COVID-19 Bulletin: December 20

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices fell roughly 2% Friday to end the week with a loss. Crude futures sank further in late morning trading on Omicron fears, with WTI down 5.6% at $66.91/bbl and Brent down 4.7% at $70.09/bbl. U.S. natural gas was 4.8% higher at $3.87/MMBtu.

- The U.S. active oil rig count rose by three to 579 last week, the most since April 2020.

- Goldman Sachs expects global oil consumption to hit record highs in 2022 and 2023.

- LNG prices in Asia soared last week, rising 21% from the week prior to an average of $43.35/MMBtu.

- Polish utilities are raising rates by as much as 24% next year due to high wholesale energy prices and the cost of purchasing CO2 emission rights.

- Global coal-fired power demand will likely reach an all-time high this year and next due to surging demand in China, the world’s largest consumer of the fuel, as well as India and the U.S.

- Russian officials believe the Nord Stream 2 gas pipeline to Germany could be operational by next month, much quicker than German regulators have signaled, due to the energy shortage keeping prices high in Europe.

- A French utility closed two nuclear power plants after cracks were discovered in their infrastructure, taking a full terawatt-hour of output offline when the nation’s power contracts are already at record highs.

- Italian lawmakers have approved more than 4 billion euros in energy subsidies for households and businesses next year.

- TotalEnergies and Shell were among the companies bidding for two exploration blocks in Brazil’s prolific pre-salt zone, marking one of the first big spending decisions after producers widely reported losses during the first year of the pandemic.

- Norway will invest $111 million in three new emissions-free hydrogen and ammonia projects as it works to transition to a low-carbon economy.

- Higher component and equipment costs have partially undone the years-long downswing in the price of building new renewable energy projects.

Supply Chain

- For the first time ever, the Chicago Mercantile Exchange will offer public trading on container freight futures for six global routes starting in February 2022. Along with bringing more visibility to the industry, the move could allow logistics operators to better protect against the sort of price volatility made commonplace by the pandemic.

- Early indications suggest logistics providers are seeking big boosts in prices for 2022 contracts, as high shipping demand continues to outweigh tight capacity across the freight sector.

- Tight airfreight capacity is hampering efforts by U.S. importers to expedite goods around ocean congestion.

- Supply chain disruptions are denting holiday sales for many U.S. businesses, while the cost of seasonal returns has risen as much as 7% since last year.

- Overall U.S. wholesale distribution revenues are set to grow 21% this year to more than $7 trillion, the latest data shows.

- FedEx incurred $470 million in added expenses for the quarter ending Nov. 30, with higher labor and operating costs offsetting revenue gains from elevated shipping rates.

- An upgrade at western Mexico’s Manzanillo port, the nation’s busiest, will expand its annual capacity by 300,000 TEUs to 1.7 million, with construction slated to begin in the second half of 2022.

- Lumber prices are on the rise again, up nearly double from mid-November in anticipation of the spring building season.

- Aluminum prices rose to a six-week high last week on lower Chinese production in November, a result of the nation’s efforts to restrict electricity consumption in power-intensive industries.

- The Port of Long Beach will roll out prototype technology in February to provide free cargo tracking data for supply chains.

- Maryland is starting a collaborative program aimed at helping manufacturers in the state manage supply chain disruptions.

- Consolidation among semiconductor manufacturers is raising pressure on the industry’s suppliers.

- RV maker Thor Industries has inked deals with alternative suppliers in North America and Europe to help clear an $18 billion backlog of orders spurred by ongoing component shortages.

- Self-driving technology startup Aurora has launched a pilot program with Uber’s freight unit to deliver goods in Texas.

- BP and Maersk completed their first trials of tanker sailings powered by marine biofuel, a potential future source of lower shipping emissions.

Domestic Markets

- The U.S. reported 70,815 new COVID-19 infections and 137 virus fatalities Sunday. Top government officials forecast record infections and hospitalizations this winter, but are not expecting reimposed lockdowns.

- New York state reported more than 22,000 new COVID-19 cases Friday, a record and up over 150% from last week.

- Total COVID-19 hospitalizations in California are up 12% from two weeks ago, with surges of 30% or more in southern cities including Los Angeles.

- New COVID-19 cases in Florida have risen to their highest level since the tail end of a Delta variant surge in September.

- Michigan is running out of COVID-19 antibody treatments due to surging demand.

- The highest protection against COVID-19 likely comes after a breakthrough infection, new research shows.

