COVID-19 Bulletin: July 14

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Saudi Arabia and the United Arab Emirates reached a compromise in their stalemate over OPEC+ production quotas, allowing the UAE to increase its output and paving the way for another OPEC+ meeting.

- Oil prices climbed roughly 1.6% Tuesday to their highest close since October 2018 following news of an eighth consecutive week of U.S. inventory draws. Crude prices eased in morning trading, with the WTI down 1.5% at $74.12/bbl and Brent off 1.1% at $75.66/bbl. Natural gas was down 1.1% to $3.66/MMBtu.

- After stagnating in May, global refining throughput increased by 1.6 million bpd in June, a trend the International Energy Agency expects to continue through July and August.

- U.S. shale production is expected to increase modestly by 42,000 bpd in August on higher activity in the Permian Basin, the Energy Information Administration predicts.

- China’s crude oil imports dropped by 3% in the first six months of 2021 compared to a year ago, the first half-year contraction since 2013.

- China began constructing the world’s first onshore “small” nuclear reactor, a powerful miniaturized technology that could meet the needs of 526,000 households while providing greater safety than traditional nuclear.

- U.S. firm 8 Rivers Capital is partnering with the U.K.’s Sembcorp Energy to build a 300-megawatt, “net-zero” power plant in England whose emissions will be captured and stored offshore.

- Royal Dutch Shell is mulling construction of a carbon capture and storage project in Canada’s Alberta province with the capacity to store 300 million tonnes of carbon over its lifetime along with boosting regional hydrogen production.

- Shippers are tightening operations and upgrading technology to avoid unwittingly transporting sanctioned oil, a response to fears of being cut off from the U.S. financial system or having assets seized.

- Germany raised its forecast for electricity consumption in 2030 by 9.3%, citing the increase of electric vehicle production and the continued phase out of oil and gas for fuel.

- BP is increasing its U.S. retail presence with the acquisition of more than 200 Thorntons stores in midwestern and southern states.

- ERCOT, the main power distributor in Texas, introduced new tactics to improve the reliability of its power grid, announcing plans to purchase more reserve power and review the need for on-site fuel supplies for some generators.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Roughly 60 wildfires are being reported across 10 states in the U.S. West, with Arizona, Idaho and Montana accounting for nearly half of the blazes. A record heat wave engulfing the region cooled slightly Tuesday night and is expected to diminish further the rest of the week.

- The World Shipping Council says that increased demand for imports is causing congestion across supply chains, and that a return to normal levels of demand rather than more regulation will help solve the backlogs.

- Freight overflows led FedEx to temporarily suspend service to some 1,400 less-than-truckload (LTL) customers in the fourth quarter of 2020, an issue now spreading to other LTL carriers.

- Freight expenditures rose 11% from May to June and 56.4% year over year, the fastest such growth on record for the Cass Freight Index.

- A survey of small businesses shows that 47% of respondents plan to raise prices, the highest level in 40 years.

- U.S. pork prices rose 3.8% in June, the biggest jump in 25 years, while the price of beef increased by 4%.

- Small meat and dairy farmers are withering under increased competition from slaughterhouses and mega-dairies, which are better able to handle a current surge in feed costs.

- Freight carriers and cargo owners diverge in their opinions of a new White House directive toughening oversight of cargo transport in response to growing port congestion and unusually high fees.

- U.S. vacancy rates for industrial real estate fell to a record low of 4.5% in June, while asking rents increased 6.8% year over year.

- A COVID-19 outbreak in Hanoi, Vietnam, has closed a key supplier to Adidas and Nike.

- The Ever Given container ship that blocked the Suez Canal for several days in March set sail from Egypt yesterday, ending a 112-day battle between the ship’s owners and the Egyptian canal authority over compensation for the incident.

- Walmart will begin a new initiative working with product suppliers to optimize fleets and freight routes in a bid to reduce emissions.

- Our logistics team reports that bulk trucking firms are often declining to book long-haul, out of network loads due to extreme capacity constraints.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports primarily due to increased volume of ships and containers. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- The U.S.’s seven-day average for COVID-19 cases surpassed 23,000, more than double the number of cases from three weeks ago. The country reported 25,919 new cases and 372 deaths Tuesday, with 48.65% of the population now fully vaccinated.

- The virulent Delta variant of COVID-19 now accounts for 58% of infections in the U.S.

- COVID-19 cases rose in 48 states over the past two weeks, with just Maine and South Dakota keeping virus numbers at bay.

- COVID-19 cases in New York City have risen 32% over the last seven days compared to the seven-day average from four weeks ago, a result of certain neighborhoods lagging in vaccinations.

