COVID-19 Bulletin: February 18

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- This week’s oil market volatility continued Thursday with prices ending the day 2% lower. Crude futures continued to fall in mid-morning trading, with WTI down 0.7% at $91.16/bbl and Brent down 0.4% at $92.59/bbl. U.S. natural gas was 1.9% higher at $4.57/MMBtu.

- At least half of U.S. LNG shipped this month has gone to Europe, with the continent poised to remain the top destination for U.S. shipments for the third month in a row. The surge in LNG imports is straining Europe’s processing and storage capacity for the fuel. https://oilprice.com/Energy/Energy-General/Europe-Is-Running-Out-Of-Space-For-LNG.html

- Several influential U.S. crude producers pledged to limit 2022 output increases to no more than 5%, breaking with a common pattern of frenzied drilling activity amid elevated prices.

- With production growing in the U.S. Permian Basin and demand rising from new LNG export plants on the Gulf Coast, several companies are looking to add new gas pipelines in the region.

- France’s state-owned utility revised down its nuclear output estimates for this year and next amid widespread maintenance on existing plants, which could prolong the continent’s energy shortage.

- European lawmakers are set to unveil a proposal that would require member nations to have a minimum level of natural gas storage by Sept. 30 of every year.

- The Mexican administration’s push to make Mexico self-sufficient in gasoline and diesel risks bringing back imports — originally halted in 2018 — as early as next year due to projected supply deficits in 2023 and 2024.

- U.S.-based Freeport LNG plans to build a new barge terminal on the coast of Texas to bunker ships with LNG and haul cargoes to small customers who can’t receive full-size tankers.

- Europe’s biggest utility will build a factory to make sun-tracking devices for solar panels in southern Italy, part of the firm’s plan to convert disused power plants to green energy and transition to totally green power generation by 2040.

- A California energy firm is proposing to develop what it says would be the U.S.’s largest green hydrogen pipeline system for deliveries into Los Angeles.

- The U.S. commission overseeing interstate transmission of oil and gas approved its first policy update in over two decades yesterday, which will allow greater scrutiny of the environmental impact of pipeline projects before approval.

- Finland-based Nordea bank will fully exit supporting offshore drilling and eliminate its lending exposure of around 1 billion euros to the sector before 2025.

- Celanese is buying DuPont’s mobility and materials businesses for $11 billion.

Supply Chain

- Police began putting up fencing and arresting protesters in Ottawa yesterday evening, signaling the end of a three-week blockade over pandemic mandates.

- A strong winter storm is expected to disrupt trucking routes in major metropolitan areas of the central and eastern U.S. today, as well as Toronto and Montreal.

- Eastbound container shipping rates from Asia to the U.S. have been rising since the middle of January, normally a slow season.

- An average of 23 container ships per day waited to berth at Hong Kong in January, up from 18 vessels in December, as port congestion rises on the island and in China due to tightened COVID controls.

- Industry analyst Alphaliner says there has been no significant improvement in global container shipping backlogs since last November.

- Inventory replenishment will keep U.S. freight activity at a “fever pitch” through at least the first half of 2022, truckload carrier U.S. Xpress says.

- North American intermodal volumes began 2022 with across-the-board annual declines, including a 22.1% drop in international containers, due to terminal congestion, equipment shortages and continued labor challenges.

- Half of all new Chevrolets, Fords, Toyotas and other major brands arriving on U.S. dealer lots in the next 90 days are already sold, AutoNation says.

- A car carrier transporting hundreds of luxury vehicles caught fire in the Atlantic Ocean yesterday and was abandoned by its crew.

- The price of lithium skyrocketed 400% over the past year, challenging growth prospects for the electric vehicle industry, which relies on the metal for its rechargeable batteries.

- Semiconductor shipping backlogs for major electronics companies are as long as two years in some cases.

- While the U.S. and Europe are moving to lift remaining pandemic restrictions, China’s commitment to zero-COVID will continue to threaten factory operations for makers of household products and other goods.

- Chunker, a marketplace for leasing short-term warehouse space, signed a deal for six temporary 20,000-container sites in California, as the state works out long-term plans for easing supply chain bottlenecks.