- The White House is asking the U.S. Supreme Court to rule on its COVID-19 vaccine mandate for healthcare workers, a measure now blocked by lower courts in about half of states.

- Pfizer will switch to trials of a three-dose COVID-19 regimen for children under age 4 after tests with a standard two-dose regimen failed to produce sufficient immune responses.

- New CDC guidelines recommend that students exposed to COVID-19 continue attending school in person as long as they are routinely tested.

- Moderna said a booster of its COVID-19 vaccine raises antibodies against the Omicron variant and that a double-dose booster significantly improves the protection, while a booster of China’s Sinopharm vaccine appears to have limited effect against the variant.

- Concerns over the COVID-19 Omicron variant are not expected to dent travel volumes this holiday season, U.S. officials say. The CDC has started handing out free COVID-19 tests to incoming foreign visitors at major international airports.

- CNN closed its U.S. offices to non-essential staff over concerns of the COVID-19 Omicron variant.

- A Royal Caribbean ship docked in Miami with 48 COVID-19 infected passengers, most of whom were vaccinated, raising concerns about the outlook for the cruise industry.

- An index of activity in the U.S. services and manufacturing sectors fell to 56.9 in December from 57.2 last month, the slowest pace of expansion in three months.

- Economists expect more Americans to return to the labor force as record household savings during the pandemic begin shrinking.

