COVID-19 Bulletin: February 3

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices settled higher Wednesday after OPEC+ said it would stick to a 400,000-bpd production increase in March. Futures were up in late-morning trading, with WTI higher by 0.4% at $88.59/bbl and Brent up 0.3% at $89.75/bbl.

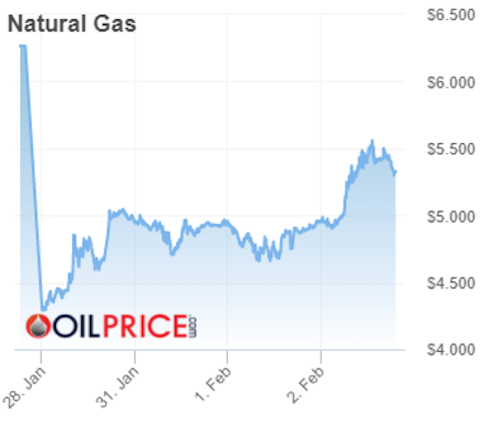

- A cold blast sent U.S. natural gas prices soaring over 12% Wednesday, with heating demand expected to be very high throughout the weekend. U.S. natural gas futures were down 11.6% in late-morning trading today at $4.86/MMBtu.

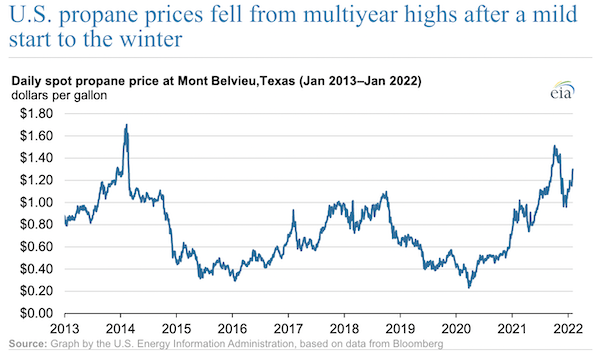

- U.S. propane prices are climbing toward eight-year highs:

- U.S. crude inventories declined by 1 million barrels last week, roughly 10% below the five-year average for this time of year.

- OPEC+ slightly lowered projections for this year’s crude surplus from 1.4 million bpd to 1.3 million bpd.

- Natural gas supplies on the Yamal-Europe pipeline from Russia to Germany halted Wednesday, dashing hopes of a restart in the western flow of gas that has been interrupted since December.

- The U.S. and Europe are talking to major LNG importers in Asia — including Japan, South Korea, India and China — to potentially send some of their gas supply to Europe in case of an emergency.

- Venezuelan crude exports fell 34% to 416,387 bpd in January, the lowest level since September 2020 due to inbound vessel congestion.

- Shell will repurchase $8.5 billion shares in the first half of 2022 after fourth-quarter net income hit $6.39 billion, an eight-year high, even as production volumes declined.

- The U.S. Gulf Coast refining margin is over $20/bbl, the highest in five years, after hitting a low of just $2.31/bbl at the start of the pandemic:

- The Netherlands’ Vitol Group, the world’s largest independent oil trader, announced plans to acquire more wells in the U.S. Permian and Bakken shale regions.

- Ford says the onboard battery capability of its F-150 Lightning model is strong enough to power a home, as the automaker begins to work with U.S. solar firm Sunrun to enhance home energy independence.

Supply Chain

- Illinois, Missouri and Oklahoma are under a state of emergency due to a severe winter storm sweeping across the Great Plains to the Northeast. More than 2,000 flights were canceled Wednesday while authorities cautioned against road travel due to snow and ice.

- Power plants in Texas are running on overdrive to keep up with high energy demand forecast to last until Sunday.

- Transit times on some international maritime routes are 20 days longer than a month ago, as global shipping congestion shows no sign of easing.

- Reduced container capacity on intra-Asia trade routes is driving up rates on lanes heavy with manufacturing components.

