COVID-19 Bulletin: February 18

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Winter Storm Uri

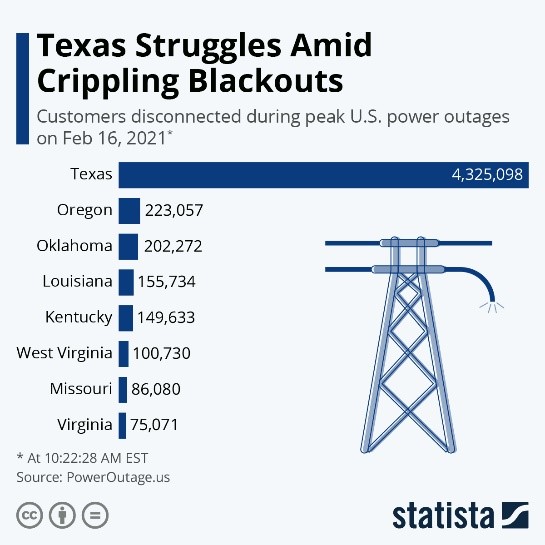

- Nearly 3.6 million Texans remain without electricity in the fourth day of the energy crisis caused by Winter Storm Uri and persistent extreme cold weather. More than 7 million Texans are under orders to boil water after power outages robbed utilities of pumping capacity, causing pressure to drop to bacteria-spreading levels.

- Another winter storm is beginning to blanket parts of the South with more snow and freezing rain, prolonging icy conditions in some areas that have been without power for days.

- Texas is facing another day of subfreezing temperatures today, warmer temperatures tomorrow, and a return to wintery weather over the weekend as another arctic blast aims for the state.

- Texas is banning gas from leaving the state through Feb. 21 to ensure in-state power generators have adequate supplies, a move that some are calling a violation of the U.S. Constitution’s commerce clause. Mexico’s government requested the U.S. to guarantee gas supplies following the announcement.

- Volkswagen is suspending some production in Mexico on Thursday and Friday due to limited natural gas supplies in the country.

- The weather event has exposed weaknesses in the power system in Texas, the only deregulated grid in the nation, which operates independently from the national power grid.

- Texas hospitals, some without power or water, are back in crisis mode just as COVID-19 strains were easing.

- Livestock are having a particularly tough time bearing the cold in the American Plains, South and Southwest, with many perishing due to freezing or a lack of power in shelters.

- Chipmakers including Samsung and NXP were asked to idle production at Texas factories due to their large power demands, exacerbating the global chip shortage.

- Inclement weather has forced temporary closures of some of our logistics sites in Arkansas, Canada and Texas.

- The arctic weather has severely disrupted petrochemicals production:

- Covestro announced that the winter storm has curtailed production at its Texas operations, forcing a reassessment of allocations and extension of lead times.

- Flint Hills declared force majeure on polypropylene products due to the storm.

- ExxonMobil said it is allocating polypropylene products.

- Formosa Plastics Corporation USA declared force majeure on PP, PE and upstream products from its Point Comfort, Texas, plant.

- INEOS declared force majeure on polypropylene products due to the storm.

- Invista declared force majeure on U.S. supply of PA66 intermediate chemicals.

- LyondellBasell declared force majeure on polyethylene and polypropylene products due to the storm.

- LyondellBasell announced a partial lifting of force majeure, affecting Line 5 at its Morris, Illinois, facility and LD1, LD2 and PF4 at its Clinton, Iowa, facility.

- Occidental, the second largest producer in the Permian Basin, declared force majeure on oil deliveries.

- OxyChem declared force majeure on U.S.-based PVC products.

- Total declared force majeure on polypropylene products made at its La Porte, Texas, facility.

Supply

- Brent crude rose 1.4% to $63.30 a barrel yesterday, the highest level since January 2020 prompted by a 40% plunge in production in the wake of shutdowns caused by extreme cold temperatures. The drop equates to more than 4 million bpd of lost supply, sending ripples throughout the global market.

- Energy prices were higher in early trading today, with the WTI up 0.3% at $61.35/bbl, Brent up 0.3% at $64.53/bbl, and natural gas 0.5% higher at $3.24/MMBtu.

- Saudi Arabia reversed course on recent production cuts, announcing a preliminary plan to increase oil output in the coming months in the wake of the recent recovery in prices.

- Some frackers, who were beginning to resume drilling with the recent recovery in crude prices, are now on the sidelines struggling to restore production in Texas and nearby areas.

- Jet fuel suffered the biggest demand decline among all oil products in 2020 as aviation activity collapsed.

- Flint Hills Resources and Encina Resources entered an agreement to produce renewable chemicals and fuels from waste plastic.

Supply Chain

- The Federal Trade Commission plans to demand information from major shippers on their policies and procedures, a possible precursor to formal hearings on congestion hobbling U.S. ports.

- The U.S. Chamber of Commerce and trade groups for the automotive, medical devices and other manufacturing industries sent a letter to the White House encouraging federal subsidies to increase domestic computer chip production. Meanwhile, the White House has appealed to the government of Taiwan for help in easing the chip shortage.

- Soaring demand for computer chips is stressing the supply chain for computer chip packaging.

- Nearly 3,000 truck drivers in Myanmar have suspended operations due to the country’s recent military coup, causing disruptions in freight logistics in the region.

- J.B. Hunt announced a partnership with Google to develop machine-learning models to make better matches between shippers and carriers alongside more accurate fuel and transportation costs.

