COVID-19 Bulletin: January 18

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose half a percent Monday to seven-year highs before gaining further in late morning trading today, with WTI up 1.5% at $85.08/bbl and Brent up 0.9% at $87.23/bbl. U.S. natural gas was 2.1% higher at $4.35/MMBtu.

- Libya is clawing its way back to full oil output after blockades shut down 300,000 bpd of production last week.

- China is expected to time its upcoming release of strategic oil reserves to the high demand period of the Lunar New Year, sometime between Jan. 31 and Feb. 6.

- Prices for European jet fuel hit a three-year high yesterday as global air traffic withstands impacts from rising COVID-19 cases. Prices are expected to rise an extra 45% by July, analysts say.

- Russia has not yet scheduled gas deliveries to Germany on the Yamal-Europe pipeline next month, the second straight month of halted flows that continue to put upward pressure on soaring European energy prices.

- Shell expects solar and wind energy to surpass China’s use of coal for electricity generation by 2034.

- TotalEnergies and BP have each made successful bids for major new offshore wind farms in Scotland, a potent sign of the oil industry’s expansion into renewables.

- Exxon Mobil, responding to investor and public pressure, pledged to achieve net-zero greenhouse-gas emissions by 2050.

Supply Chain

- More than 200,000 homes and businesses were without power Monday as winter storms all but shut down the U.S. East Coast, dropping more than a foot of snow in New York, Ohio and Pennsylvania and pummeling parts of the Southeast.

- Concern is growing among health officials that shipping times will weaken the effectiveness of the White House’s recent plan to send hundreds of millions of free at-home COVID-19 tests to Americans.

- Officials in Beijing are recommending people stop ordering items for delivery from overseas over fears of importing COVID-19 from parcel shipments.

- The U.S. government is moving forward with plans to let trucking apprentices as young as age 18 drive across state lines in a bid to ease supply chain backlogs. Currently, truckers who cross state lines must be at least 21.

- COVID-19 outbreaks among vessel crews could force container ships to reroute and be delayed, yet another potential avenue for supply chain disruptions.

- Driven by global demand for China’s exports, record-low container dwell times in Asia are in sharp contrast to congested ports in Europe and the U.S.

- More airlines are applying to operate in the U.S. as airfreight rates rise.

- Suez Canal ship volumes hit a record in 2021 and are only expected to go up this year and next with multiple expansion projects underway.

- Prices for international food commodities dipped slightly in December but still ended 2021 at a 10-year high, according to the FAO Food Price Index. China’s recent push to reduce dependence on foreign suppliers and stockpile key food staples has been a major contributing factor to the price rises.

- The U.S.’s third-largest beer producer is being forced to cut some production over a shortage of brown glass for bottles.

- Butter prices rose sharply in December due to dairy industry labor shortages, higher packaging costs and a decline in cow herds.

- Florida’s smallest orange harvest in 75 years has pushed up prices for frozen concentrate over 50% since the start of the pandemic.

- Holiday inventories were 2% lower in 2021 due to supply chain issues, according to data from Salesforce.

- Japanese core machinery orders were on the rise late last year in a sign that corporate appetite for capital spending remained resilient despite pressure from soaring raw material prices.

- More than half of global CEOs expect inflationary price pressures to continue at least until mid-2023, survey results show.

- Kroger, the U.S.’s largest grocery chain, has signed a deal to use all-electric, autonomous vehicles made by Nuro for some deliveries in Houston.

- Maersk is launching a new “decarbonization hub” in Denmark aimed at coordinating research and development in lowering the cargo shipping industry’s emissions.

M. Holland’s 2022 Plastics Industry Trends & Predictions

M. Holland’s market experts weigh in on what we can expect for the plastics industry in 2022. View the infographic and read more on current trends and predictions.

Domestic Markets

- The U.S. reported 717,874 new COVID-19 infections and 1,122 virus fatalities Monday. The nation has averaged nearly 800,000 cases and 1,800 fatalities per day the past week.

- U.S. attorneys general are warning the public of counterfeit and marked-up COVID-19 tests appearing more frequently amid a general shortage of the products.

