COVID-19 Bulletin: July 13

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices fell slightly Monday amid concerns about the effect of COVID-19 variants on the global economic recovery, while a dispute between Saudi Arabia and the United Arab Emirates continues to stall OPEC’s progress in increasing oil output.

- Crude futures were higher in late morning trading, with WTI up 0.9% at $74.74/bbl and Brent up 1.0% at $75.94/bbl. Natural gas was 1.0% lower at $3.71/MMBtu.

- Liquefied natural gas prices are rising across the world and could remain elevated for another year or more, a result of various extreme weather events and countries rapidly reopening economies.

- The White House is preparing to release a new plan to limit sales of U.S. offshore drilling rights, a partial measure drawing criticism from environmentalists seeking outright bans on the practice.

- Royal Dutch Shell inked a five-year contract to supply PetroChina with “carbon-neutral” liquefied natural gas. Shell plans to offset its emissions by investing in nature-based projects such as reforestations and land restorations. Separately, Shell announced plans to join a clean hydrogen project in Norway.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- The U.S. West faced another day of record high temperatures Monday, with over 18 million people under heat alerts.

- More than 1 million acres of land in California, Oregon, Washington and western Canada have fallen victim to wildfires this season:

- The Bootleg wildfire in southern Oregon nearly doubled to more than 150,000 acres, forcing some evacuations and severely straining a power grid the state shares with California.

- California has twice as many acres burning in the first six months of 2021 than in the same period last year. The state’s Sugar Fire north of Sacramento is the largest of the season, spreading to more than 90,000 acres with only 8% containment, while the River Fire in the state’s center grew from 10 to 4,000 acres since Sunday.

- Flash flood, thunderstorm and tornado warnings in the New York metro area persisted this morning, as remnants of Tropical Storm Elsa continued dissipating over the U.S. East Coast.

- More than 100 COVID-19 outbreaks were reported from shipping vessels and offshore platforms in April and May, as low vaccinations among seafarers are expected to continue disrupting trade.

- Continued congestion problems at the Port of Long Beach have prompted Levi Strauss to ship the bulk of its product through the U.S. East Coast.

- China’s export volumes rose 32.2% in June from a year earlier, crushing expectations and accelerating gains from the previous month despite concerns over rising raw material prices and global shipping delays.

- Aircraft leasing company BBAM has ordered 12 additional Boeing 737-800 converted freighters to meet rising demand from the e-commerce and express cargo markets.

- Spot truckload rates averaged $3.18/mile over the past two months, up from $2.96/mile in the last two months of 2020, with rising fuel costs driving most of the increase.

- Lumber prices at Monday’s market close were down 0.6% for the year, a staggering reversal from previous record highs and a potential precursor to other commodity price declines.

- New fallout from the global semiconductor chip shortage is affecting small businesses and municipalities, which must compete for a limited supply of commercial vehicles.

- German auto supplier Kuka AG will build the initial fleet of General Motors’ new electric commercial vans, hoping to deliver the fleet to FedEx before the end of the year.

- Volvo Trucks reopened its Virginia assembly plant Monday after reaching a tentative contract with striking workers.

- French handbag maker Longchamp will ship at least 50% of its trans-Atlantic container volume on one of Neoline’s new sailing cargo ships set to begin operation in 2024.

- Crowley Maritime Corporation will build the U.S.’s first zero-emission, fully electric tugboat scheduled to operate from the Port of San Diego in 2023.

- German energy exchange EEX launched a zero-carbon freight index Monday, allowing investors to see for the first time how the cost of carbon emissions could affect freight prices.

- Our logistics team reports that bulk trucking firms are often declining to book long-haul, out of network loads due to extreme capacity constraints.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports primarily due to increased volume of ships and containers. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- The U.S. averaged more than 19,000 new COVID-19 cases per day the past seven days, a 47% increase from the week prior. The country reported 32,765 new COVID-19 cases and 236 deaths Monday.

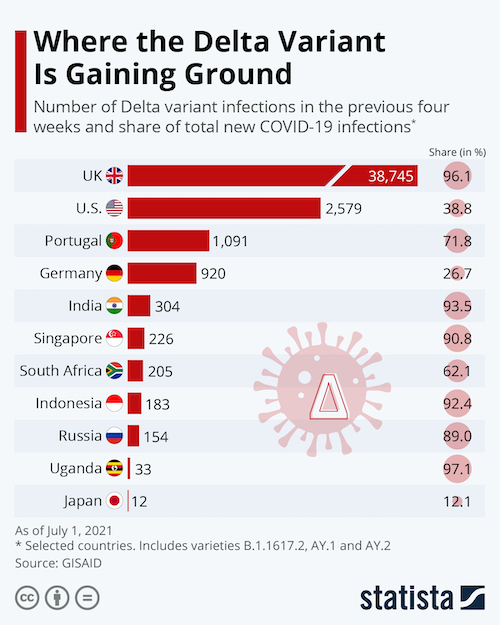

- The U.S. is second only to the U.K. for the number of new infections with the highly transmissible Delta variant:

- Most fully vaccinated people who become infected with the COVID-19 Delta variant are asymptomatic, the World Health Organization says.