- The Delta variant of COVID-19 is now the dominant strain in New Jersey, accounting for 41% of new infections in June.

- COVID-19 hospitalizations in North Texas have doubled since June 1 alongside a 90% increase in the seven-day average of new cases, led by the Delta variant.

- After falling steadily since April, COVID-19 cases in Tennessee are on the rise, with hospitalizations jumping by 28% since July Fourth.

- Chicago reinstated a COVID-19 emergency travel order for Missouri and Arkansas, requiring unvaccinated travelers from the states to have a negative test or quarantine for 10 days.

- Florida’s Orange County is asking residents to wear masks indoors regardless of vaccination status amid rising COVID-19 case numbers. In Miami-Dade County, the seven-day average infection rate rose to 150 per 100,000 people, five times the national average and second highest in the nation behind Los Angeles County.

- Health officials in Louisiana are warning of a new wave of COVID-19 after reporting 631 new infections Tuesday, a 176% increase over the past two weeks.

- Health officials in Mississippi are warning about the danger of the Delta variant to children, reporting that seven children in the state are in intensive care units.

- California will require all students and staff to wear masks indoors when school reopens in the fall.

- Delaware officially ended its COVID-19 state of emergency Tuesday.

- U.S. health officials say more data is needed to determine whether a third COVID-19 shot is necessary, warning that a booster dose could cause more serious side effects.

- Norwegian Cruise Line is suing Florida over the state’s ban on businesses requiring proof of COVID-19 vaccination, a critical step in the resumption of cruises. In Singapore, a “cruise to nowhere” was cut short and passengers were sequestered in their cabins after a passenger was detected with COVID-19.