- Cargoes on the U.S. Great Lakes are being delayed over a lack of Coast Guard icebreaking assets.

- UPS predicts the small package market to outgrow capacity additions this year, allowing carriers to maintain firm pricing power as shippers continue fighting for limited space.

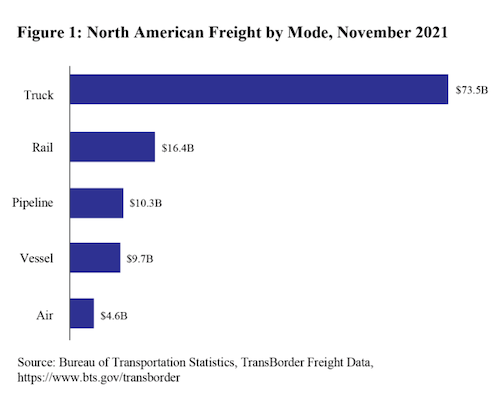

- The value of transborder freight in North America rose 25.2% in November from the year before and 21.3% from November 2019:

- McDonald’s expects the rate of cost increases for materials in the U.S. to double this year.

- Profits of the world’s largest ocean carriers have uniformly more than tripled over the past year.

- Malaysia’s Port of Tanjung Pelepas, which handled 11.2 million TEUs last year, is set to increase capacity by more than 10% by the middle of this year.

