COVID-19 Bulletin: February 9

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil futures dropped over 2% yesterday to log their lowest finish in almost a week. Crude futures were higher in mid-morning trading, with WTI up 0.9% at $90.14/bbl and Brent up 1.1% at $91.76/bbl. U.S. natural gas futures were 5.0% lower at $4.03/MMBtu.

- High oil prices will drive U.S. producers to boost output to nearly 12 million bpd this year and a record 12.6 million bpd in 2023, the U.S. Energy Information Administration predicts. The agency also upped its 2022 price forecasts for U.S. and global benchmark prices by about 11%.

- Western Canada crude stockpiles have fallen to 36% of storage capacity, a record low for this time of year, as oil-sands producers prepare to shut some operations for maintenance. Dwindling supply could put even more upward price pressure on U.S. crude.

- Almost half of last month’s record 9.5 million metric tons of European gas imports came from the U.S., with another 30 vessels set to arrive this month. The surge has oversaturated the European LNG market, with spot freight rates to the continent turning negative for the first time since 2019 after peaking at $273,000 in early December.

- Japan will send some of its gas reserves to Europe to help forestall future supply disruptions.

- Louisiana’s Calcasieu Pass export terminal accepted its first LNG export vessel yesterday, a year ahead of schedule.

- Mexico’s Pemex slashed oil exports to India, its third-largest market, to just 15,000 bpd as the nation works toward ending all crude exports by 2023. India plans to make up for the shortfall by importing more oil from Iraq.

- BP reported its strongest quarterly profit in nearly a decade yesterday and said that its planned slashing of 40% of fossil fuel production by 2030 will not eat into revenue streams.

- Russia’s Rosneft extended an annual 100-million-tonne oil supply deal with China for the next decade.

- A California firm is raising millions of dollars to develop technology that would store excess renewable energy as heat for use by heavy industry, a heavy carbon emitter due to its reliance on fossil fuels.

Supply Chain

- Anti-vaccine protests escalated in Canada, as protestors halted traffic yesterday on the Ambassador Bridge in Detroit, which carries some 25% of all traded goods between the U.S. and Canada. The demonstrations included only three semitrucks, a sharp contrast to demonstrating truckers in Western Canada that are forcing carriers to reroute and delaying freight movement into Alberta. Auto manufacturers and suppliers are warning of operational disruptions within the coming days due to supply shortages.

- Parts of Nebraska, Kansas and the Dakotas will see strong wind gusts over the coming days that increase the risk of truck rollovers, officials say.

- U.S. railroad carload and intermodal freight were down in January from a year ago, with overall traffic off 9.5%.

- The roughly 18 recently built container storage yards at West Coast and Southern cargo hubs should help ease congestion across freight networks, industry analysts say.

- Hong Kong is now requiring cargo pilots to wear electronic monitoring bracelets as part of significantly tightened rules to stop the record spread of COVID-19.

- California officials estimate a below-sea reservoir could produce up to 600,000 metric tons of lithium carbonate per year, potentially limiting dependence on Australia, Chile and China for the key battery material.

- The Alabama Port Authority is building an inland intermodal transfer facility in Montgomery to extend rail service northeast from the Port of Mobile, to be served by CSX.

- The Federal Maritime Commission is seeking feedback on proposals that would potentially limit container demurrage and detention billing practices.

- VF Corp., owner of North Face and Vans, said it is pulling forward commitments to suppliers by a few weeks on average to offset lingering supply chain delays.

- Old Dominion Freight Line’s less-than-truckload tonnage per day rose 14.3% in the fourth quarter from a year earlier.

- Freight broker C.H. Robinson’s quarterly profit rose 55.7% to $230 million while employment costs rose 35.8%.

- DHL Express’ $360 million expansion program will fund new air cargo hubs in Atlanta, Ontario, Texas and California, the firm announced.

- Knight-Swift Transportation, the U.S.’s largest truckload fleet, is working with autonomous tech firm Embark Trucks to install self-driving software in some of its tractors by the end of the year.

- Autonomous vehicle startup TuSimple will begin hauling freight for Union Pacific sometime this spring.

- Sam’s Club is deploying inventory-tracking robots mounted on self-driving floor cleaners at the retailer’s 600 locations across the U.S.

- Kroger, the largest grocer in the U.S., debuted its first delivery service network in Atlanta this week.

- Soaring demand from China and Mexico lifted U.S. farm exports 18% last year to a record $177 billion.

