COVID-19 Bulletin: February 8

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices dipped from seven-year highs Monday. Crude futures were lower in late morning trading, with WTI down 2.6% at $88.91/bbl and Brent down 2.5% at $90.36/bbl. U.S. natural gas was 1.8% higher at $4.31/MMBtu.

- After peaking last week at $3.45/gallon, the national average gasoline price is expected to ease due to price cycling in the retail market.

- The U.S. administration is mulling Chevron’s request to allow it to accept and trade Venezuelan oil cargoes to recoup unpaid debt.

- Saudi Aramco plans to increase its oil production capacity to over 13 million bpd by 2027 from 12 million bpd currently, underscoring its confidence in the long-term outlook for oil and gas.

- The U.S. asked Japan if it could divert LNG supplies to Europe in case of an emergency.

- Lower temperatures pushed up gas demand in France by 6% last year, contributing to the continent’s energy shortage.

- High spot rates for LNG are pushing oil majors and nations toward more long-term contracts.

- Canadian oil and gas producer Crescent Point Energy is looking to sell some of its assets in Alberta and Saskatchewan for almost $400 million, as more producers seek to cash out on non-core assets amid high crude prices. Spanish oil major Repsol also is seeking to cash out on almost $600 million in western Canadian assets.

- Argentina’s largest oil union briefly went on strike Monday before the government ordered a negotiating conciliation period, limiting disruption to the nation’s production.

- Namibia expects to have its first oil field operational by 2026 after Shell made a large offshore discovery last year.

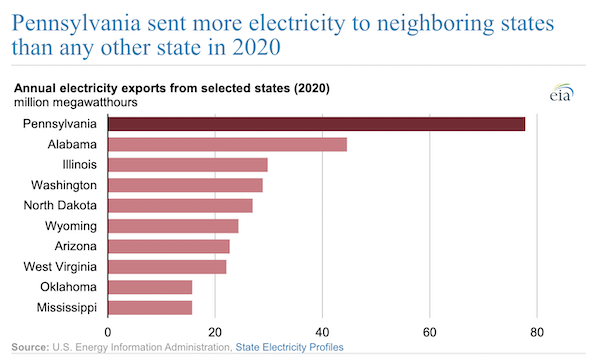

- Pennsylvania sent more electricity to neighboring states than any other state in 2020, new data shows:

- Major international wind farms are emerging as suitors as the White House weighs selling offshore wind rights alongside almost all U.S. coasts.

- Swiss lawmakers are proposing new ways to speed up solar and wind development to help the nation reach net-zero emissions by 2050.

- Global hydropower capacity will exceed 1,200 GW for the first time this year, cementing its spot as the most popular renewable source and the third-largest power generator behind coal and natural gas.

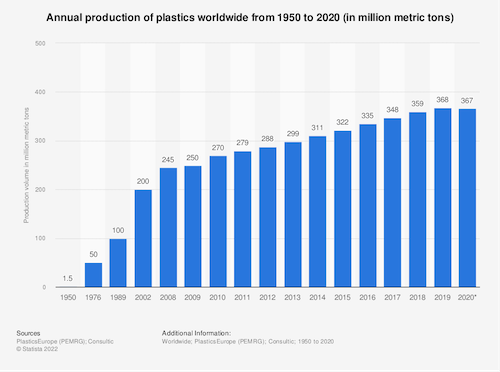

- Global plastics production fell roughly 0.3% in 2020 from the year before, the first annual decline in decades:

- More than 80% of proposed commercial carbon-capture efforts around the world have failed, primarily because the technology didn’t work as expected or the projects proved too expensive to operate.

Supply Chain

- Long-term contract ocean freight rates dropped 3.6% in January from the previous month, the second straight monthly decline, according to the Xeneta Shipping Index.

- Overall container throughput at Chinese ports rose 7% last year to roughly 282.7 million TEUs.

- UAE ports giant DP World saw a 9.4% rise in global container volumes last year, with Asia Pacific, India, the Americas and Australia seeing double-digit growth.

- The U.S. has vaccinated more than 76,000 seafarers.

- Critical infrastructure in England is growing more prone to flooding due to high levels of erosion on the coasts.

- The U.S. will suspend a 25% levy on some 1.25 million metric tons of Japanese steel imports each year, a measure imposed under the previous administration.

- Tractor Supply Company plans to ramp up its use of “mixing centers” that provide its stores with just-in-time replenishment of some of the fastest-turning items including livestock feed, pet food and fertilizer.

- Artificial intelligence and software technology will be the future of the auto supply market, according to the world’s largest auto supplier.

- Subaru’s profits plunged by 66% in the fourth quarter on a 20% decline in output caused by the global semiconductor shortage.

- One million more vehicles could be lost from production this year due to the global chip shortage, still just a fraction of last year’s estimated loss of 10 million vehicles.

- The EU is considering the European Chips Act, proposed legislation that could direct nearly $50 billion to expand computer chip production.

- Aluminum prices hit a near-decade high as about 4 million tons of capacity have been closed or halted globally due to rising energy prices, while stockpiles in warehouses are at their lowest level since 2007.

- Daimler’s North American trucking unit is preparing to build a nationwide charging network for commercial vehicles with partners NextEra Energy Resources and BlackRock Renewable Power.

