COVID-19 Bulletin: August 4

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Crude futures were lower in morning trading, with WTI down 2.1% at $69.08/bbl and Brent down 1.5% at $71.35/bbl. Natural gas was 4.2% higher at $4.19/MMBtu.

- Russian oil production rose 0.3% from June to July, its first increase in three months following OPEC’s decision to further ease pandemic-induced output cuts.

- U.S. refiner HollyFrontier is acquiring Sinclair’s oil and transportation assets for $2.6 billion, adding new refining, pipeline and storage facilities in the U.S. Rocky Mountain region.

- U.S. refiner Phillips 66 posted its first profit in a year Tuesday, following a rebound of fuel demand after the country began easing travel curbs.

- Higher oil prices led BP to strong second-quarter earnings, with the company raising its dividend after reporting profits of $2.8 billion, up from $2.6 billion in the first quarter.

- LyondellBasell reported both lines affected by a recent lightning strike at its Lake Charles, Louisiana, Equistar Chemicals facility have restarted.

- Some of the world’s top financial firms, including Prudential, Citi, HSBC and BlackRock, plan to create public-private partnerships to buy and subsequently close Asia’s coal-fired power plants, a bid to speed up the elimination of the energy sector’s largest source of carbon emissions.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Embattled California utility PG&E is under investigation for potentially starting the state’s Fly Fire, a small blaze that scorched 4,000 acres before merging with the much larger Dixie Fire, which has now burned more than 253,000 acres with just 35% containment.

- Colorado is likely to declare a state of emergency after a number of mudslides prompted officials to shut down Interstate 70 west of Denver, a key route for the economy of the western U.S.

- Iowa, Minnesota and Wyoming joined South Dakota in issuing 30-day waivers for hours-of-service limits for truck drivers to help alleviate freight transportation disruption caused by driver shortages.

- Spreading COVID-19 infections in China could threaten the nation’s exports and retail and spending growth in the second half of the year. A small cluster of cases in Wuhan led officials to order mandatory testing for all the city’s 12 million residents, while Beijing announced a ban on passenger trains from 23 high-risk regions.

- Fresh COVID-19 outbreaks and low vaccination rates in Indonesia, Vietnam, the Philippines and Thailand could significantly disrupt Southeast Asia’s factory sector, which supplies much of the world with critical products from PPE equipment to semiconductors and car parts.

- General Motors is shutting down its three full-size truck assembly plants in North America next week due to the ongoing global semiconductor shortage.

- Toyota posted record quarterly profit while Honda raised its annual profit estimate, despite both automakers warning of continued hits to production from the global chip shortage.

- Electric-truck startup Nikola cut production forecasts by 50% this year down to just 25-50 vehicles, citing ongoing supply chain disruptions.

- U.S. Gulf Coast ports are investing a combined $5.4 billion on expansion projects by 2027, a response to growing cargo volumes and larger vessels traveling through the Panama Canal.

- Maersk raised its full-year earnings outlook on forecasts of higher demand in the final two quarters of 2021, alongside the continued effects of a more than 50% rise in average freight rates since last year.

- Despite surging activity, global goods losses of shipping vessels declined to record-low levels in 2020, while the number of casualties at sea also decreased from the prior year.

- DHL Express purchased 12 electric cargo planes from startup Eviation to use for U.S. package delivery beginning in 2024, part of a plan to build the world’s first electric air cargo network and reduce the industry’s carbon emissions.

