COVID-19 Bulletin: June 3

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil futures closed at 15-month highs Wednesday, with Brent trading above $71/barrel on growing demand expectations for the summer and a higher-than-expected crude draw of 5.4 million barrels last week.

- Analysts predict that oil prices could reach $80 during peak driving season this summer.

- Energy futures were lower in mid-day trading today, with the WTI down 0.2% at $68.69/bbl, Brent off 0.2% at $71.18/bbl and natural gas down 1.2% at $3.04/MMBtu.

- It will likely take until mid-2022 for global oil demand to reach pre-pandemic levels, an analyst predicts.

- The International Energy Agency is reporting that global energy investment is expected to increase by 10% this year compared to last, while energy demand is expected to expand by 4.6% this year, offsetting a 4% contraction last year.

- U.S. gas producer Southwestern Energy has inked a $2.7 billion deal to acquire natural gas producer Indigo Natural Resources, hoping to boost production and take advantage of rising natural gas prices.

- BP is acquiring a 9-gigawatt (GW) portfolio of U.S. solar power projects from developer 7X Energy for $220 million, boosting the oil giant’s global renewables capacity from 14GW to 23GW.

- Danish renewables company Ørsted, the world’s biggest developer of offshore wind farms, is planning to invest over $57 billion by 2027 to triple its production capacity to 50 gigawatts by 2030.

- California’s renewable natural gas (RNG) vehicles removed more carbon dioxide from the atmosphere than they emitted in 2020, while the state’s use of RNG in fleets of trucks, buses and other vehicles grew 25% between 2019-2020 and is up more than 170% over the last five years.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Meat giant JBS restored most of its U.S. factory operations following a cyberattack early this week that caused the price for choice cuts of beef to rise 1.1%. Some of the company’s Australian facilities remained offline Wednesday while others operated at limited capacity as authorities continued to investigate the origins of the attack.

- Taiwan is stepping up COVID-19 vaccinations for tech workers to avert further disruption in the global supply of semiconductors, as many “COVID migrants,” professionals who moved to the island as a safe haven from the virus, now flee the country as infections surge.

- Container ship congestion is clogging the southern Chinese export hub of Yantian Port, as 44 vessels and counting sit at anchor in the Daya Bay area.

- Shipping companies are rerouting ships from the Port of Hamburg, Germany, due to disruptions caused by local climate protestors.

- Estes, the nation’s largest privately-owned trucking company, is purchasing 1,200 new tractors amid “exceptional growth,” joining other major shippers, including Old Dominion and J.B. Hunt, in announcing large equipment spends.

- U.S. ports are joining efforts to get more seafarers vaccinated against COVID-19, with local health officials and nonprofits boarding cargo carriers to administer Johnson & Johnson’s single-dose COVID-19 vaccine.

- DHL announced plans to expand the use of assisted picking robots at its facilities, aiming to deploy 2,000 robots in 2022.

- The U.S. administration is threatening 25% tariffs on over $2 billion in imports from six countries — Austria, Great Britain, India, Italy, Spain and Turkey — because of their digital services taxes.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports primarily due to increased volume of ships and containers. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

