COVID-19 Bulletin: July 8

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices fell nearly 2% Wednesday, as the American Petroleum Institute reported a larger-than-expected crude draw of 7.98 million barrels last week.

- Futures prices were higher in late morning trading, with the WTI up 0.5% to $72.57/bbl, Brent up 0.6% to $73.84/bbl and natural gas up 2.8% to $3.70/MMBtu.

- Average U.S. diesel prices rose for the tenth consecutive week to $3.33 per gallon for the week ended June 28, up $0.89 since the same time last year.

- U.S. consumption of petroleum products, natural gas and coal fell 9% from 2019 to 2020, the largest yearly drop since at least 1949, to the lowest level of consumption in at least 30 years.

- U.S. and Canadian trade officials expressed concern over the increasing nationalization of Mexico’s energy industry, saying the moves discriminate against foreign companies and discourage investment.

- A sticking point for the United Arab Emirates in its failed output talks with OPEC was the demand to be able to produce more crude as an individual nation, a bid to stock up on cash and diversify its economy before greener energy takes over.

- China’s crude oil imports rose 8.8% from May to June to an average of 10.5 million bpd.

- Argentina’s government is working to sanction a number of foreign oil firms drilling in the country’s disputed area near the British-controlled Falkland Islands.

- Investments of over $60 billion will be required for Canada’s oil sands industry to meet its goal of achieving carbon neutrality by 2050, with much of the funding expected from public coffers.

- The plastics industry, a net beneficiary of the pandemic in 2020, faces mounting margin pressures as more refiners shift from fuel production to plastics, feedstock costs rise and concerns return about plastic pollution.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Tropical Storm Elsa is expected to track up the U.S. East Coast from South Carolina to New England after making landfall in Florida yesterday before moving inland with heavy rains and storm surges.

- Scandinavian regions are experiencing the hottest weather in decades, the Northern Hemisphere’s latest extreme weather event in an unusually busy heat and wildfire season.

- Scientists believe climate change creates a greater risk for more frequent extreme weather events, warning that last week’s record-setting heat wave in the Pacific Northwest could occur every five to 10 years in the future.

- The White House issued an executive order aimed at challenging consolidation and predatory pricing in the rail and ocean shipping industries.

- Japanese carmaker Toyota sold more cars in the U.S. than General Motors for the first time ever between April and June, largely a result of Toyota’s previous stockpiling of computer chips that allowed it to continue production while rivals shut down.

- Roughly 150,000 Vietnamese technology laborers are living at the industrial parks where they work, a desperate bid to reduce further global supply chain disruption in the home of major suppliers including Samsung and leading Apple manufacturers.

- The cost to ship a 40-foot container from China to the U.S. rose 5% over the past week to $9,631, a 229% increase from a year ago.

- A container ship suffered an explosion at one of the world’s busiest ports in Dubai yesterday, charring nearby containers and causing an unspecified amount of damage to the sprawling port and surrounding cargo.

- Congestion at China’s Yantian Port is easing after several weeks of bottlenecks, with overall productivity increasing to 85% of normal levels while nearby ports face increasing delays.

- More shipping vessels — including container ships, tankers and bulkers — were bought and sold in the first half of 2021 than any other six-month period on record, while orders for newbuilds also hit a record high.

- A European Union agency is recommending the shipping sector be integrated into the bloc’s carbon quota system due to extremely high levels of emissions produced in 2020.

- U.K. officials are relaxing time restrictions for heavy-duty truck drivers this month as a short-term remedy for a severe shortage of drivers following Brexit and the effects of the pandemic.

- German logistics firm Deutsche Post raised profit forecasts for the rest of 2021 and gave additional pandemic bonuses to staff, as the company predicts a continued boom in e-commerce activity.

- Amtrak placed a $3.4 billion order for 73 trains powered by hybrid engines to be produced by Siemens Mobility.

- Our logistics team reports that bulk trucking firms are often declining to book long-haul, out of network loads due to extreme capacity constraints.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports primarily due to increased volume of ships and containers. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- There were 22,931 new COVID-19 cases and 312 deaths in the U.S. yesterday. Over 48% of the population is fully vaccinated.

- Twenty-four states experienced upticks in COVID-19 infections of 10% or more over the past week as the Delta variant, dubbed “Covid-19 on steroids,” rapidly spreads.

- Roughly 1,000 counties primarily in the U.S. Southeast and Midwest have COVID-19 vaccination rates less than 30%, a worrying statistic as the highly transmissible Delta variant became the nation’s most prevalent strain.

- Arkansas reported 547 new COVID-19 cases Wednesday, the most in several months as hospitalizations in the state also increase.

- Roughly 28% of COVID-positive people in Oklahoma are admitted to the hospital, a result of increased Delta variant infections and fewer people getting tested.

- Roughly 30% of Americans believe the COVID-19 pandemic is over while nearly 90% believe the situation is at least improving, according to a recent Gallup poll.

- The U.S. military could make COVID-19 vaccines mandatory for all troops, Pentagon officials said.

- The Minneapolis Federal Reserve Bank is requiring all employees to be vaccinated for COVID-19 by the end of August.

- The supply of donated blood in the U.S. has been severely curtailed by the loss of blood drives and fewer community donors during the pandemic, forcing hospitals to postpone surgeries.

- Twenty-four major industry organizations and dozens of lawmakers are urging the White House to ease travel restrictions on those entering the country by July 15.

