COVID-19 Bulletin: February 19

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Winter Storm Uri

- The energy crisis in Texas is now in its sixth day, where widespread shortages knocked out power to more than 4 million people and killed at least 21. More than 14 million people in the state are without safe drinking water.

- The power outages have spread to restaurants and supermarkets throughout the Southwest, with some people facing long lines at grocery stores and gas stations alongside a lack of bottled water and frozen food.

- Oregon, Mississippi and Louisiana each reported around 100,000 people without power, while Kentucky, Alabama, North Carolina, Virginia, West Virginia and Ohio are reporting smaller outages.

- The weather is disrupting COVID-19 vaccine supply chains, complicating an already rocky rollout, and is expected to cause widespread delays in shipments and deliveries the next few days.

- Four of the largest refineries in Texas are discovering widespread damage from the cold blast and are expected to undergo weeks of costly repairs. Overall, a fifth of the nation’s refinery capacity is temporarily shut down.

- U.S. natural gas production has dropped by nearly 20% over the past week.

- Texas’s governor is asking lawmakers to force the state’s grid manager to “winterize” power plants.

- In Houston, Dallas, San Antonio and other cities, social workers fanned out to search for homeless people amid the extreme cold temperatures.

- Some Texas owners of Ford’s new hybrid F-150 pickup are using the vehicle’s PowerBoost onboard generator to power and heat their homes, in line with the car maker’s claim that the truck is like a “mobile generator.” Ford urged its dealers in the state to loan out F-150s with generators to help with the crisis.

- Honda, Nissan and Toyota halted operations in Mexico due to a lack of natural gas from the U.S.

- Terminals and truck offices remained closed at the Port of Houston this morning.

- The inclement weather continues to disrupt operations at many of our logistics sites in affected areas.

- BASF, Braskem, Celanese, Chevron, DuPont and Sabic have been added to the list of companies reporting production disruptions or declaring force majeures due to the weather event:

- BASF declared force majeure on nylon products and intermediates made at its Freeport, Texas, plant and on Ultraform® POM Q600 grades.

- Braskem declared force majeure on polypropylene products.

- Celanese declared force majeure on a broad list of products.

- Chevron Phillips declared force majeure on polyethylene products.

- Covestro announced that the winter storm has curtailed production at its Texas operations, forcing a reassessment of allocations and extension of lead times.

- DuPont declared a global force majeure on Zytel® (including Zytel® HTN and Zytel® Specialty Nylons), Crastin®, Rynite®, Selar®, Minlon® and Pipelon®.

- Flint Hills declared force majeure on polypropylene products due to the storm.

- ExxonMobil said it is allocating polypropylene products.

- Formosa Plastics Corporation USA declared force majeure on PP, PE and upstream products from its Point Comfort, Texas, plant.

- INEOS declared force majeure on polypropylene products due to the storm.

- Invista declared force majeure on U.S. supply of PA66 intermediate chemicals.

- LyondellBasell declared force majeure on polyethylene and polypropylene products due to the storm.

- LyondellBasell announced a partial lifting of force majeure, affecting Line 5 at its Morris, Illinois, facility and LD1, LD2 and PF4 at its Clinton, Iowa, facility.

- Occidental, the second largest producer in the Permian Basin, declared force majeure on oil deliveries.

- OxyChem declared force majeure on U.S.-based PVC products.

- Sabic declared force majeure on LEXAN™ resins, CYCOLOY™ resins, XENOY™ resins, GELOY™ XP series resins, VALOX™ FR resins and XYLEX™ resins, as well as ABS product from its Tampico, Mexico, plant.

- Total declared force majeure on polypropylene products made at its La Porte, Texas, facility.

Supply

- Oil prices dipped yesterday on concerns that refineries along the Gulf Coast could remain down for another week. Crude futures fell further in early trading today, with the WTI down 1.6% at $59.60/bbl and Brent down 1.1% at $63.29/bbl. Natural gas was up 0.3% at $3.09/MMBtu.

- Mexico’s government is readying over $5 billion in investment and tax breaks for state oil company Pemex, currently the world’s most indebted oil company.

- U.S. exports of liquified natural gas are set to exceed natural gas exports via pipeline as early as 2022, according to the Energy Information Administration.

