COVID-19 Bulletin: January 24

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Crude benchmarks rose about 2% last week for their fifth straight week of gains. Oil futures were lower in late morning trading, with WTI down 3.0% at $82.58/bbl and Brent down 2.6% at $85.65/bbl. U.S. natural gas was 0.6% higher at $4.02/MMBtu.

- Oil markets are vulnerable to shrinking spare capacity among OPEC+ nations, who have consistently fallen short of production targets, which could cause big price spikes in the event of unexpected disruptions.

- The active U.S. oil rig count fell for the first time in three months last week.

- U.S. seaborne crude exports increased in recent weeks to roughly 3 million bpd, led by higher demand from Asia and Europe.

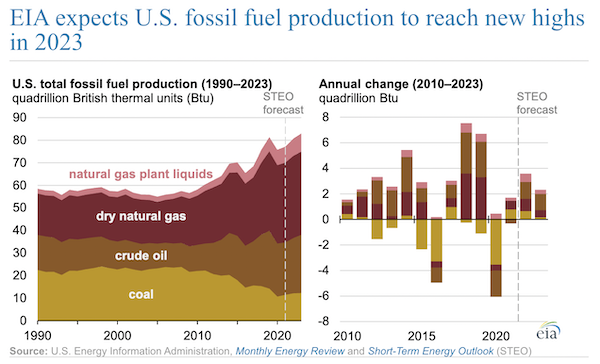

- U.S. fossil fuel production is set to hit record levels in 2023 due to increased efficiency and higher prices, the U.S. government predicts:

- Oil field servicer Schlumberger reported a larger-than-expected $587 million quarterly profit on higher crude and natural gas prices.

- The construction of Mexico’s giant Dos Bocas oil refinery is reportedly running $3.6 billion over budget, while delays could mean operations may not start in time for the state oil firm’s plan to end gas imports in 2023.

- The U.S. Treasury Department extended a moratorium on bond transactions related to Citgo, the U.S. subsidiary of Venezuela’s state-owned oil firm that has been used as collateral for loans by the cash-strapped government.

- Federal regulators cleared the way for construction to begin on New York’s first offshore wind farm.

Supply Chain

- The U.S.’s third major winter snowstorm in the past two weeks dropped six inches of snow in parts of the Southeast and mid-Atlantic over the weekend, causing more roadway delays.

- The U.S. closed its borders to unvaccinated and partially vaccinated truckers from Canada and Mexico Saturday.

- Canadian truckers began a caravan from Vancouver to Ottawa yesterday to protest the nation’s vaccine mandate for drivers.

- Container spot rates from Asia to the U.S. West Coast spiked up to 5% last week as demand rose ahead of China’s week-long New Year holiday starting Feb.1.

- After losing $5 million to cargo thefts the past year, Union Pacific said it is considering “serious changes” to its operating plans to avoid Los Angeles County, home of the U.S.’s largest transport network.

- The Port of Los Angeles saw a record 10.7 million TEUs of cargo last year despite unending congestion.

- Container throughput at the Port of Singapore declined slightly in December but ended the year 1.6% higher at 37.5 million TEUs, making it the world’s busiest container transshipment port. The island also reached a four-year high in bunker sales last year.

- Maersk raised its full-year earnings forecast after an 80% increase in shipping rates last quarter offset declining volumes.

- Trailer orders fell an annual 40% in December on supply disruptions, labor shortages and sporadic part and component availability, according to ACT Research.

- The U.S. consumer-price index rose at its fastest pace since 1982 in December, jumping 7% from the year-ago period, while the food-at-home index rose 6.5% in 2021, the largest over-the-year increase since 2008.

- COVID-19-induced worker shortages are adding further strain to the U.S. food supply, with in-stock levels falling to a half-year low.

- Prices for palm oil, the world’s most consumed edible oil, rose 2.6% to an all-time high of $1,272/ton last week due to labor shortages in Indonesia and Malaysia.

- Prices for construction materials rose 20% last year, including a 34% hike in plastic construction products.

- Hundreds of British construction businesses are failing every month due to rising material prices and labor shortages.

- California beer prices are rising on a shortage of barley caused by droughts.

- With many of the largest new semiconductor facilities not expected to be operational until 2023 at the earliest, global chip supply will likely remain limited throughout this year, according to Deloitte.

- Apple supplier Foxconn is expanding its involvement in electric vehicles (EVs), most recently entering a partnership to support EV battery and infrastructure development in Indonesia.

- Contract manufacturer Compal Electronics, a supplier for Dell and Amazon, suspended production at a Taiwan factory after an outbreak of the COVID-19 Omicron variant.

- China’s semiconductor output rose 33% last year while imports increased 23.6%.

- Recreational-goods retailer REI plans to open a 400,000 square-foot warehouse in Lebanon, Tennessee, as early as next year.

