COVID-19 Bulletin: December 30

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose slightly yesterday on news of larger-than-expected draws in U.S. crude and gasoline stockpiles. Futures were mixed in late morning trading, with WTI up 0.2% at $76.74/bbl and Brent down 0.1% at $79.14/bbl.

- U.S. natural gas prices edged lower despite forecasts of regional colder weather and higher heating demand. Futures were 5.3% lower in morning trading at $3.65/MMBtu.

- Mexico will suspend crude oil exports in two years in a bid to focus on domestic self-sufficiency, starting with a 50% reduction to 435,000 bpd of exports next year.

- Saudi Arabia is expected to slash prices for all export grades to Asia by more than $1 per barrel in February, reversing December’s 60¢ increase to the lowest price in four months.

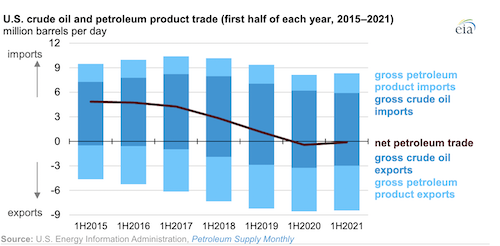

- U.S. exports of petroleum and crude oil products topped imports by 120,000 bpd in the first half of 2021, according to the Energy Information Administration.

- Benchmark European gas prices are up about 400% this year and could remain elevated into early 2023, as German regulators continue to stall boosted flows from Russia. Prices have steadied on higher LNG imports from the U.S.

- Equipment, leasing and other input costs rose to an all-time high this quarter for drillers in the largest U.S. oil fields, the Dallas branch of the Federal Reserve said.

- Brazil’s Petrobras is stepping up re-injections of CO2 into its oil fields as part of long-term emissions reduction goals.

- Ukraine is doubling down on nuclear power with plans for $335 million in investments in uranium mining and processing sites over the next five years.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Greek operator Euroseas signed three-year charter extensions for two boxships at $40,000 per day, nearly triple the current charter rate of $15,500.

- The U.S. deficit in merchandise trade widened to a record $97.8 billion in November on a sharp rise in imports, concentrated in industrial supplies and consumer goods.

- Small and midsize retailers are increasingly buying up logistics companies for in-house operations, signaling their continued difficulties finding delivery capacity in a tight market. Smaller stopgap measures are also being used more frequently, such as storing goods in idle truck trailers.

- Quick turnarounds on returns have helped U.S. retailers restock depleted inventories, spurring rising investment in return automation and warehouse systems.

- Shares of the U.S.’s biggest egg producer fell 8% Wednesday on disappointing quarterly results caused by rising feed and labor costs.

- Much of 2021’s commodity price volatility can be traced to extreme and wildly changing weather in several global regions.

- Analysts project lower grain prices in 2022 as a record planting season brings supply up to demand, although volatility could result from extreme weather and geopolitical tensions.

- Global crude steel production fell 9.9% year over year in November, keeping prices unusually high compared to historical levels despite cooling pressures the past several months. U.S. cold-rolled coil closed last week at $2,503 per short ton, more than double the $1,018 rate from December 2019.

- More than half of states are set to raise their minimum wage next year in response to continued labor shortages and inflationary pressures.

- Computer chip maker Micron Technology is warning customers of delayed shipments over a facility shutdown caused by China’s latest COVID-19 outbreak.

- Electric vehicle maker Rivian is pushing back deliveries of some electric pickups and SUVs to 2023 due to battery component shortages in high-trim models.

- The U.S.’s first human-less and fully autonomous heavy duty truck trip was completed on an 80-mile route in Arizona.

Domestic Markets

- The U.S. reported 489,267 new COVID-19 infections and 2,184 virus fatalities Wednesday. Despite record-high daily case counts, total hospitalizations are roughly half their previous peaks from last January.

- Unvaccinated Americans are 17 times more likely to go the hospital for COVID-19 than vaccinated peers, the CDC said.

- The U.S.’s seven-day average for COVID-19 fatalities fell 7% last week to about 1,100. The CDC is predicting another 44,000 fatalities over the next month.

- COVID-19 hospitalizations among U.S. children are just shy of early September peaks and rising.

- Emergency departments in Washington, D.C. are overwhelmed with new COVID-19 patients, doctors say, with admittances rising three times faster than any state.

- Ohio deployed more than 1,200 national guard troops to northeastern hospitals to help with depleted staffing amid record COVID-19 hospitalizations. Cincinnati’s mayor declared a state of emergency as COVID-19 infections crippled the city’s fire department.

- Georgia called out 200 national guard members to help state hospitals and testing sites with a surge of COVID-19 patients.

- New York reported more than 67,000 new COVID-19 cases Tuesday, smashing its previous record, as hospitalizations steadily increase. Officials launched more than a dozen new state testing sites Wednesday.

- COVID-19 hospitalizations in California are up nearly 25% since Dec. 20.

- New Jersey added more than 20,000 new COVID-19 cases Wednesday, a record, with virus hospitalizations up 250% the past month. A Walmart in the state began turning away customers after 90 infections were reported among store employees.

- Florida reported a record 46,923 new COVID-19 infections Tuesday, bringing total cases since the start of the pandemic past 4 million. Schools in Miami-Dade County are considering reimposing mask mandates and other restrictions.