- COVID-19 cases in Arkansas topped 1,000 for three straight days, the highest levels since February.

- COVID-19 cases in California and New York City have been rising the past two weeks.

- New York state reported just one COVID-19 death Sunday, the lowest since the start of the pandemic.

- The federal government will provide rural hospitals in Missouri and Kansas with nearly $31 million in support following jumps in the seven-day average of COVID-19 cases in each state.

- Florida is averaging 3,380 new COVID-19 infections per day as cases of the virulent Delta strain spread.

- Over 10% of Michigan residents have contracted COVID-19 since the start of the pandemic, new data shows.

- Pfizer met with top U.S. health officials to request federal approval of a booster dose of its COVID-19 vaccine, with the U.S.’s top medical adviser reiterating booster shots are not currently needed, as 99% of the nation’s virus deaths in June were among unvaccinated people.

- The FDA issued a new warning that Johnson & Johnson’s single-shot COVID-19 vaccine could heighten risk for a rare neurological condition causing weakness and tingling in the arms and legs.

- With 71% of the state’s employers eyeing a hybrid work model, New York’s bus, trains and subway systems are at risk of losing key revenue generated by commuters.

- U.S. consumer prices rose 5.4% in June from a year earlier, the biggest year-over-year jump since 2008, with a 10.5% rise in used car and truck prices leading the increase.

- A survey by the New York Federal Reserve shows the general public expects U.S. inflation to hit 4.8% a year from now, up from projections of 4% recorded in May, while economists point to reversals of recent trends in globalization, demographics and e-commerce that could increase inflationary pressures.

- Boeing will halt production of 787 Dreamliners for roughly three weeks over a newly discovered problem, the company’s third production stoppage in the past year for the jets.

- The share of U.S. restaurant and hotel workers leaving their jobs hit a two-decade high in May at 5.7%, as employment in the industry remains down roughly 1.3 million jobs since the start of the pandemic.

- To attract scarce workers, McDonald’s franchises are offering higher wages, paid time off and tuition reimbursement.

- Meal-kit service Blue Apron announced plans to use only 100% recyclable, reusable or compostable material for its meal kit boxes by the end of 2025.

International

- Indian health officials are warning state governments and citizens to stay vigilant against COVID-19, saying that a third wave of the virus is unavoidable, as the country reported more than 37,000 new cases and 700 virus deaths Monday.