- Backlash in China is growing over Starbucks’ recent menu price increases, the first in three years.

- CMA CGM is rebuilding and expanding the Port of Beirut following a massive chemical explosion at the site in 2020.

- Arizona-based freight broker FreightVana will buy 1,000 53-foot dry van trailers this year as part of an effort to expand its brokerage offering.

Domestic Markets

- The U.S. reported 96,603 new COVID-19 infections and 3,223 virus fatalities Thursday. The seven-day average for new infections is down to 134,000 after hitting 800,000 just one month ago, while average daily fatalities fell 9% week over week on Wednesday, led by drops in the Northeast and Midwest.

- White House officials indicated the federal government could release broad new guidance for the next — and presumably less severe — phase of the pandemic.

- California became the first state to shift to an “endemic” approach to the pandemic that emphasizes prevention and quick reactions to outbreaks rather than mandates. The state’s latest surge is far from over, however, with Los Angeles seeing the highest single-day virus fatality count in almost a year Wednesday.

- Washington state, New Mexico and North Carolina are the latest states to reduce or eliminate mask mandates. Only four states still have a specific indoor mask mandate.

- Colorado ended its “crisis” designation that put more resources into overstressed state hospitals, signaling an easing of the state’s latest Omicron wave.

- Nearly three-quarters of Americans may now be immune to COVID-19, virus models suggest.

- Nearly all the health-specific resources from the White House’s $1.9 trillion pandemic aid package have been spent or allocated, reducing the nation’s ability to respond to future variants, stockpile vaccines or develop new technology.

- The White House is working on plans to distribute free high-quality masks to U.S. children, like the program announced for adult-sized masks several weeks ago.

- Moderna may roll out a COVID-19 booster dose tailored to the Omicron variant by August, the firm said.

- COVID-19 sufferers are 41% more likely to develop lasting sleep disorders than those who have not had the virus.

- Four-day, 32-hour workweeks adopted in Iceland, Belgium and other countries to help with retention are proving popular with employees and not diminishing productivity as many feared.

- U.S. existing home sales jumped an unexpectedly high 6.7% in January, despite record low inventories, as the median price of a home rose 15.4% from a year ago to $350,300.

- The president of the St. Louis Federal Reserve said bringing down inflation could require the central bank to overshoot a neutral target interest rate of about 2%.

- Rising prices pushed U.S. disposable income spending on food to the highest level in over two decades last year.

- Small business borrowers are struggling to meet the conditions to have roughly $28 billion in federal pandemic loans forgiven, new data shows.

- The average 30-year mortgage rate hit 3.92% this week, the highest in three years. Housing starts, meanwhile, fell 4.1% in January, the first decline in four months.

- Intel’s CEO expects the firm to reach and sustain double-digit annual revenue increases and gain market share in as little as three to four years.

- Nissan announced a $500 million revamp of a Mississippi assembly plant to start producing electric vehicles by 2025.