- COVID-19 hospitalizations in Texas rose 11% over the past 24 hours, with Austin returning to its second highest virus alert level with stricter recommendations for social gatherings and mask-wearing.

- Hospital beds occupied by COVID-19 patients in Chicago are at the highest level since last December. Starting Monday, the city will require everyone over age 5 to be vaccinated to enter most indoor public places.

- The White House will complete its order for 500 million at-home COVID-19 tests by next week for distribution to Americans free of charge.

- The CDC is soon expected to release a decision on approving COVID-19 booster shots for 12- to 15-year-olds.

- A booster shot of Johnson & Johnson’s COVID-19 vaccine is 85% effective against the Omicron variant, according to a study in South Africa.

- State and local leaders are moving away from raw COVID-19 infection numbers as the basis for new pandemic measures, instead focusing on increasing testing options and vaccine uptake.

- Four Smithsonian museums in Washington, D.C., are temporarily closing due to rising COVID-19 cases among staff.

- Duke University will require all staff and faculty to provide proof of a COVID-19 booster shot by Feb. 1 or be terminated.

- The World Junior hockey tournament has been shut down midway through due to rising COVID-19 cases among players.

- U.S. travelers faced a fifth day of more than 1,000 flight cancellations yesterday as snowstorms across the Midwest and Pacific Northwest clogged airports, exacerbating disruption from COVID-19 outbreaks among staff and crews.

- Carnival Cruise Line will stick to its planned itineraries despite rising scrutiny from lawmakers over continued COVID-19 outbreaks during sailings. Mexico has established itself as a haven for ships docking with COVID-19 infections.

- Hundreds of millions of dollars are at stake in escalating patent disputes between COVID-19 vaccine inventors.

- Roughly three out of every five pregnant women in the U.S. have zero protection against COVID-19, new data shows.

- Roughly 22% of U.S. gym locations have closed permanently during the pandemic, with rising cases of the Omicron variant threatening even more closures.

- Foot traffic at U.S. discount retailers rose by double-digit percentages last weekend compared to a year ago, on par with data showing record holiday sales this year.

- First-time jobless claims last week fell to 198,000, lower than expected and near a half-century low, as continuing claims fell to pre-pandemic levels.

- Economists from Moody’s Analytics and Oxford Economics expect continued economic growth in 2022 but cut their projections from 4.4% to 4.0% due to the rise of the Omicron variant of COVID-19.

- U.S. pending home sales unexpectedly fell in November on limited housing stock and continued high prices, new data shows.

- Italy’s Prysmian Group, the world’s largest cable maker, will spend $226 million on a new plant in Massachusetts for submarine power transmission cables.

International Markets

- The seven-day average for new global COVID-19 cases is approaching 1 million per day, with the largest rises in the U.S., Europe and Australia.

- The U.K. reported 183,037 new COVID-19 cases Wednesday, 50,000 higher than the previous day’s record on a backlog of holiday data. More than 90% of new cases are the Omicron variant, while officials have so far resisted more restrictions.

- Ireland recorded 16,428 new COVID-19 infections yesterday, smashing its prior single day record by nearly 50%.

- France posted more than 208,000 new COVID-19 cases yesterday, a European record, as infections with the Omicron variant double every three days. Officials reimposed an outdoor mask policy in Paris.

- Spain reported more than 100,000 new COVID-19 cases Wednesday, the second record in as many days. Following the U.S.’s lead, the nation reduced quarantine periods for infected people by three days.

- Italy was just shy of 100,000 new COVID-19 infections yesterday, a record. The nation’s world-famous restaurant industry is withering under new quarantine rules during the normally busy holiday season.

- Switzerland is reporting record COVID-19 case counts.

- The Netherlands will require incoming U.S. visitors to quarantine for up to 10 days upon arrival.

- Greece banned music at entertainment venues in a bid to halt surging COVID-19 cases.

- Fearing more COVID-19 protocols would cripple its economy, Israel removed quarantine requirements for fully vaccinated people who are exposed to COVID-19 and test negative.

- Australia reported more than 18,000 new COVID-19 cases Wednesday, a record.

- Chinese officials are reaffirming the nation’s strict policy of eradicating every COVID-19 outbreak as new infections in the northwestern city of Xi’an continue to number in the hundreds.

- The World Health Organization renewed calls for wealthy countries to prioritize getting vaccine shots to low-income nations over doling out boosters domestically, as nearly half of the group’s member nations missed a target of vaccinating 40% of their populations by the end of the year.

- India approved two new homegrown COVID-19 vaccines as well as Merck’s at-home antiviral pill.

- Hong Kong’s main airline is cutting passenger flights in January due to tighter COVID-19 quarantine policies announced earlier this week.

- Russia’s service sector shrank for the third consecutive month in November as business confidence slipped to an annual low.

- The pandemic has reversed westward migration across Europe for the first time in decades, with nations like Bulgaria reporting an influx of people largely due to strong job opportunities.

- Swedish battery maker Northvolt created a lithium-ion battery cell for use in electric vehicles, the first by a European company in a market dominated by Asian manufacturers.

- Starting Jan. 1, large public European firms will be required to disclose how much of their operations align with a new emissions-reduction classification system developed by the bloc’s governing body, serving the dual purpose of encouraging sustainability alongside favorable investor status.

At M. Holland

- M. Holland will be closed tomorrow for the New Year’s holiday. We wish all a safe and happy new year!

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.