- Iraq, OPEC’s second-largest producer, boosted crude oil exports by 4.4% to 3.44 million bpd in the first two weeks of February, despite the nation’s pledge to restrain production to comply with OPEC+’s production cuts.

- Shell plans to install 500,000 electric vehicle charging stations at its gasoline stations by 2025, part of its effort to achieve net carbon neutrality by 2050.

- Wind and solar installations were up 61% in 2020, a record increase, adding enough energy to power 11 million homes for a year.

Supply Chain

- The computer chip shortage hobbling the global automotive industry is intensifying and could extend into summer.

- UNICEF has recruited major airlines across the globe to help distribute COVID-19 vaccines to low-income countries as part of its Humanitarian Airfreight Initiative.

- Forklift technology has an underrated impact on the efficiency of warehouses, with many companies investing in new methods after being pushed to speed up e-commerce operations.

- Norwegian shipper Wallenius Wilhelmsen announced plans to build the world’s first full-sized wind-powered pure car and truck carrier (PCTC), with the capacity to carry 7,000 vehicles or a mix of cars and heavy machinery.

- We expect continuing logistics disruption in the U.S. from severe winter conditions blanketing much of the country.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

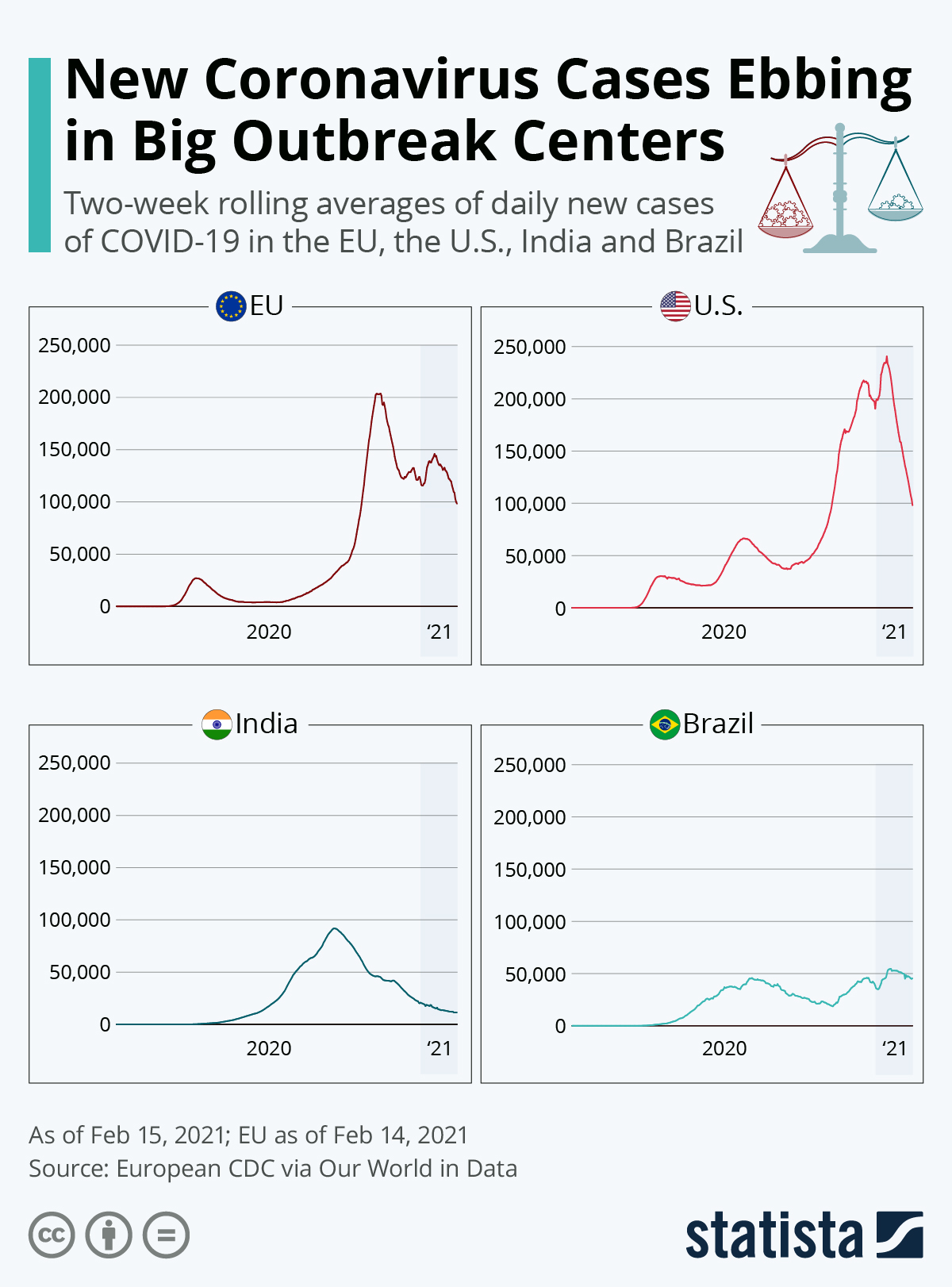

- There were 69,228 new COVID-19 cases reported in the U.S. yesterday and 2,558 fatalities.

- While COVID-19 cases are declining in 46 states, the 7-day average case count this past week jumped 147% in North Dakota and 20% in Nebraska, two of the Great Plains states where the last major national spike began.

- COVID-19 cases in U.S. nursing homes declined for the seventh straight week to 5,672, the lowest weekly case total since May of 2020.

- America’s vaccine supply is set to double in the coming weeks and months, setting the stage for a broad expansion of available doses across the country.

- The White House is contributing $4 billion to the international Covax program that helps supply coronavirus vaccines to low- and middle-income countries. Drugmaker Novavax also pledged to send 1.1 billion vaccine doses to the group.

- Pfizer/BioNTech is beginning clinical studies of its COVID-19 vaccine on pregnant women, a previous source of debate regarding safety.

- U.S. industrial production climbed 0.9% in January, the fourth consecutive month of expansion.

- Americans finished 2020 with the largest nest eggs on record, with the average 401(k) balance rising 11% in the fourth quarter to $121,500.

- Office space rental company WeWork cut its U.S. rental prices by 10%, and 25% in some areas, as workers continue staying home.