- Amazon raised the price of its Prime membership for the first time in four years due to a rise in transportation and labor costs, executives said.

- Higher beef prices offset rising supply chain costs at Tyson Foods, whose profit nearly doubled in the latest quarter.

Domestic Markets

- The U.S. reported 340,947 new COVID-19 infections and 2,908 virus fatalities Monday. The seven-day average for new cases dipped below 300,000 for the first time this year, down 61% from January’s peak.

- More U.S. states, including Connecticut, New Jersey, California and Oregon, are easing public mask mandates as the latest Omicron surge subsides.

- The California Legislature passed a bill yesterday that would mandate sick leave for COVID-19 absences and make California the fourth state with such a law.

- New COVID-19 cases fell 43% in New York and 33% in Florida last week.

- COVID-19 hospitalizations in Virginia are down 22% week over week.

- COVID-19 could linger in white-tailed deer and be transmitted back to humans with new variants, scientists warn.

- Pfizer projected it will do $54 billion in sales this year of COVID-19 vaccines and treatments.

- Retail grocery stocks are about 10% below their 2019 levels as Americans continue buying in bulk over fears of future shortages.

- The share of Americans who feel it’s a good time to buy a house has dropped to 25%, an all-time low.

- The U.S. is unlikely to return to pre-pandemic employment trends for two years, as rising retirement rates dampen growth of the labor force. Still, some officials expect the unemployment rate to fall below 3% this year, the lowest since the 1950s.

- Employers last month posted roughly 340,000 unfilled IT job openings, 11% higher than the 12-month average.

- Amazon is more than doubling the base pay salary cap for U.S. employees to $350,000, a response to the tight labor market.

- Total consumer credit among Americans rose just $18.9 billion in December, down from a record $38.8 billion rise the prior month.

- In a recent study, 70% of respondents said they are living paycheck to paycheck.

- Toy maker Hasbro smashed Wall Street expectations in the latest quarter, reporting a 17% revenue increase to $2.01 billion despite pandemic bottlenecks and rising raw material costs.

- Pandemic highflier Peloton is slashing its corporate workforce by 20% and replacing its CEO after the company’s stock price fell 80% from its peak.

- The U.S. Department of Agriculture allotted $1 billion for pilot projects that promote sustainable farming practices, which farmers have struggled to adopt because costs often exceed returns.

- New spinal cord stimulation technology is gifting paralyzed people with renewed mobility.

International Markets

- Over 90% of countries across the globe have seen “severely impacted” basic health services due to COVID-19, the World Health Organization said.

- Russia is recommending people work from home amid sustained record levels of COVID-19 infections.

- Almost half of healthcare worker absences in the U.K. are caused by COVID-19 infection, new data shows. As many as 1 in 20 Britons have yet to regain their sense of smell roughly 18 months after getting COVID-19.

- Ireland will hold St. Patrick’s Day celebrations for the first time in three years amid falling COVID-19 cases.

- Italy will end its outdoor mask mandate now that more than 90% of its eligible population has received at least one COVID-19 vaccine dose.

- South Korea reported 38,691 new COVID-19 cases Monday, a ninefold increase from mid-January.

- The CDC added Japan to its “Level Four: High Risk” destinations list for COVID-19, raising the number of nations with its highest risk warning to 135.

- Long a protected bubble in the COVID world, New Zealand reported a record 243 new infections Saturday.

- Hong Kong reported a record 614 new COVID-19 cases Monday and almost as many likely cases of the virus. The city was experiencing a shortage of fresh vegetables yesterday as deliveries from China were disrupted by virus infections among drivers.

- Rising COVID-19 hospitalizations in Indonesia are putting strain on the nation’s healthcare system, prompting officials to reimpose social restrictions in major cities.

- As Olympians struggle under China’s tight COVID-19 restrictions, Chinese researchers say getting rid of the nation’s zero-tolerance strategy could lead to 2 million virus fatalities per year.

- Vietnam reopened public schools for the first time in a year.

- Thailand will hold talks with China and Malaysia later this month to discuss opening travel bubbles to help revive tourism.

- Only 11% of Africans are fully vaccinated against COVID-19, the World Health Organization said.

- The International Monetary Fund projects Latin America’s economy will grow just 2.4% this year, far weaker than the rest of the world. The figure aligns with Mexico’s own projections of 2.5% GDP growth.

- South Korea’s LG Energy Solution forecasts an 8% revenue boost this year on higher demand for electric-vehicle batteries.

- Porsche expects a global surge in demand for luxury vehicles to boost sales 11% this year to 335,000 cars, despite the global chip shortage.

- Nissan plans to stop developing new combustion vehicles in all its major markets except the U.S. and focus on making electric vehicles, reports say.

- Lexus’ electric- and hybrid-electric sales rose 10% last year to 260,000 vehicles, a record.

- Paris will launch public transit gondolas through some parts of the city by 2025, a bid to improve urban mobility.

At M. Holland

- Plastics News reported that M. Holland earned a Bronze rating from EcoVadis, a trusted provider of business sustainability ratings. The article reports that our improved annual score for 2021 is due to progress in our diversity and inclusion program, wellness benefits, career development and more.

- Our Healthcare team has published a revised Medical Resin Selection Booklet containing additional resins, new focus grades and new 3D printing resins.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.