COVID-19 Bulletin: January 31

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose Friday for their sixth straight weekly gain, the longest win streak since October. Energy futures were higher in late morning trading, with WTI up 0.5% at $87.25/bbl and Brent up 1.2% at $91.14/bbl. U.S. natural gas was 1.9% higher at $4.73/MMBtu.

- The number of active U.S. oil and gas rigs rose by six last week to 610, up more than 225 from the same time last year as higher oil prices attract more drilling activity.

- The national average for a gallon of gas in the U.S. rose to $3.348 last week, up from $3.286 a month ago and $2.408 a year ago.

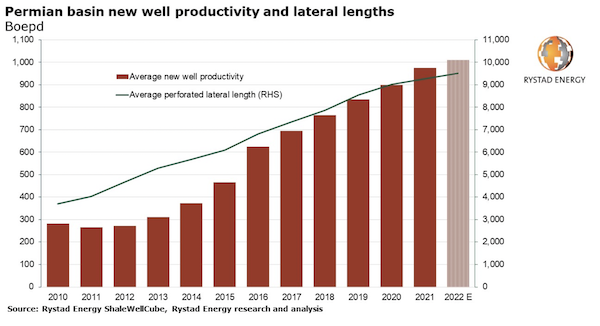

- The average productivity of new wells in the U.S. Permian Basin will hit a record high in 2022, breaching 1,000 barrels of oil equivalent per day on a surge in lateral well length.

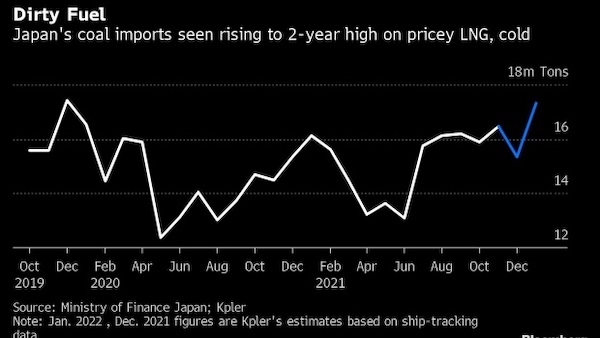

- Global coal prices are shooting back to record highs as political tensions in Eastern Europe escalate, and high LNG prices continue forcing some nations, including Japan, the world’s third-largest importer, to scramble for alternative power generation supplies.

- The U.S. administration finalized a rule that would give oil refiners more time to comply with biofuel blending mandates, including those from previous years.

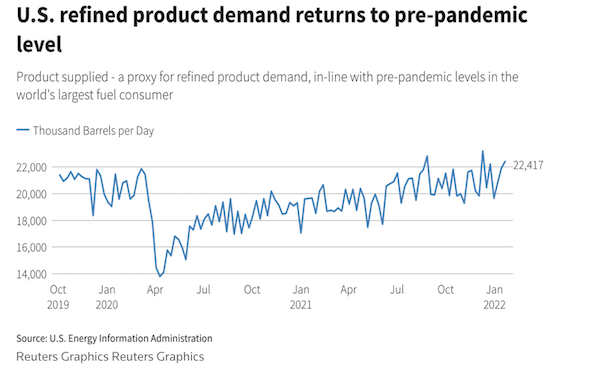

- U.S. refiner Phillips 66 smashed Wall Street expectations for fourth-quarter earnings despite rising input prices, as travel opened up and demand for refined products rose to pre-pandemic levels:

- Chevron earned $15.6 billion last year, a seven-year high after a loss of more than $5 billion during the first year of the pandemic.

- A union representing 30,000 U.S. refinery and chemical plant workers rejected a pay increase offered by lead negotiator Marathon Petroleum, with current contracts set to expire tomorrow.

- Austria is paying $1.9 billion to residents to help cover the costs of surging European energy prices.

- China will have more renewable and low-carbon power generation capacity than fossil fuel capacity by the end of 2022, officials say.

Supply Chain

- A severe winter storm blanketed New England with heavy snow and hurricane-force gusts last weekend, cutting power to more than 100,000 people and all but shutting down major roadways.

- Port congestion is spreading to every port in the U.S. as more importers attempt to circumvent severe bottlenecks in Southern California.

- The U.S. Department of Agriculture will help fund a new container yard for farm exports at California’s Port of Oakland, one in a series of “inland pop-up ports” that have helped improve the flow of goods at other U.S. gateways.

- Nearly, 1,700 dockworkers in Southern California tested positive for COVID-19 in January, more than the entirety of 2021.

- Thousands of trucks are stuck at Chili’s borders with Argentina and Bolivia awaiting COVID-19 tests required to enter the country, with some stranded for weeks.

- Norfolk Southern and Union Pacific both saw total volume decline 4% in the fourth quarter as rising COVID-19 cases among workers hampered transit operations.

- China and Vietnam are urging workers to cancel trips home during Lunar New Year, which starts tomorrow, amid fears that COVID-19 outbreaks could lead to more factory shutdowns.

- The Department of Homeland Security’s recent COVID-19 mandate, which makes no exceptions for essential workers, could create havoc for seasonal migrant workers and businesses.

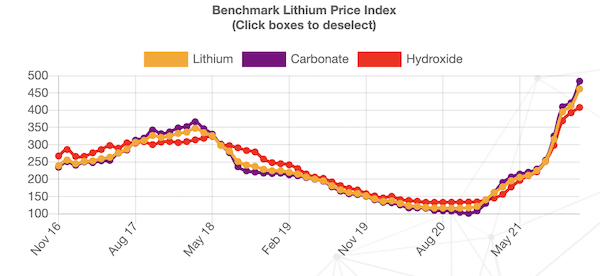

- Many key electric-vehicle battery metals, including processed lithium, are in short supply and prices for the materials are rising sharply.

