COVID-19 Bulletin: December 6

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices made modest shifts Friday on news that OPEC could quickly review its January output policy if COVID-19 cases pick up across the globe. Crude futures were higher in morning trading, with WTI up 2.8% at $68.08/bbl and Brent up 2.6% at $71.67/bbl.

- U.S. natural gas futures hit a three-month low late last week on forecasts of milder than normal weather in December. Prices rose roughly 2% Friday but fell 11% to $3.68/MMBtu in late morning trading today.

- Facing uncertainty from British regulators, Shell backed out of a second North Sea oil development project just weeks after a first failed to gain approval. The loss of Shell’s 30% stake could spell the end of the Cambo project, formerly expected to produce 175 million barrels of oil in its first phase.

- Hundreds of oil and gas workers in the North Sea announced plans to strike periodically until February of next year over labor contract disputes.

- Saudi Aramco increased January prices for all crude grades shipped to Asia and the U.S., a signal the cartel is confident in demand staying strong.

- Refiners are turning to sour crude as its price delta widens with sweet crude amid rising natural gas prices and power companies hesitating to use coal over environmental concerns.

- The Baker Hughes count of active rigs in the U.S. stood at 569 last week, up from 246 a year ago but still well below the pre-pandemic count of 790.

- The U.K.’s energy crisis, which has led to the collapse of more than 24 suppliers and the first forced nationalization since 2008, could cost the average household an extra $112 next year.

- Phillips 66 will begin supplying British Airways with renewable jet fuel produced from waste feedstock in the U.K.

- Germany’s oil industry is aiming for net-zero carbon emissions by 2045, industry leaders say, aided by the rapid development of hydrogen power and electric-vehicle infrastructure.

- Shell firmly rejected calls to spin off its renewable energy operations, breaking with recent moves by Italy’s Eni and Spain’s Repsol.

- The world’s first liquefied hydrogen carrier is set to leave Japan for Australia to pick up its inaugural cargo of hydrogen later this month, after the pandemic delayed the ship’s maiden voyage from last spring.

Supply Chain

- Texas’ energy regulator will cut the state’s wholesale electricity price cap from $9,000 to $5,000 MWh in a bid to limit future price hikes like February’s freeze.

- Severe droughts are driving up the cost of milk in California, the nation’s top producer.

- High demand and supply chain disruptions have New York’s iconic bagel shops begging for an essential ingredient: cream cheese.

- Some Californians will be paid to reduce power usage or sell power from their electric vehicles during extreme heat waves straining the grid, new regulatory measures provide.

- The global logistics market is expected to grow 12% in 2021, surpassing pre-pandemic levels.

- A broad trend of reorganizing and shortening supply chains could spur even more inflationary pressure, economists warn, as the share of foreign content in global manufactured goods continues a decline since 2011.

- Record-low warehouse vacancies combined with soaring rents — already up more than 8% from last year — are likely to persist through the end of 2023, real estate forecaster Cushman & Wakefield said.

- Canadian trucker Fuel Transport will pay employees a $7,800 full-year bonus for being fully vaccinated against COVID-19.

- Facing labor shortages and rising raw material prices, U.S. auto suppliers have largely missed out on soaring profits for other carmakers and dealers in the latter half of the pandemic.

- Apparel prices are rising on a growing cotton shortage in the U.S., normally the world’s largest exporter.

- Apparel retailer Lands’ End forecasts at least $15 million in additional fourth-quarter supply chain costs on higher shipping rates and delays.

- The U.S. has doubled tariffs on Canadian softwood lumber, raising fears over the effect on domestic construction costs.

- The U.S. plans to issue tariffs on Vietnamese polyester over alleged dumping.

- The U.S. is importing record amounts of Taiwanese goods in the wake of continued 25% tariffs on many Chinese electronic exports.

- Amazon will begin contracting with small trucking firms in five European countries to exclusively haul Amazon shipments, part of the company’s plan to expand its driver-contractor model.

- The U.S. administration tightened rules on cybersecurity reporting for nearly all freight and passenger rail systems, a response to increased ransomware attacks on the nation’s critical infrastructure.

- The Panama Canal will begin imposing emissions fees on high-emitting vessels, a step up from the canal’s previous ranking system that allowed low-emitters to pass through quicker.

Domestic Markets

- The highly contagious Delta variant has brought the U.S. seven-day average for new COVID-19 cases to more than 118,000, the highest since October, as the nation reported 34,221 new COVID-19 infections and 161 virus fatalities Sunday.

