COVID-19 Bulletin: January 5

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose more than 1% Tuesday after OPEC+ signaled its confidence in demand by sticking to a planned 400,000-bpd output increase in February. Futures were higher in mid-morning trading, with WTI up 1.7% at $78.29/bbl and Brent up 1.6% at $81.31/bbl.

- The American Petroleum Institute reported a 6.43 million barrel U.S. crude draw for the week ending Dec. 31, almost double analyst expectations. Gasoline inventories saw a surprise build.

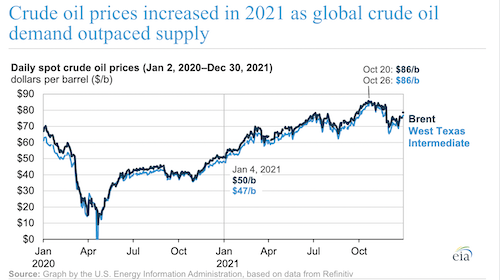

- Brent crude’s 2021 average of $71/bbl marked a three-year high as increased COVID-19 vaccinations and lifted restrictions pushed crude prices higher throughout the pandemic:

- U.S. natural gas prices slid 3% Tuesday on forecasts of less cold weather and lower heating use over the next two weeks. Futures were 2.82% higher in morning trading at $3.82/MMBtu. Regional next-day prices were higher in some East Coast cities battered by winter storms, more than doubling in New York City to $8.50/MMBtu Tuesday.

- The U.S. surpassed Qatar to become the world’s No. 1 exporter of LNG for the first time ever last month on a crush of deliveries to energy-starved Europe. Exports are expected to remain strong throughout 2022 due to high demand in Europe and Asia.

- By April, some 6 million British households may be unable to afford higher energy bills barring government intervention, a new report suggests.

- Russian gas volumes flowing from Ukraine to Europe dropped 25% in 2021, year-end data shows.

- The latest projections for firing up the expanded Nord Stream 2 gas pipeline from Russia to Germany have been pushed back to mid-2022.

- Thermal coal futures in China rose 7.8% Tuesday on concerns of supply disruptions after Indonesia, its biggest overseas supplier, halted exports. Indonesia is set to revisit the policy today after securing an extra 7.5 million tons of coal supplies yesterday.

- China is limiting fuel sales abroad and curbing refinery output, slashing 2022’s first batch of combined export quotas for gasoline, diesel and jet fuel by 56%.

- The planting of U.S. crops for soil restoration and carbon capture grew to 22 million acres in 2021, a 43% increase from 2017.

- With resin supply improving and most 2021 force majeures lifted, we are ending our force majeure link. Please contact your M. Holland account manager if you have questions concerning availability of specific products.

Supply Chain

- More than 330,000 homes and businesses mostly in Virginia were without power early Tuesday after a snow and ice storm battered the U.S. East Coast on Monday.

- Virginia’s I-95 highway is expected to reopen this morning, where some motorists were trapped for more than 24 hours.

- The Port of Oakland is looking to expedite agricultural exports with the addition of a 25-acre off-terminal yard to move containers off chassis and store them for pickup.

- Disruption is expected to grow at China’s Ningbo port, the world’s largest by cargo volumes, as regional lockdowns tighten following a COVID-19 outbreak at a clothing factory.

- The Suez Canal crushed previous records for revenue and tonnage in 2021, while total ship transits rose 10% over year-ago levels.

- Global supply chain pressures, while still historically high, may have peaked and could start to moderate going forward, a New York Federal Reserve index suggests.

- American real estate firm CBRE Group plans to complete one of the largest industrial real estate transactions ever by acquiring the $4.9 billion portfolio of logistics properties from Hillwood Investment, including 28 million square feet of warehouse space.

- Walmart and Kroger are raising the price of some of the U.S.’s most popular at-home COVID-19 testing kits after a federal subsidy expired.

- U.S. grocer giant Kroger is quietly expanding its regional delivery service with the soft opening of new automated fulfillment centers in Atlanta and other locations.

- Semiconductor industry revenue is poised to surpass a record $500 billion in 2022 after three straight years of rising sales.

- Schneider International has acquired Ohio-based trucker Midwest Logistics Systems for $263 million, adding a fleet of 900 tractors across 30 central U.S. locations.

- Korea Shipbuilding & Offshore Engineering has ordered 10 newbuilds worth $1.39 billion, including six large container ships, three feeder boxships and an LNG carrier.

- In the first-ever use of a new dispute resolution panel by the U.S.-Mexico-Canada trade agreement, Canada will be forced to end tariffs on U.S. dairy products, allowing American dairy farmers to increase sales to the nation by more than $200 million annually.

- The Indonesian government will begin subsidizing domestic sales of palm oil, the world’s most consumed edible oil, to lower food prices.

- Japanese shipper Expect K Line is accelerating plans to remove inefficient car carriers and bulkers from its fleet on a path to net-zero emissions by 2050.

Domestic Markets

- The U.S. reported 869,187 new COVID-19 infections and 2,384 virus fatalities Tuesday. The Omicron variant now accounts for more than 95% of all new cases.

- The pace of COVID-19 vaccinations in the U.S. has slowed by half from a month ago.

- Nine states, including Illinois, are reporting record levels of COVID-19 hospitalizations among children. A dispute in Chicago escalated yesterday when teachers voted in favor of a lockout over the city’s decision to leave schools open, forcing schools to close today.