- Weekly COVID-19 case counts in Florida remain above 420,000, their highest level of the pandemic.

- Courts in western Michigan have paused jury trials due to surging COVID-19 infections.

- Washington, D.C., is now requiring proof of COVID-19 vaccination for anyone over age 12 to enter gyms and restaurants.

- A school system in Alabama was forced to alert every family in the district of COVID-19 exposure last week.

- Average daily COVID-19 cases in New York are slowing, though strain on the state’s healthcare system remains high.

- New workplace rules in California require all employers to provide free COVID-19 testing to employees and paid time-off after any workplace exposure to infected persons.

- The U.S. Army is prepping to begin human trials on a COVID-19 vaccine that would protect against all strains of the virus, including future strains.

- COVID-19 tests are available in vending machines at some college campuses.

- Four states — Arizona, Idaho, Utah and Texas — have seen employment return to pre-pandemic levels.

- Google now requires a negative COVID-19 test for all employees coming to the office, regardless of whether they are vaccinated.

- Carnival Cruise Line is giving out free, highly protective KN95 masks to all passengers to help limit chronic COVID-19 outbreaks on cruise ships at sea.

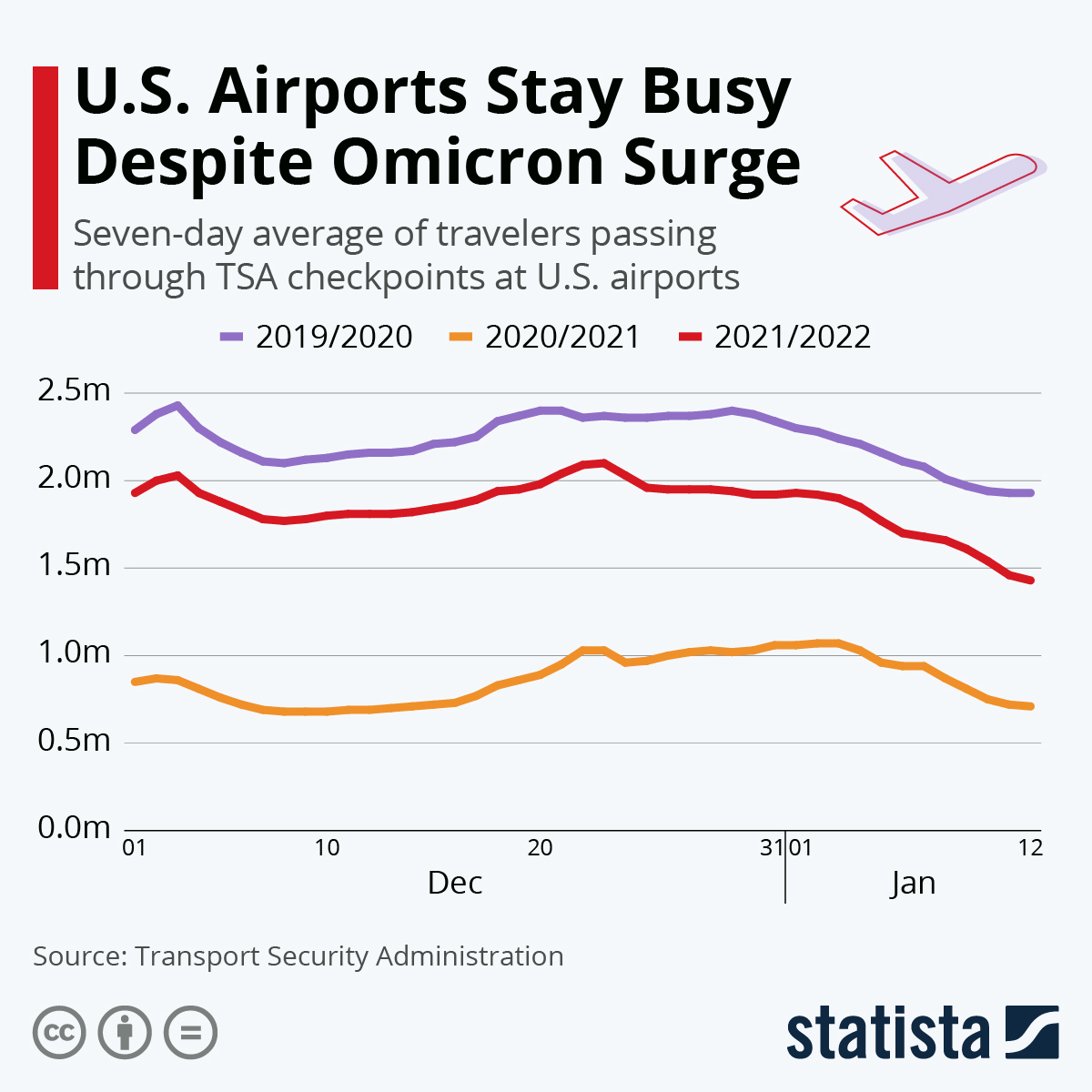

- U.S. airport traffic is staying resilient in the face of rising COVID-19 cases, with last week’s TSA screenings more than double last year but still down roughly 25% from pre-pandemic levels:

- The CEOs of the U.S.’s largest airlines warned Monday of a “catastrophic disruption” to operations if telecommunication companies roll out 5G technology without restrictions near airports.

