COVID-19 Bulletin: August 30

More news relevant to the plastics industry:

Some sources linked are subscription services.

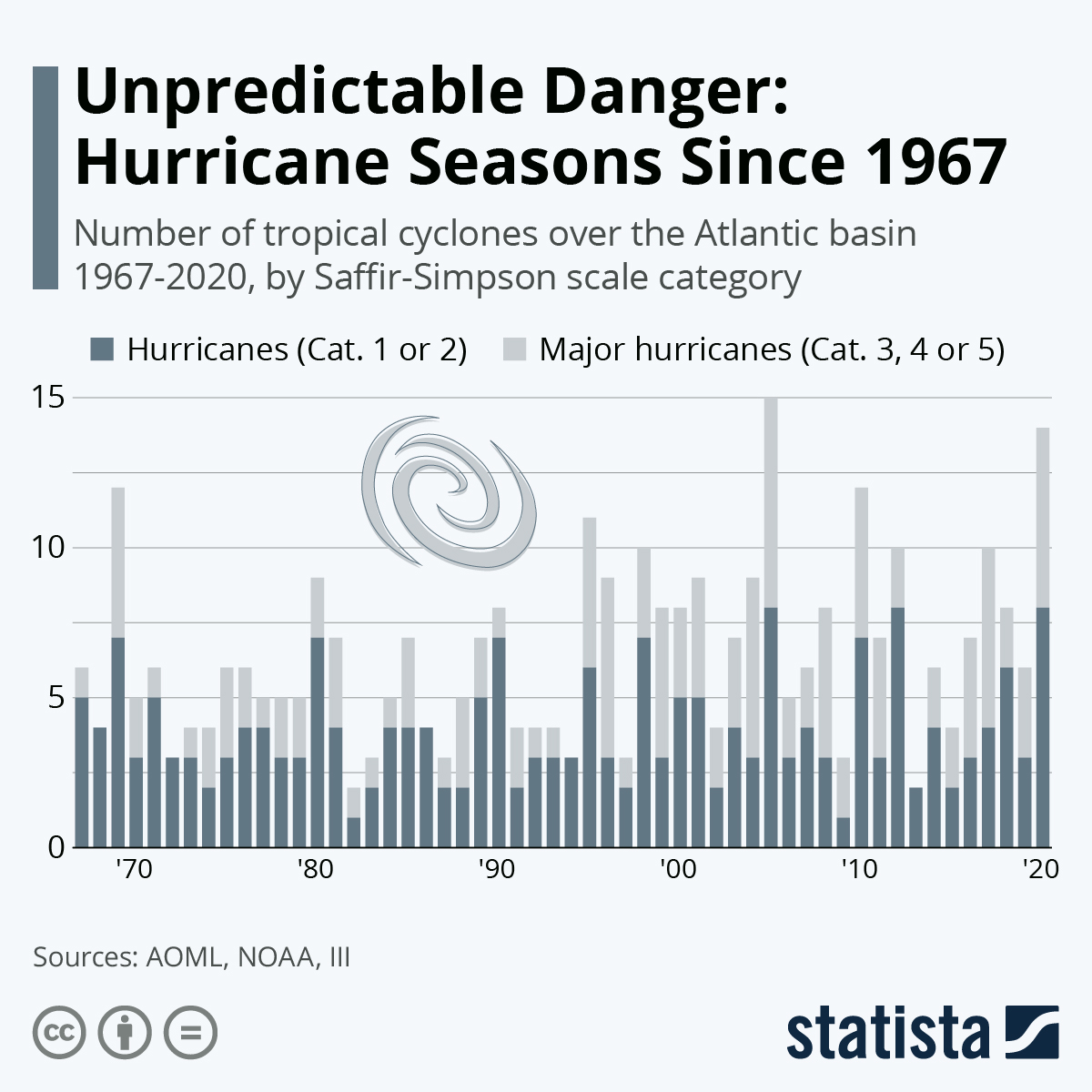

Hurricanes

- Ida became a Category 4 hurricane before slamming into Louisiana Sunday, bringing 150-mph winds, pounding rain and dangerous sea surges throughout the coastal region.

- More than 1 million are without power in Louisiana, while early estimates suggest total damages could exceed $40 billion.

- The storm, with such severe wind and rainfall that it reversed the flow of the Mississippi River, darkened New Orleans and knocked out backup electricity for the city’s vital pumping stations.

- One fatality in Ascension Parish, Louisiana, was reported early this morning after a tree fell on the victim’s house.

