COVID-19 Bulletin: January 12

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose nearly 4% Tuesday to a two-month high. Futures were higher in late morning trading, with WTI up 2.1% at $82.89/bbl and Brent up 1.6% at $85.04/bbl. U.S. natural gas jumped 11.2% higher at $4.72/MMBtu.

- The American Petroleum Institute reported a much lower-than-expected crude draw of 1.08 million barrels last week.

- India’s December fuel consumption, a proxy for the nation’s oil demand, was the highest in nine months although still roughly 3% below pre-pandemic levels.

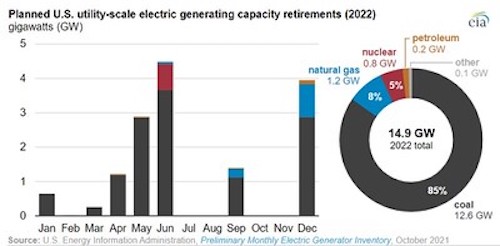

- Coal will make up 85% of the 14.9 GW of U.S. power capacity to be retired this year.

- Indonesia eased its recent ban on coal exports yesterday, sending coal futures lower in China, the world’s top importer.

- Independent producer Canadian Natural Resources projects about $4.3 billion in capital spending this year, up from around $3.5 billion in 2021.

- Exxon Mobil bought a near-50% stake in a Norwegian biofuels producer planning to ramp up output in the coming years with five new production sites.

- Agriculture processing giant Archer-Daniels-Midland plans to build a 350-mile pipeline from Iowa to Illinois to capture and transport up to 12 million tonnes of CO2 per year.

- Countries across the globe traded a record amount of carbon allowances last year, with the most activity coming from European nations pressured by recent government policies to meet stricter climate targets.

Supply Chain

- Snowstorms and ice buildup in the Pacific Northwest are expected to close portions of major highways and down power lines, forecasters say.

- The U.S. West Coast continues to have the longest wait times for container vessels to discharge or pick up cargoes, Maersk said. The backup of ships outside Southern California ports has risen to 105 vessels.

- Two new studies from regional Federal Reserve banks show a broad swath of logistics activity has been strained to unprecedented levels, pushing more shippers toward alternative means of transportation, especially freight rail.

- Tens of thousands of flight cancellations in recent weeks have delayed deliveries and added to transportation costs for retailers and manufacturers seeking to fly goods over clogged ocean ports.

- The world’s biggest automakers, chipmakers and retailers are already reporting production setbacks from recent COVID-induced factory shutdowns in China. Tennessee trucker Averitt Express says more than three-quarters of the shippers it surveyed plan to ship more in 2022 than they did last year.

- Many East and Gulf Coast ports broke records for container volumes last year, including the Port of Virginia, the Port of Charleston and the Port of Mobile.

- The Port of Seattle opened the first phase of its refurbished Terminal 5 container gateway, a project launched in 2016 aimed at expanding capacity to handle the largest Transpacific vessels.

- California’s budget proposal for next fiscal year allocates a record $2.3 billion for expanding and modernizing the state’s ports.

- BNSF Railway led the big six Class I railroads in growth last year, with traffic up 7.4% on an 8.3% surge in intermodal volumes and an 11% surge in coal shipments.

- Russian Railways, the nation’s state-owned rail monopoly, saw a 34.4% jump to record high container volumes last year as it helped Asian manufacturers deliver more goods to Europe.

- The National Automobile Dealers Association is forecasting a lower-than-expected rise in U.S. auto sales this year on continued impacts from the global computer chip shortage.

- Volkswagen’s global deliveries fell 12.6% in 2021 to 878,200 vehicles, primarily a result of the global chip shortage, which the automaker’s CEO expects to persist throughout the year.

- Bed Bath & Beyond is closing 37 more stores across the U.S., an announcement coming just days after the retailer reported a large sales decline for the latest quarter.

- Baby formula has emerged as another distinct casualty of global supply chain logjams.

- Chinese officials on Tuesday announced several new measures aimed at raising imports and bolstering companies’ credit to stabilize trade amid more frequent COVID-19 outbreaks.

- Japan is facing an oversupply of milk after farmers overcorrected production following a dairy shortage several years ago.

M. Holland’s 2022 Plastics Industry Trends & Predictions

M. Holland’s market experts weigh in on what we can expect for the plastics industry in 2022. View the infographic and read more on current trends and predictions.

Domestic Markets

- The U.S. reported 752,387 new COVID-19 infections and 2,641 virus fatalities Tuesday.

- U.S. COVID-19 hospitalizations continued their climb into uncharted territory, rising to 145,982 patients as of Tuesday, accounting for some 30% of available ICU beds across the nation.

- The COVID-19 Omicron variant now accounts for nearly 100% of new cases in the U.S.

- One in five eligible Americans remain unvaccinated against COVID-19, the latest data shows.

- COVID-19 hospitalizations in Texas rose to 10,417 Monday, the highest since September and a 234% increase from a month ago.

