COVID-19 Bulletin: December 17

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose roughly 2% Thursday on signals of high demand and a positive economic outlook from the Federal Reserve. Crude futures were lower in late morning trading, with WTI down 1.5% at $70.90/bbl and Brent down 2.1% at $73.48/bbl. U.S. natural gas was 0.8% higher at $3.80/MMBtu.

- Only half of U.S. oil pipeline space is being used compared to 60%-70% utilization levels before the pandemic, resulting in discounts on overbuilt networks in high-output areas.

- U.S. gas prices have dropped by $0.10 since Thanksgiving and could fall further by Christmas, averting a new record high for this time of year.

- Germany’s energy regulator said a decision on fully certifying the Nord Stream 2 gas pipeline from Russia won’t come until the second half of 2022, a setback for Russian producers and a possible cause for higher European energy prices this winter.

- Global demand for every oil product besides jet fuel made a full recovery to pre-pandemic levels in the third quarter, new data shows.

- Global coal-fired power generation is forecast to rise 9% and hit a record by the end of 2021 as electricity demand sharply rises in China and India, the world’s largest coal consumers.

- Los Angeles private equity firm Ares Management has raised over $2 billion it plans to invest in infrastructure businesses focusing on renewable energy, energy efficiency and energy storage.

- Italian infrastructure operator Snam is preparing to sell a minority stake in its gas storage unit for 6 billion euros, a bid to raise funds for further expansion into storage.

Supply Chain

- A powerful weather system swept through a large swath of the middle U.S. on Wednesday, with the National Weather Service logging at least 55 reports of hurricane-force wind gusts. More than 400,000 people between Colorado and Michigan lost power.

- Texas energy regulators entertained at least a dozen new proposals yesterday on making the state’s power grid more stable and reliable in case of emergencies.

- Malaysia’s Port Klang and Greece’s Port of Piraeus are the latest to see severe congestion and long lines of container ship queues.

- An increase in U.S. rail carloads was offset by an 11% decline in intermodal volumes last week, new data shows.

- Rates for the largest bulk ships fell 31% this week after hitting a six-week high last week, a result of easing congestion and lower iron ore shipments from Brazil.

- Maritime shipping stakeholders are launching a new hotel cataloguing program aimed at helping seafarers navigate rapidly changing government border policies.

- The FAA will begin awarding $2.89 billion to more than 3,000 airports across the U.S. for infrastructure upgrades.

- Apple is reportedly building a new office that will work to design more chip components in-house.

- Maersk agreed to a deal to manage all of Unilever’s ocean and air transport starting in 2022, a partnership aimed at streamlining the consumer giant’s 190-country logistics footprint.

- Kellogg has tentatively agreed to a five-year contract with about 1,400 striking workers, potentially ending the two-month standoff as soon as this weekend.

- Self-driving truck-maker TuSimple inked a deal to integrate its vehicle technology into DHL’s supply chain operations, with the logistics giant reserving 100 trucks for delivery in 2024.

- Uber announced it will expand same-day local delivery services to 6,000 U.S. cities and towns.

- North Carolina cotton producer Parkdale Mills will open a textile facility in Honduras as part of an effort to lure sourcing away from Asia. In a similarly inspired move, some of the largest Japanese apparel-makers are moving production back home.

- Singapore Airlines inked a provisional deal with Airbus for seven A350 freighters as it tries to make headway into the air cargo market.

- Japan’s Mitsubishi Shipbuilding unveiled designs for a hybrid electric biomass fuel carrier that could reduce CO2 emissions and help ease workloads for shipping crews.

- Adverse weather is set to dent seasonal Brazilian sugar production, with analysts predicting a decline up to 17%.

Domestic Markets

- The U.S. reported 138,885 new COVID-19 infections and 1,142 virus fatalities Thursday.

- The U.S. is averaging more than 120,000 new cases of COVID-19 per day, a 40% increase from two weeks ago. Weekly infections could jump another 55% by Christmas due to the Omicron variant, now present in 36 states and counting.

- COVID-19 hospitalizations in Illinois are up 20% compared to a week ago.

- New York City’s COVID-19 positivity rate doubled from 3.9% on Dec. 9 to 7.8% three days later. Several Broadway shows are canceling performances.

- Los Angeles saw its highest number of new COVID-19 infections since Sept. 1 yesterday.

