COVID-19 Bulletin: January 10

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- U.S. benchmark WTI rose 5% last week, its third straight week of gains, as markets continue to shrug off demand impacts from the COVID-19 Omicron variant. Futures started the week lower, with WTI down 0.8% at $81.08/bbl in mid-morning trading and Brent down 0.8% at $81.60/bbl. U.S. natural gas was 4.0% higher at $3.98/MMBtu.

- There were 588 active oil and gas rigs in the U.S. last week, 228 more than the same time last year.

- Power and gas prices in the U.S. Northeast surged to their highest levels since 2018 last week on increased heating demand.

- Oil producers in some of the most prolific parts of the U.S. Permian Basin could lose up to half their wastewater disposal wells as state officials worry about the effect of deep reservoirs on seismic activity.

- Canada’s oil sands producers shipped record crude exports to primarily Asian overseas markets in December thanks to a new link to the U.S. Gulf Coast.

- A Dutch gas field scheduled for shutdown later this year is being asked to nearly double production in its final stretch of life to accommodate Europe’s energy shortage, which showed signs of easing last week on forecasts for milder weather.

- Petrobras and Novonor, formerly Odebrecht, plan to take their ownership stakes in Braskem SA public in stock offerings worth an estimated $32 billion after adjustments to their shareholder agreement.

- Indonesia has not yet reached a decision on lifting its coal export ban as authorities continue discussing logistics issues that have slowed efforts to distribute coal to domestic power plants. Coal traders in China, the world’s top coal importer, say they have built up enough stockpiles to withstand the loss of Indonesia’s exports.

- India is seeking bids for a new batch of natural-gas supplier licenses, part of a plan to raise the share of natural gas in the nation’s energy mix to 15% by 2030 from the current 6.2%.

Supply Chain

- A winter storm blanketed large parts of the U.S. East Coast from Maine to Virginia Friday, causing school closures, power outages and flight cancellations, while New Jersey and Virginia declared states of emergency.

- A small COVID-19 outbreak prompted China to impose strict new controls on truckers servicing Ningbo port, slowing down the transport of manufactured goods and commodities at one of the world’s busiest trade hubs.

- Officials in the northern Chinese port city of Tianjin, near Beijing, said its entire population of 14 million would be tested for COVID-19 following a 20-person outbreak.

- Truckload rates from East Coast and Gulf Coast ports to Chicago are surging amid “extraordinary demand.”

- Canadian officials pushed ahead Saturday with a COVID-19 vaccine mandate for cross-border truckers despite fears of exacerbating driver shortages and logistics costs.

- Decades of dependence on Asian factories, especially in China, has been upended by delays, surging freight rates and port congestion, prompting companies to test whether the U.S. can regain some of the manufacturing output it ceded in recent decades.

- The overall vacancy rate for U.S. industrial space fell in the fourth quarter to a record low of 3.7%, as Dallas-Fort Worth leads the nation in new warehouse construction.

- Longer return windows and higher parcel costs are expected to take a bigger chunk out of retailer revenues this year, with UPS already reporting record numbers of returns from the holiday shopping season.

- FedEx is warning that the spread of the COVID-19 Omicron variant is contributing to staffing shortages and delayed air cargo shipments.

- In the most recent commercial electric vehicle news, Walmart reserved 5,000 electric delivery vans from GM subsidiary Brightdrop, while U.S. truckers Saia and USA Truck announced bulk purchases of electric freighters made by Nikola.

- California, Oregon, Washington, New York, New Jersey and Massachusetts will require a growing percentage of all medium- and heavy-duty trucks sold to be zero-emission starting in 2025.

- Volkswagen is giving a 10% pay raise to workers at a plant in Tennessee as the COVID-19 Omicron variant stretches the local work force thin.

- Pallet-management company 48forty Solutions is continuing its acquisition streak from last year with its purchase of a sixth rival.