- Maine activated another 169 National Guard troops to help hospitals manage a surge of COVID-19 patients.

- New Jersey and Washington, D.C., declared a state of emergency to help hospitals overwhelmed by COVID-19 patients.

- Tennessee is ending its daily COVID-19 case reports at a time when infections have surged to their highest levels of the pandemic.

- Florida reported 47,709 new COVID-19 cases Monday, a decrease from the 64,000-daily average of last week. Computer models predict that 80% of the state’s residents will have contracted the virus by the end of the Omicron wave.

- New York’s COVID-19 test positivity rate dropped nearly 4 percentage points in recent days, bolstering predictions that the state’s most recent Omicron wave has peaked. Average daily caseloads are below 50,000 for the first time since Christmas.

- Chicago distributed 1.5 million highly protective KN95 face masks to residents Tuesday.

- COVID-19 infections among U.S. nursing home staff have doubled from their previous peak in December 2020, while resident infections are also on the rise.

- COVID-19 was the leading cause of death among police officers in 2021, with fatalities rising 65% from the previous year to 301.

- United Airlines is preemptively trimming more flights as more than 4% of its workforce has called out sick with COVID-19.

- A growing number of U.S. firms have indefinitely pushed back return-to-office plans amid rising COVID-19 cases. Facebook parent Meta Platforms delayed its plans from January to March and will also require COVID-19 booster doses for all employees.

- COVID-19 vaccines likely saved 241,000 lives and prevented more than 1.2 million Americans from going to the hospital in the first half of 2021, new research suggests.

- The White House will start sending 5 million rapid COVID-19 tests to K-12 schools each month.

- New NCAA rules consider college athletes “fully vaccinated” if they have been infected with COVID-19 within the last 90 days.

- Roughly 11% of U.S. workers were remote in December, according to the U.S. government’s latest jobs report.

- JPMorgan Chase is readying to fire employees who do not get vaccinated against COVID-19.

- CVS and grocery chain Albertsons are forecasting larger-than-expected profitability for 2021 as COVID-19 testing and vaccines led to repeat customers and more purchases.

- The American Red Cross declared a first-ever national blood crisis due to COVID-induced staffing shortages and closures of blood drive clinics.

- Boeing said Tuesday that it won orders for 909 planes in 2021 but delivered only 280 passenger jets, less than half as many delivered by Europe’s Airbus in a sign of the changing landscape for the world’s two dominant plane makers.

- There were 3.3 million, or 7%, more U.S. retirees as of October 2021 than in January 2020, while a record 4.53 million Americans quit their job in November:

- U.S. inflation hit 7% in December, the highest since 1982.

- All signs suggest the Federal Reserve’s first interest rate increase of 2022 will come as soon as March.

- This year’s tax season is starting 17 days earlier on Jan. 24 to give the Internal Revenue Service more time to process refunds amid COVID-19 disruptions.

- U.S. small business confidence rose slightly in December as more firms planned on increasing employment and capital outlays.

- General Motors debuted its CarBravo app to help dealers sell used cars.

- Auto parts supplier Aptiv is buying software maker Wind River for $4.3 billion, a bid to stay ahead of the market as suppliers are threatened with more automakers moving software development in-house.

- New Jersey’s legislature passed a recycling bill requiring that post-consumer recycled content comprise 10% of rigid plastic containers, 15% of plastic beverage containers and 20% for plastic carryout bags.

International Markets

- The World Health Organization predicts half of Europe could be infected with the COVID-19 Omicron strain within the next two months.

- France reported more than 368,000 new COVID-19 cases Tuesday, beating its previous record by nearly 40,000.

- Italy reported a record 220,532 new COVID-19 cases Tuesday.

- The U.K. reported 120,821 new COVID-19 cases Tuesday, more than 20,000 below Monday’s tally.

- A third Chinese city has locked down its residents over a two-person COVID-19 outbreak, bringing the total number of locked-down citizens in the nation to more than 20 million.

- Tokyo reported more than 2,000 new COVID-19 cases yesterday for the first time since early September, a fivefold increase from a week ago.

- India’s northern neighbor Nepal banned public gatherings and closed schools due to spiking COVID-19 cases.

- Quebec is readying to impose fines on unvaccinated residents to help the province’s overburdened healthcare system.

- COVID-19 particles lose most of their infectious potency within five minutes of becoming airborne, new research out of Britain suggests.

- German vaccine maker BioNTech expects to generate $19 billion in revenue this year from its COVID-19 vaccine developed with Pfizer, pledging to reinvest extra cash toward more vaccine and cancer research.

- The World Bank lowered its growth forecast for the global economy this year from 5.5% to 4.1%, citing rising COVID-19 infections and ongoing supply chain disruptions.

- In a strategic shift, Citibank/Banamex is exiting consumer, small business and middle-market banking in Mexico.

- Tesla sold 70,847 China-made vehicles in December, the highest monthly output since it began manufacturing in the country in 2019.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.