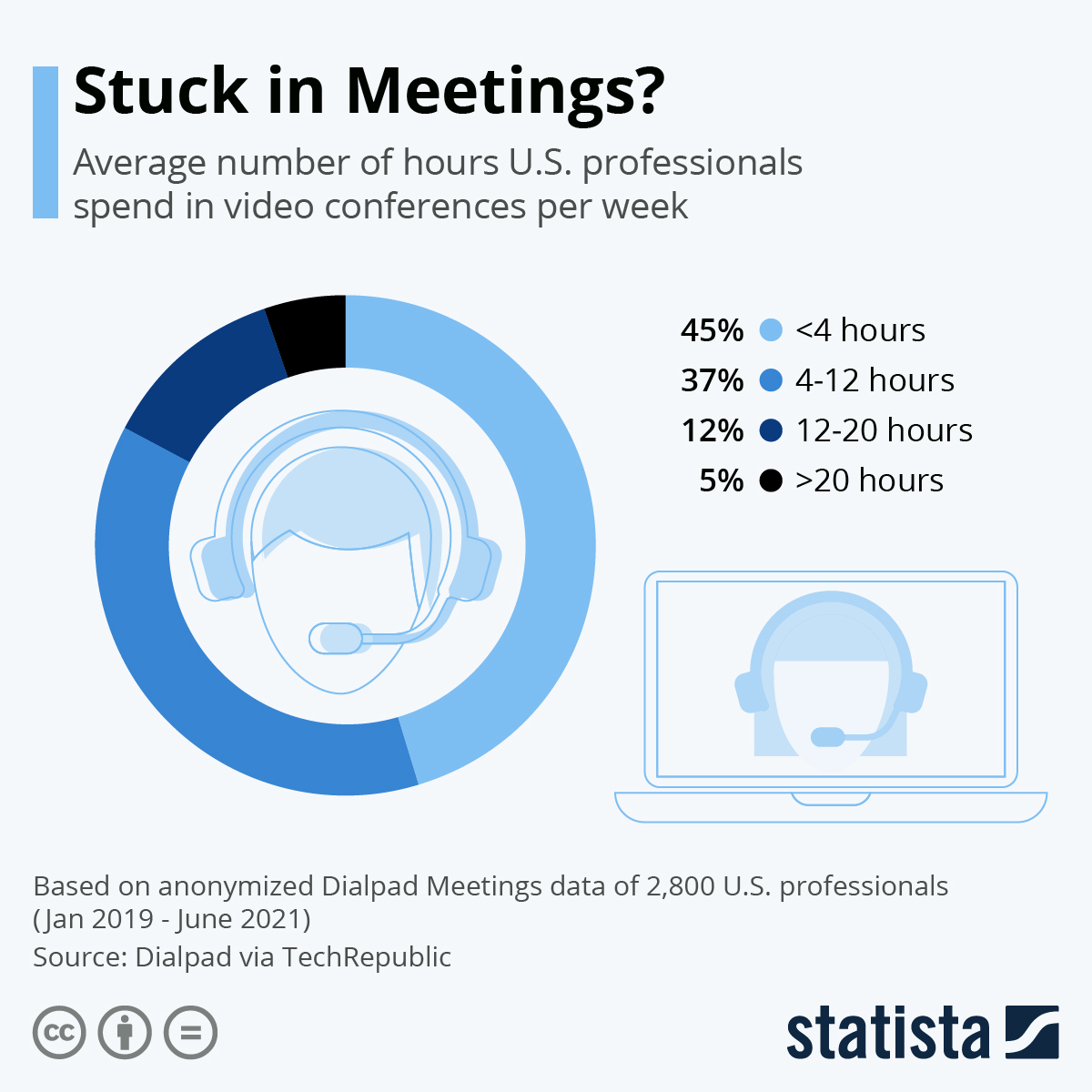

- About 5% of U.S. professionals surveyed were in video conferences for more than half their average workweek during the pandemic, led by marketing and advertising companies:

International Markets

- Germany’s total COVID-19 infections since the start of the pandemic surpassed 8 million as weekly transmission rates rose to a new-high. In a positive sign, virus ICU admissions are starting to decrease, officials said.

- Europe is prepping to restrict travel from Argentina, Australia and Canada due to COVID-19 fears.

- COVID-19 hospitalizations in France hit their highest level since December 2020 yesterday after the biggest single-day increase since November 2020. Paris reimposed a partial outdoor mask mandate just days after dropping the measure.

- Denmark dropped its pandemic restrictions yesterday as new COVID-19 cases hit a pandemic record and hospitalizations rose to their highest level in a year.

- Austria’s government said it would issue fines of more than $4,000 this March to people unvaccinated against COVID-19. Greece is planning similar fees of just over $100 for unvaccinated people over age 60 this February.

- New COVID-19 infections in the U.K. are down 38% week over week, with under 85,000 reported for the second straight day Monday.

- The U.K. and Israel joined the growing list of nations shortening mandatory quarantine periods for cases of asymptomatic COVID-19.

- Health officials in Poland expect its fifth COVID-19 wave to peak in mid-February with over 60,000 infections per day, nearly double its prior peak.

- New COVID-19 infections in Russia more than doubled week over week to the highest daily totals in a month.

- A fourth COVID-19 booster appears to be only moderately effective at increasing antibody levels, leaving recipients still vulnerable to breakthrough infections, Israeli health officials say.