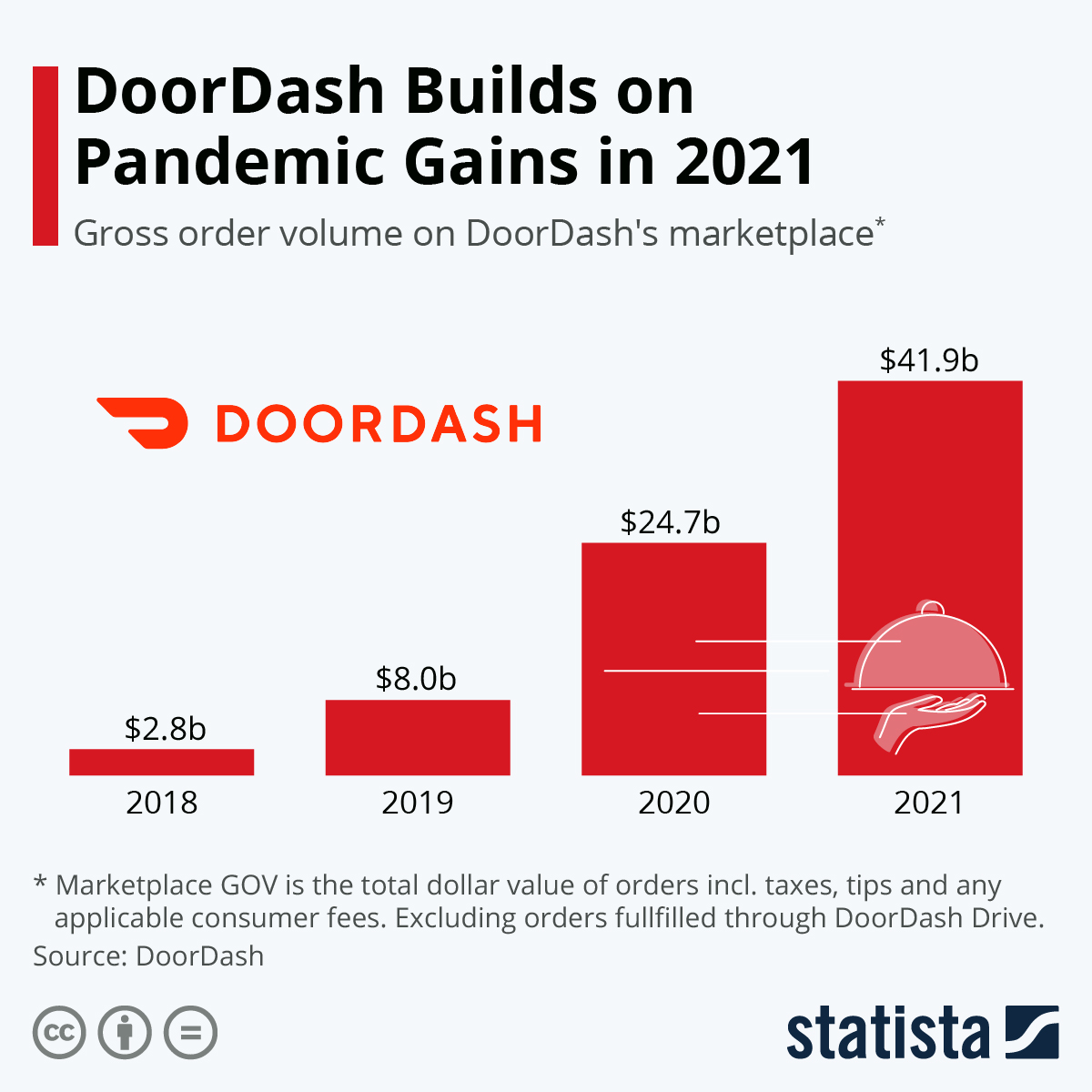

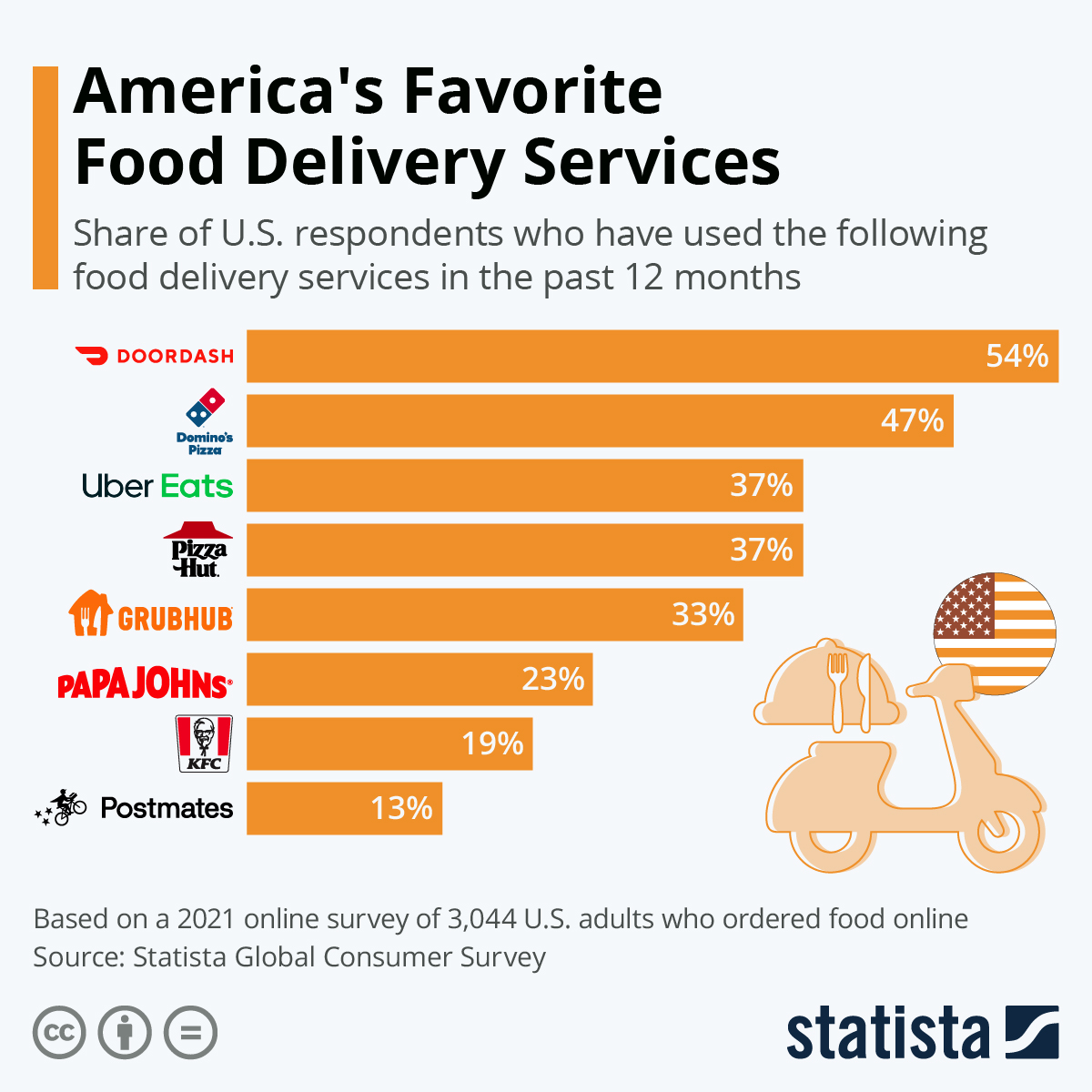

- DoorDash saw a 34% jump in fourth-quarter revenue, signaling that soaring demand for third-party delivery services has spread beyond the restaurant industry.

International Markets

- South Korea exceeded 100,000 new COVID-19 infections for the first time in the pandemic yesterday.

- Hospitals in Hong Kong surpassed 90% capacity yesterday as the island’s worst COVID-19 surge continues. Single-day cases dropped to 3,629, well below a record of over 6,000 the day before.

- Indonesia surpassed 5 million COVID-19 cases since the start of the pandemic, the most of any Southeast Asian nation.

- Australia scrapped nearly all pandemic curbs in its largest cities amid a steady fall in COVID-19 hospitalizations.

- Australia gave the world’s first approval of Moderna’s COVID-19 vaccine for children under age 12.

- Germany and Portugal announced plans to lift the bulk of remaining COVID-19 restrictions in the coming weeks.

- Israel dropped its proof-of-vaccine requirement for some public venues as COVID-19 infections decline across the nation.

- Ontario, Canada, officials are considering scrapping COVID-19 vaccine mandates for businesses by March 1.

- Canada granted approval to U.S.-based Novavax’s COVID-19 vaccine.

- Costa Rica and the Dominican Republic are the first Latin American nations to eliminate remaining COVID-19 restrictions.

- A study in Japan suggests the BA.2 “stealth” subvariant of Omicron may be more contagious than Omicron and as severe as Delta.

- BioNTech says it will not enforce intellectual property rights if drug makers in Africa begin producing unauthorized versions of its COVID-19 vaccine.

At M. Holland

- M. Holland just published a 2022 Logistics Outlook examining continued trucking, ocean freight and rail challenges, plus key takeaways for plastics companies. Read it here.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.