- Arabica coffee futures rose 76% in 2021, the largest annual gain in more than a decade as drought and frost hit Brazil, the world’s top producer. U.S. coffee retailers are passing on the costs to consumers in the form of higher-priced menu items.

Domestic Markets

- The U.S. reported 198,738 new COVID-19 infections and 3,277 virus fatalities Tuesday.

- Seven-day averages for new COVID-19 cases and hospitalizations are falling while average fatality rates appear to have stabilized above 2,500 per day, the highest level in a year.

- New COVID-19 cases in Michigan are at a two-month low as lawmakers passed a $1.2 billion spending bill with $300 million marked to help retain healthcare workers.

- New York, Illinois and New Jersey joined a growing list of states rolling back mask mandates.

- Utah will stop issuing rapid COVID-19 tests to residents after an audit of one brand showed high numbers of false negatives.

- Travel nurse wages have doubled since the onset of the pandemic due to overwhelming demand for immediate and short-term healthcare employees.

- The CDC is expected to shorten the time for immunocompromised people to get a COVID-19 booster from five to three months.

- Johnson & Johnson has temporarily shut down its only COVID-19 vaccine production site for unexplained reasons.

- There were only about 7,000 fewer births through the first nine months of 2021 compared to the year prior, a much smaller baby bust than researchers predicted.

- The U.S. trade deficit rose 27% to a record $859.1 billion on elevated consumer spending for overseas goods. The previous record was $763.53 billion set in 2006.

- More than 60% of U.S. small businesses raised their prices last month due to labor and material costs, the highest percentage in a half-century.

- U.S. households added more than $1 trillion in debt last year, the largest increase since 2007, driven by a jump in mortgage and auto loans. More Americans also are returning to pre-pandemic spending levels, with credit-card balances rising every quarter in 2021 to end the year at $856 billion.