- J.B. Hunt has recruited Waymo to bring self-driving technology to its fleet.

- A startup led by former SpaceX engineers is preparing to build fully autonomous electric railcars.

- WorkStep, a startup aimed at helping companies hire and retain supply chain workers, raised $25 million in financing to develop its software.

- IBM acquired an Australian supply chain analytics firm with software focused on tracking environmental performance across operations.

M. Holland’s 2022 Market Trends & Predictions: Healthcare

M. Holland’s Global Healthcare Manager, Josh Blackmore, shares his insight on the healthcare and medical device market for 2021 and 2022.

Domestic Markets

- The U.S. reported 204,804 new COVID-19 infections and 572 virus fatalities Sunday.

- The seven-day average for new COVID-19 hospital admissions appears to have plateaued, according to the U.S. Department of Health and Human Services.

- COVID-19 hospitalizations in California are at their highest since last January. The Los Angeles Unified School District is requiring only non-cloth masks for students beginning today.

- COVID-19 hospitalizations in Arkansas set a record high on Saturday for the fifth consecutive day.

- COVID-19 cases are surging among children in New Mexico, with more than 10,000 pediatric infections reported for the week ending Jan. 17. The virus also is causing staffing shortages among teachers, prompting the state to streamline the process to allow National Guard members and state workers, including the governor, to work as substitute teachers.

- New York’s COVID-19 positivity rate dropped below 10% over the weekend for the first time since Dec. 20, while virus hospitalizations have dropped 12% over the past 10 days.

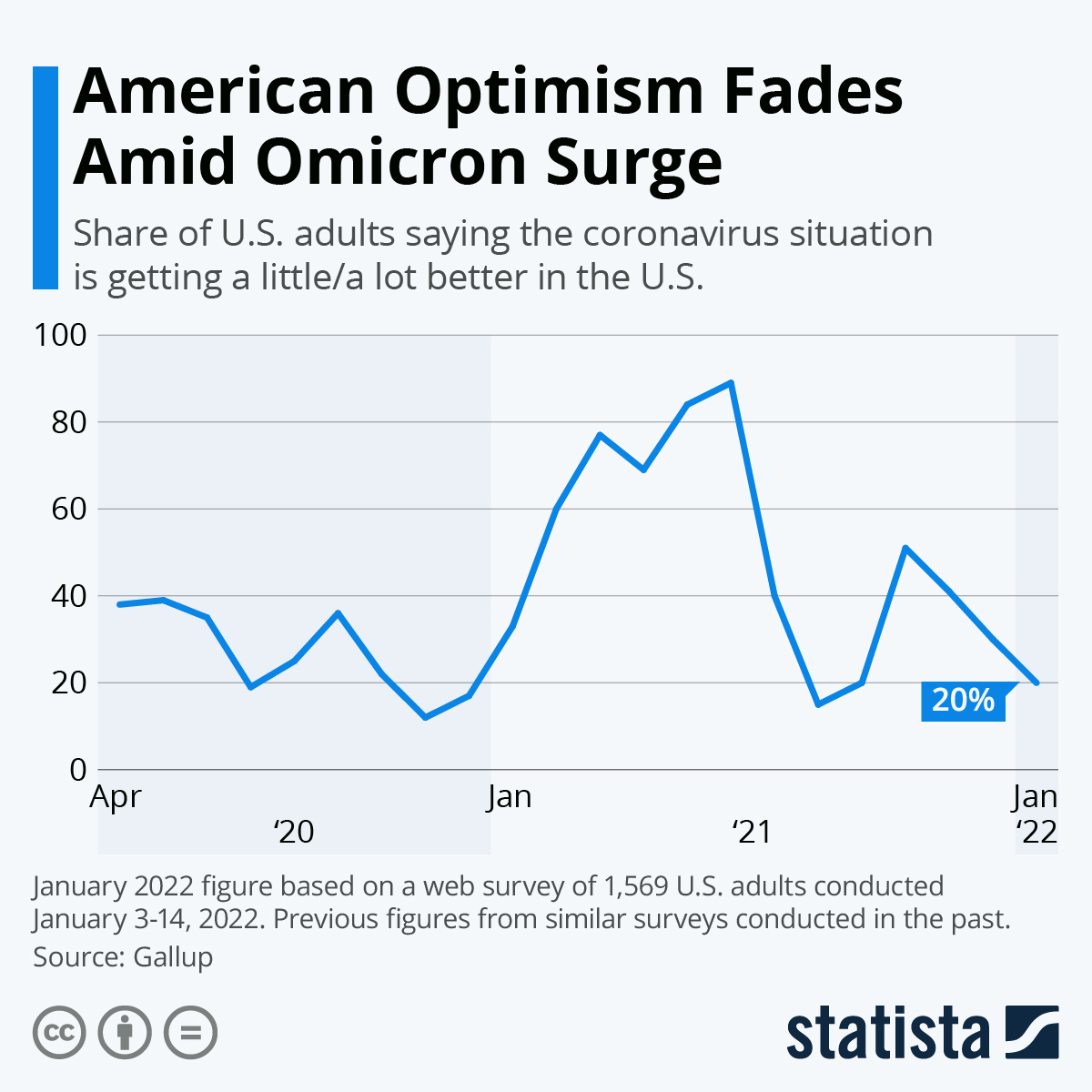

- American optimism over the current state of the COVID-19 pandemic is approaching all-time lows:

- Health officials are tracking a subvariant of Omicron, named BA2, or the “stealth Omicron,” which has been detected in 40 countries and may be more transmissible than its predecessor, BA1.

- Without a consistent set of rules on COVID-19, businesses are being forced to navigate an increasingly complex and often contradictory patchwork of federal, state and local regulations on vaccines, testing and safety measures.

- Unvaccinated Americans over age 50 are 44 times more likely to wind up in the hospital from COVID-19 than people who have gotten a booster.

- COVID-19 booster doses made by Pfizer and Moderna were 90% effective in preventing hospitalizations from the Omicron variant, the latest data shows.

- COVID-19 vaccines for U.S. children under the age of 5 could be approved by March, federal health officials say.

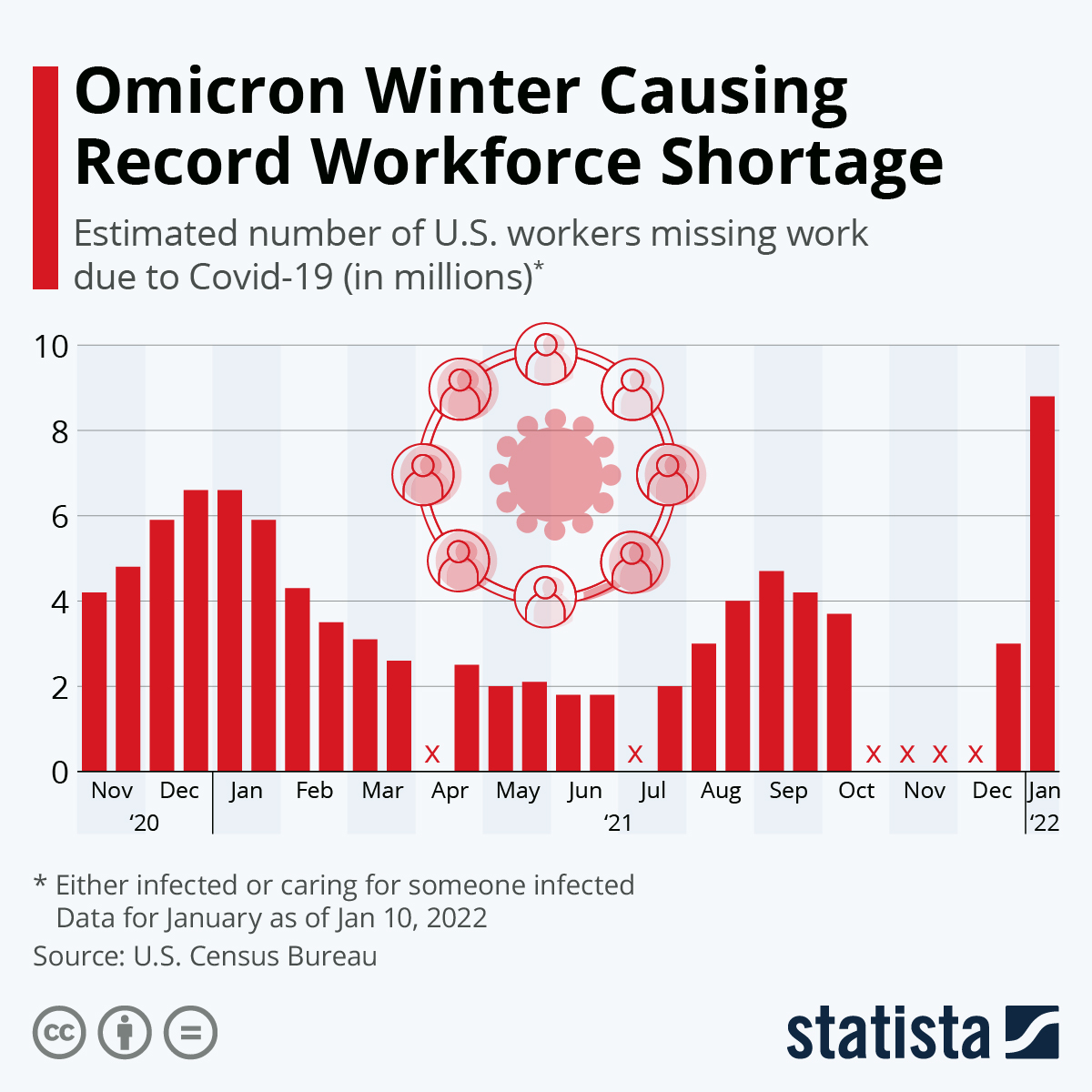

- The largest workforce shortage of the pandemic came during the first half of January with nearly 9 million people out sick or caring for sick loved ones, new data shows:

- The U.S. began imposing its new COVID-19 vaccine requirement for non-citizens arriving at the nation’s land ports of entry and ferry terminals, requiring anyone who is not a U.S. citizen or permanent resident to provide proof of full vaccination to enter the country.

- Both United Airlines and American Airlines posted losses for the final quarter of 2021, citing impacts from the COVID-19 Omicron variant. Executives expect a return to profitability to be delayed by half a year or more.

- Just 18 U.S. flights were canceled on the second day of 5G network rollouts last Thursday, as the FAA continues to expand airline operations in 5G zones.

- Home fitness maker Peloton will suspend production of bikes and treadmills after demand waned after the company’s early pandemic popularity.

- GlaxoSmithKline Healthcare has rejected three acquisition bids from Unilever, as the consumer goods supplier signals it may want to expand further into health, beauty and hygiene products.

- Ford stopped taking orders for its compact Maverick pickup truck until this summer. Separately, the automaker selected a general contractor to build its massive Blue Oval City electric vehicle production complex in Tennessee.

- GM and its battery partner plan to invest $6.5 billion in electric vehicle and battery plants in Michigan, expected to create 4,000 jobs in Lansing and Greater Detroit.

International Markets

- Russia reported more than 63,000 COVID-19 infections yesterday, its third record high in as many days.

- Germany’s leaders were meeting today to confer on the nation’s COVID-19 response after a string of daily new case records over the past two weeks and as the infection rate soared to over 840 per 100,000 citizens.

- The Czech Republic recorded nearly 13,000 new COVID-19 cases Sunday, the most since the start of the pandemic.

- Single-day COVID-19 fatalities in Australia hit a new high over the weekend.

- New Zealand is imposing new mask mandates and limiting capacity at gatherings after a recent cluster of Omicron COVID-19 cases emerged, prompting its prime minister to cancel her own wedding plans as a result.

- Mainland China reported 57 new COVID-19 cases Sunday as concerns build over measures the country may use to contain the virus before February’s Olympics in Beijing, where 72 virus cases have been reported among Games’ personnel. The nation is cancelling more passenger flights from the U.S. and other nations.

- Hamsters may be fueling Hong Kong’s latest COVID-19 outbreak.

- COVID-19 vaccine makers are lowering sales estimates for this year based on the reduced severity of the Omicron variant.

- Australia’s Qantas Airways is cutting passenger capacity 60% below pre-pandemic levels next quarter due to continuing effects of pandemic travel bans.

- Hong Kong and China have resumed some Boeing 737 MAX flights following a more than two-year grounding of the aircraft.

- A legal battle is escalating between Airbus, the world’s largest plane maker, and Qatar Airways, the world’s largest long-haul airline, with Airbus recently terminating a $6 billion jet contract with the carrier.

- Germany’s economy likely shrank between 0.5% and 1% in the fourth quarter, sending an ominous signal to other European nations hoping for an economic rebound in the new year.

- Eurozone economic activity grew at its slowest pace in nearly a year as COVID-19 infections take a toll on the services industry, with IHS Markit’s purchasing managers index dropping to 52.4 in January from 53.3 in December.

- Debit card usage in the U.K. rose significantly for the first two weeks of the year, with consumer spending up 27% from the same period of 2020, though rising inflation in the nation has caused concern that the spending is unsustainable.

- China’s economy expanded 8.1% last year despite slowing growth in the final months of 2021. The nation’s goods exports rose 30% to a record $3.36 trillion.

- Foreign investment rebounded to $1.65 trillion last year to surpass pre-pandemic levels, while relatively little of the surge went toward boosting manufacturing capacity despite widespread goods shortages.

- A Mitsubishi/Nissan/Renault alliance is expected to announce plans to invest over $23 billion to develop 30 electric vehicle models on five different platforms.

- Luxury car brands including Rolls-Royce, Bentley, Porsche and BMW are reporting record sales while sales of mainstream vehicles lag.

- The relative ease of building electric cars is allowing new entrants into the world of vehicle manufacturing, most recently consumer electronics giant Sony.

- Lamborghini will unveil its first electric vehicle in 2023.

At M. Holland

- M. Holland’s 2021 EcoVadis rating improved year over year, reflecting a continued commitment to sustainability and corporate social responsibility initiatives. See the press release.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.