COVID-19 Bulletin: February 14

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

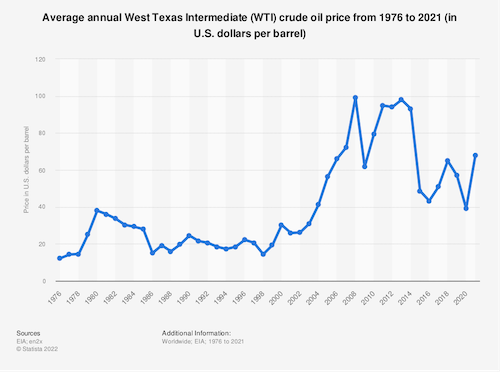

- Oil prices shot up 3% to eight-year highs on Friday as OPEC struggles to live up to supply pledges and on fears of war in Europe. Energy futures were mixed in mid-morning trading, with WTI down 0.1% at $93.03/bbl, Brent off 0.4% at $94.08/bbl and U.S. natural gas 4.3% higher at $4.11/MMBtu.

- The world’s five supermajors booked $37 billion in combined cash flows last quarter, a 14-year high.

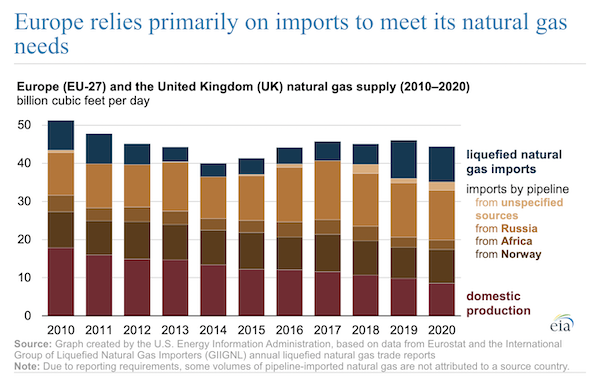

- Russian gas flows on the Yamal-Europe pipeline from Russia to Germany have been flowing eastward back to Russia for nearly two months, with no signs of increasing gas flows in March, exacerbating shortages caused by Europe’s increased reliance on gas imports.

- Italy’s largest tourist attractions shut off their lights for half an hour every evening last week to call attention to excessive energy prices.

- Diesel and petrol prices in the U.K. soared to record highs yesterday.

- The sudden return of coal-powered energy generation to make up for gas shortages is disrupting Spain’s planned energy transition and throwing coal workers into doubt about the stability of their employment.

- Saudi Arabia transferred 4% of Aramco shares, totaling roughly $80 billion, to its sovereign wealth fund as part of continued efforts to diversify the nation’s hydrocarbon-dependent economy.

- Renewable power generators will be used to help provide stability to the U.K.’s National Grid for the first time, as the nation aims to reach net zero emissions by 2050.

- Indian industrial giant Reliance Industries, which operates the world’s largest refining complex, announced plans to begin producing “blue” hydrogen from non-renewable sources as it further develops green hydrogen technology.

- South Korean officials ordered a production halt at a petrochemicals plant that exploded over the weekend, killing four.

Supply Chain

- Canadian police arrested demonstrators and towed vehicles on the Ambassador Bridge to Detroit Sunday, after a six-day blockade of the vital trade lane put Ontario into a state of emergency late last week.

- The U.S. logistics economy expanded in January after shrinking in December for the first time since last summer.

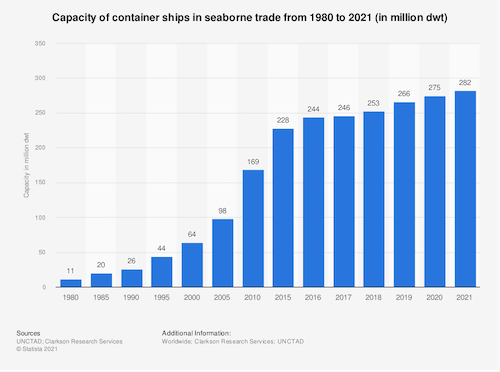

- Clarkson Research forecasts global seaborne trade will grow 3.4% this year after recovering to pre-pandemic levels last year, as global container capacity also grows to all-time highs:

- The U.S. federal government’s Freight Transportation Services Index, a monthly measure of freight shipments in ton-miles, saw a slight decline in December after three straight months of gains.

- U.S. intermodal volumes were down 14% the first five weeks of 2022 compared to a year ago, according to the Association of American Railroads.

- Last week, the U.S. administration removed 25% import tariffs on Japanese steel imposed under the prior administration.

- Fourth-quarter profits doubled at Tyson, the biggest U.S. meat processor by sales, with demand from restaurants and supermarkets soaring despite rising prices.

- Stanley Black & Decker is adding suppliers and investing in vendor projects to make up for lithium shortages for its rechargeable batteries.

- Rotterdam and Amsterdam are banning “dark stores,” small fast-delivery hubs run by on-demand delivery services, because of the disruption they cause.

- A British asset manager delayed a shareholder vote on a $2 billion deal because an international paper shortage left it unable to print enough required notifications.

- Fresh produce supply dropped 70% last week in Hong Kong due to rising COVID-19 cases among drivers and transport workers at a key border gateway.