- Ivy League universities canceled their spring sports season over continued COVID-19 concerns.

- U.S. business leaders expect to cut fewer jobs or raise employees pay in coming months as confidence in the nation’s economic outlook heightens.

- Walmart is raising wages for nearly half a million employees, which will increase pay for its hourly U.S. workers to an average above $15 an hour.

- Gucci’s fourth-quarter revenues dropped 14% from the same time a year ago, exposing the luxury brand’s reliance on tourist shoppers at boutique stores that have largely been shut down due to lockdowns.

- Hilton reported an unexpected loss in the fourth quarter as the toll of lockdowns mounted for the travel and leisure industry.

- Streaming technology firm Roku reported a 58% increase in revenue during the holiday quarter as customers ramped up entertainment consumption at home.

- According to the U.S. Federal Reserve Governor, Lael Brainerd, the U.S.’s financial system is being affected by climate change, evidenced by higher incidence of extreme weather events such as droughts, wildfires, hurricanes and heat waves in the past year.

International

- Global COVID-19 infections topped 110 million.

- Brazil, facing an uptick in COVID-19 infections and with limited vaccine supplies, became the third country to surpass 10 million total infections, behind the U.S. and India.

- COVID-19 fatalities in Africa surpassed 100,000 as the continent confronts a rapid spread of the virulent South African strain of the virus amidst a shortage of medical supplies.

- COVID-19 case numbers in Germany are stagnating, signaling the lockdown that began in December is working. Concerns are growing about an outbreak of the virulent U.K. strain of the virus along Germany’s northern border.

- The World Health Organization narrowed its COVID-19 origin search to two animals – ferret badgers and rabbits – that can carry the virus and were sold at a Chinese market where many early cases emerged.

- Singapore will soon admit the first members of its “Connect@Changi” program, meant to allow people to enter the island for business without quarantining if they stay near the airport.

- Australian household spending rose only slightly in January, disappointing expectations.

- Spending at major Chinese retailers and restaurants over the seven-day Lunar New Year jumped 29% from last year.

- Factory activity in Europe and Japan is accelerating in February, while their service sectors weaken under the strain of renewed lockdowns and restrictions.

- Nigeria, Africa’s largest economy, defied pessimistic expectations of economists with a 0.1% GDP expansion in the fourth quarter, ending its recession.

Our Operations

- Our 3D Printing business unit has launched a new e-commerce site. Access the new site here.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.