Markets

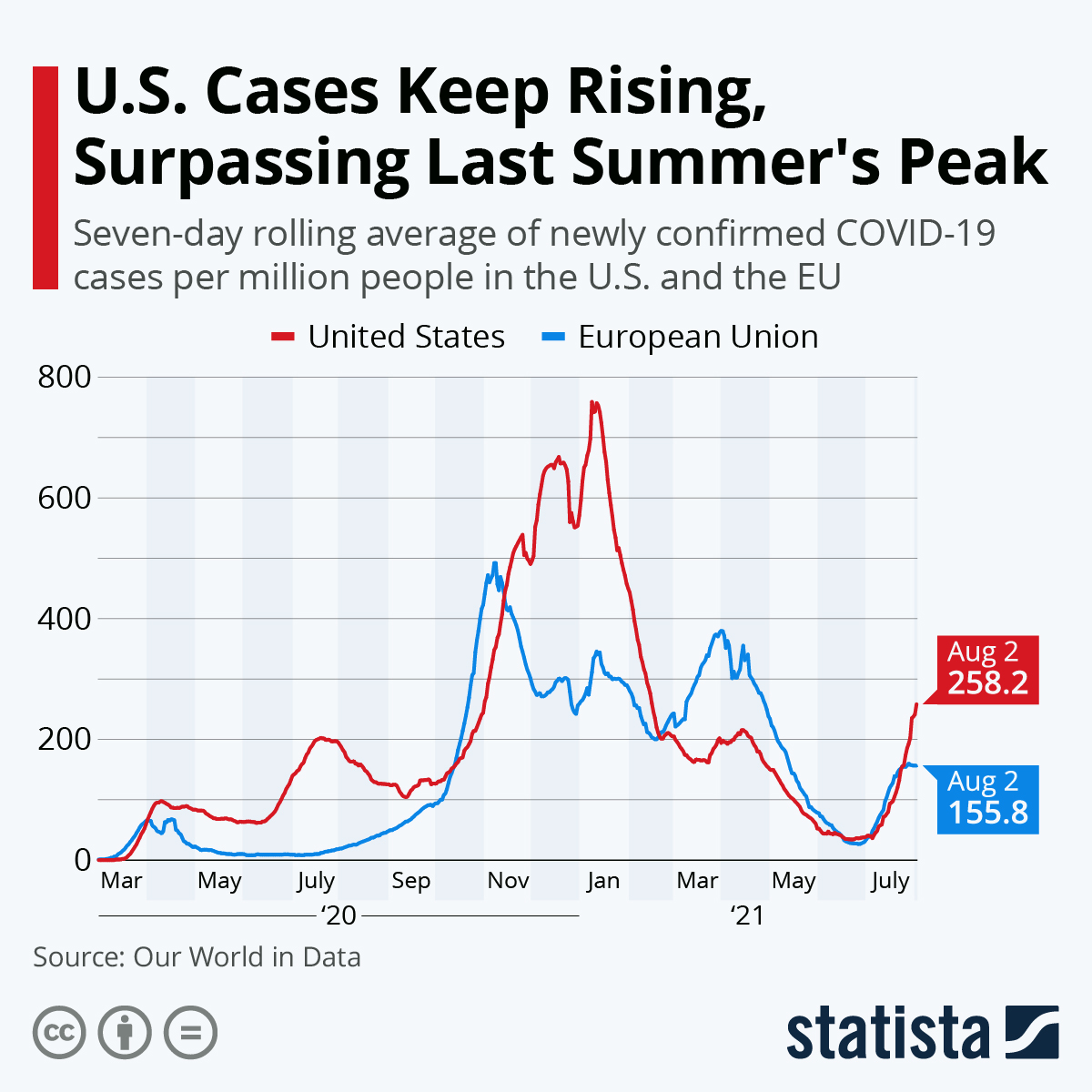

- New COVID-19 infections are rising in every U.S. state, with the nation reporting 106,557 new cases and 616 virus deaths Tuesday.

- The U.S.’s most recent COVID-19 surge is having a greater effect on younger populations than past virus waves, with hospitalizations among people aged 18-29 rising 25% last week.

- Surging COVID-19 hospitalizations have once again forced hospitals to put off treatments for other conditions that are on the rise, including cancer, heart disease and other respiratory viruses.

- Health researchers predict the spreading COVID-19 Delta variant has pushed the world’s threshold for herd immunity past 80% of people being fully vaccinated, well above initial predictions of 70%.

- New York City will require proof of at least one COVID-19 vaccination for indoor activities including dining, gyms and performances. Many bars and restaurants in California’s Los Angeles County, the nation’s largest, have followed suit.

- COVID-19 hospitalizations in Florida climbed to 11,515 Tuesday, a record, while the state’s governor ruled out imposing new pandemic restrictions or mask mandates. Health officials predict the state is about one month away from peak infections.

- Florida and Texas were responsible for one-third of all new COVID-19 cases in the U.S. last week.

- COVID-19 cases in Missouri have increased nearly 560% while hospitalizations have risen 205% since early June, as the state’s vaccination rates remain at nationwide lows.

- A majority of Chicago-area counties are seeing significantly increased COVID-19 cases, prompting officials to recommend indoor mask-wearing regardless of vaccination status.

- New Jersey’s seven-day average for new COVID-19 cases more than quadrupled over the past month, rising to 977, its highest since May.

- The seven-day average for COVID-19 cases in Virginia has risen to 224, its highest since May and 8.9% higher than the same time last year, while virus hospitalizations in the state more than doubled from mid-July.