- COVID-19 hospitalizations in New York City are up 64% from last week, prompting the U.S. military to send medical teams to assist overburdened hospitals. Breakthrough infections across New York state rose fivefold in December, led by the highly contagious Omicron variant.

- COVID-19 hospitalizations in Texas surpassed 7,000 Monday, more than double the level from two weeks ago, while virus hospitalizations among children are up 200% since Christmas.

- Washington, D.C., has the highest number of COVID-19 cases per capita in the U.S., new data shows.

- Maryland declared a 30-day state of emergency due to spiking COVID-19 case counts.

- Vermont legislators will work remotely the first two weeks of January due to surging COVID-19 infections.

- A hospital in Fort Lauderdale, Florida, was forced to temporarily close its maternity ward due to staffing shortages caused by a COVID-19 outbreak.

- New COVID-19 cases in Kansas are at record levels, with hospitals in the state poised for crisis levels of care due to rising infections among staff.

- Maine is approaching a record for COVID-19 hospitalizations.

- Oregon reported a COVID-19 test positivity rate of 18.2%, a record.

- The U.S. announced plans to purchase an additional 10 million courses of Pfizer’s COVID-19 antiviral pill for June delivery.

- The CDC rejected adding a testing requirement to recently shortened quarantine protocols for those infected with COVID-19.

- The CDC recommends that children with weak immune systems get a Pfizer COVID-19 booster dose as soon as four weeks after receiving their second shot. The agency is now considering whether to approve the booster for all children as young as age 12.

- Congress is beginning talks about potential additional stimulus spending to aid businesses impacted by the rise in Omicron infections.

- Late night television is the latest to see disruption and cancellations from COVID-19 infections among staff.

- Macy’s will reduce hours across all of its U.S. stores this month due to the nationwide surge of COVID-19.

- BlackRock and American Express join a growing list of large U.S. financial firms to extend remote work options this month.

- More than 1,000 U.S. flights were canceled for the ninth straight day Tuesday due to poor weather and COVID-19 infections among aircrew.

- More than 3,500 U.S. schools shifted to remote learning or closed for at least one day this week due to rising COVID-19 cases.

- Walmart temporarily closed 60 U.S. stores in December for mass sanitization, the firm said.

- Real estate investors are increasingly looking to convert office buildings vacated during the pandemic into deluxe residential properties.

- Manhattan home sales surged to a record in the fourth quarter with the median price rising 11% from a year earlier to $1.17 million.

- New York may not return to pre-pandemic labor force levels until 2025, new research suggests.

- So far, the $44 billion of insured losses caused by the COVID-19 pandemic mark the third largest cost to insurers of any catastrophe, falling only behind Hurricane Katrina and 9/11.

- Ford plans to double production of its electric F-150 pickup truck to 150,000 vehicles per year, a response to surging demand.

- GM is unveiling its all-electric Silverado pickup truck at the Consumer Electronics Show today. GM’s fourth quarter U.S. auto sales dropped 43% to 440,745 vehicles, the second consecutive quarterly drop and the first time since 1931 that the Detroit automaker wasn’t the best-selling car company in the U.S., a spot now held by Toyota.

- Self-driving trucking company TuSimple, the first to operate a human-less truck route in the U.S., announced a partnership with Nvidia to build advanced computer chips for future vehicle models.

- Deere & Co. said it has developed a fully autonomous tractor for large-scale farming that it plans to introduce later this year.

International Markets

- France reported a record 271,686 new COVID-19 cases Tuesday, the largest single-day tally for any European nation.

- The U.K. saw a record 218,724 new COVID-19 cases Tuesday, with weekly infections up 51%. The nation’s businesses are calling for reduced isolation rules due to labor shortages caused by COVID-19 outbreaks.

- Italy reported a record 170,844 new COVID-19 cases Tuesday, more than doubling Monday’s count.

- At 2,500 COVID-19 cases per 100,000 people, Ireland has the highest per capita rate of infection across Europe.

- High-density tourism areas are driving new COVID-19 cases in Mexico, with the nation’s active infections doubling from Dec. 28 to Jan. 2.

- The Philippines imposed strict stay-at-home orders for unvaccinated people amid rising COVID-19 infections. The nation saw a record test positivity rate of 31.7% on Tuesday.

- Hong Kong reported its first COVID-19 case from an unknown source in nearly three months, prompting officials to ban flights from eight countries, including the U.S. and U.K., for two weeks from Jan. 8.

- The city of Yuzhou in China’s Henan province was locked down after four COVID-19 cases were reported, affecting 1.1 million residents. Thirteen million people remain completely locked down in the northwestern Chinese city of Xian, with international concern growing over suspected food shortages and a lack of medical care.

- Japan is expected to declare a quasi-state of emergency for Okinawa due to a spike in COVID-19 infections.

- Thailand will start offering fourth COVID-19 vaccine doses to frontline and high-risk workers three months after receiving their third dose.

- Belgium joins a growing list of nations relaxing isolation requirements for exposure to COVID-19, a measure broadly implemented to prevent worker shortages.

- Several large fashion shows in Paris have been canceled due to surging COVID-19 infections across Europe.

- COVID-19 antibodies among Israelis who received a fourth vaccine dose increased fivefold just one week after the shot, new research shows.

- British manufacturing activity in December slowed from a three-month high in November, weighed down by a clearing of production backlogs.

- Australia is spending $132 million to boost hydrogen refueling and charging stations for electric vehicles.

- Sony will create a car unit this spring and explore entering the electric vehicle market, the firm said.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.