- The price of aluminum is up 24% over the past six months to more than $3,100 per metric ton, a near-decade high.

- High fertilizer costs are forcing farmers across the globe to cut back on production, signaling global food-price bills could go higher this year after hitting multi-decade highs in 2021.

- Supply chain and COVID-19 issues have delayed the start of Steel Dynamics’ new mill in Texas.

- Key household appliances including washing machines and refrigerators will remain in short supply this year as elevated COVID-19 infections fuel disruption at Whirlpool, the firm’s CEO said.

- Bed Bath & Beyond ran short of 200 bestselling items over the holiday season, resulting in $100 million in lost sales for the most recent quarter.

- Planned capacity expansions should double global sales of semiconductors to more than $1 trillion within the next decade, analysts say.

- The debate is growing over whether firms should stock up on inventories or continue relying on just-in-time supply chains, whose benefits were widely undercut by pandemic-induced logistics snarls.

- Orient Overseas Container Line reported $4.88 billion in fourth-quarter freight revenue, more than double the same period in 2020 on a 16.9% decline in volume and a 142.3% increase in average revenue per container.

- Dutch startup EcoClipper is refitting a 110-year-old sailing vessel for cargo service in the North Sea.

- Costco’s shareholders voted last week to make the retailer set out plans for net-zero carbon emissions deep in its supply chain.

Domestic Markets

- The U.S. reported 96,887 new COVID-19 infections and 321 virus fatalities Sunday. Hospitalizations have slowed 8% from a peak on Jan. 20, while the lagging indicator of average daily fatalities is up to 2,379.

- COVID-19 hospitalization rates are declining fastest in the U.S. Northeast, the first region to get hit by the U.S.’s Omicron wave.

- Despite new COVID-19 cases declining sharply in Florida, the state’s virus fatalities are at their highest level since the last wave of the Delta variant.

- Puerto Rico is dropping testing requirements for vaccinated visitors from the mainland while mandating that government workers and contractors receive a COVID-19 vaccine booster by Feb. 28.

- One-third of all U.S. COVID-19 cases have occurred since early December.

- The U.S. COVID-19 booster drive is stalling with only about 40% of eligible Americans having received a third shot.

- Health care providers are using Merck’s COVID-19 antiviral pill as a last resort when treating the virus due to its low efficacy and potential safety concerns among high-risk individuals.

- The U.S. administration procured another 100 million COVID-19 tests on top of the 500 million already slated for no-cost distribution to Americans.

- New York City will begin distributing free, home-delivered COVID-19 antiviral pills to infected residents.

- T-Mobile will begin firing unvaccinated corporate employees by April 2, the firm said.

- Student enrollment in New York City is at a decade low, emblematic of the entire U.S. public-school system contending with staff shortages, low attendance rates and fluctuating COVID protocols.

- U.S. consumer outlays fell a surprise 0.6% in December, the first decrease since last winter.

- The U.S. dollar is near an 18-month high against the euro after having its best week in seven months, supported by investors seeking safety amid a sell-off in riskier assets and by analysts raising forecasts for U.S. interest rate hikes.

- Large U.S. fast food chains are eliminating or substantially reducing their value menus as inflation lowers margins.

International Markets

- Russia is in the middle of its worst COVID-19 wave of the pandemic, with a record 112,288 new cases reported Sunday.

- England is expanding its COVID-19 vaccine eligibility to include high-risk children between ages 5 and 11.

- Australia, which recorded a record 98 COVID-19 deaths Friday, reported around 34,000 new COVID-19 infections and 44 virus-related deaths Monday, the lowest daily totals in several weeks.

- Officials in Beijing have locked down two more neighborhoods ahead of this week’s Olympic Games, after the city reported an additional 20 new COVID-19 cases over the weekend along with 37 new infections among athletes within the Games’ closed-loop system.

- COVID-19 fatalities in Ontario, Canada, are at record highs.

- The International Automobile Federation is requiring all Formula One staff to be vaccinated against COVID-19 when its new season starts in March, mandating shots for all drivers, teams, media and hospitality guests.

- India’s economy is forecast to grow between 8 and 8.5% in the next fiscal year starting in April.

- France’s economy saw its strongest growth in 52 years last year, expanding 7% and almost making up for the previous year’s decline of 8%.

- Eurozone economic growth slowed during the final quarter of 2021, expanding by just 0.3% between October and December, compared to 2.3% in the previous quarter.

- China’s economy continued slowing at the start of the year, with surveys of purchasing managers showing a dip in spending due to COVID-19 curbs and the sharpest contraction in factory activity in almost two years.

- Japanese factory output shrank for the first time in three months in December as a decline in machinery output offset a small rise in car production.

- Economists are trimming forecasts for global economic growth this year over worries that inflation rates will rise even faster than predicted.

- Daimler AG will formally change its name to the title of its flagship brand, Mercedes-Benz, a year after the automaker spun off its truck and business division.

- Toyota’s sales rose 10% last year despite the global chip shortage, cementing the firm’s position as the world’s largest automaker for the second year in a row.

- China’s Great Wall Motor will invest $1.81 billion over the next decade to produce electric vehicles in Brazil.

- Swiss-based automation company ABB is boosting its majority stake in Chinese electric vehicle charging provider Chargedot to 80%.

At M. Holland

- Our Healthcare team has published a revised Medical Resin Selector Guide containing additional resins, new focus grades and new 3D printing resins.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.