- First-time unemployment claims unexpectedly inched higher last week to 373,000, rising by 2,000 from the prior week. Economists expected claims to fall to 350,000.

- Minutes of the Federal Reserve’s June meeting were released yesterday, revealing central bank officials were not ready to set a timeline for scaling back pandemic-induced asset purchases due to continued economic uncertainty. Several participants, however, noted surprise at a stronger-than-expected surge in U.S. inflation, which could require faster easing of economic support, a sentiment shared by the International Monetary Fund.

- U.S. grocery sales are nearly 15% higher than pre-pandemic levels, prompting retailers to stockpile goods as inventories become tighter.

- After 12 straight monthly increases, global food costs fell 2.5% in June, providing some relief to inflation fears.

- Fearing a pandemic resurgence and weakening global recovery, investors are rushing into U.S. Treasurys, sending the yield on 10-year Treasurys to 1.25%, the lowest since the first quarter.

- U.S. companies were involved in over $1.7 trillion worth of mergers in the first six months of 2021, a four-decade high spurred by continued low interest rates.

- Shares of Apple rose nearly 2% Wednesday after the company raised its growth outlook for the second half of 2020, predicting higher sales of iPhones.

- U.S. businesses are expected to spend record amounts on software this year, with a focus on process automation, artificial intelligence and security. Some of the investment will go toward reworking predictive modeling systems after more than a year of severely skewed data caused by the pandemic.

- U.S. airlines are running into a myriad of problems as air travel rapidly returns, ranging from a shortage of pilots and staff to cancellations and delays caused by overbookings.

- Home mortgage applications in the U.S. last week fell to the lowest level since early 2020, as a wave of refinancings was completed and home prices continued to rise amid short supply.

- Consumer borrowing in the U.S. was up 39% in April over the year-ago period and 11% over the level of April 2019.

- U.S. apparel imports rose 35.3% in the first five months of 2021.

- U.S. law school admissions are up 28% this year compared to the same time last year, a surge fueled by increasing awareness of social issues and the traditional attractiveness of graduate school during economic downturns.

International

- More than 4 million people have now died from COVID-19 globally, about equal to the number of people killed in battle in all of the world’s wars since 1982.

- New COVID-19 cases in the U.K. broke 30,000 Thursday for the first time since January, less than two weeks before the nation is set to end most remaining pandemic restrictions.

- Daily COVID-19 deaths in Indonesia nearly doubled Wednesday from two days prior, breaking past 1,000 for the first time as the nation’s virus surge worsens.

- South Korea reported 1,275 new COVID-19 cases Thursday, a record.

- New South Wales, Australia’s most populous state reported 38 new COVID-19 cases Wednesday, the most in a year as officials weigh the merits of continuing a strict lockdown.

- With the summer Olympics scheduled to begin July 23, Japan declared a state of emergency through August 22 for Tokyo to contain spiking COVID-19 infections. The Olympic Games could look much different from years past, with Japan expected to restrict or eliminate spectators while keeping athletes separated from each other and their families.

- Central banks in the U.S., Europe, and Japan have spent nearly $9 trillion on economic stimulus since the pandemic began, a record.

- U.K. businesses hired the most permanent staff in June since the late 1990s, while both job openings and employee salaries approached years-old highs.

- Japanese bank lending rose at its slowest pace in eight years in June as cash-rich companies held onto savings amid continued economic uncertainty.

- More than 200 million people in India have reverted to earning less than minimum wage because of the pandemic, which swiftly wiped out decades of economic gains in the nation.

- Almost 130 of 150 major global cities saw real estate prices rise year over year in the first quarter of 2021, with prices in 43 growing at double-digit rates.

- France is discouraging citizens from vacationing in Portugal and Spain because of rising COVID-19 infections there, dampening expectations for Europe’s tourist season.

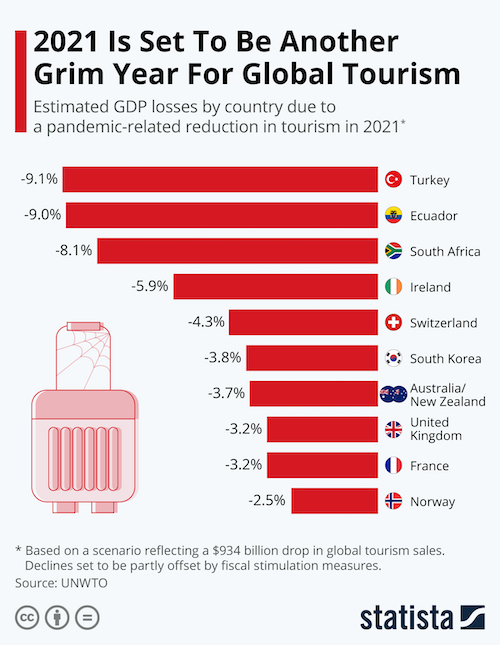

- While the U.S. airline industry returns full force, global passenger air travel remained 63% lower in May 2021 than pre-pandemic levels for the same period.

- Four global banks are launching a voluntary carbon-credit trading platform next month, a sign of growing financial interest in the carbon offset market.

- Stellantis said it will invest over $35 billion in the next four years to electrify all 14 of its vehicle brands.

- British carmaker Lotus unveiled its last gas-powered car this week as the small company seeks to become a major player in the electric vehicle market by the end of the decade.

Our Operations

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.