- Florida suffered its biggest jump in new COVID-19 infections since September on Thursday.

- New York financial giants Citadel, Millennium Management and Citigroup are telling employees to work remotely through the holidays.

- UCLA and the University of Pennsylvania are the latest top-tier U.S. colleges to resume remote activities over rising COVID-19 cases.

- Sixty-five of the NFL’s 1,700 players have tested positive for COVID-19 in the past two days. The league yesterday announced strict new protocols, including a mask mandate for both vaccinated and unvaccinated players.

- The Miss World competition, scheduled to take place today in Puerto Rico, was postponed yesterday after nearly one-fourth of contestants and many staffers tested positive for COVID-19.

- About 98% of active-duty Army personnel have received at least one dose of a COVID-19 vaccine ahead of this week’s deadline. The Navy has the highest rate at 98.4%.

- Major U.S. music venues are reporting no-shows of 20% or higher amid rising COVID-19 cases throughout the nation.

- The Omicron variant of COVID-19 appears to thrive in air passages rather than the lungs, which could account for its rapid transmissibility, which is up to 70 times faster than previous variants.

- The CDC officially recommended COVID-19 vaccines made by Pfizer and Moderna as the nation’s preferred shots, citing potential rare health concerns with Johnson & Johnson’s version.

- Roughly 20% of U.S. children aged 5 to 11 have received their first COVID-19 vaccine dose.

- U.S. hospitalizations for influenza nearly doubled from late November to the first week of December.

- The White House gave final approval to a bill raising the nation’s debt ceiling by $2.5 trillion, an amount likely to stave off default until next November. The president also indicated that the passage of a $2 trillion social spending bill likely won’t occur until sometime next year.

- The Federal Reserve’s gauge of U.S. manufacturing output rose 0.7% in November to 100.6, its highest level since January 2019, while manufacturing activity slowed to a one-year low so far in December, despite signs of easing labor and raw material constraints.

- U.S. airlines are warning that the planned rollout of 5G wireless networks in January could disrupt flight schedules and cost passengers up to $1.6 billion per year in delays.

- Despite rising fears of the COVID-19 Omicron variant, Delta Air Lines expects to post a profit in the fourth quarter fueled by strong holiday bookings. The airline also forecast profitability for 2022.

- U.S. electric-vehicle startup Rivian will start constructing a new, $5 billion manufacturing facility in Georgia next year, with an annual capacity of 400,000 vehicles.

- The U.S. administration cleared the potential site of a 7 GW wind farm offshore New York.

- Southern California Edison faces a $500 million fine for its equipment’s role in sparking five wildfires in 2017 and 2018.

- Pent-up demand is expected to drive up new car sales by 1.2% in 2022 to a total of 15.2 million units.

- Virginia passed legislation permitting localities to charge a five-cent tax on single-use plastic bags to fund local environmental initiatives.

International Markets

- The U.K. reported 88,376 new COVID-19 infections Thursday, its second record in as many days, as officials expect virus hospitalizations to quickly surpass previous peaks. Omicron infections are doubling every day-and-a-half in parts of the country, and restaurants and bars are voluntarily closing due to high reservation cancellations and concern about employees. France has banned all non-essential travel to and from the nation.

- Denmark reported nearly 10,000 new COVID-19 infections yesterday, a record, and became the first European nation to approve Merck’s antiviral pill for virus patients with severe illness.

- Spain’s COVID-19 case rate has more than doubled since the start of December to 442 cases per 100,000 people.

- Italy extended its COVID-19 state of emergency until the end of March.

- Germany has begun rationing COVID-19 vaccine doses amid a surge in inoculations in response to the emergence of the Omicron variant and will receive an additional 25 million of Moderna’s doses in the first quarter of next year. COVID-19 infections are rising fastest in the nation among schoolchildren.

- Sweden will require all travelers from its Scandinavian neighbors to show proof of COVID-19 vaccination upon entering the country.

- COVID-19 infections in Australia set a record for the second consecutive day, but the prime minister said there are no plans to restore pandemic restrictions.

- South African COVID-19 hospitalizations are down roughly 60% from peak levels during former waves of the Delta variant, supporting a growing medical consensus that the symptoms of Omicron are milder.

- Brazil has approved Pfizer’s COVID-19 vaccine for children as young as age 5.

