COVID-19 Bulletin: January 7

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose more than 2% Thursday, extending their new year’s rally. Futures eased in mid-morning trading, with WTI off 0.4% at $79.08/bbl and Brent down 0.1% at $81.95/bbl. U.S. natural gas was 2.8% higher at $3.92/MMBtu.

- Oil contracts for delivery in a few months are much pricier than those further out, a signal of near-term rising demand that could keep supply tight for the first part of 2022.

- OPEC pumped 27.8 million bpd in December, a 70,000-bpd increase from November but well short of the 253,000-bpd increase planned as part of its monthly output boost.

- Libya’s oil output currently stands at 729,000 bpd, down from a high of more than 1.3 million bpd last year, due to maintenance and oilfield shutdowns.

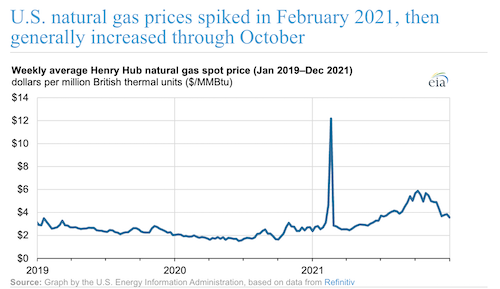

- Year-end data shows the drastic, though temporary, impact of last February’s Texas Freeze on U.S. LNG prices:

- A global shortage of natural gas is worsening as emerging economies in South and Southeast Asia return to the spot LNG market.

- Canadian natural gas prices have surged to their highest levels since October due to extreme cold weather in the western part of the nation. The cold has hampered Alberta-based TC Energy’s efforts to restart production on a 590,000-bpd oil pipeline, which temporarily shut down Tuesday for maintenance.

- German officials plan to send financial aid to households struggling to pay exorbitant energy costs, which resumed a rally at the start of the new year after more than tripling in 2021.

- France’s next batch of six advanced nuclear reactors should come online between 2035 and 2037, officials said.

- New York will invest $500 million to develop 4.3 GW of offshore wind energy this year, enough to power nearly 3 million homes.

- With resin supply improving and most 2021 force majeures lifted, we are ending our force majeure link. Please contact your M. Holland account manager if you have questions concerning availability of specific products.

Supply Chain

- A gusty winter snowstorm is blowing through the northeast and mid-Atlantic today, bringing up to one inch of snow per hour and severely disrupting morning commutes.

- U.S. federal task forces are working with logistics operators to prioritize containers with critical medical goods, notably COVID-19 rapid tests.

- Hong Kong’s Cathay Pacific airline will operate just one-fifth of its pre-pandemic cargo capacity this month after the island imposed strict quarantine measures on crews.

- China will test hundreds of thousands of workers for COVID-19 in the eastern metropolis of Zhengzhou today, home to Apple iPhone supplier Foxconn, after two COVID-19 cases put authorities on high alert.

- Georgia’s Port of Savannah has lowered the number of waiting container ships to less than five from earlier backlogs as high as 30 vessels.

- Cargo volume at Minnesota’s Port of Duluth-Superior was up 30% the first 10 months of 2021 after falling to the lowest level in 83 years in 2020.

- Emirati logistics giant DP World began construction of a 1.2-million-TEU container port near Senegal’s existing Port of Dakar in northwest Africa.

- LNG carrier charter rates have tumbled up to 40% on falling gas prices after a surge of American exports to Europe.

- Maersk upped its newbuild orders for eight methanol-powered ultra large container ships to twelve vessels.

- Orders from Chinese shipbuilders overtook South Korean builders in 2021 based on vessel tonnage capacity, year-end data shows.

- For the first time under the U.S.-Mexico-Canada Agreement, the Mexican government has requested a panel to resolve a dispute with the U.S. over how to calculate the regional content of vehicles.

- The Institute for Supply Chain Management’s index of U.S. manufacturing activity slipped to 58.7 in December from 61.1 in November, indicating a modest easing of supply chain disruptions.

- Chipmakers are launching into competitors’ niche markets as demand rises for semiconductors across all industries.

- British car sales rose slightly from 2020 to 2021 while remaining roughly 30% below pre-pandemic levels. The global chip shortage will dent the nation’s auto sales into 2023, an industry group warned.

- Record quarterly revenue at Samsung will translate to a 52% jump in operating profit, the company forecasts, boosted by resilient demand for memory chips.

- Expectant parents face delays in getting car seats, cribs and other goods due to supply chain disruptions.

- IKEA is expanding investments of in-store automated fulfillment this year after seeing most of its online sales fulfilled from stores in 2021.

- Bed Bath & Beyond saw a 28% annual sales drop for the quarter ended Nov. 27, its second straight quarter of declines largely due to supply chain disruptions.

- Port congestion is hampering the efforts of California almond growers to reach overseas markets.

- Americans are finding it harder to sell used goods as more consumers pile into the secondhand resale market.