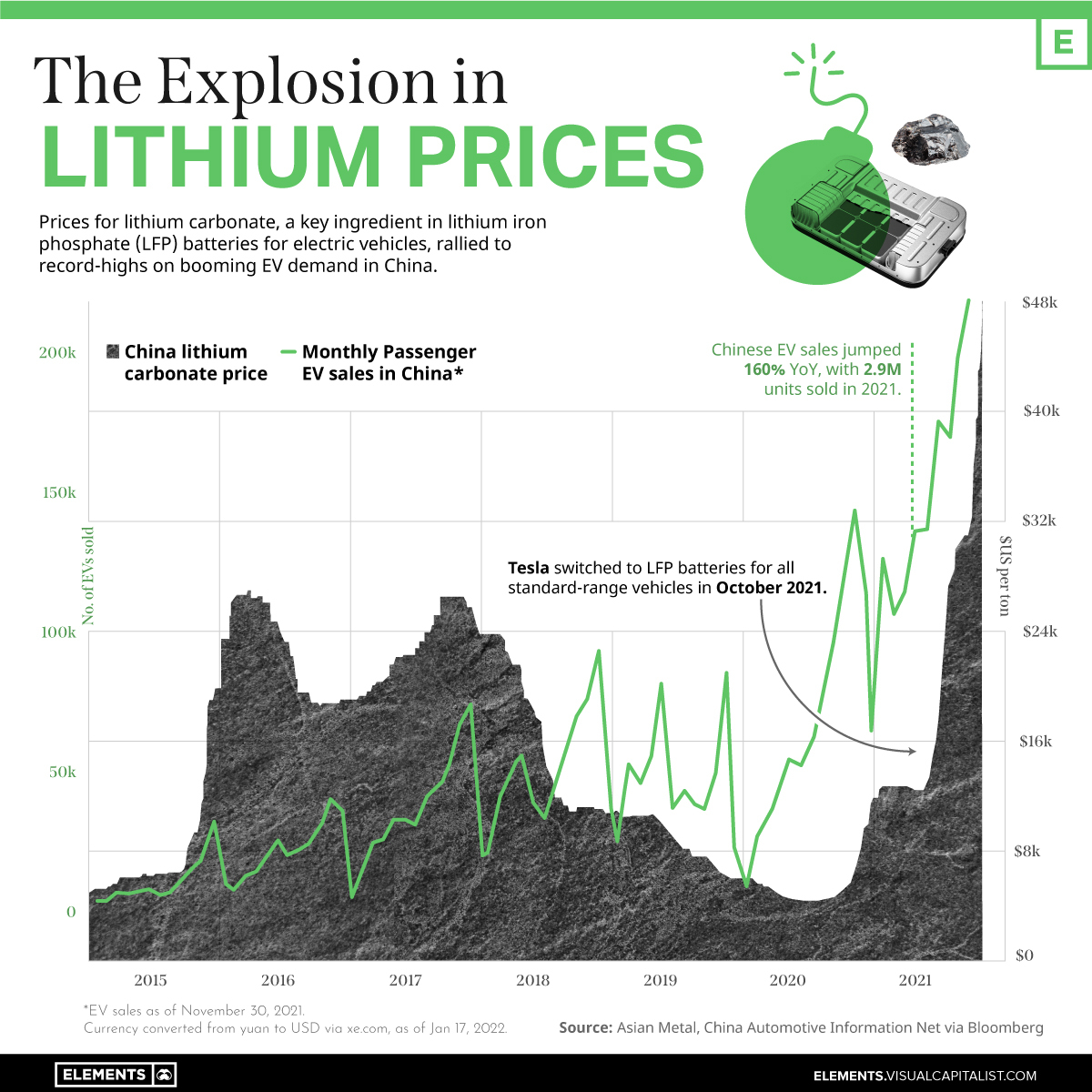

- Lithium prices have surged 500% the past year, new data shows:

- U.S.-listed Scorpio Tankers sold 14 vessels for a total of $472.2 million, a bid to take advantage of high rates for secondhand vessels as it prepares to renew its fleet.

- Self-driving freight startup TuSimple is moving up its commercialization plans to late 2023 after completing its first driverless run in late December.

- Truckload carrier Landstar System’s fourth-quarter profit jumped 74% to $65.1 million on a 50% gain in revenue.

- GE Appliances is testing use of electric, autonomous Einride delivery vehicles within its operations in Louisville, Kentucky.

- Virgin Hyperloop is pitching 670-mph transit tubes to air cargo hubs across the world.

- GM expects an easing of the global chip shortage to allow it to send 30% more vehicles to dealers across the globe this year.

- LG Energy Solution raised about $10.6 billion in South Korea’s largest ever initial public offering, pumping optimism into the market for makers of electric cars and their suppliers.

- California drone firm Zipline will begin delivering prescription medicines to households outside Charlotte, North Carolina, later this year.

Domestic Markets

- The U.S. reported 330,128 new COVID-19 infections and 3,546 virus fatalities Wednesday.

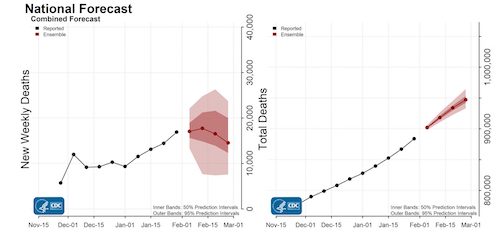

- The daily average of U.S. COVID-19 fatalities climbed 9% the past week to over 2,600. More than 65,000 Americans could pass away from the virus over the next four weeks, the CDC predicts.

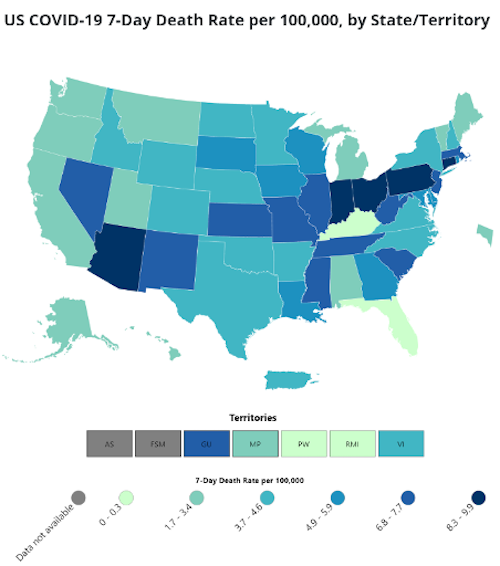

- Arizona, Indiana, Ohio, Pennsylvania and Connecticut have the highest COVID-19 fatality rates in the nation. Connecticut, a state of just 3.61 million people, surpassed 10,000 COVID-19 virus fatalities yesterday.