- Dole, the world’s largest fresh produce company, plans to reduce its market exposure in 2022 as shipping delays and a lack of refrigerated containers slow agricultural exports, leaving the U.S. market awash in certain products and causing some prices to decline.

- Fertilizer prices driving up food inflation swung wildly last week, ending Friday on the sharpest decline since 2009, which traders fear will be short-lived.

- Walmart is expanding its InHome delivery service to 30 million households, allowing employees wearing cameras to enter a customer’s home to deliver groceries straight to the refrigerator.

- Stoughton Trailers is adding a manufacturing site in Waco, Texas, to expand its production of intermodal chassis beyond Wisconsin.

- Japanese air-conditioning giant Daikin Industries is rolling out refrigerated truck shipping containers that it claims reduce fuel consumption by 20%.

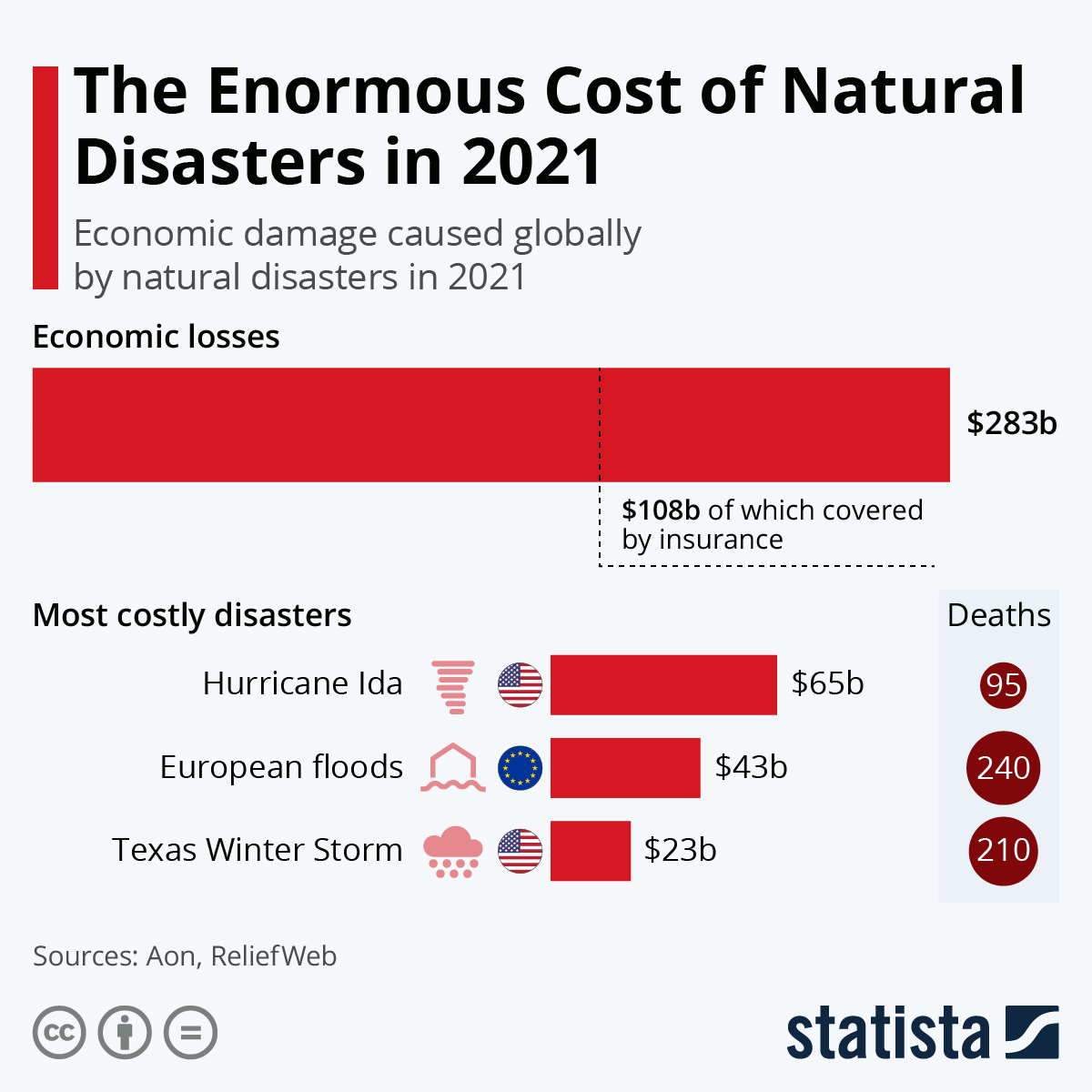

- The financial impact of natural disasters last year reached $283 billion, the sixth year in the past 10 of more than $100 billion in insured losses:

- Losses from Colorado’s Marshall Fire last week are expected to reach $1 billion after thousands of homes were destroyed or damaged.

Domestic Markets

- The U.S. reported 307,208 new COVID-19 infections and 330 virus fatalities Sunday. The seven-day average for new infections topped 700,000 for the first time.

- Nearly a quarter of all U.S. hospitals are reporting critical staffing shortages, with COVID-19 infection a major contributor. Hospitals in nearly half of states have started postponing elective surgeries and are at risk of exceeding capacity, with many leaving beds unfilled due to worker shortages.

- More than 5 million American workers are estimated to have called in sick due to COVID-19 infection or exposure last week, as absenteeism poses a new threat to the U.S. economy.

- Florida reported more than 75,000 new COVID-19 cases Friday, a record, as 3 in 10 people tested were infected with the virus.

- Los Angeles County reported more than 45,000 COVID-19 infections Sunday, a record. Virus hospitalizations are up 165% across California the past month.

- Some hospitals in Arizona and California are allowing workers who are asymptomatic or mildly symptomatic with COVID-19 to continue working due to severe staffing shortages.

