COVID-19 Bulletin: January 4

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose more than 1% Monday on news that Libya would cut output by 200,000 bpd this week for pipeline maintenance. Futures were higher in late morning trading ahead of an expected announcement later today on OPEC’s February production schedule, with WTI up 0.8% at $76.67/bbl and Brent up 0.9% at $79.65/bbl. U.S. natural gas was 1.2% lower at $3.77/MMBtu.

- OPEC’s secretary general-elect expects global oil demand to fully rebound to pre-pandemic levels by the end of this year.

- European gas prices skyrocketed 20% Monday over winter supply concerns caused by decreased flows from Russia. Gas shipments into Germany via a key Russian pipeline were halted for the 14th consecutive day.

- Indonesia, the world’s biggest thermal coal exporter, is banning exports of the fuel due to a domestic shortage.

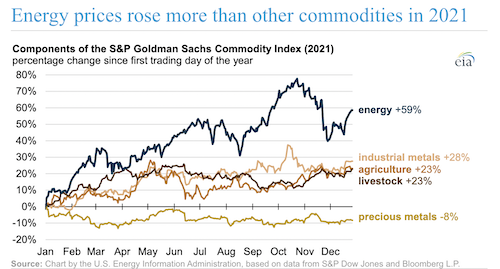

- Energy prices in the S&P Goldman Sachs Commodity Index ended last year 59% higher, more than double the rate of increase for other commodity groups:

- HollyFrontier’s acquisition of a Washington refinery is off to a rocky start, with severe flooding and landslides in the Pacific Northwest lowering the refiner’s fourth-quarter throughput by 11% from planned levels.

- European lawmakers are working on legislation that would place a controversial “green” label on qualifying natural gas and nuclear investments.

- With resin supply improving and most 2021 force majeures lifted, we are ending our force majeure link. Please contact your M. Holland account manager if you have questions concerning availability of specific products.

Supply Chain

- The Washington, D.C., area saw record-breaking snow accumulations Monday as a strong system worked its way across the eastern U.S., shutting off power to hundreds of thousands. Many of the East Coast’s largest traffic thoroughfares were blocked overnight, with officials unclear on a timeline for reopening. A crash closed I-95, leaving hundreds of motorists stranded in frigid weather for more than 15 hours.

- New York City’s public transit system was forced to partially suspend operations Monday due to worker shortages and spreading COVID-19 cases among staff, a pattern seen in several large U.S. cities.

- Shipping delays are growing on China’s Yangtze River, a key maritime waterway, after 200 pilots were quarantined by authorities due to a COVID-19 outbreak earlier this week.

- Supermarket shelves in Sydney are going empty as COVID-19 infections surge in Australia’s trucking and warehousing industries.

- U.S. carloads and intermodal traffic for the first 51 weeks of 2021 hit 25,757,345 units, a 5.9% rise from 2020.

- On Jan. 30, the Port of Los Angeles will start charging $100 fees for each day over nine days an empty container lingers at the port’s marine terminals, a similar fee structure to that announced — but not yet imposed — on lingering import containers last October.

- The Suez Canal will raise waterway tolls by 6% for all vessel types except cruise ships and LNG carriers, a move expected to bring in roughly $400 million in annual revenue.

- U.S. steelmakers are buying up scrap businesses in a bid to maintain a steady supply of raw materials amid rising demand and production capacity.

- Early estimates suggest U.S. auto sales were down 23% in December from a year ago due to a lack of inventory, capping the industry’s worst half-year since the 2008 financial crisis.

- The average cost of a used vehicle in November was $29,011, a 39% increase from the same time in 2020, putting vehicle ownership out of reach for many American households.

- The U.S. administration will distribute $1 billion to independent beef, pork and chicken processors in an effort to increase competition and reduce soaring food prices.

- Argentina is extending a ban on some beef exports for another two years due to a domestic shortage.

- The most recent surveys of global purchasing managers signaled a modest easing of supply chain bottlenecks in the final months of last year as Asian factories reopened following pandemic lockdowns.

- Japanese commodity prices last year increased across the widest range of raw materials since 2013.

- Manufacturers suffering disruptions due to their supply lines with China are pursuing a strategy of supply chain diversification rather than an exodus from the country.

- Major automakers including GM and Volkswagen are spending heavily on joint-venture factories to ensure supplies of electric vehicle batteries, a strategy tracing its roots to the early days of the auto industry when some manufacturers owned or acquired much of the supply chain necessary for production.

- Two large industrial projects will bring more than 2 million square feet of warehouse space to north Fort Worth, Texas, by early next year.

- Canadian trucker Bison Transport will acquire Maine’s Hartt Transportation Systems, adding 360 vehicles to its fleet as well as three U.S. terminals in the Northeast.

- A German firm has launched a new platform for ranking a ship’s sustainability against the International Maritime Organization’s new long-term emissions targets.

Domestic Markets

- The U.S. reported 1.08 million new COVID-19 infections Monday, a staggering one-day increase 2.5 times higher than the largest one-day case count of any country during the pandemic and nearly double the U.S.‘s previous record set four days ago. More than 1,600 virus fatalities were also reported yesterday.

- Prior to Monday, average daily COVID-19 infections in the U.S. had risen 204% the past two weeks to 405,470, a record, while more than 100,000 Americans were hospitalized with the virus, a four-month high.

- U.S. regulators approved Pfizer’s COVID-19 booster dose for children as young as age 12.

- The U.S. administration lowered the waiting period for a COVID-19 booster dose from six months to five.

- Florida saw 302,179 new COVID-19 cases in the week to Jan. 1, a 142% increase from the week prior. Infections in the state now account for more than 10% of total U.S. cases.

