounding California’s largest ports to limit warehouse sizes, truck hours and volumes.

- Port-city warehouse rents rose 2.4% to record highs from last quarter as an import boom put a strain on the market.

- A current shortage in truck drivers could increase to 105,000 in the next two years, potentially increasing prices for everything from groceries to oil.

- A bipartisan group of lawmakers endorsed a report that includes raising the gasoline tax as a possible way to pay for infrastructure spending.

- The cost of cardboard has increased up to 15% in Mexico due to low global and local production amid high demand generated by e-commerce.

- U.K. exports of milk and cream to the EU are down 96%, and chicken and beef 80%, due to post-Brexit red tape.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- There were 47,691 new COVID-19 cases and 474 deaths in the U.S. yesterday. Over 230 million vaccine doses have been administered, with 26.9% of the population fully vaccinated.

- New COVID-19 cases in the U.S. were down 16% last week, while deaths fell below 5,000 for the first time since October. New infections in Michigan, New Jersey and Pennsylvania, which have the highest case rates nationally, fell by more than 20%, while Arizona, Oregon and Tennessee had the highest increases in cases.

- COVID-19 hospitalizations have been on the rise for the past month in Florida, as five “variants of concern” circulate widely in counties.

- The CDC updated its public health guidance regarding outdoor mask wearing, allowing fully vaccinated people to exercise and attend small gatherings outdoors without wearing a face mask.

- The U.S. plans to share its supply of 60 million AstraZeneca COVID-19 vaccine doses with other countries in the coming months.

- New York and New Jersey are easing some pandemic restrictions due to falling coronavirus cases.

- Some U.S. employers are starting to mandate COVID-19 vaccines before candidates are hired.

- Starting May 3, the Small Business Administration will accept applications for its $29 billion Restaurant Revitalization Fund to help restaurants, bars and other food service businesses recover from the pandemic.

- The U.S. Census revealed that the U.S. population grew the past decade at the slowest pace since the Great Depression and second slowest since records began in 1790.

- Census Bureau data shows that nearly 1.5 million women with children left the workforce over the past year.

- New orders for durable goods in the U.S. increased 0.5% in March compared with February, continuing months-long gains spurred by low retail inventories. New orders for capital goods, meanwhile, rose 0.9% for the same period, indicating business expansion.

- Foot traffic at a sampling of 50 U.S. shopping malls was up 86% year over year in March.

- Apple unveiled plans to build a new, 3,000-employee campus in North Carolina, expanding the company’s reach into Raleigh’s growing tech hub.

- A cluster of small tech-startups are betting that a fully in-office work schedule will lure top talent, despite a potentially permanent shift by major U.S. employers toward hybrid or remote work.

- Wholesale shipments of RVs in North America rose nearly 10% above their previous record to 148,507 units in the first quarter, as cash-flushed Americans reevaluate their recreational choices.

- If pandemic habits of eating out less, working more and seeing doctors remotely keep up, there could be 3 million fewer jobs by the end of the decade, many of them in the food service and retail sectors, the U.S. Bureau of Labor Statistics predicts.

- A tight supply of new vehicles has significantly benefited car dealerships, which are increasingly charging full price for vehicles and reducing promotional spending.

- Ride-hailing company Lyft announced that it will sell its autonomous driving unit to Toyota for $550 million.

- Since a low point last May, shares of General Electric have surged more than 145%, a result of increased optimism in the company’s natural gas, wind turbine and renewables units.

- Mexican travel agencies are mining a new pandemic-driven market: vaccination vacations to the U.S. for well-heeled travelers.