- The storm is the fiercest to batter New Orleans since Hurricane Katrina, whose 16th anniversary marked Ida’s arrival on Sunday.

- Ahead of Hurricane Ida, which forced many producers to shut down Gulf Coast operations, oil prices closed 2% higher Friday, up 10% since last Monday for the biggest weekly gain in more than a year.

- In advance of the storm, oil producers suspended 1.6 million bpd of production capacity, more than was idled during Hurricane Katrina in 2005, evacuating 90 offshore facilities representing 59% of the region’s oil capacity and 49% of natural gas production.

- Analysts predict a six-week downtime for refineries because of the storm, while drivers in affected markets could pay 10 cents more per gallon of fuel.

- The Port of New Orleans suspended loading and unloading operations today, joined by transloading and break-bulk service providers.

- Hurricane Nora made landfall on Mexico’s Pacific coastline Sunday, bringing widespread regional floods, landslides and road blockages. The storm is expected to weaken as it moves north into the Gulf of California today.

Supply

- Oil prices were higher in mid-day trading, with WTI up 0.3% at $68.93/bbl and Brent up 0.5% at $73.08/bbl. Natural gas was off 1.2% at $4.28/MMBtu.

- Mexico’s Pemex raised production forecasts for next year from 1.7 to 1.9 million bpd, the first growth forecast since 2004, at an average price of $60/bbl compared to the current $64/bbl.

- First half earnings for China Petroleum & Chemical, Asia’s largest oil refiner, reached $6.05 billion, exceeding pre-pandemic levels, led by renewed domestic fuel demand and a rebound in oil prices.

- Several top producers from Russia and the Middle East may join the race for a majority stake in Bharat Petroleum Corporation, India’s third-largest oil refiner with a 14% market share and second-largest fuel retailer with a 23% share.

- The EPA recommended that the White House lower biofuel mandates under the federal Renewable Fuels Standard retroactive to 2020, potentially helping refiners who incurred more than $1 billion in biofuel credit deficits during the pandemic and creating consternation among biofuel producers.

- CEOs of major toy companies are predicting shortages and higher prices this holiday season due to supply chain congestion and high freight costs.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