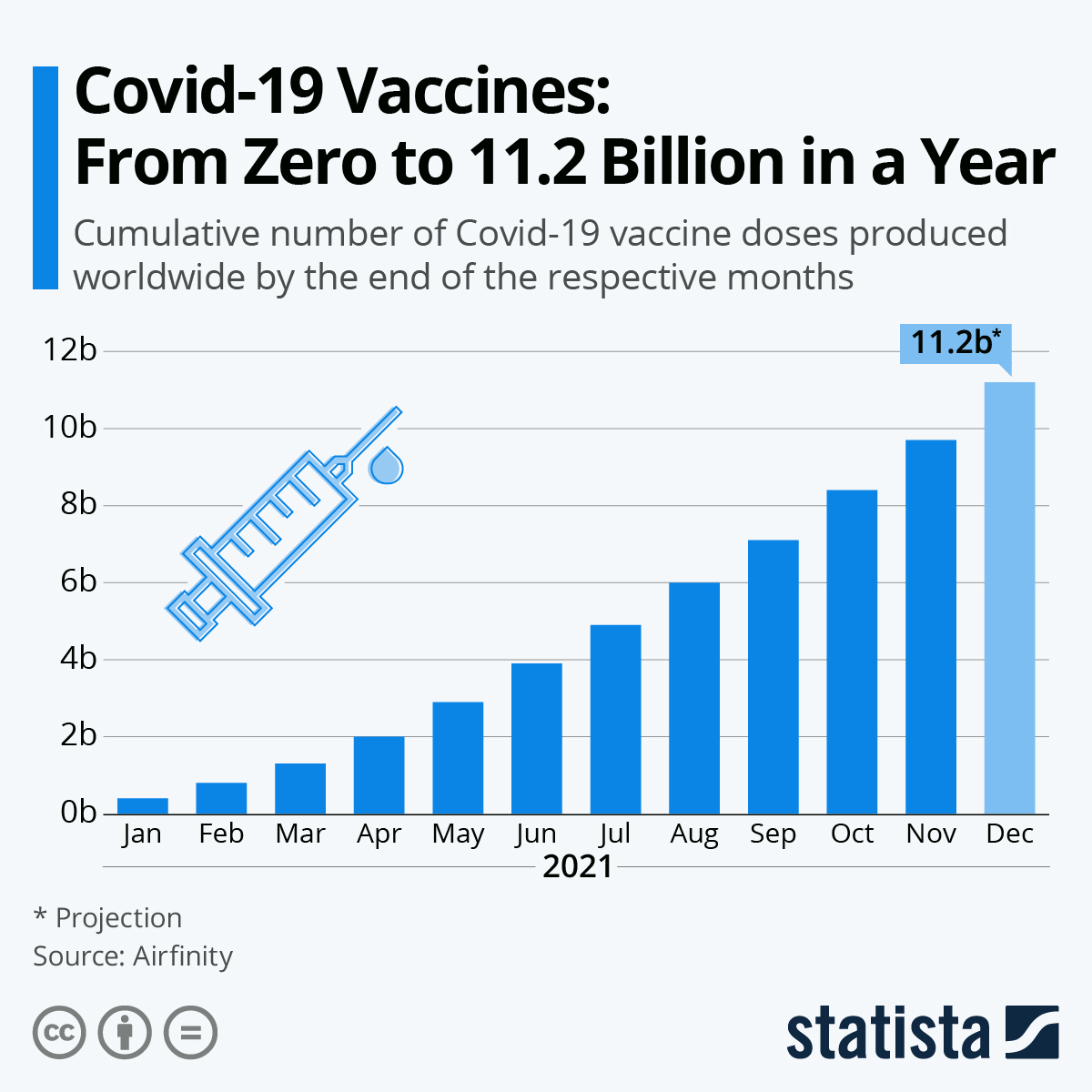

- Pfizer is expected to reap a windfall next year from wealthy countries ordering its new COVID-19 antiviral pill, while low-income nations likely won’t see the drugs until 2023. Across the globe, more than 11 billion vaccine doses have been produced this year:

- European nations will be allowed to administer Pfizer’s COVID-19 antiviral pill despite the treatment not yet gaining approval.

- AstraZeneca’s COVID-19 antiviral treatment was effective in neutralizing the Omicron variant, the drugmaker said.

- Nepal is asking for a slowdown in COVID-19 vaccine deliveries due to lack of cold storage space.