- New York reported 130 COVID-19 deaths last Wednesday, the most in the vaccine era. Forty hospitals across the state have been forced to halt nonessential, non-urgent elective surgeries for two weeks due to low bed capacity.

- Wyoming and Ohio lead the nation in per capita COVID-19 fatalities, new data shows. Ohio is experiencing its highest COVID-19 hospitalizations since the start of the pandemic.

- A county in eastern Kansas declared a state of emergency after running out of ventilators for COVID-19 hospital patients.

- At least 1,000 clinical workers across Hawaii were out of work with COVID-19 or COVID-19 exposure last week.

- Division over COVID-19 protocols is growing between Chicago leadership and the city’s teacher’s union, which effectively shut down public schools for three days last week and again today.

- Twenty public schools in Pittsburgh will temporarily halt in-person learning today due to staffing shortages caused by COVID-19 infection.

- The U.S. CDC is broadly encouraging schools to stay open this year, as many school districts across the country remain remote or employ hybrid learning.

- A cruise ship docked at the Port of Miami with more than 160 crew members on board infected with COVID-19, authorities said.

- West Virginia could become one of the first states to authorize fourth COVID-19 vaccine doses to some of its population.

- The FDA added Moderna’s COVID-19 vaccine to reduced time periods for a booster dose.

- New York financial giant Citigroup is moving forward with plans to put all unvaccinated employees on unpaid leave by Jan. 14.

- Surging COVID-19 cases across the U.S. have caused some soon-to-be public companies to delay their stock market debuts, as new rules at the New York Stock Exchange and the Nasdaq Stock Market now mandate vaccines and require negative virus tests for all guests.

- Alaska Airlines cut its schedule by 10% the rest of the month due to staff shortages caused by COVID-19 infections. The move comes after U.S. airlines scrubbed about 7% of all flights between Dec. 24 and Jan. 6.

- Growth in the U.S. services economy fell an unsurprising 7.1% in December from the previous month’s record pace, the latest purchasing managers index shows.