- German banks have fled the shipping industry because of its volatility, causing a 50% contraction in the number of German-owned oceangoing vessels over the past decade and concentrating the industry in bigger maritime powers such as China, Greece and Singapore.

- Maersk sped up plans to release its first container ship running on biofuel, now expecting the vessel to be completed within two years.

- We expect continuing logistics disruption in the U.S. from severe winter conditions blanketing much of the country.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- There were 70,188 new COVID-19 cases in the U.S. yesterday and 2,459 fatalities.

- COVID-19 fatalities in nursing homes are declining to the lowest levels since December.

- Life expectancy in the U.S. fell by a full year in the first half of 2020 to the lowest level in 15 years.

- About 12% of the U.S. population has now been vaccinated against COVID-19, despite shortages of shots in several major cities.

- The U.S. has secured 200 million more COVID-19 vaccines from Pfizer/BioNTech and Moderna, expanding the current supply under contract by a third.

- Pfizer/BioNTech’s COVID-19 vaccine is effective against the virulent South Africa strain, new research shows.

- In one of the first large-scale studies to assess vaccine performance in the real world, coronavirus infection rates were almost 90% lower in people who received two doses of Moderna’s or Pfizer/BioNTech’s COVID-19 vaccine.

- The White House is spending $1.6 billion to ramp up COVID-19 testing and sequencing procedures ahead of expected waves of highly contagious variants in many regions.

- A large hospital in New York suspended blood plasma treatments for COVID-19, citing emerging clinical trials that show no benefit for patients.

- Alaska dropped its testing requirement for people entering the state.

- COVID-19 testing demand could decline by as much as half this year, leaving many businesses that have scaled up the service facing a steep demand drop later in the year as more vaccines are rolled out.

- Kroger is producing a smartphone-enabled, at-home COVID-19 rapid test that is currently waiting for FDA approval, a potential milestone in virus-tracking technology.

- First-time jobless claims in the U.S. took an unexpected jump last week to a four-week high, rising by 13,000 to 861,000. That makes the second week of rising claims after the Labor Department revised the prior week’s tally from a drop to an increase.

- The latest round of stimulus checks boosted U.S. retail spending in January to its largest increase in seven months, jumping 5.3% from the month earlier.

- Federal Reserve officials agreed at their January policy meeting that interest rates will be kept low and the central bank will continue bank bond purchases to help spur the economy.

- The McKinsey Global Institute predicts 20% of business travel will not return and 20% of employees will operate remotely post pandemic, prompting concerns that many lost jobs are gone forever and calls for stepped up worker training.

- U.S. agents seized 10 million counterfeit N95 face masks bearing the 3M logo in recent weeks, which likely spawned a false sense of security in many first-line responders and consumers.

- Airbus returned to positive cash flow in the fourth quarter but expressed caution about the outlook for the aviation industry and aircraft orders in 2021.

- Many startups are aiming to make e-commerce more sustainable, such as aggregating home deliveries in reusable totes, providing reusable plastic mailing boxes, making compostable packaging materials, and substituting algae-ink on shipping labels.

- The Department of Defense has contracted with 3D printing company ExOne to build a fully contained additive manufacturing factory in a shipping container for portable deployment.

International

- Global COVID-19 infections last week were at the lowest level since October.

- Indonesia, Southeast Asia’s largest country, made COVID-19 vaccines mandatory for all citizens.

- COVID-19 vaccination rates in low-income countries are falling well behind that of the U.S. and Europe, with rates of just 1.8% in South America, 1.5% in Asia, and 0.1% in Africa.

- The U.K. began trials that will deliberately infect young, healthy volunteers with coronavirus to better understand the virus’s impact on the human body.

- While South Africa has not yet authorized Johnson & Johnson’s COVID-19 vaccine for emergency use, the nation is already rolling out first doses after trials showed effective results against a homegrown virulent mutation.

- Japan and Colombia both kicked off national COVID-19 vaccine campaigns Wednesday.

- India will begin mandatory testing for people arriving from Brazil, South Africa and the U.K. over fears of new virus mutations creating another wave in the country.

- Everyone in the 45,000-person Brazilian town of Serrana is set to receive a COVID-19 vaccine in coming weeks, part of the world’s first clinical study determining vaccine effects after every person in a location has received shots.

- Pfizer is behind on 10 million COVID-19 vaccine deliveries to the European Union that were due in December, leaving the bloc about one-third short of the supply it had expected by this time.

- Toyota and Honda are among the only automakers not expected to suffer large financial harm from the global semiconductor chip shortage.

- One in four British businesses expect to fire staff if the government does not extend a job furlough program set to expire at the end of April.

- Ontario’s new Electrical and Electronic Equipment (EEE) Regulation, which holds manufacturers and retailers responsible for recycling electronic products, is causing confusion since its Jan. 1 rollout.

Our Operations

- Join us today at 1:00 p.m. CT for a webinar on 2021 Drivers and Trends for the North American Plastics Market, featuring Andrew Reynolds, Director of Business Publishing International (BPI); Ray Hufnagel, President and CEO at Plastic Express; Frank LaRocque, Director of Resale Sales at M. Holland; and Mike Foldvary, Director of Distribution Sourcing at M. Holland. Click here to register.

- Our 3D Printing business unit has launched a new e-commerce site. Access the new site here.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.