COVID-19 Bulletin: January 11

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices fell Monday on reports of rising production in Libya, where output rebounded to 1 million bpd after the nation’s largest oil field emerged from a three-week shutdown. Crude futures were higher in late morning trading, with WTI up 1.8% at $79.63/bbl and Brent up 1.7% at $82.23/bbl. U.S. natural gas was 0.8% lower at $4.05/MMBtu.

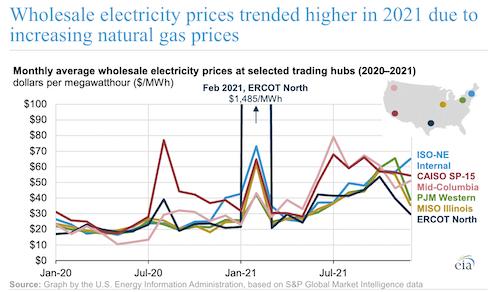

- Rising fuel costs, especially for natural gas, drove up wholesale electricity prices in every U.S. region in 2021, the Energy Information Administration said.

- The U.S. oil field services and equipment industry added 7,450 jobs in December, up 1% from the prior month, bucking trends of hiring slowdowns in many other industries.

- The White House is looking to block oil and gas leasing on half of Alaska’s 23-million-acre North Slope, an area set aside for energy development decades ago that has been the subject of sharply different policies from recent U.S. administrations.

- Wholesale gas prices in Europe surged Monday as Russia continued reversing flows back to itself on the Yamal-Europe pipeline, hampering European supply. Germany is sending $147 million to households to help offset rising heating costs, lawmakers said.

- Venezuela’s state-run oil company said it would resume exporting diluted crude for the first time in nine months on a build in condensate inventories. The nation has ramped up its gasoline output to 160,000 bpd following maintenance at aging plants.

- U.S. pipeline operator Enterprise Products is set to buy Navitas Midstream for $3.25 billion, a move giving the firm access to about 1,750 miles of natural gas pipelines in the Permian Basin’s Midland section, a main thoroughfare of the U.S. shale market.

- Fourteen state attorneys general are lobbying the U.S. government to drop a proposed rule allowing LNG to be shipped by rail, citing concerns about public and environmental safety.

- Capital expenditures by big companies worldwide are expected to increase 6.1% from 2021 levels this year, led by excess cash and pressures to invest in the transition to clean energy.

- The EU’s internal market chief forecasts hundreds of billions of euros will be needed to build and maintain the continent’s nuclear reactors by 2050.

- The European Commission delayed plans to implement a “green” labeling structure on natural gas and nuclear energy projects on pushback over misleading claims of sustainability.

Supply Chain

- Containers are taking more than twice as long to reach their destination compared to the same period in 2019, as global port congestion shows no signs of easing with the new year.

- Tight terminal space at the Los Angeles and Long Beach ports is leaving container ships waiting longer at berths, a contrast to prevailing notions of disruption stemming from higher call sizes.

- China tightened restrictions on vehicles entering Shenzhen, the world’s fourth largest port hub, after an outbreak of four COVID-19 cases was reported Monday.

- Analysts fear Hong Kong logistics costs could rise 40% over the next three weeks on a severe shortage of freight space caused by tightened COVID-19 restrictions and the cancellation of flights from 150 countries, including the U.S., U.K. and Australia.

- Supply chain backlogs have stymied the flow of many goods and materials critical for homebuilding, with about 90% of surveyed homebuilders saying they experienced supply disruptions in November.

- The cost of construction materials in Mexico rose 17.4% in December year over year, with plastic pipe up 34%, wire and wire rod up 35%, and electrical cable 30% higher.

- Production is slowing at U.S. dairy and meatpacking facilities due to COVID-19 infections among staff, potentially leading to higher prices for dairy and meat.

- The Baltic Exchange’s dry bulk index fell to 2,277 Monday, a two-week low, due to declines in smaller vessel rates.

- British freight forwarders have told government regulators that growing concentration in shipping is distorting markets and diminishing competition.

- Industry analysts estimate some 60,000 railcars will be built through 2023 in response to growing demand for competitive transportation alternatives.

- There were 23,100 North American orders for heavy-duty trucks in December, more than double the historic low the previous month but 55% below December 2020 orders.

- Shipowners contracted for the building of 90 LNG-powered vessels in 2021, an annual record.

- Maersk has inked a deal with South Korea’s Hyundai Heavy Industries for four new 16,000-TEU dual-fuel container ships powered by carbon-neutral methanol.

- New York cargo carrier Atlas Air ordered four new Boeing 777 freighters for delivery starting in November.

- Electric-vehicle startup Rivian Automotive is looking to put sales of its vehicles ahead of profits as it scales up its supply chain and faces more competition from legacy automakers with deeper pockets and auto-making know-how.