- Dryer weather in West Africa has caused cocoa futures to rise more than 10% this month to $2,811 per metric ton, putting the commodity on track to reach its highest monthly level since April 2018.

Domestic Markets

- The U.S. reported 32,531 new COVID-19 infections and 441 virus fatalities Sunday.

- New COVID-19 cases in the U.S. are down to around 215,000 per day, a 71% drop over the last three weeks to the lowest point since Christmas. Hospitalizations also are declining, down about 25% the past week.

- California has surpassed 80,000 COVID-19 fatalities since the start of the pandemic.

- COVID-19 hospitalizations in New York are at their lowest level in two months.

- Virginia and Maryland are the latest states set to drop school mask mandates.

- Pfizer postponed its application to the FDA to expand the use of its COVID-19 vaccine for kids under age 5 due to a lack of efficacy data.

- The FDA authorized a new monoclonal antibody treatment from Eli Lilly that has been shown to be effective against the COVID-19 Omicron variant.

- A CDC study suggests that booster shots of the Pfizer/BioNTech and Moderna COVID-19 booster shots begin to wane after four months.

- Even mild cases of COVID-19 can lead to heart and cardiovascular complications for up to a year.

- Walmart dropped its COVID-19 mask mandate for vaccinated employees.

- Most Wall Street firms are dropping mask mandates and recalling their workers back to the office by the end of March after Omicron delayed plans for months.

- New research suggests that exercise can worsen the symptoms of “long COVID.”

- Medical officials fear that delayed health screenings during the pandemic will cause a surge in cancer cases and deaths.

- The federal government ran a monthly budget surplus in January for the first time in over two years as pandemic-induced outlays receded. Receipts were also up with a record $1.5 trillion in taxes collected over the first four months of FY22.

- The Internal Revenue Service is grappling with a backlog of nearly 24 million unprocessed returns from last year as it struggles to hire and train workers entering this year’s tax season.

- U.S. consumer sentiment dropped to its lowest level in over a decade earlier this month, according to the University of Michigan.

- The average price of a used car in January was up 31% year over year, straining household budgets and putting car ownership out of reach for many new drivers.

- Inflation is spreading throughout the economy, raising the cost of insurance claims for used cars at Allstate, causing cutbacks in corporate ad spending for media companies, boosting inflation-adjusted legal settlement costs at Altria and reducing credit card payments among consumers.

- Atlanta, Phoenix, St. Louis and Tampa saw the highest metropolitan inflation rates last year, while some of the U.S.’s most expensive cities, such as San Francisco, saw the lowest.

- Americans are turning to fixer-uppers to bypass soaring home costs, with sales rising 13.4% from 2020 to 2021.

International Markets

- COVID-19 cases continue to surge in Russia, with the nation breaking 200,000 single-day infections for the first time on Friday. Children reportedly make up 20% of current cases.

- The Netherlands and Norway are dropping the remainder of their pandemic restrictions in the coming weeks.

- Scientists in the U.K. are concerned about England’s planned lifting of most COVID-19 restrictions next week, saying that a future virus variant could lead to higher infection and death rates.

- The U.K. and Spain have begun loosening some vaccination and isolation requirements for incoming travelers. Japanese lawmakers are contemplating similar measures.

- Vietnam recorded more than 26,000 new COVID-19 infections Sunday, twice its 2021 peak, but has no plans to shut factories as it did during prior waves. The country is also lifting travel restrictions for vaccinated travelers on international flights after nearly two years of near closure.

- Hong Kong reported 1,325 new COVID-19 infections Friday, the latest in a string of daily records, as pressures mount on the island’s healthcare resources. Officials scrapped a policy requiring hospitalization for all new virus cases and will begin vaccinating children as young as 3 years old.

- South Korea has begun administering fourth COVID-19 vaccine doses to its high-risk population amid a surge of infections brought on by the Omicron variant.

- Anti-restriction protestors are turning up in large numbers in the capitals of New Zealand and Australia, two nations with some of the most restrictive pandemic protocols outside China and its neighbors.

- Lingering barriers to travel in Asia are isolating the region and its tourism-reliant economies, just as the economic recovery in Europe and the U.S. accelerates.

- Iceland started easing some COVID-19 restrictions over the weekend, increasing capacity limits at both public and private events and extending hours at restaurants and bars, with plans to lift all restrictions two weeks early at the end of the month.

- The head of the World Health Organization says that the acute phase of the COVID-19 pandemic could end this year if 70% of the world gets vaccinated against the virus by July.

- Contracted sales among China’s top 100 property developers were down 40% year over year in January, the seventh consecutive month of decline, as the nation’s property crisis continues.

- India’s year-over year retail inflation jumped to over 6% in January, its highest pace in seven months.

- British firms are expected to raise employee wages by the largest amount in almost a decade this year. Still, a new forecast from the Bank of England projects that average real incomes in the U.K. will drop by 2% this year, the largest decline since 1990.

- The Bank of England indicated it would raise interest rates faster than initially planned, with a third hike expected next month.

- Just months after a decision to stop selling and manufacturing vehicles in India, Ford indicated it may begin producing electric vehicles there.

- Intel’s autonomous driving unit Mobileye announced plans to launch new self-driving electric shuttles in the U.S. beginning in 2024.

- Chrysler parent Stellantis is recalling nearly 20,000 plug-in hybrid vehicles after reports of battery fires.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.