COVID-19 Bulletin: January 20

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices settled higher Wednesday after an Iraqi pipeline fire briefly stopped flows, raising concerns of tighter global supply. Crude futures were higher in late morning trading, with WTI up 0.9% at $87.73/bbl and Brent down 0.6% at $88.93/bbl. U.S. natural gas was 5.6% lower at $3.81/MMBtu.

- The International Energy Agency is sticking to its forecast that global oil supply will soon overtake demand, as some producers are set to pump at or above all-time highs following a year in which global refining capacity dropped for the first time in three decades.

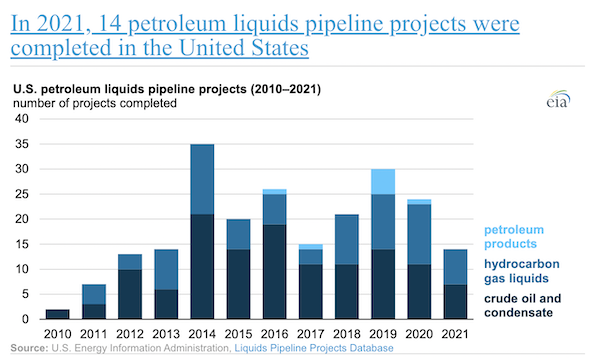

- Fourteen U.S. pipelines carrying petroleum liquids were built, expanded, or modified last year, including seven crude oil projects:

- Russia may halt gas deliveries to Moldova as the country’s gas importer struggles financially because payments from consumers are inadequate to cover the utility’s surging import costs.

- China’s largest state-owned oil company improperly sold more than 1.32 billion barrels of crude to private refiners since 2006, officials ruled Wednesday, ending a two-year investigation into the firm that could result in a reversal of earnings and fees owed.

- More than half of China’s record number of solar installations last year were built on rooftops, totaling some 29 GW. Despite adding more renewable power last year than any other nation, the share of coal and gas in China’s power generation remained unchanged at 71%.

- Academics are lobbying against Canada’s plans for a carbon-capture tax credit in the country’s oil patch, saying the move would improperly subsidize fossil fuel development.

- GM announced it would expand its hydrogen fuel cell business beyond vehicles by supplying hydrogen-powered generators to construction sites, music festivals, data centers and the military.

- UAE-based renewables firm Masdar has inked deals with several French companies, including TotalEnergies, to develop green hydrogen projects for electricity generation and aviation fuel. The firm is also in talks to build a major solar field in Indonesia to send electricity to Singapore.

- Renewables companies and other firms in sustainable sectors raised a record amount of equity for further expansion last year.

- Canadian refiner Imperial Oil has pledged to lower emissions from its oil sands operations 30% by the end of the decade.

Supply Chain

- The White House on Tuesday said it would send $14 billion in infrastructure dollars to more than 500 projects targeting the nation’s ports and waterways this year.

- FedEx started selling capacity on empty 53-foot containers it imports from China, part of a new offering aimed at helping shippers bypass congestion at Southern California ports.

- Some air cargo carriers are warning of shipping delays and higher transport costs if 5G networks are rolled out near airports without safety features protecting airplane cockpits.

- DHL is advising customers to agree to longer-term contracts as a hedge against high freight costs expected to continue throughout 2022.

- Trucking company ArcBest and logistics provider NFI are investing $42 million in software that allows workers to operate forklifts remotely, a potential remedy for persistent labor shortages in the distribution sector.

- J.B. Hunt Transport beat expectations for earnings in the fourth quarter and surpassed $10 billion in annual revenue for the first time amid strong freight demand, rising rates and a tight labor market.

- Proterra will begin supplying batteries for some of Nikola’s electric semitrucks later this year.

- Auto output in Mexico fell 2% last year and is forecast to continue its sluggish pace for the first half of this year due to continued effects of the global chip shortage, Mitsubishi’s Mexican unit said.

- Dutch chipmaker ASML reported better-than-expected quarterly results and said it would continue struggling to meet high demand throughout 2022 with sales forecast to grow 20%.

- Israeli carrier ZIM signed eight-year charter agreements for three 7,000-TEU LNG-powered container ships.

M. Holland’s 2022 Plastics Industry Trends & Predictions

M. Holland’s market experts weigh in on what we can expect for the plastics industry in 2022. View the infographic and read more on current trends and predictions.

Domestic Markets

- The U.S. reported 979,920 new COVID-19 infections and 3,810 virus fatalities Wednesday. Computer models suggest the U.S. could see up to 300,000 more virus fatalities by mid-March.

- COVID-19 hospitalizations in the U.S. were at a record 158,000 yesterday.

- Americans will be able to start picking up free highly protective N95 masks at pharmacies and community health centers across the nation starting next week, the White House said.

- One percent of New Mexico’s population was infected with COVID-19 between last Friday and Tuesday.

- Three in 10 people who test for COVID-19 in Kentucky are positive, a record, while 1 in every 24 Mississippians has tested positive since the start of January.

- Daily COVID-19 cases in Iowa are at all-time highs.

- Nevada imposed a statewide mandate for indoor mask-wearing regardless of vaccination status.

- New Jersey will now require all healthcare workers to get a COVID-19 booster dose.

- Missouri’s attorney general threatened to sue school districts that impose mask mandates.

- Nearly 90% of Illinois school districts are struggling with staff shortages, while New Mexico tapped National Guard troops to serve as substitute teachers in short-staffed schools.

- Major national museums in Washington, D.C. are cutting back hours due to staffing shortages caused by COVID-19 infection.