- U.S. consumer borrowing surged in November by the most on record, jumping $40 billion from the prior month as Americans’ pandemic savings start to wane. U.S. lenders are embracing more borrowers with less-than-perfect credit, a sharp reversal from the early pandemic.

- The U.S. treasury announced a new plan to hand out $10 billion to states and local governments for small business loans, using funds from Congress’ earlier $1.9 trillion coronavirus aid package.

- U.S. hybrid vehicle sales rose 76% to 801,550 units in 2021, representing 5% of the nation’s light vehicle sales for the year.

International Markets

- Total global COVID-19 cases topped 300 million last Thursday, just five months after reaching 200 million.

- The U.K. became the seventh country to surpass 150,000 COVID-19 fatalities since the start of the pandemic. New infections have started declining in about two-thirds of London.

- The number of repeat infections in Spain over the past two weeks was larger than the total number of reinfections since the start of the pandemic.

- India has seen an eightfold rise in daily COVID-19 infections over the last 10 days, including more than 140,000 reported Saturday, the most since May, prompting the nation to start administering COVID-19 vaccine booster doses to its front-line workers and vulnerable elderly population.

- China is struggling to contain its latest COVID-19 outbreak, with an additional 95 infections added last Friday. The northwestern metropolis of Xian is headed for its fifth week of ultra-strict lockdowns, while Zhengzhou closed all public restaurants, venues and schools. China could delay a restart in widespread international travel another three years, officials signaled.

- Australia’s total COVID-19 infections surpassed 1 million Monday, with more than 500,000 recorded in the last week.

- COVID-19 cases in the Philippines rose tenfold the past week to new records.

- Brazil reported 35,826 new COVID-19 cases Thursday, the most since September, as the nation’s virus fatalities climbed to the third highest globally at 619,641.

- Disruption is growing at Mexico City’s airport after more staff tested positive for COVID-19. Meanwhile, the nation saw a record 30,671 new virus infections Saturday, a pandemic record.

- The vaccination rate in Quebec jumped fourfold in a single day after the government announced that proof of vaccination will be required to purchase alcohol and marijuana.

- Inflation in the eurozone hit a surprise 5% in December, a new record largely stemming from rising food prices.

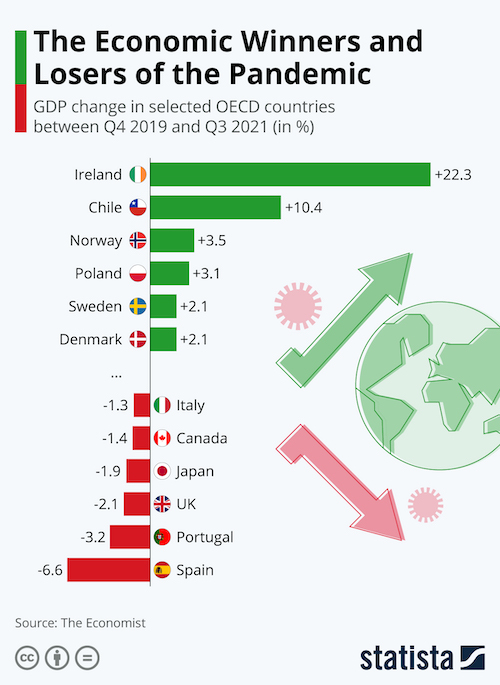

- Ireland and Chile led the world in GDP gains during the pandemic:

- Mercedes was dethroned by BMW from the top of the luxury car market for the first time in five years last year, though sales dropped 5%. British luxury automaker Aston Martin saw an 82% rise in sales.

- BMW has unveiled the world’s first car that can instantly change exterior color schemes.

- Airbus bested its full-year target of 600 deliveries last year, maintaining a lead over U.S. rival Boeing.

- Air France-KLM airline says it will need 2 billion euros in emergency funding this year to offset continued pandemic-induced hits to travel.

- Shell has begun fully converting some former British gas stations into electric vehicle charging hubs complete with lounge areas, restaurants and shops.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.