- The U.S. administration has suggested the COVID-19 Omicron variant, now present in at least 15 states, may not cause more severe illness than the more widely circulating Delta variant. So far, states and local governments are largely avoiding new pandemic restrictions, while travel bans on south African nations are reportedly being reconsidered.

- Beginning today, all travelers to the U.S. must test negative for COVID-19 within 24 hours before entering the country.

- With substantial differences in testing procedures across states, an accurate picture of the COVID-19 Omicron variant’s spread in the U.S. is likely impossible, health experts say.

- Philadelphia hospitals are verging on full capacity following a significant rise in COVID-19 patients the past two weeks.

- New Hampshire reported a seven-day COVID-19 test positivity rate of 13.4%, the highest in the nation.

- On Friday, Delaware recorded its highest number of daily COVID-19 infections since January.

- COVID-19 is surging in Massachusetts, with cases up 150% and hospitalizations up nearly 200% in the past few weeks.

- Arizona reported 5,236 COVID-19 infections Friday and 6,043 Saturday, the first time since January the state has recorded back-to-back daily infections of more than 5,000.

- Washington, D.C. expanded its at-home COVID-19 vaccine program to every household, which sends on-call medical professionals to deliver and administer shots.

- The U.S. administration is working on new guidelines that would fast-track the approval of vaccines targeted at the COVID-19 Omicron variant and other strains.

- Demand for COVID-19 vaccines in the U.S. has spiked from under 1 million per day in October to more than 1.5 million per day in recent weeks.

- Economists predict the Omicron variant threatens only a modest hit to the global economy.

- The U.S.’ recent decline in unemployment has prompted the Federal Reserve to quicken its plans to end the nation’s bond buying stimulus program by March instead of June in a bid to quell the nation’s surging inflation rate.