- Florida’s seven-day average of new COVID-19 cases fell 25% in a week.

- COVID-19 case rates have started declining in California even as the state approaches all-time highs for hospitalizations.

- Starbucks will no longer require employees to be vaccinated against COVID-19 or undergo testing following the U.S. Supreme Court’s ruling that struck down the White House’s mandate for large companies.

- Researchers at Yale have developed a wearable device that can detect COVID-19 in the ambient air.

- New research continues to show that COVID-19 vaccinations provide better protection from future virus strains compared to prior infection.

- A genetic link has been found for the long-term loss of smell experienced by some people infected with COVID-19, a potential first step toward treatment.

- Moderna is working on a combined flu/COVID-19 shot that could be ready by late 2023.

- New airport safety buffers agreed to by wireless companies will allow some 62% of the U.S. aviation fleet to perform low-visibility landings at most airports without fear of interference from 5G mobile phone service, according to the FAA. Combined with clear weather, the announcement helped blunt many threatened flight disruptions Wednesday, the first day of 5G rollouts.

- United Airlines said the COVID-19 Omicron variant dented near-term bookings and will slow the carrier’s pandemic recovery by forcing a reduction in planned flight volumes this year to below pre-pandemic levels.

- First-time jobless claims jumped to 286,000 last week, higher than expected.

- New U.S. home builds rose to a nine-month high in December on a surge in multi-family housing construction. Single-family housing starts dropped 2.3% for the month.

- The average rate for a 30-year fixed mortgage rose to 3.64% last week, the fourth straight week of gains.

- Home sales hit a 15 year high in 2021, driven by low interest rates and the pandemic-induced shift to remote work.

- Bank of America and Morgan Stanley reported stellar quarterly results on Wednesday on a mix of higher investment-banking revenue and increases in consumer and business borrowing.

- Citigroup laid out goals for firms in the bank’s energy loan portfolio to cut emissions by almost 30% by 2030. The bank is also targeting a 63% reduction in emissions intensity for corporate borrowers across the power sector.

- The White House will invest $3 billion over the next 10 years from its bipartisan infrastructure bill to launch a comprehensive response to worsening wildfires in the U.S. West.

- New 3D printing technology using lasers for printing metals could revolutionize manufacturing in many applications and industries.

International Markets

- More nations are considering treating COVID-19 as an “endemic” disease like the flu, with expectations that the virus will occur regularly in certain areas according to established patterns.

- Germany reported more than 130,000 new COVID-19 infections the past 24 hours, its second straight daily record.

- Poland’s health minister is recommending a work-from-home mandate after the nation saw more than 30,000 COVID-19 cases Wednesday, the most since April.

- The Czech Republic has eliminated its COVID-19 vaccine mandates over growing concerns of social unrest, despite new cases rising to a record 28,469 on Tuesday.

- Portugal will allow COVID-positive people to leave their homes to vote in upcoming elections at the end of this month.

- Feeling singled out by the Netherland’s industry-specific COVID-19 restrictions, Dutch museums and theaters are reopening by describing themselves as hair salons and gyms.

- Britain will drop mask-wearing mandates, some vaccine requirements and remote work recommendations starting next week as COVID-19 infections begin to level off in most parts of the country. The nation reported more than 108,000 new cases Wednesday.

- New Zealand is temporarily closing its borders even to its own citizens over concerns of importing new COVID-19 Omicron cases.

- Hong Kong is returning to fully remote schooling amid rising COVID-19 infections.

- Beijing reported five new COVID-19 cases at a cold storage facility Wednesday, adding to the nation’s concerns of importing the virus from frozen food deliveries and other international parcel shipments. Some local authorities are requiring anyone who has accepted an international package to be tested within three to seven days.

- COVID-19 infections in India hit an eight-month high yesterday. Cases are declining in India’s largest cities, giving hope that the current Omicron surge is peaking.

- Mexico suffered nearly 60,000 new COVID-19 infections yesterday, a record.

- The COVAX vaccine-sharing initiative needs another $5.2 billion in funds to continue distributions to low-income nations, the agency said. A separate organization is seeking to deliver 100 million vaccine doses to countries across the Americas by the middle of this year.

- Researchers in Switzerland have started trials for a next-generation COVID-19 vaccine that could be delivered via arm patch.

- A vaccine manufacturing site under construction in South Africa could produce up to 1 billion doses per year by 2025.

- South African researchers say the COVID-19 Omicron variant could be more dangerous to children than other strains and more likely to resist the added protection offered by booster shots.

- Subtler symptoms of long-haul COVID-19 include memory loss and the inability to focus for up to nine months after infection, British researchers say.

- Two Japanese airlines announced they would resume service to the U.S. after Verizon and AT&T voluntarily delayed the rollout of some 5G networks near U.S. airports.

- China’s central bank lowered its benchmark rates Wednesday following a raft of economic data showing slowing growth in the final months of last year.

- Canadian inflation soared to a 4.8% rate in December, a 30-year high, prompting a potential interest-rate hike as soon as next week that economists estimate could be as high as 2%.

- British consumer prices rose 5.1% in December, the steepest rate since March 1992, putting new pressure on the Bank of England to raise interest rates.

- International firms fear cyberattacks more than any other threat to business activity, new survey results show:

- Hyundai Motor is partnering with quantum computer maker IonQ to develop longer-lasting and more efficient lithium batteries for electric vehicles.

At M. Holland

- M. Holland’s 2021 EcoVadis rating improved year over year, reflecting a continued commitment to sustainability and corporate social responsibility initiatives. See the press release.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.