- Global spending on industrial digital twin technology will reach $4.6 billion in 2022 and climb to $33.9 billion by 2030, ABI Research forecasts.

- The FAA approved a North Carolina drone service’s radius to one nautical mile, covering roughly 10,000 households in the state for five-minute food and retail delivery.

- Many large logistics industry conferences are scheduled to be in-person this year, including this month’s 20,000-person forum put on by the National Retail Federation in New York City.

Domestic Markets

- The U.S. reported 786,824 new COVID-19 infections and 1,870 virus fatalities Thursday.

- New U.S. COVID-19 cases have more than tripled over the past two weeks to an average of 550,000 per day, a record.

- Almost 1,000 American children were hospitalized with COVID-19 Wednesday, a record.

- Roughly 35% of the U.S. population is boosted against COVID-19, compared to 62% who only received their first two doses.

- About 10% of hospitalized COVID-19 patients in New York state are winding up in the ICU, compared to 35% in previous waves of the Delta variant.

- More than one-fifth of New York City’s subway operators called out sick this week, forcing lines to shut down and changes to route schedules.

- Chicago has added every U.S. state and territory to its COVID-19 travel advisory list. Public schools canceled classes for a second day on continued pushback from the city’s teachers union over returning to in-person classes.

- Nearly every COVID-19 patient on a ventilator in North Carolina is unvaccinated, officials said.

- One in ten Hawaii schoolteachers were out this week due to a mix of COVID-19 infection or family leave.

- Florida is sending out 1 million at-home COVID-19 tests to nursing homes and long-term care facilities in a bid to boost virus tracking in high-risk populations.

- Royal Caribbean and Norwegian Cruise Line are starting to cancel sailings due to high numbers of COVID-19 infections on current routes. All 91 U.S. cruise ships currently at sea are reporting COVID-19 infections on board.

- U.S. airlines canceled or delayed thousands of flights for the 12th straight day Thursday.

- The NFL could move this year’s Super Bowl to a new city due to tight pandemic restrictions for outdoor venues in Los Angeles, the game’s current location.

- The world-famous Sundance Film Festival is scrapping its in-person audience for the second consecutive year amid rising COVID-19 infections throughout the U.S.

- The CDC officially brought pandemic quarantine guidelines for K-12 schools in line with the relaxed five-day recommendation for the general public.

- The pandemic could be reducing newborns’ social and motor skills, new research suggests.

- Nonfarm payrolls rose by a lower than expected 199,000 in December as the unemployment rate dipped to 3.9%.

- The U.S. goods deficit rose to a record $99 billion in November as Americans started spending for the holiday season.

- The average U.S. 30-year mortgage rate is up to 3.22%, the highest since May 2020.

- Sales of U.S. residential properties worth more than $50 million were up considerably in 2021 compared to the prior year.

- Apartment occupancy in the U.S. rose to an all-time high 97.5% in December, tightening supply and likely leading to higher rent for new residents.