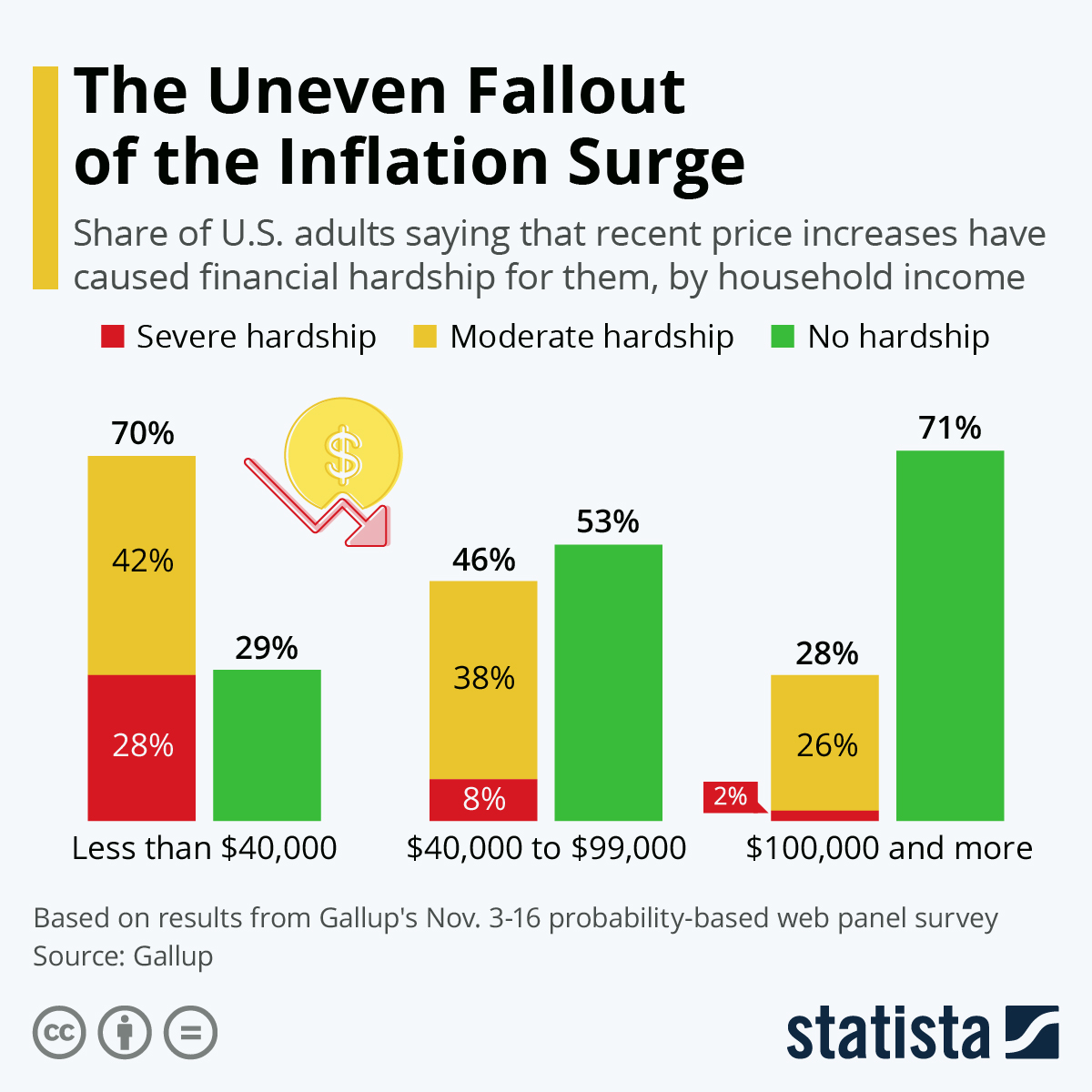

- One in ten U.S. adults report suffering severe hardship from recent inflationary pressures, new survey results show:

- A Norwegian Cruise Line ship docked in New Orleans Sunday with at least 17 passengers and crew members infected with COVID-19, including one likely case of the Omicron variant.

- E-bike sales could get a boost from the Build Back Better Act, which includes a $900 tax credit for the purchase of the bicycles.

- Amazon unveiled eight new utility-scale wind and solar projects throughout the U.S., part of a plan to power 100% of the company’s operations with renewables by 2025.

- The U.S., with just 5% of the world’s population, is the largest waste polluter, with Texas leading the country in plastics pollution.

International Markets

- The COVID-19 Omicron variant has now spread to 42 countries, with Britain (246) and Denmark (183) reporting the most cases.

- COVID-19 cases in Denmark surged over the weekend, jumping from 18 new infections Friday to 183 Sunday, prompting new concerns from the nation’s health authorities.

- Russia and Croatia both reported their first cases of the Omicron COVID-19 variant Monday.

- South African researchers say the variant could be three times more likely to reinfect than other strains, while international studies on the effectiveness of available vaccines will be released shortly, the World Health Organization said.

- The COVID-19 Omicron variant has spread to seven of South Africa’s nine provinces, with people under age 40 accounting for 68% of new cases in the strain’s epicenter. While hospital data suggest recent cases have been less severe than the nation’s last virus wave. the nation is preparing for a surge in hospitalizations as Omicron now is the dominant strain in most provinces.

- South Africa is reporting an alarming surge in hospitalizations of patients under age 5 with the Omicron variant.

- The U.K. reported more than 50,000 COVID-19 cases Friday, with more than half of the nation’s new Omicron infections coming from fully vaccinated people. The nation’s Jersey Island has begun giving a fourth COVID-19 vaccine dose to people with weakened immune systems. Meanwhile, the nation’s prime minister is waiting for updated guidance regarding the Omicron variant before making any possible changes to the nation’s pandemic rules.

- More than 1% of Germany’s population is currently infected with COVID-19, as the nation reported a record 74,352 new infections and 390 virus fatalities Friday.

- Switzerland expanded its COVID-19 vaccine and mask mandates following record new daily infections, as lawmakers strongly urge people to work from home.

- Civil unrest is growing in Belgium and the Netherlands over new pandemic restrictions in response to the COVID-19 Omicron variant.

- Italy expanded proof of COVID-19 vaccine requirements to include all public transit and hotels, part of a plan to forestall a winter virus surge.

- Poland, where only 54% of the population is fully vaccinated, is set to unveil a new set of pandemic restrictions on its residents to help prevent further COVID-19 cases spurred by the Omicron variant.

- South Korea reversed course and will reimpose tighter pandemic restrictions, as new daily cases hover near 5,000.

- Singapore will require all incoming travelers to self-administer COVID-19 tests for seven days.

- Chinese health authorities completed a seventh round of citywide COVID-19 testing in the border city of Manzhouli, detecting five more cases for a total of 332 in the nation’s latest outbreak.

- New Zealand reopened bars and restaurants in its largest city of Auckland Friday, ending a three-month lockdown.

- UBS Group is asking European, African and Middle Eastern employees to refrain from traveling over a maze of border restrictions caused by fears over the COVID-19 Omicron variant.