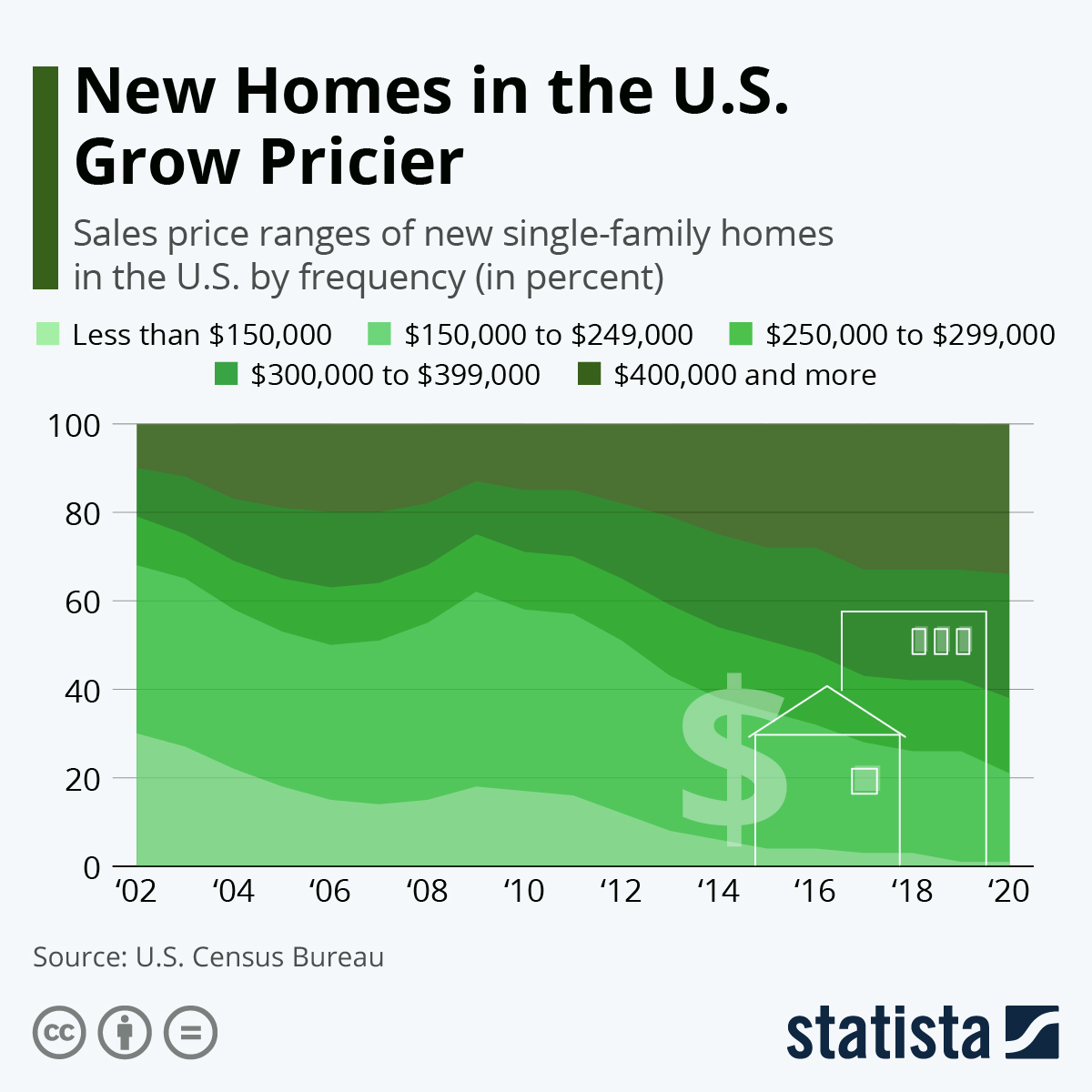

- A typical U.S. house found a buyer within 61 days in January, 10 days faster than a year ago and 29 days faster than the pace of sales from 2017-2020.

- At $70.8 billion, foreign investment in U.S. commercial property returned to pre-pandemic levels last year as focus shifted from office buildings in major cities to hot locations such as warehouses, rental apartments and specialized office buildings for pharmaceutical businesses.

- Apple introduced a new feature that will allow small businesses to accept payments directly on iPhones. The firm also is increasing benefits to attract and retain retail workers.

- Big U.S. automakers are warning of consequences to dealerships that add to the already high sticker prices of cars, a practice enabled by pandemic-induced shortages.

- Qualcomm plans to expand beyond its core cell phone market after automotive chip sales rose 21% in the most recent quarter, leading to $3.4 billion in net income. Ferrari, for example, made a recent announcement to use Qualcomm’s Snapdragon chips in its vehicle dashboards.

- Tesla initiated plans for an expansion of an Austin facility to produce cathodes for battery manufacturing.

- An Australian battery firm will break ground this year on a Tennessee factory to build 30,000 rapid electric vehicle charging stations per year.

- EVgo, the U.S.’s largest rapid-charging network for electric vehicles, signed a deal to be Subaru’s preferred charging partner.

- A San Francisco startup raised more than $3 million in seed funding for an artificial intelligence platform it claims can model new materials at an atomic level.