- Missouri-based Christenson Transportation is expanding its freight network with the purchase of Tennessee’s Sharp Transport, bringing around 120 drivers, 240 tractors and 940 trailers to its fleet.

- Australia’s Port of Newcastle, the world’s largest hub focused on coal exports, plans to run its operations on 100% renewable energy by 2040.

Domestic Markets

- The U.S. reported 1,481,375 new COVID-19 infections and 1,904 virus fatalities Monday, shattering the highest daily case total for any country in the world. The record came the same day as COVID-19 hospitalizations hit an all-time high of more than 132,000, topping last January’s peak.

- The U.S.’s seven-day average for new COVID-19 cases is set to triple from the same time last year.

- New Jersey has returned to its highest COVID-19 hospitalization levels of the pandemic at over 6,000 patients.

- The seven-day average of COVID-19 positivity rates and hospital visits are down in New York, suggesting the state’s most recent Omicron wave has peaked.

- Virginia’s governor declared a state of emergency as a surge of COVID-19 patients overwhelms its hospitals.

- Los Angeles has surpassed 2 million COVID-19 cases since the start of the pandemic. Some 62,000 public school students and staffers in the city have tested positive for the virus.

- Over 5,400 U.S. public schools were closed at some point last week due to pandemic-related impacts.

- Chicago public schools will resume in-person learning tomorrow after the teachers’ union reached agreement with city leadership on new COVID-19 testing and safety measures.

- COVID-19 infections in the U.S. military nearly tripled from Dec. 22 to Jan. 5.

- Much of the White House’s COVID-19 vaccine mandate on large businesses went into effect yesterday despite pending legal challenges in the U.S. Supreme Court. The rule requires businesses with more than 100 employees to have a procedure to ensure employees are vaccinated and to keep track of their vaccination status.

- The White House says its first batch of free COVID-19 tests will start arriving early next week.

- Private insurers will be required to reimburse individuals for up to eight at-home COVID-19 tests per month starting this Saturday, the White House said.

- Merck delivered 900,000 courses of its COVID-19 antiviral treatment to the U.S. in December, with plans to provide an additional 3 million doses by the end of this month.

- Pfizer is set to release an Omicron-tailored COVID-19 vaccine by March, the company said.

- New CDC recommendations will allow some people with weakened immune systems to get a fourth COVID-19 shot.

- Up to 1.6 million Americans have chronic problems with their sense of smell caused by COVID-19.

- Royal Caribbean canceled four cruise voyages due to fallout from broadly rising COVID-19 cases.

- Orders for U.S. manufactured goods rose in November for the 18th time in the past 19 months.

- The U.S. added just 26,000 manufacturing jobs in December, the sector’s slowest growth in six months amid surging COVID-19 infections and a tight labor market.

- A hotel in South Bay, California, is using robots to deliver room service due to severe staffing shortages during the pandemic.

- U.S. airlines scrubbed fewer flights over the weekend and Monday than in recent weeks, a result of subsiding winter storms and better management of COVID-induced worker shortages.

- The rollout of U.S. 5G cellular networks over the coming weeks could lead to some flight cancellations and delays in bad weather, as regulators move with caution after concerns about the technology’s effect on cockpits.

- Staffing shortages tied to COVID-19 have shut down large chunks of public transit systems in Detroit, Washington, D.C., Portland, Oregon, and New York City.

- U.S. greenhouse gas emissions surged 6.2% in 2021 on rebounding economic activity. The nation also saw its fourth-hottest year on record, contributing to the highest average temperatures ever recorded over the last seven years.

- GM has decided to recognize California’s authority to impose the nation’s most ambitious vehicle emissions standards, a move aimed at making its vehicles eligible for state government fleet purchases.