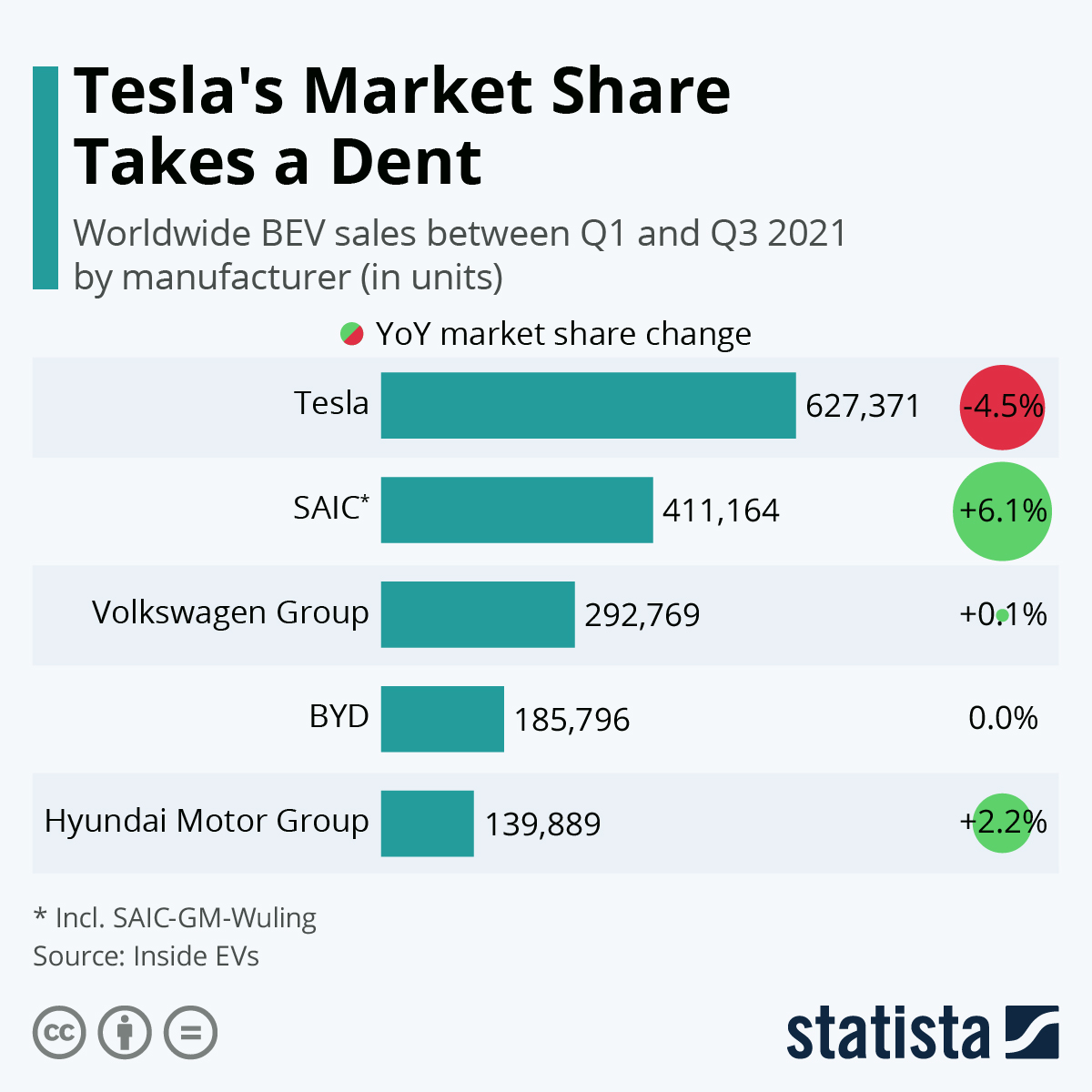

- Despite its status as the world’s most valuable automaker, Tesla’s electric vehicle (EV) dominance could wane as other major brands, including Volkswagen and Toyota, gain from hundreds of billions of dollars in planned battery EV investments over the next several years.

- Walgreens’ sales rose 10.6% for the quarter ended Nov. 30, the largest gain in two decades on strong demand for pandemic-related medical supplies and services.

- New York is looking to extend permits for bars and restaurants to sell alcohol to-go, a source of considerable new revenue during pandemic lockdowns.

International Markets

- Global COVID-19 cases surged 71% for the week ended Jan. 2, with the largest gains in the U.S. The World Health Organization is warning that COVID-19 hospitalizations will continue rising to dangerous levels due to the sheer number of new cases globally, despite evidence showing Omicron is less likely to cause serious illness.

- France reported 332,252 new COVID-19 infections Thursday, smashing its single day record. The nation will only allow vaccinated people to enter public businesses from now on after removing a negative test bypass.

- Italy reported 219,441 new COVID-19 infections Thursday, a second straight daily record.

- Germany is poised to impose new curbs on dining out out while limiting quarantine periods to seven days.

- Austria will impose outdoor mask-wearing requirements and limit the validity of vaccine passports to six months amid a rise in COVID-19 infections.

- The U.K. reported 179,756 new COVID-19 cases Thursday, bringing its seven-day total 29% higher than the week before. Hospitals are expecting a similar rise in virus patients in the coming weeks, as military troops are being deployed in London to provide assistance to strained medical facilities.

- Peru now has the highest COVID-19 fatality rate per capita, as cases increased 25% the past week. Some 100,000 children there have lost at least one parent or primary caregiver to COVID-19.

- Filipino law enforcement began arresting unvaccinated people who violate stay-at-home orders.

- Tokyo reported 641 new COVID-19 cases Thursday, the most in three months.

- Several Chinese cities are forcing fruit buyers to quarantine after trace amounts of COVID-19 were found on fresh imported produce.

- More than 85% of Indonesia’s population has antibodies against COVID-19, new research shows.

- At least 125 passengers on an India-bound flight from Italy tested positive for COVID-19 upon landing Thursday.

- India cut its economic growth projections due to rising COVID-19 infections.

- Canada’s trade surplus rose to $2.45 billion in November, the largest since September 2008 on record export volumes.

- Eurozone inflation hit a record 5% in December, higher than expected.

- German inflation slowed for the first time in six months in December, rising 5.7% compared to 6% the previous month.

- British carmaker Bentley rode a wave of strong demand for luxury vehicles toward a 31% sales increase in 2021.

- Electric vehicles accounted for two-thirds of auto sales in Norway last year, as the nation aims to ban all new sales of gas-powered cars by 2025.

- Honda announced plans to open a new factory in Wuhan, China, by 2024, with the annual capacity to produce 120,000 electric vehicles.

- Volkswagen’s legendary hippie-era bus will return as an electric vehicle this March, the automaker announced.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.