- Idaho health officials say children up to age 11 are the state’s most vulnerable population to COVID-19 in a Delta wave sweeping the state, while more than 2,000 of Louisiana’s last 11,000 infections arose among children and teens.

- Arkansas reported that COVID-19 hospitalizations among those under 18 years of age have risen 270% since April, with nearly 20% of active cases among those under 18 and 10% among children younger than 12, as the state’s governor expressed regret for signing a law barring local governments from issuing mask mandates.

- The CDC added 16 destinations to its highest COVID-19 risk level Monday, including Greece, Ireland and the U.S. Virgin Islands, with guidance to avoid traveling to the areas unless necessary.

- With only $3 billion of an allocated $47 billion so far disbursed, the CDC issued a new federal moratorium on evictions Tuesday that is expected to cover more than 80% of U.S. counties with “substantial or high” COVID-19 risk.

- U.S. colleges have greater support to impose vaccination requirements on returning students following Tuesday’s federal appeals court ruling upholding Indiana University’s vaccine mandate.

- Microsoft pushed back its planned return-to-office date until Oct. 4 and will require all employees to show proof of a COVID-19 vaccination before entering any company facility in the U.S.

- A new study on the long-term effects of a COVID-19 infection shows that people recovering from the virus may suffer declines in various indicators of intelligence.

- A new survey suggests 65% of American workers would be willing to take a 5% pay cut to work from home full-time. In a separate survey, 1 in 3 workers who returned to the office reported the shift had a negative impact on their mental health, while another third reported a positive impact.

- JPMorgan Chase and Bank of America, the nation’s largest banks, together had nearly $1 trillion in unused corporate credit at the end of June, up 20% from a year ago and a quarterly record at both banks.

- Spirit airlines canceled over 40% of its flight schedule Tuesday, its third straight day of significant disruption caused by staffing shortages, inclement weather and system outages. American Airlines also reported widespread disruptions in scheduling.

- The number of people passing through U.S. airports hit a fresh pandemic-era record Sunday with nearly 2.24 million passing through security, still 17% lower than 2019 levels.

- General Motors, Ford Motors, Stellantis and the United Auto Workers union are reimposing mask mandates at all U.S. locations regardless of a person’s vaccination status.

- Dodge will begin offering a plug-in hybrid in 2022, while Jeep plans to launch its first all-electric vehicle in the first half of 2023.

- CVS Health, Target and Walmart will begin piloting design finalists from the Beyond the Bag innovation challenge aimed at finding alternatives to single-use plastic bags.

International

- Japanese health experts are calling for a nationwide state of emergency after Tokyo reported a near-record 3,709 new COVID-19 infections Tuesday, while the country has begun publicly naming international quarantine rule breakers.

- China reported 71 new COVID-19 cases Tuesday, the most since Jan. 30 and the fifth consecutive day of increases.

- Hong Kong announced it will begin allowing vaccinated travelers from most countries back into the city beginning Aug. 9.

- COVID-19 deaths in Africa rose by 80% over the past four weeks, driven mostly by the Delta variant spreading rapidly across the continent. New infections are surging in South Africa, with the country’s Western Cape province reporting more than 38,000 active cases by midday Tuesday.

- New pandemic restrictions in Israel will require vaccine certificates or negative tests to enter venues holding fewer than 100 people, while the nation placed an additional 18 countries on its list of places from where incoming travelers will be required to quarantine, regardless of COVID-19 vaccination status.

- COVID-19 cases in Turkey rose to almost 25,000 Tuesday, the most since May.

- The U.K. reported 21,691 new COVID-19 infections Tuesday, a slight drop from Monday, as the country considers offering vaccines to teenagers ahead of schools reopening in September.

- Scotland announced it will lift the bulk of its COVID-19 restrictions Aug. 9.

- The United Arab Emirates is set to lift a ban on transit flights from India and Pakistan beginning Thursday after restricting passengers last year due to the pandemic.

- Members of the International Monetary Fund have approved a $650 billion reserve injection, the biggest in IMF history, to be used to help countries deal with rising debt and fallout from the pandemic.

- The percentage of women in India’s labor force dipped to 16.1% between July and September 2020, highlighting the pandemic’s disproportionate demographic impact on the country’s economy.

- Carmakers in India are asking the government for a one-year extension to meet new fuel efficiency targets as they try to recover from the financial impact of the pandemic.