- COVID-19 cases in New York state dropped 90% over the past month and 50% the past week, while virus hospitalizations have fallen 33%.

- Unvaccinated people in Los Angeles were 23 times more likely to be hospitalized with COVID-19 than vaccinated peers during the latest Omicron wave, new data shows. Across the nation, unvaccinated people are 97 times more likely to pass away from COVID-19, the CDC said.

- The U.S. Army said it would immediately discharge soldiers who refuse to get vaccinated against COVID-19.

- The airline industry is urging the government to drop its pre-boarding COVID-19 testing requirement for vaccinated passengers traveling to the U.S.

- State attorneys general are warning Americans against rising numbers of fraudulent COVID-19 testing sites that deliver fake results and steal personal information.

- First-time jobless claims fell by 23,000 last week to 238,000, the second consecutive weekly decline, as the Omicron surge eases.

- Private payrolls fell by 301,000 in January versus expectations of a 200,000 gain, the first decline in over a year, according to ADP.

- The pandemic’s severe labor shortage has forced many U.S. firms to rethink benefit systems in a bid to retain talent.

- U.S. lenders issued a record 20.1 million new credit cards in 2021, pushing the number of American cardholders to an all-time high of 196 million.

- Ohio-based medical product maker Thermo Fisher Scientific topped quarterly profit and sales estimates and said revenue from COVID-19 test sales would be $1 billion higher than initially forecast this year.

- California chip maker Qualcomm bested Wall Street expectations with $10.7 billion in sales and $3.4 billion in net income in the most recent quarter, bolstering upbeat sales projections for 2022 as semiconductor demand remains strong.

- Michigan selected Israel’s Electreon to construct the first wireless charging roadway for electric vehicles in the U.S., a mile long stretch of street in Detroit that can charge vehicles while moving or parked.

International Markets

- More than 22 million new COVID-19 cases were reported globally last week, along with 59,000 virus fatalities, 9% higher than the week before in a sign that the pandemic is far from over.

- Germany reported a record 208,498 new COVID-19 infections Wednesday, while total cases since the start of the pandemic surpassed 10 million.

- Nearly 142,000 new COVID-19 cases were posted in Russia Wednesday, a record.

- The World Health Organization is criticizing moves by more European nations, most recently France and Sweden, to roll back travel and other pandemic curbs due to their ineffectiveness against the Omicron variant. Denmark became the first European nation to completely eliminate pandemic curbs, while Switzerland dropped some quarantine and remote work requirements.

- One in every 20 people in England tested positive for COVID-19 each day the past three weeks.

- Tokyo reported 21,576 new COVID-19 cases Wednesday, crushing a previous record by nearly 4,000 cases.

- Australia took hope in a flattening of new COVID-19 infections and a decline in hospitalizations.

- Beijing reported roughly 31 new COVID-19 cases per day the past week as officials try to tamp down concerns ahead of the start of the Olympics Friday. The nation is significantly bolstering land barriers in a bid to prevent importing COVID-19, adding to concerns about the fluidity of regional trade.

- Quebec, Canada, dropped plans to charge a health tax on residents unvaccinated against COVID-19.

- More than 10 billion COVID-19 vaccines have been administered worldwide, a milestone.

- The Bank of England instituted its first back-to-back increase in interest rates since 2004 in a bid to slow inflation.

- Mexico’s economy shrank 0.1% in the latest quarter following a 0.4% contraction the prior quarter, putting the country into a second technical recession of the pandemic.

- Electric vehicles made up 7.2% of global car sales in the first half of 2021, up from 4.3% in 2020 and just 2.6% in 2019.

At M. Holland

- Our Healthcare team has published a revised Medical Resin Selection Booklet containing additional resins, new focus grades and new 3D printing resins.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.