- COVID-19 hospitalizations in New York state leaped 130% between Dec. 24 and Dec. 31, more than double the rate of new cases for the same period.

- Los Angeles County, the nation’s most populous, reported nearly 45,000 new COVID-19 cases last weekend, while positivity rates surpassed an all-time high at 20%. Teachers and staff at public schools will now be required to wear surgical grade masks indoors.

- Chicago’s mayor signaled more pandemic restrictions could be on the horizon as COVID-19 cases spike in the city.

- Arizona reported 14,192 new COVID-19 infections Monday, the most in a year.

- New Jersey’s administration is seeking a 90-day extension of the authority to impose emergency pandemic measures as cases and hospitalizations in the state spike.

- Connecticut’s COVID-19 positivity rate rose to a record 21.5% Monday.

- Rhode Island is combating a severe labor shortage by allowing healthcare staff to continue working despite testing positive for COVID-19 if they have mild symptoms and wear an N95 mask.

- Maryland state workers will be paid to get a COVID-19 booster dose, as officials warn that a surge in cases could overwhelm hospitals within a month.

- More than 7,000 U.S. flights were canceled or delayed Monday, extending a holiday streak of record airline disruption caused by severe weather and COVID-19 cases among aircrews.

- Starbucks will require all U.S. employees to be vaccinated against COVID-19 or undergo weekly virus testing starting Feb. 9.

- Goldman Sachs is now asking U.S. employees to work remotely until Jan. 18 amid a nationwide surge in COVID-19 infections.

- The COVID-19 positivity rate among Congressional lawmakers has risen to 13%, leading to calls for better mask-wearing and remote work where possible.

- Schools in major cities are struggling with Omicron protocols, with New York City opting to keep schools open; Milwaukee, Wisconsin, going remote; and teachers in Chicago holding an emergency meeting on a potential walkout over the school district’s decision to keep schools open.

- Doctors are noticing differences in patient responses to treatments depending on the type of COVID-19 strain they are infected with.

- A growing number of Americans with weakened immune systems are getting unauthorized fourth or fifth COVID-19 booster doses in a bid to boost protection against emerging variants.

- Workers quit their jobs at a record pace in November, and there were 12 million job openings in the U.S. at the end of December, according to job-search site Indeed, an increase of 1 million since the end of October.

- U.S. manufacturing activity slowed in December, with IHS Markit’s purchasing managers index dropping to 57.7 for the month, down from 58.3 in November.

- More than 30 million U.S. households will lose up to $300 per month in pandemic-induced child-tax-credit payments in mid-January barring further legislative action.

- Apple became the first U.S. company to top $3 trillion in market value for a brief period during Monday trading.

- AT&T and Verizon reversed course and will voluntarily delay this month’s planned rollout of 5G networks by two weeks due to potentially harmful effects on airplane cockpits.

- Craig Shell, senior account/product manager for our Wire & Cable team, was featured in Wire and Cable Technology International magazine announcing a new sustainable water-blocking gel for fiber optic cable.

- E-commerce grocery shopping, expected to grow 21% this year, is reinforcing the importance of strong product branding as 46% of millennials in a recent study say they buy most of their groceries online.

International Markets

- COVID-19 cases in the U.K. rose by 50% last week, with 157,758 new infections reported Monday. New data from the nation suggests Omicron-variant hospitalization rates are roughly one-third of those from the Delta strain. On Monday, British regulators approved Pfizer’s new at-home pill to treat COVID-19.

- New COVID-19 cases in Scotland rose to a record-high 20,217 Monday.

- Italy reported more than 68,000 new COVID-19 cases Monday, down from recent highs near 100,000.

- Canada’s largest province of Ontario moved to fully remote learning and reimposed 50% capacity restrictions on businesses amid a surge in COVID-19 infections.

- Australia reported a record 48,000 new COVID-19 cases the past 24 hours, bringing the nation’s total case count to more than 500,000 since the start of the pandemic.

- India reported 37,379 new COVID-19 infections the past 24 hours, a four-month high.

- Hong Kong registered 26 new COVID-19 cases Sunday, the most in 8.5 months. The island expanded its vaccine mandate to include restaurants, schools and public leisure facilities.

- Brazilian officials are warning people not to board cruise ships due to increased COVID-19 outbreaks among passengers and crew. Passengers on a ship in Portugal were stuck at port for five days recently due to an outbreak on-board.

- The UAE is banning its own citizens from leaving the country without having received a COVID-19 booster dose.

- COVID-19 vaccine passes in South Korea will be invalidated for people who don’t get a booster dose within six months of their second dose.

- Israel will begin welcoming its first foreign visitors next week following the global emergence of the COVID-19 Omicron variant.

- A new Danish study suggests the COVID-19 Omicron variant is up to 3.7 times more infectious than the Delta strain among vaccinated people.

- A Swedish startup has created a scannable microchip that can be implanted in a person’s arm to display their COVID-19 vaccine status.

- Rising COVID-19 infections in Britain took a hit on the nation’s retail industry, with foot traffic down 24.5% year over year the week ending Dec. 31.

- Turkey’s currency crisis is far from over, as the nation’s annual inflation rate rose to a two-decade record of 36.08% early this week.

- China’s manufacturing and service sectors showed surprise recoveries to close out 2021 despite slowdowns in the production of textiles, oil and coal, new data shows.

- French jet engine maker Safran plans to hire 12,000 new employees this year amid hopes of a continued recovery in air traffic.

- Japanese plastic production rose 3% to 4.71 million tons the first 10 months of 2021, putting the nation on track for its first annual production increase in three years.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.