International

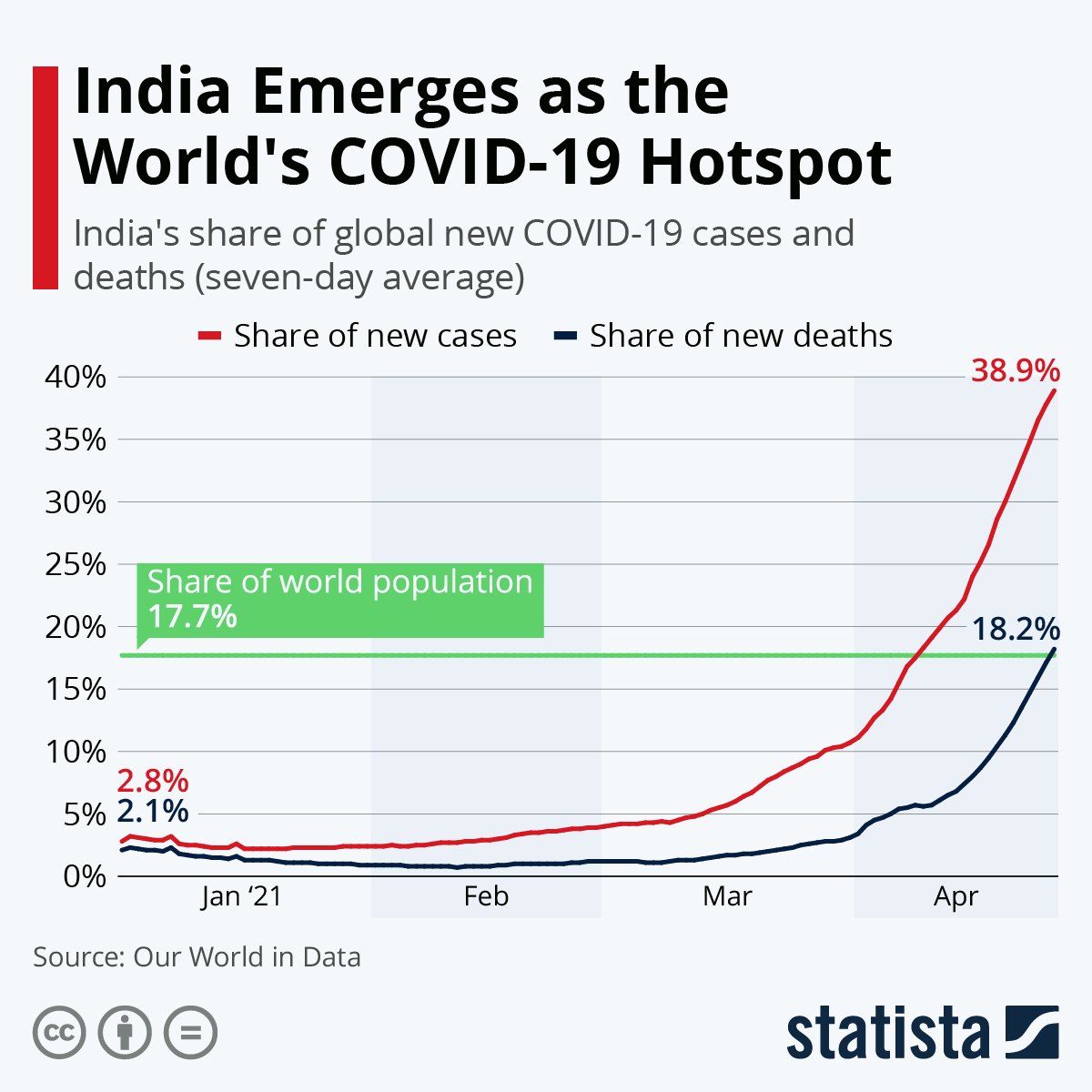

- New COVID-19 cases eased to 323,023 in India today after the nation reported five consecutive one-day infection records as total deaths approach 200,000. The nation’s federal government has decided to leave the import of COVID-19 vaccines to state authorities and companies, a move likely to slow its inoculation campaign. Germany announced it will send oxygen and other medical aid to India to help fight off its overwhelming COVID-19 surge.

- Royal Caribbean Cruises has suspended all assignments for its Indian staff and will halt hiring in the country.

- For the second year in a row, the Spanish city of Pamplona has cancelled the famous Sam Fermin festival, which includes the Running of the Bulls ceremony, due to the pandemic.

- Turkey’s president announced the country’s strictest pandemic lockdown so far, closing businesses and schools and limiting travel for nearly three weeks starting Thursday.

- Members of Canada’s military will deploy to Ontario, the nation’s largest province, to support hospitals that are struggling with an influx of new COVID-19 patients.

- Despite having only 8% of the world’s population, Latin America has recorded more than 30% of the world’s COVID-19 deaths to date, as the region struggles to speed up its inoculation drive.

- Hospitals in the Philippines are using tents and other ad hoc structures to accommodate increasing numbers of coronavirus patients.

- With COVID-19 infections surging in Japan, epidemiologists say that this summer’s Olympics can be held safely if everyone involved is vaccinated, a protocol that the International Olympic Committee says it won’t require.

- Hong Kong will ease COVID-19 restrictions for vaccinated individuals beginning Thursday, allowing bars, nightclubs and karaoke parlors to reopen past midnight to help incentivize shots.

- A patchwork of approvals for different COVID-19 vaccines across the world is leading to complicated procedures for those looking to travel to and from the U.S., the EU and China.

- French drugmaker Sanofi will help manufacture up to 200 million doses of Moderna’s COVID-19 vaccine.

- Coffee bars, restaurants and theaters partially reopened in Italy yesterday as the nation began a gradual easing of many pandemic measures into the summer months.

- Goldman Sachs predicts that the U.K. economy will rebound faster than the U.S. economy this year due to its quicker vaccination drive.

- The German government raised its growth forecast for this year from 3% to 3.5%, a reflection of a stronger-than-expected fourth quarter.

- South Korea’s gross domestic product grew 1.8% year over year in the first quarter of 2021 and 1.2% over the previous quarter.

- A recent price rally in U.S. crops is stirring global food inflation fears, as staple crops heavily influence consumer prices for everything from bread and pizza dough to meat and soda.

- Tesla plans to add electric vehicle component recycling capacity at its Shanghai factory, potentially tied to China’s tightened rules requiring the recycling of electric vehicle materials.

- Countries may need to invest more than $115 trillion in clean technologies through 2050 to limit global warming to 1.5 degrees Celsius.

Our Operations

- M. Holland is the headline sponsor for AMI’s Thermoplastic Concentrates & Masterbatch Virtual Summit on April 26-29. For registered attendees, stop by M. Holland’s virtual booth to speak with our experts.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.