- Rising COVID-19 cases prompted China to halt ticket sales to the upcoming Beijing Olympics. Some people have been locked down inside office buildings since Sunday as authorities conduct emergency testing and contact tracing.

- Daily COVID-19 cases in India surpassed 250,000 for the fifth straight day, prompting officials to ban political gatherings for upcoming state elections until later this month. Infections are down sharply the past two days in the nation’s largest cities, however.

- Australia suffered a record number of COVID-19 fatalities yesterday as hospitals struggle with surging admissions and staff shortages due to the virus. The nation reversed its rules and will now accept travelers who received their COVID-19 vaccination from Russia’s Sputnik V shots.

- One in two Filipinos who test for COVID-19 are positive, as the nation’s new daily cases surge to their highest levels of the pandemic. The government banned unvaccinated people from public transportation, among other restrictions.

- Daily COVID-19 cases are up 3,000% in Argentina and 1,900% in Brazil from a month ago, increasing strain on hospitals even as the region’s vaccination rates are among the highest in the world.

- Global deliveries of COVID-19 shots to developing nations have surpassed 1 billion.

- It could take up to two years for global unemployment to return to pre-pandemic levels due to a high number of job vacancies worldwide, especially in low-income nations, economists say.

- Canada has seen its share of the global housing market frenzy, with home sales rising to an all-time high last year while inventories hit an all-time low.

- In the U.K., property prices are rising at their fastest rate in six years.

- With plastic production forecast to double within 20 years, major international consumer brands including Coca-Cola, PepsiCo, Unilever and IKEA are calling for a reduction in plastic pollution ahead of a United Nations summit on the issue later this year.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.