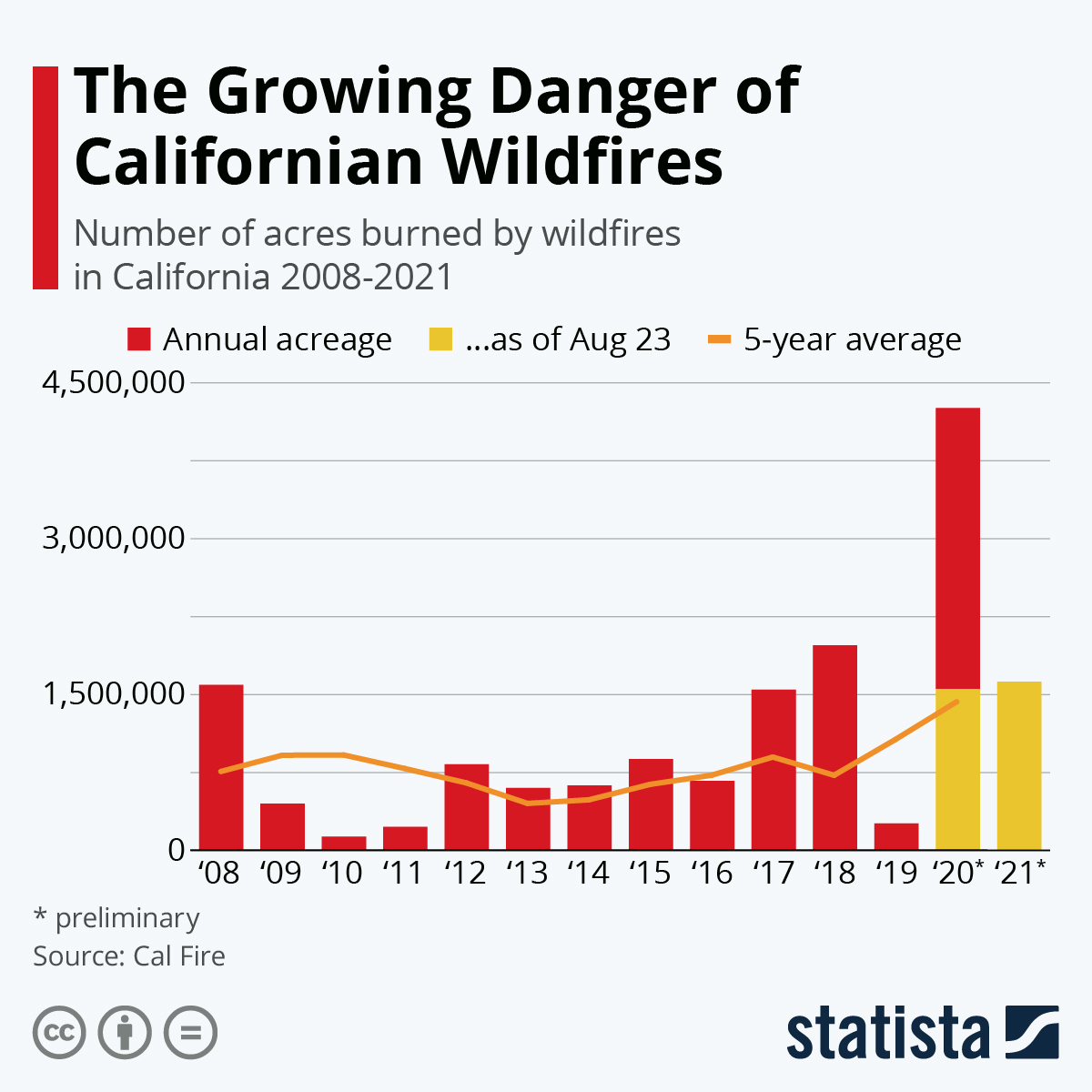

- A new wildfire, the Chaparral Fire, forced evacuations in California’s San Diego County.

- California’s Caldor Fire is continuing to rage as it moves closer to the region’s more heavily populated areas, spreading to 168,387 acres Sunday with just 13% containment.

- COVID-19 outbreaks in Malaysia, one of the world’s top destinations for assembling and testing automotive chips, threaten to further production disruptions in the global auto industry.

- Murata Manufacturing, a key producer of semiconductors for smartphones, appliances, cars and data centers, has temporarily halted production following a 98-case COVID-19 cluster at its 7,000-employee Japanese factory.

- As of Friday, a record 44 vessels were awaiting berth space to unload at the ports of Los Angeles and Long Beach.

- The global air cargo sector is flying planes at almost 90% capacity ahead of the peak holiday season, overflowing airport cargo warehouses, spilling goods into off-site facilities, and exacerbating a shortage of sorting and loading staff.

- Ripple effects are growing from a small outbreak of COVID-19 at China’s main cargo airport, prompting freight forwarders to stop accepting bookings for Shanghai and divert flights to other airports, adding to transit times. Mazda suspended production at two Japanese plants due to the disruption.

- It will take another week for Meishan terminal operations at China’s Ningbo port, the world’s third busiest, to return to normal following a two-week closure caused by a single COVID-19 infection.

- Global port disruption caused by severe weather and COVID-19 outbreaks has stretched some seaborne deliveries that ordinarily take weeks to more than half a year.

- Steel shortages and supply chain disruptions are restraining production of storage and handling equipment well below surging growth in warehouse demand, forcing companies into pricey leases for facilities that can’t be used for nine months or longer.

- China’s production of crude steel, usually half the world’s yearly total, fell in July by the largest amount since the 2008 financial crisis, with early indicators suggesting it might slip again this month.

- Canada joined Mexico in disputing content-origin rules for automobiles under the new U.S.-Mexico-Canada Agreement, which strengthened requirements for North American part sourcing but left open varying interpretations of the rule.

- Severe drought in South America has nearly halved vessel cargo capacity on the Paraguay River, the major trade route for the world’s fourth-largest exporter of soybeans.

Domestic Markets

- Total COVID-19 hospitalizations in the U.S. surpassed 100,000 last week, more than doubling from last month and edging toward all-time highs reached last winter, as several regions struggle with severe medical equipment and staffing shortages.

- COVID-19 fatalities last week rose in 42 states, with 14 of those states seeing increases above 50%.

- More than 1 in 5 new COVID-19 cases in the U.S. last week were among children, a higher share than at any other time during the pandemic. The federal government has thrown early support behind mandating vaccines for students, drawing comparisons to similar requirements made in years past for shots against polio, measles, mumps and rubella.

- Infections with the highly contagious Delta variant of COVID-19 carry a viral load 300 times greater than the original strain, new research suggests, and are twice as likely to result in hospitalizations.