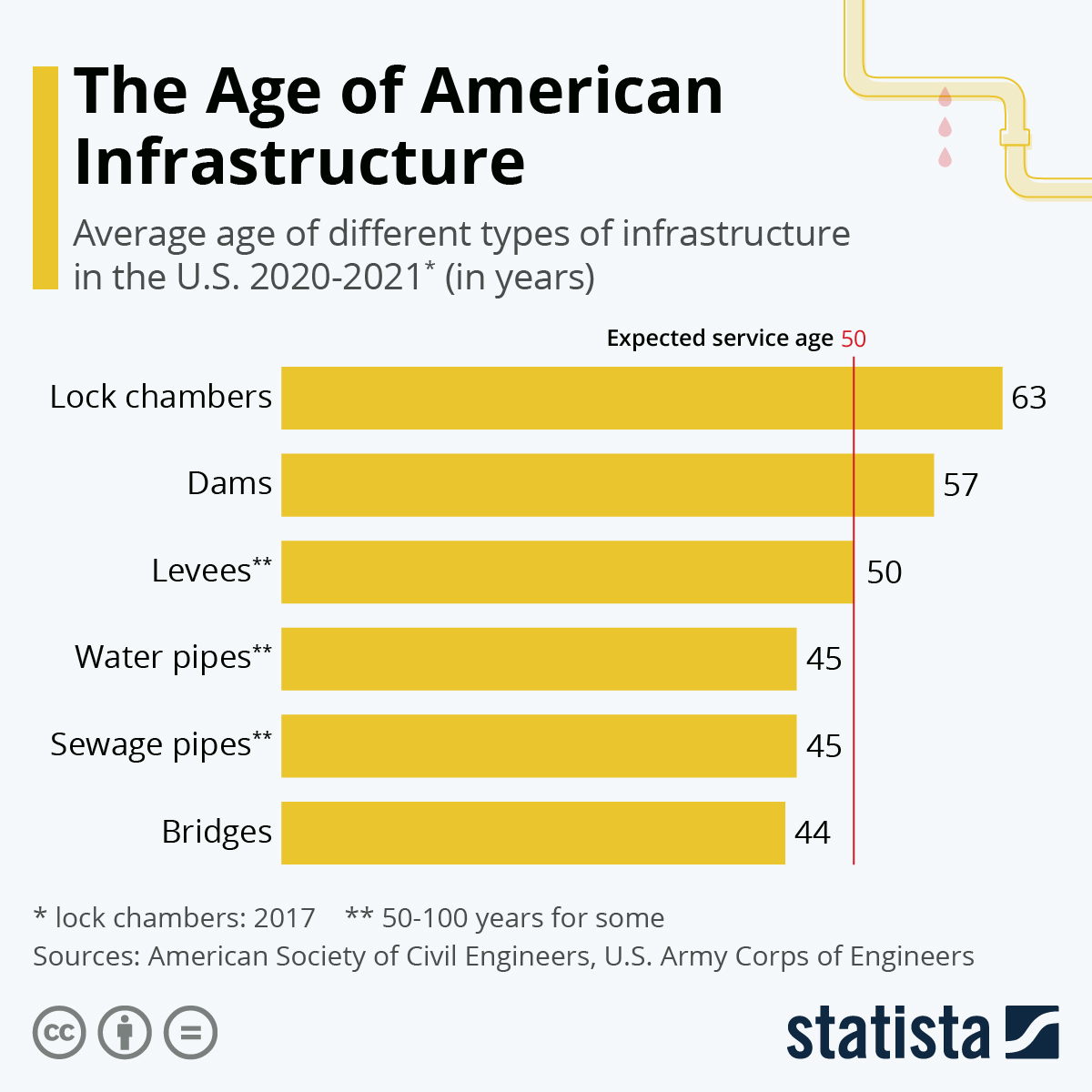

- Many types of U.S. infrastructure are approaching servicing age:

- The cost of hotel and motel stays in the U.S. rose nearly 8% in June compared to a month earlier, the second-largest gain on record, pushing prices back above pre-pandemic levels.

- Despite many restaurants and hospitality businesses offering new perks to lure back employees, economists fear labor shortages will continue in the wake of the mass exodus of workers from the industry during the pandemic.

- Delta reported its first quarterly profit of the pandemic and said leisure travel has returned to pre-COVID levels.

- United Airlines will purchase 100 19-seat electric planes from Swedish startup Heart Aerospace, hoping to reduce its carbon emissions for short, regional flights.

- Airbus delivered more than three times as many jets as Boeing last year, now commanding a 68% share of total net orders for versatile narrow-body jets.

- Volkswagen announced plans to more than double its charging infrastructure in the U.S. and Canada by 2025, supporting the company’s goal of raising electric vehicles to 50% of sales by 2030.

- General Motors will invest $71 million in a new Pasadena, California, campus focused on advanced technologies, including flying cars and lunar rovers.

- Apple raised its goal for iPhone production for the year as it introduces new models, seeking a 20% increase from its suppliers on expectations that COVID-19 vaccine rollouts will boost demand.

- Pepsi, benefiting from the return of restaurant and leisure venues, saw its fastest sales growth in at least 10 years, reporting a 13% increase in organic sales last quarter.

International

- With more than 40,000 COVID-19 cases reported for three straight days, daily infections in Indonesia have surpassed levels in India, formerly Asia’s virus epicenter.

- India reported 32,906 new COVID-19 cases Tuesday, its lowest daily total since March, while supply shortages and vaccine hesitancy are slowing the country’s inoculation campaign.

- South Korea reported 1,615 new COVID-19 cases yesterday, a record, as pandemic restrictions were tightened.

- Tokyo reported its highest daily infections in six months Wednesday, less than two weeks ahead of the Olympics.

- Amid controversy, a growing number of localities in China are mandating vaccinations.

- The COVID-19 Delta variant continues to overwhelm South Africa’s healthcare system, with an average of 20,000 new infections per day, while civil unrest and looting spread through the country.

- New COVID-19 cases in Israel rose to 730 Sunday, the most in four months, prompting the country to reinstate indoor mask mandates.

- COVID-19 cases in the Netherlands jumped dramatically to 52,000 last week from only 8,500 the week prior. The nation’s prime minister restored curbs on dining and entertainment venues while apologizing for reopening the economy too soon.

- All COVID-19 cases in Portugal’s Lisbon and Algarve regions are of the Delta variant, representing 86% of cases throughout the country.

- More than 821,000 British schoolchildren missed class due to exposure to COVID-19 in July, a record.

- Scotland will begin easing COVID-19 restrictions July 19.

- Increased pressure from the French administration has prompted more than 1 million citizens to sign up for COVID-19 shots.

- COVID-19 fatalities in Argentina, among the hardest hit countries in Latin America, are expected to surpass 100,000 today.

- El Salvador suspended all public and private gatherings for the next 90 days amid rising COVID-19 infections.

- Japan is increasing COVID-19 vaccine donations to Asian nations in a bid to boost inoculations in the region.

- Analysts trimmed forecasts for Japan’s economic growth this quarter following fresh pandemic curbs in Tokyo.

- U.S. businesses along the Mexican border have lost an estimated $10 billion in revenue as a result of border restrictions imposed early in the pandemic, while business activity on the southern side of the border rose by more than $2.2 billion.

- The EU approved pandemic recovery plans for 12 nations Tuesday, including France, Germany, Italy and Spain, allowing them to use funds in financing projects aimed at spurring economic growth.

Our Operations

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.