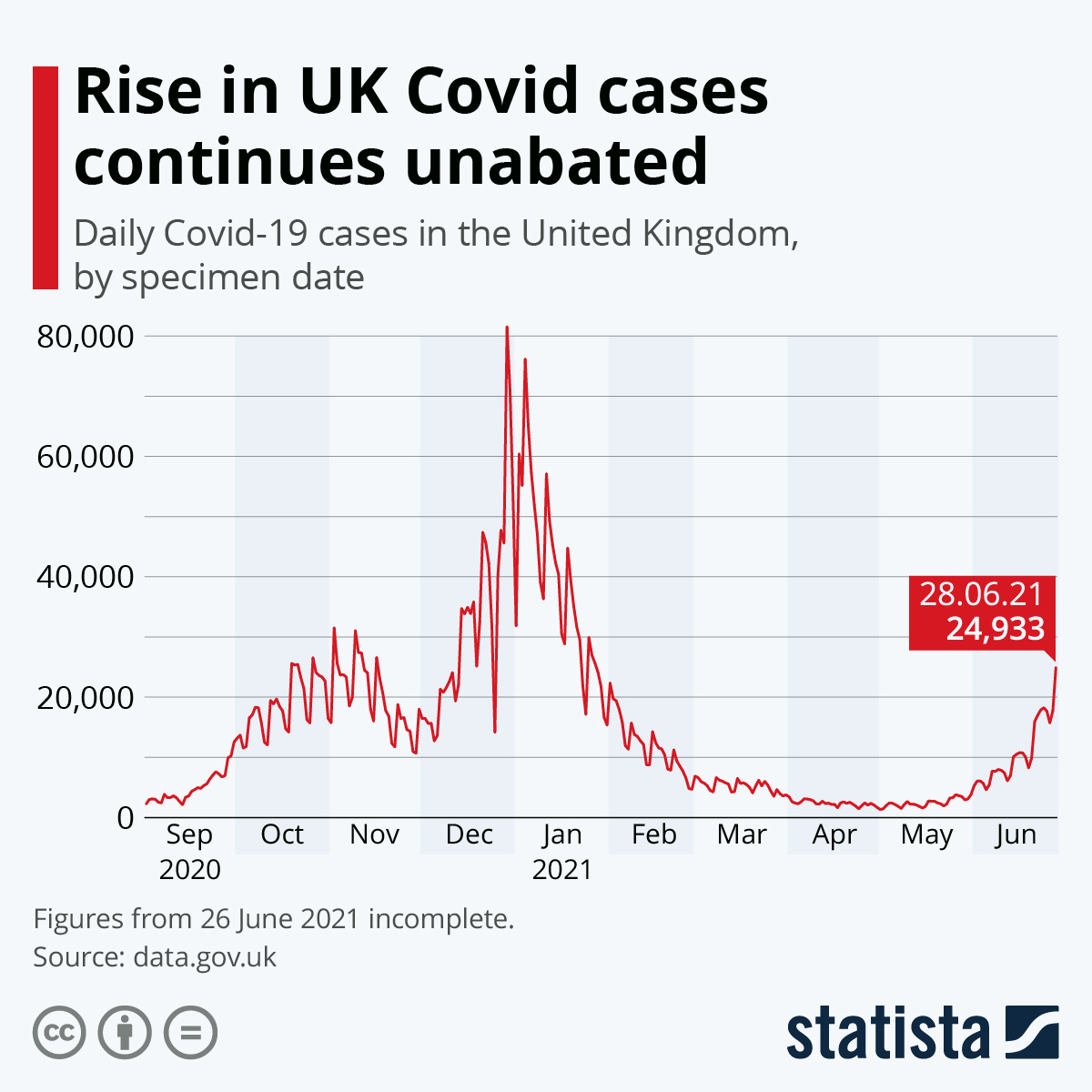

- The U.K. will stick to lifting most remaining pandemic restrictions July 19 despite rising COVID-19 infections. New data suggests that the country could see a peak in August with up to 200 virus deaths per day.

- Infections in the U.K. began surging in late May:

- Malta is the first European country to ban incoming travelers who are not vaccinated against COVID-19.

- Greece and France announced new measures that will restrict access to some activities, including indoor dining, for unvaccinated people.

- South Africa extended its COVID-19 restrictions for an additional two weeks amid continued high infection levels.

- Sydney reported 112 new COVID-19 cases Monday, its highest one-day total since the start of the pandemic, prompting officials to warn that the city may need to extend its current lockdown.

- A Mexico health official proclaimed the country has entered a third wave of COVID-19, with average daily infections up 84% in July compared with June and cases among unvaccinated younger people driving the surge.

- Israel will start administering a third COVID-19 shot to people with weakened immune systems.

- The World Health Organization came out against the practice of combining COVID-19 vaccinations over safety concerns.

- China and Australia will build new quarantine facilities for incoming travelers as a safer but stricter alternative to mandatory isolation at hotels.

- Chinese drugmakers Sinopharm and Sinovac pledged to provide up to 550 million COVID-19 vaccines to the COVAX vaccine sharing initiative through mid-2022.

- Japan will let domestic spectators and crowds of up to 10,000 people attend the Tokyo Olympic Games later this month. Starting July 26, the nation will also start accepting vaccine passports allowing its citizens to travel abroad.

- World hunger surged last year during the pandemic to its highest levels since 2005, with roughly 811 million, or 10% of the global population, undernourished.

- A once-in-a-century drought in Brazil is causing wholesale coffee prices to surge, with arabica beans up 18% in the past three months to $1.51 per pound.

- Global government debt during the pandemic ballooned past the world’s annual economic output to the highest level since World War II.

- The EU announced that it would delay plans to move forward with a levy on digital tech companies in favor of a higher global corporate tax.

- India’s industrial output in May rose 29.3% compared to the same time last year.

- Air France-KLM is holding talks with Boeing and Airbus to secure 160 single-aisle planes, as the airline hopes to increase its low-cost operations.

- Chinese electric vehicle maker Nio is planning to build 4,000 battery-swapping stations worldwide by 2025, a quicker alternative to charging that could boost the appeal of electric vehicles.

- Volvo increased its stake in electric vehicle maker Polestar, now controlling 49.5%. The company reported an 11% global sales increase in June year over year, with plug-in sales accounting for 25% of all cars sold in the first half of the year.

- The Spanish government announced plans to invest over $5 billion in electric vehicle production, hoping to register 250,000 of the vehicles by 2023.

Our Operations

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.