International Markets

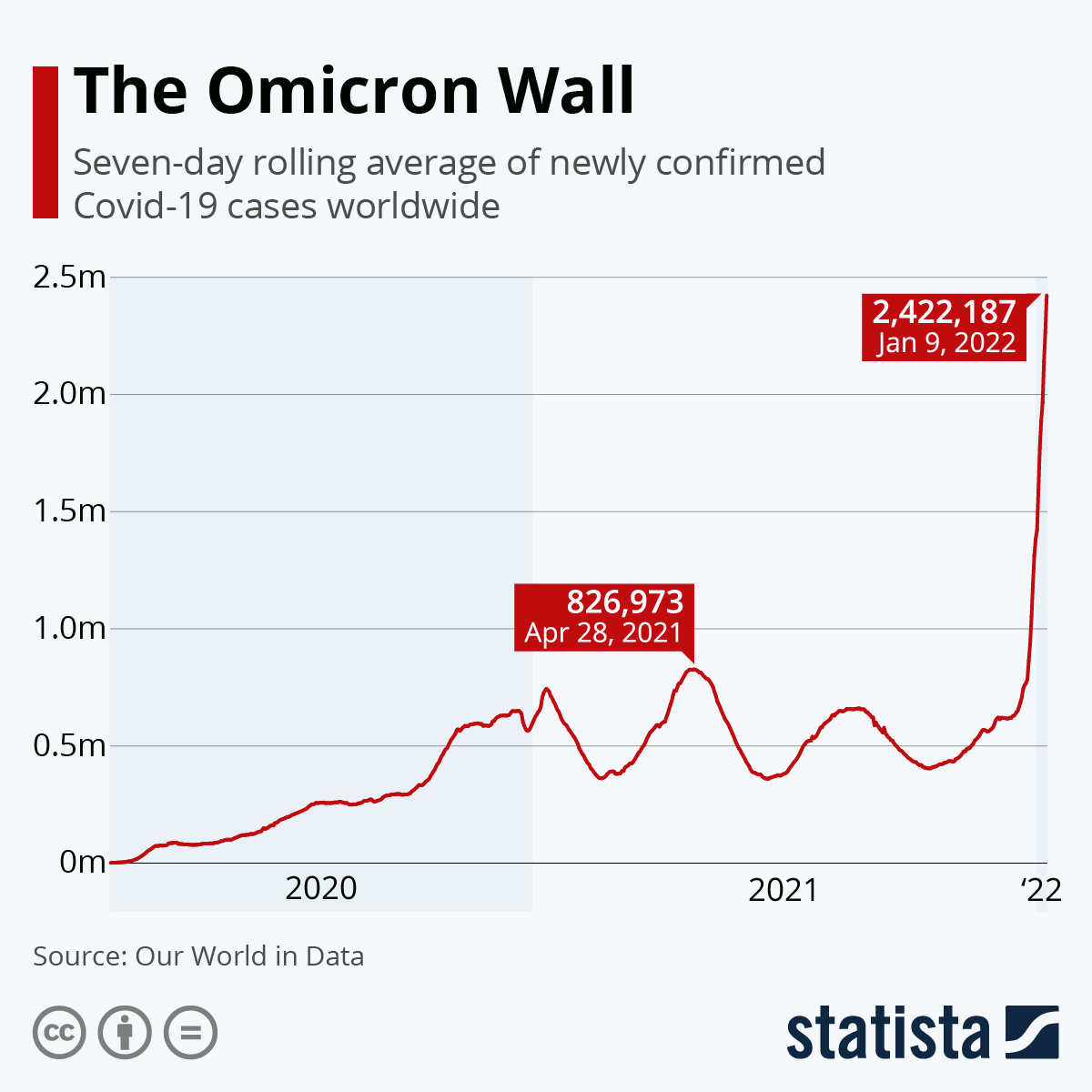

- The global average of daily COVID-19 cases rose to 2.42 million on Sunday, three times the previous peak reached in April 2021.

- Yesterday, France experienced the biggest jump in COVID-19 hospitalizations since April 2021.

- Sweden is imposing curfews and work-from-home requirements to help curb a rise in COVID-19 infections.

- Unvaccinated Italians will be barred from restaurants, bars and public transport, officials said.

- Hungary’s COVID-19 vaccine rollout continues to lag despite the nation having one of the highest virus death rates in the world, as concerns mount over Chinese and Russian shots approved for the nation’s public.

- New COVID-19 cases in the U.K. are down 10% week over week, the fifth straight day of declines.

- Chinese officials are scrambling to contain several COVID-19 outbreaks cropping up ahead of the Beijing Winter Olympics planned for the beginning of February. More than 190 cases were reported in the mainland on Monday.

- Bars and restaurants in India’s capital will shut down as the nation sees a steep rise in COVID-19 infections.

- Japan will extend its ban on non-resident foreigners until the end of February as COVID-19 cases surge after being kept low for months.

- Half of all people tested for COVID-19 in the Philippines are positive.

- Active COVID-19 cases in Mexico, where the president is isolating with his second virus infection, are at an all-time high with 13 states at elevated risk levels.

- Canada was placed on the U.S.’s highest-risk travel category due to rising COVID-19 infections.

- The EU has lifted its Omicron-inspired travel ban against southern African countries first to report the strain, one of the last governments to do so.

- Chile has begun rolling out fourth COVID-19 vaccine doses to some of its population.

- Virgin Australia cut 25% of its flights through February due to staffing shortages caused by COVID-19 infections.

- Aeroméxico canceled more than 300 flights over the past five days as over 150 pilots and crew members tested positive for COVID-19.

- Mexico auto production fell by 2% last year compared to 2020, the fourth annual decline in a row.

- Electric vehicles accounted for 15% of China’s auto sales last year, driving the market’s first growth in three years.

- German luxury carmaker Rolls-Royce saw a 49% rise in sales last year to a record 5,586 vehicles.

- South Korea’s Posco International unveiled plans to build a $43.6 million plant in Mexico to produce electric vehicle motor cores.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.