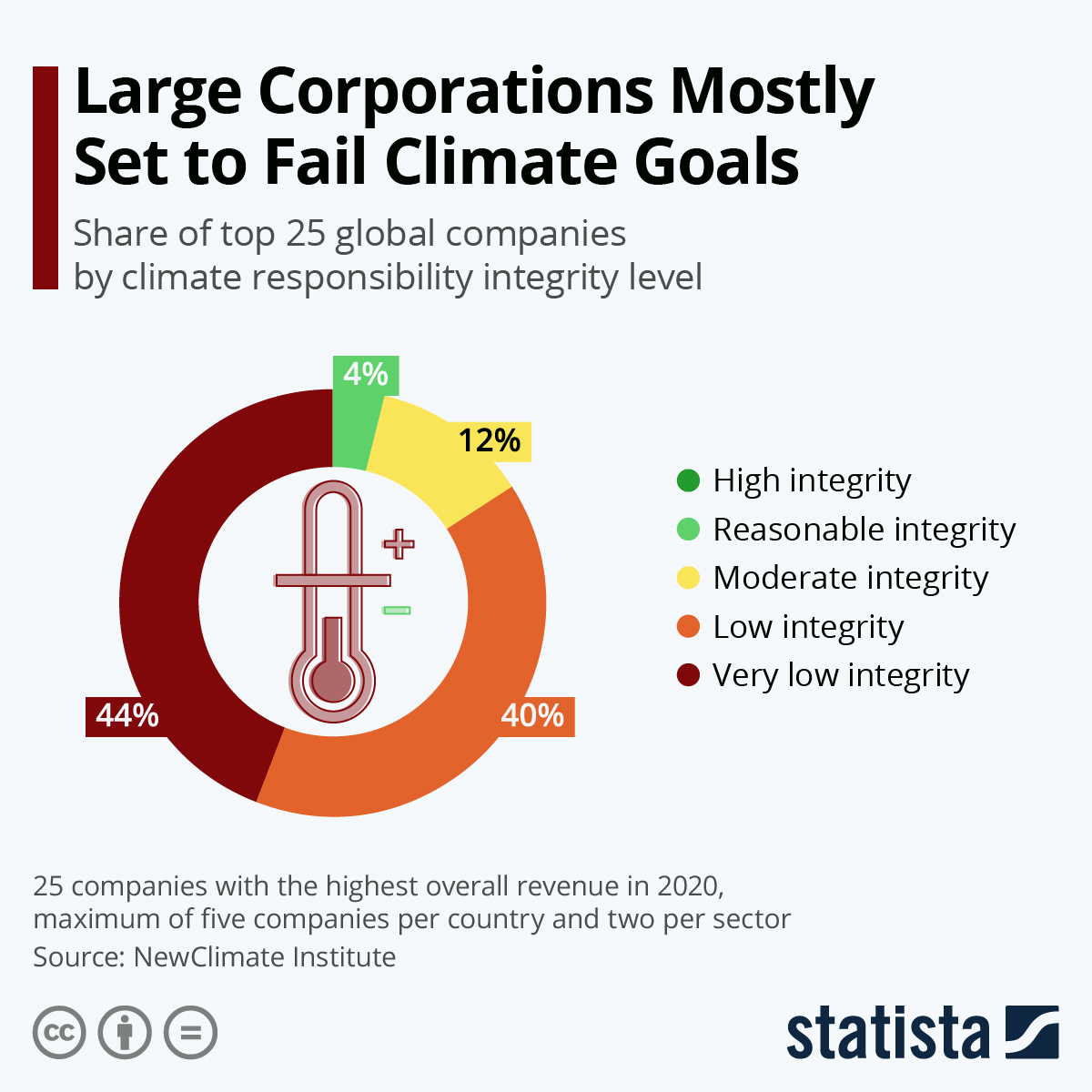

- Complicated and lengthy assessments call into question the true gains from corporate emissions-reduction plans, researchers say.

International Markets

- New COVID-19 cases across the globe fell by 17% last week but still surpassed the 400 million mark, just one month after crossing 300 million.

- Japan saw a record 100,000 new COVID-19 cases and 155 virus fatalities Tuesday.

- Hong Kong upped restrictions on unvaccinated people after a record number of daily cases topped 600 for the second straight day.

- Protests over strict COVID-19 restrictions are blocking services in New Zealand’s capital, while officials warn the nation could see a record 30,000 new cases per day by March.

- Zero COVID-19 cases were reported among the 133 people arriving to Beijing for the Olympics Monday, a first. Officials will allow more spectators now that the virus is apparently under control within the Games’ “closed-loop” system. Thirty-two athletes remain quarantined with the virus.

- Malaysia’s COVID-19 recovery panel recommended the nation fully reopen its borders March 1 without quarantine mandates, a bid to boost its economic recovery.

- Despite a 22% rise in COVID-19 infections the past week, German provinces are widely easing restrictions due to lower strain on hospitals from the Omicron variant.

- Poland indefinitely delayed its March 1 deadline for public employees to be fully vaccinated against COVID-19.

- Spain will end its outdoor mask mandate this week amid falling COVID-19 infections and hospitalizations.

- Sweden is lifting its travel restrictions and halting wide-scale testing for COVID-19.

- A quarter of British employers cited “long COVID” as a main cause for long-term absences among workers. Separately, national officials say it will take years to clear a backlog of elective medical procedures sidelined by the pandemic.

- Six more states were added to Mexico’s level Orange-High Risk status for COVID-19, raising the total number to 15 of the country’s 32 states.

- Mexico added a record 900,000 formal jobs in the 12 months ended in January.

- The “only detectable impact” of Brexit has been increased burdens on businesses, a British watchdog said.

- Backlogged orders at Airbus shrank by 16 last month after a 52-jet contract with Qatar Airways was scrapped.

- With electric vehicle sales in Europe projected to double each year for the next five years, the continent will likely need another 65 million chargers to fuel those vehicles, economists say.

At M. Holland

- Plastics News reported that M. Holland earned a Bronze rating from EcoVadis, a trusted provider of business sustainability ratings. The article reports that our improved annual score for 2021 is due to progress in our diversity and inclusion program, wellness benefits, career development and more.

- Our Healthcare team has published a revised Medical Resin Selection Booklet containing additional resins, new focus grades and new 3D printing resins.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.