- Australia’s Qantas airlines will temporarily lay off 2,500 employees amid a drop in travel due to a growing number of COVID-19 infections in Sydney.

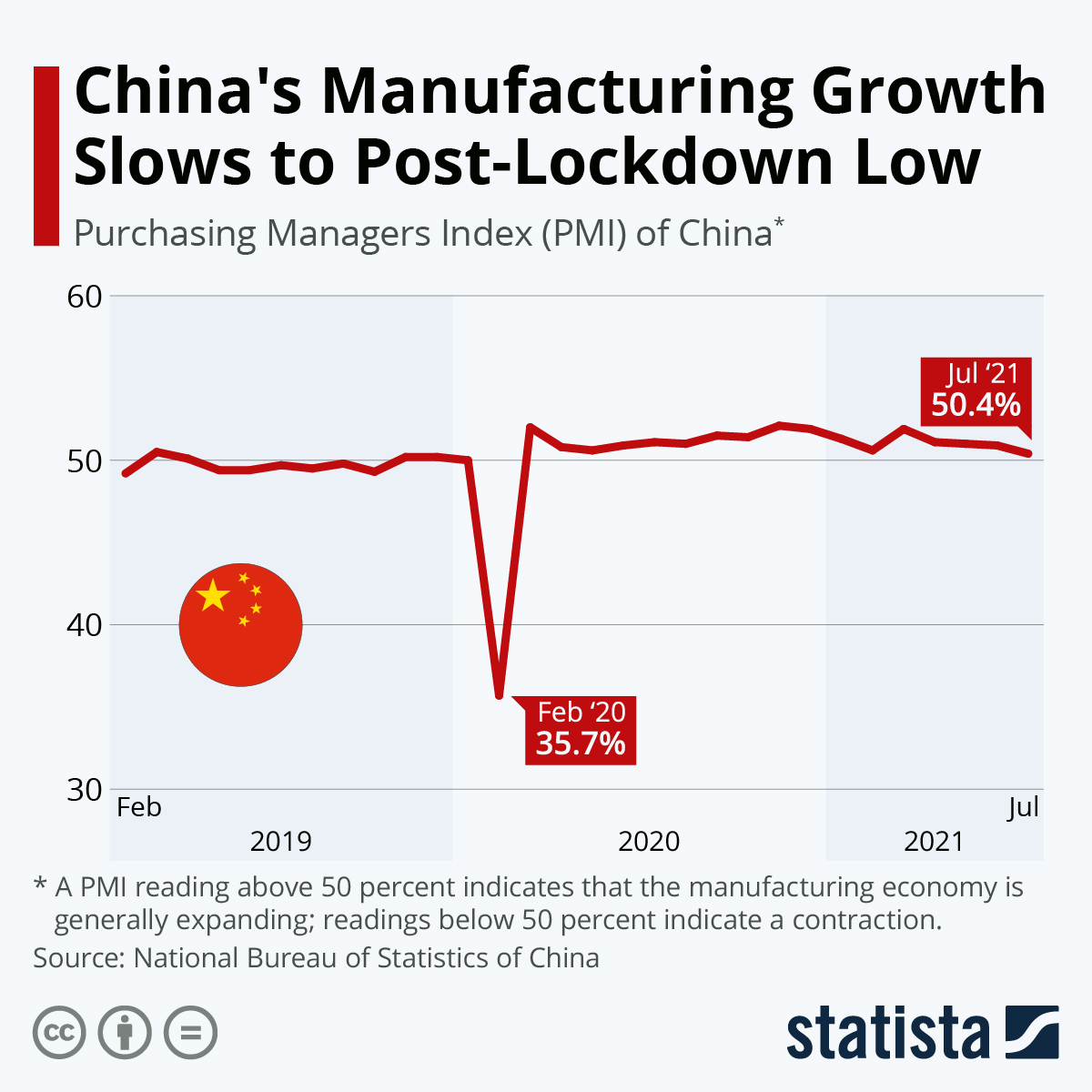

- Canada’s manufacturing activity grew at its slowest pace in five months, hampered by supply chain pressures, with an index falling to 56.2 in July from 56.5 in June.

- Germany’s service sector grew in July at the fastest pace on record following the lifting of pandemic restrictions, matching a broader trend of soaring business activity in the euro zone.

Our Operations

- M. Holland will be exhibiting at MD&M West in Anaheim, California, Aug. 10-12! MD&M West is the largest medtech conference in the U.S. If you’re attending, please stop by Booth #4005 to meet our Healthcare experts.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.