- A new coronavirus variant, the most mutated yet and potentially the most dangerous, has been identified in South Africa.

- The share of Texans aged 30 to 49 hospitalized with COVID-19 has nearly doubled compared to the peak of last winter’s surge, as an average of 1,700 virus patients are admitted each day across the state. The state’s governor recently called in an additional 2,500 out-of-state medical personnel to help manage the surge.

- Florida reported 281 new COVID-19 fatalities Saturday, a record, as more than a dozen portable morgues were sent to the state’s central hospitals.

- School districts in Florida will once again be able to impose mask mandates after a state judge struck down the governor’s controversial order banning the measure. The ruling paved the way for Orange County to require face coverings following more than 400 virus cases among students and staff in one week.

- Oregon has deployed National Guard troops to its healthcare facilities following a tenfold increase in COVID-19 hospitalizations since July.

- Arizona reported 2,090 new COVID-19 cases Sunday, while the state surpassed 1 million total infections, accounting for roughly 14% of its population.

- In Ohio, 1 in 6 ICU beds are taken by COVID-19 patients, up from 1 in 49 patients just two months ago.

- COVID-19 numbers in New York City have improved, with transmission rates dropping 7% the past week and daily hospitalizations down 14% compared to a month ago.

- Missouri’s COVID-19 cases are at their lowest levels in a month, with under 2,000 new infections reported for five straight days.

- People with prior COVID-19 infection are less likely to contract the highly contagious Delta variant than people who have never been infected but received both shots of a vaccine, new data shows. However, those who were reinfected after vaccination are more likely to develop blood clotting.

- U.S. household income rose 1.1% in July, its largest increase since March, with economists widely agreeing that surging COVID-19 cases prevented even stronger growth.

- U.S. spending on goods fell 1.1% in July, led by a decline in vehicle purchases due to component shortages hampering production. Overall spending on goods remained 20% higher than pre-pandemic levels.

International Markets

- New COVID-19 cases in India rose sharply at the end of last week, with more than 44,500 infections reported Friday. The rise comes even as the nation reports vaccinating more than 10 million people in one day against the virus, annihilating global records. More than half the nation’s 1.4 billion people have now received at least one shot, authorities say.

- Japan experienced 1,915 new COVID-19 infections today, down by 532 from last Monday, and has seen eight straight days of week-on-week declines in daily infections.

- Australia reported 1,323 COVID-19 cases Sunday, a record, as debate over the country’s ultrastrict pandemic lockdowns intensifies amid growing civilian unrest.

- New Zealand reported 82 new COVID-19 cases Saturday and 83 infections Sunday, prompting the country’s prime minister to extend a lockdown in Auckland for an additional two weeks.

- British officials predict an uptick in COVID-19 infections in the coming weeks as cooler fall weather pushes more people inside, a trend expected to be particularly strong in children, who start school next month. Early signs suggest cases are already rising, with 1 in 70 people having the virus last week compared to 1 in 80 the week before.

- Scotland reported 6,835 COVID-19 infections Friday, the most since the start of the pandemic and more than double a week ago.

- The EU recommended a suspension of non-essential travel from the U.S. due to rising COVID-19 infections in the country.

- Israel expanded its COVID-19 booster campaign to children as young as 12.

- Sri Lanka extended an island-wide lockdown to Sept. 6 after reporting more than 200 COVID-19 deaths Friday, the most since the start of the pandemic.

- Despite holding only 18% of the world’s population, the Western Hemisphere accounts for 47% of the world’s COVID-19 deaths and 39% of all cases.

- A large-scale clinical study in Wuhan, China, found that half of people hospitalized with COVID-19 more than a year ago are still experiencing symptoms of the virus.

- Goods arriving in Germany were 15% more expensive in July compared to the same period a year ago, the biggest surge in import inflation since the 1980s.

- South Korea became the first developed economy in Asia to raise interest rates since the beginning of the pandemic, potentially signaling that rising inflation and household debt are bigger threats to the economy than resurgent COVID-19.

- Toyota suspended use of its self-driving vans created for the Tokyo Paralympic Games following an accident with a competitor.

At M. Holland

- During last week’s Plastics Reflections Web Series event, panelists from M. Holland, BPI, LyondellBasell and MTS Logistics discussed how global supply chain complexities are impacting the plastics industry. Click here to access the recording.

- Matt Zessin, our Automotive Market Manager, was interviewed about materials trends for electric vehicles on the Automotive News Daily Drive podcast, accessible here.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.