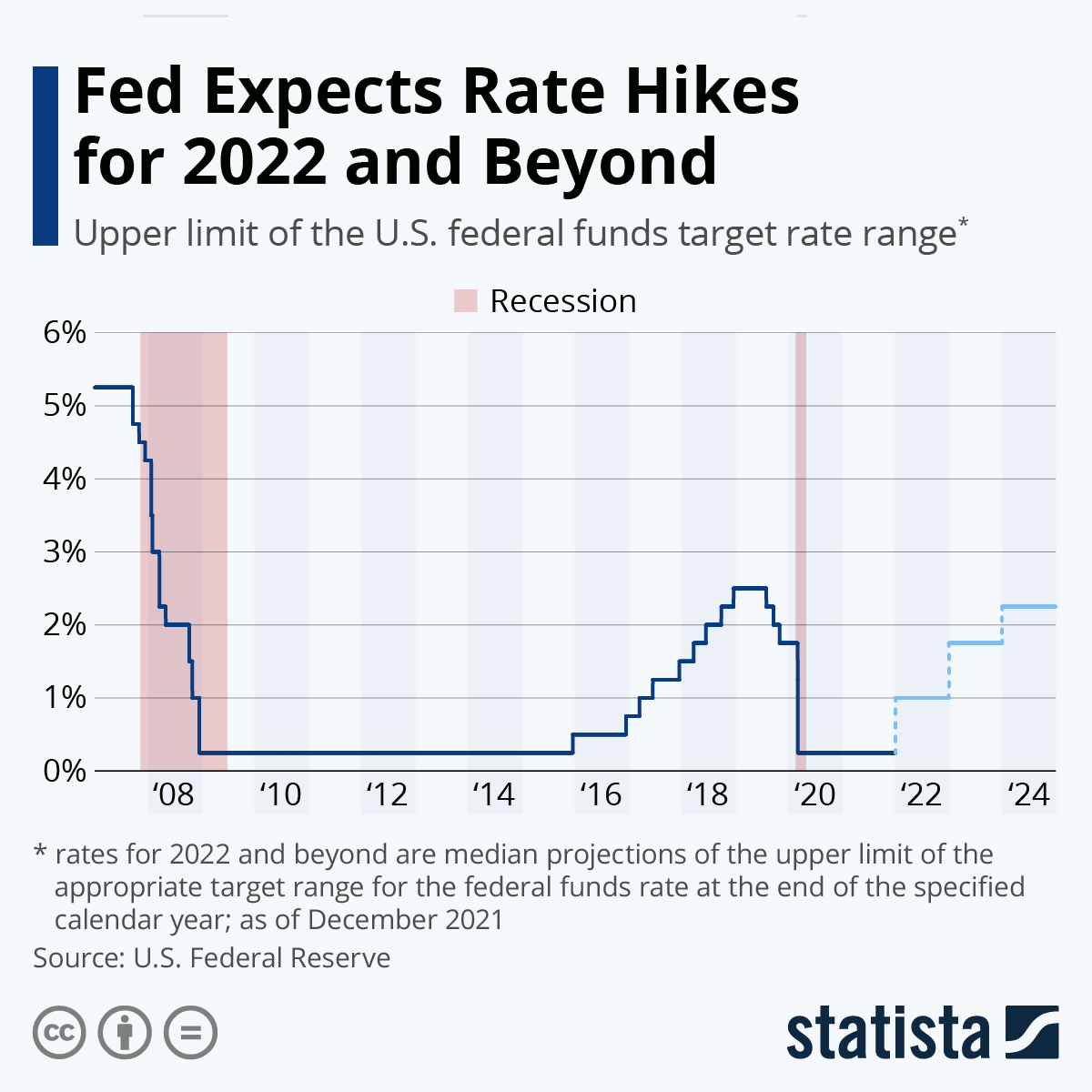

- Overshadowed by last week’s announcement that the Federal Reserve would raise interest rates three times next year, the central bank also raised its maximum target rate for year-end 2022 from 0.75% to 1%:

- Wages and stable hours are sharply rising for day laborers, long the most tenuously employed people in the U.S.

- “Buy now, pay later” plans are booming in the U.S., posing difficulties for accurate consumer credit reporting.

- Boeing made 34 aircraft deliveries in November, bringing its year-to-date total to 302 compared to 118 the same time last year. Tightened inspections are expected to sideline deliveries of the company’s advanced carbon-composite 787 Dreamliner jet until April 2022, which has reduced summer schedules for at least one U.S. airline.

- Amazon plans to significantly expand its grocery delivery service in 2022.

- U.S. restaurant seating was down as much as 12% from pre-pandemic levels in recent weeks, with the industry becoming one of the first to suffer fallout from the COVID-19 Omicron variant.

- The latest Spider-Man installment opened to a record-setting $253 million in box office earnings this weekend, puncturing expectations of the theater industry’s continued pandemic-induced decline.

International Markets

- Cases of the COVID-19 Omicron variant have ballooned to more than 49,000 in the U.K., as the nation reported 93,045 total new infections Friday, its third straight single-day record.

- New COVID-19 cases in Italy and France have risen by double-digit percentages the past several weeks.

- Germany has banned tourists from the U.K. over the nation’s outbreak of the COVID-19 Omicron variant.

- Denmark is expected to close all public entertainment venues after posting record single-day COVID-19 infections over the weekend, including more than 2,500 new cases of the Omicron variant.

- The Netherlands went back into a full pandemic lockdown Sunday amid rising cases of the COVID-19 Omicron variant, the first European country to do so.

- Austria partially lifted its pandemic lockdown Sunday, while unvaccinated people will still be required to stay home except for work and other essential trips. Other European nations have increased restrictions exclusively on unvaccinated people.

- Switzerland is barring access to most indoor public venues for people unvaccinated against COVID-19 while also reimposing work-from-home requirements.

- The COVID-19 Omicron variant accounts for 20% of new cases in Portugal and could reach 80% by the end of the month, officials warn.

- Canada reported 7,145 new COVID-19 infections late last week, the most since May, as testing requirements were tightened for incoming travelers.

- China reported more cases of the COVID-19 Omicron variant on its mainland.

- Israel is poised to bar its citizens from travelling to the U.S. because of rising COVID-19 infections.

- The COVID-19 Omicron variant may be five times more likely than Delta to cause reinfection, new research suggests.

- EU regulators have approved two new COVID-19 treatments developed in the U.S. and Sweden.

- The World Health Organization approved the U.S.-made Novavax COVID-19 vaccine for emergency use, its ninth approved shot.

- Japan today passed a $317 billion supplementary budget to counter the effects of the pandemic.

- A rate rise by Russia’s central bank on Friday was the seventh such hike in the country this year, as many countries start taking action to combat persistent inflation.

- Stricter Chinese regulatory scrutiny has led to mass layoffs across a broad swath of the economy, with joblessness rising among young people and income growth for urban workers stalling.

- Business insolvencies in England and Wales hit their highest level since January 2019 in November.

- The south African nation of Namibia is poised to become a leader in the development of renewable energy and green hydrogen, taking advantage of its frequent sunshine and 1,000 miles of windy Atlantic coastline.

- BMW plans to assemble its X5 mid-size SUV in China.

At M. Holland

- M. Holland will be closed Friday, Dec. 24, for the Christmas holiday. We will be closed Friday, Dec. 31, for New Year’s Eve.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.