- The number of COVID-19 booster shots administered in the EU rose 350% in November.

- The CEO of drug maker BioNTech expects that an updated COVID-19 vaccine may be needed to combat the new Omicron variant.

- Distress deepened in China’s property market yesterday when Sunshine 100 China Holdings defaulted on $179 million in debt and interest payments.

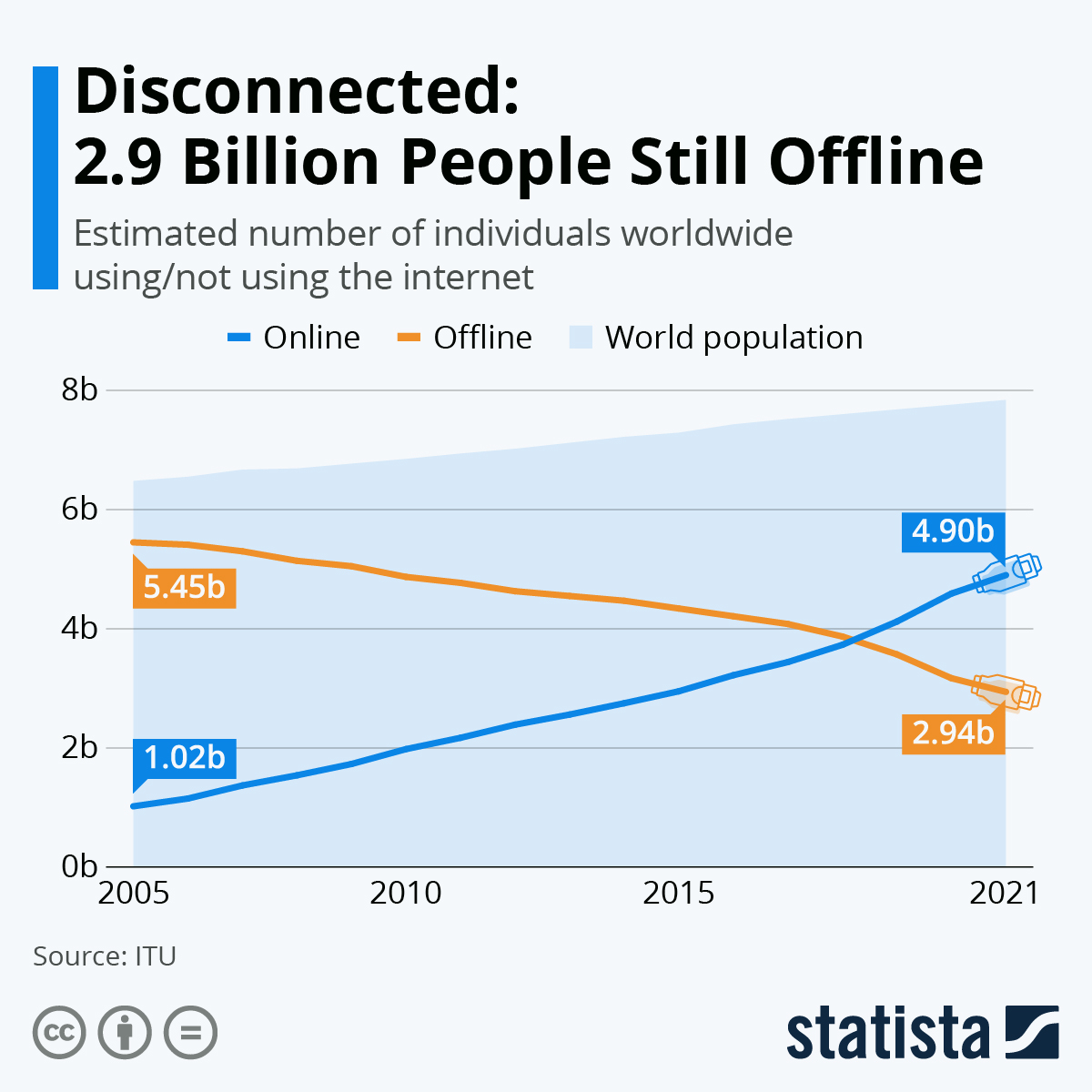

- The “COVID connectivity boost” has brought nearly 1 billion more people across the globe online since 2019, new data shows:

- Kellogg will begin testing the use of paper liners instead of plastic for cereal packaging in some U.K. stores, part of a plan to make its products fully reusable, recyclable or compostable by the end of 2025.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.