- Europe’s central bank said it would phase out an emergency bond-buying program while ramping up other stimulus measures, diverging from the more aggressive moves by the U.S. and U.K. to tamp down inflation.

- Business confidence in Germany fell for the sixth straight month in December.

- Japanese exports rose 20.5% in November from a year ago and 9.4% from October, the ninth straight month of increases.

- Mexico’s central bank raised its benchmark interest rate by a higher-than-expected 50 basis points yesterday to 5.5%.

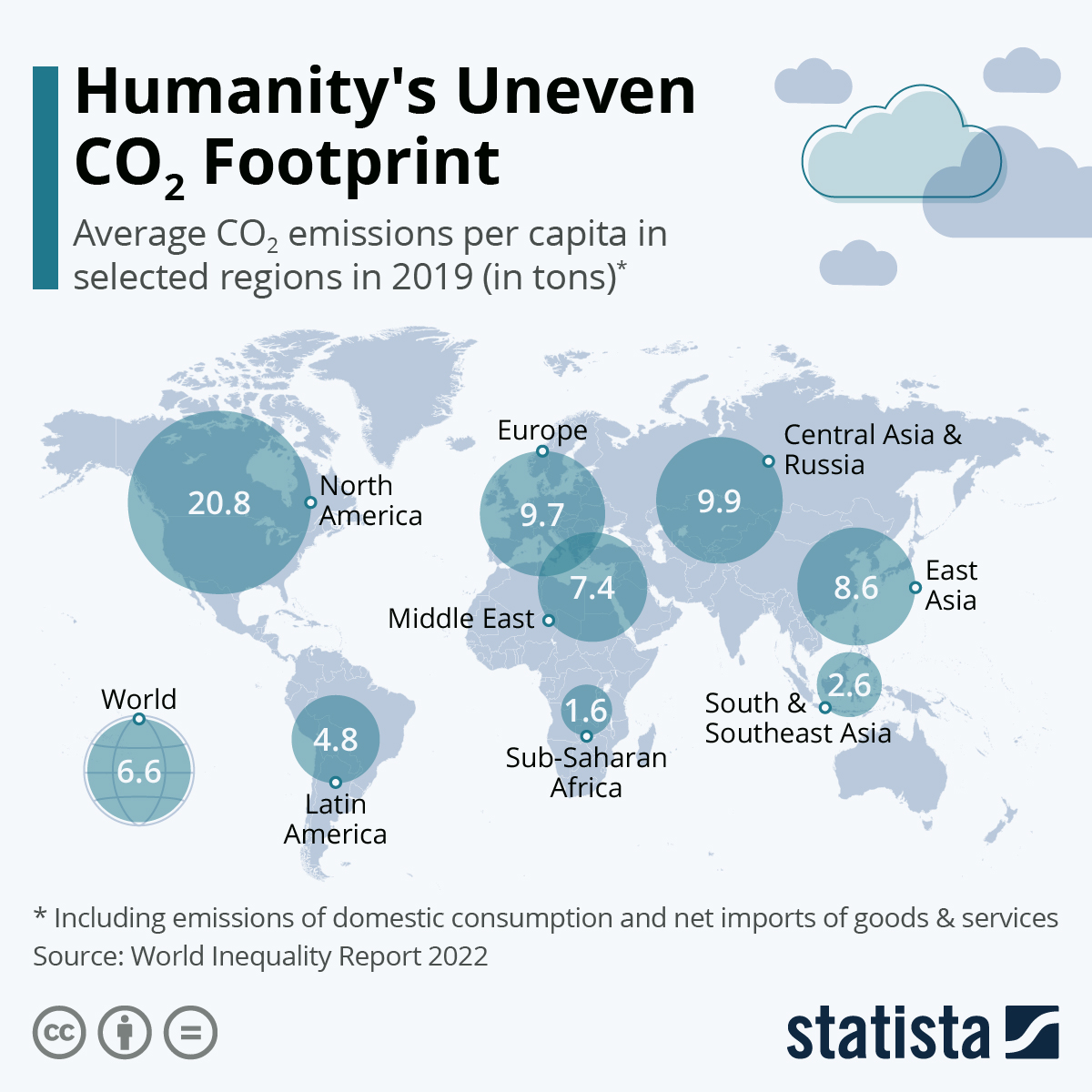

- North America had the highest rate of CO2 emissions per capita in the year before the pandemic, followed by Central Asia, Russia and Europe:

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.