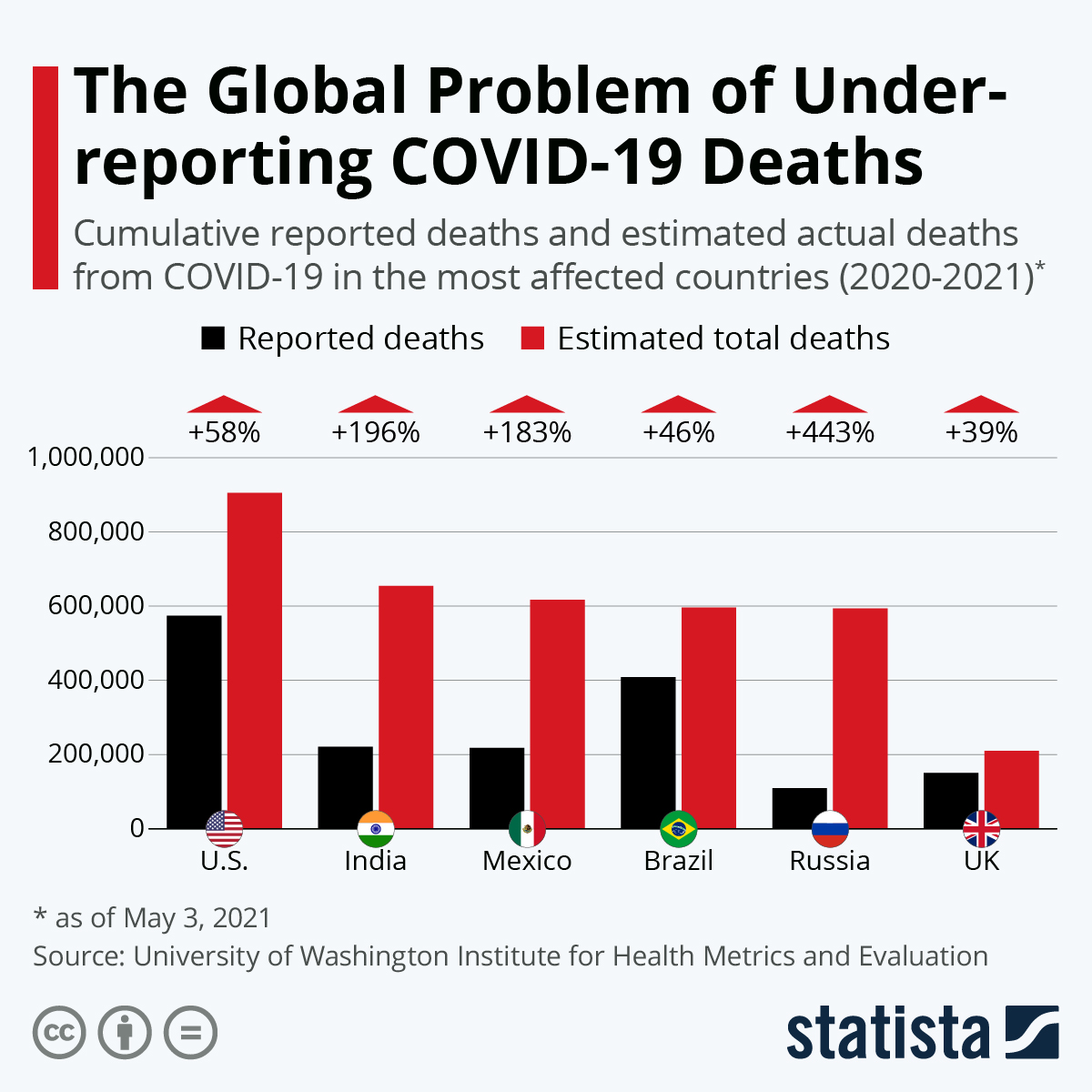

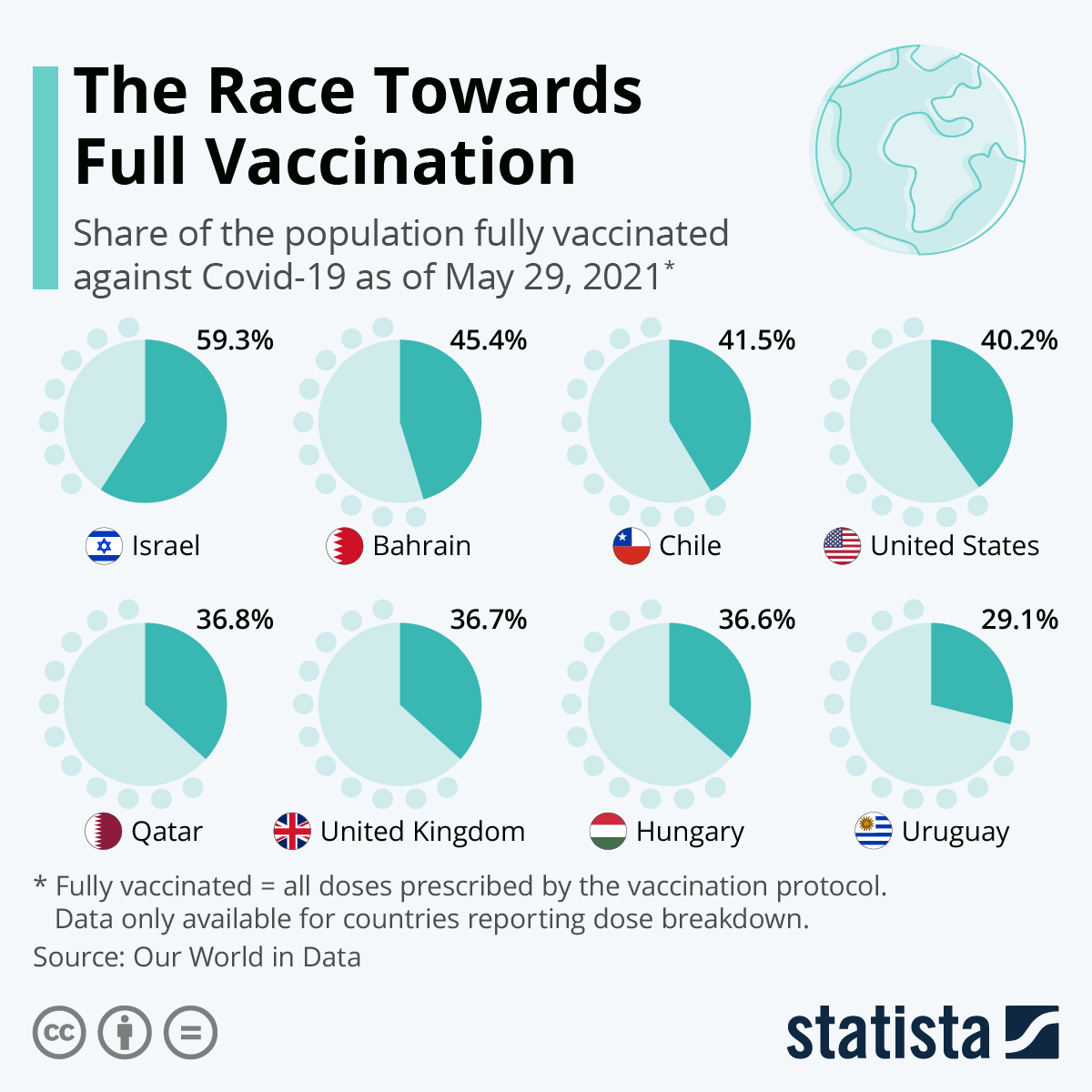

- The U.S. reported 16,913 COVID-19 cases and 610 deaths Wednesday. More than 296 million vaccine doses have been administered, with 41.5% of the population fully vaccinated.

- Twelve U.S. states have vaccinated at least 70% of their population with one COVID-19 vaccine dose, the CDC said.

- With daily vaccination rates falling below 600,000, the White House declared June a “national month of action” as it presses to meet its goal of having 70% of its population with at least one dose of a COVID-19 vaccine by July 4.

- Moderna is working to produce COVID-19 vaccines with half the dosage level of its existing shot, a potential “booster” vaccine that could be used in children and to provide additional protection against virus mutations.

- The unvaccinated remain at high risk of contracting COVID-19; in Colorado, nearly all the roughly 500 people hospitalized with COVID-19 are unvaccinated.

- Minnesota reported no new COVID-19 deaths yesterday.

- New York City’s mayor announced plans to begin distributing COVID-19 vaccines to public schools across the city’s five boroughs beginning this Friday.

- New Jersey will shut down its six vaccine mega sites by July 23 as the state nears its goal of inoculating 70% of its residents.

- Indiana University Health, the state’s largest hospital system, says it will require all employees to be fully vaccinated against COVID-19 by Sept. 1.

- Early research indicates that lasting protection from COVID-19 vaccines could diminish the need for frequent booster shots.

- Private payrolls rose by 978,000 in May, according to ADP, the largest jump since last June.

- First-time jobless claims fell to 385,000 last week, the first tally below 400,000 since early in the pandemic.

- Half of U.S. states have ended enhanced unemployment benefits.

- A shortage of labor in the U.S. has led the federal government to consider more job-creating incentives, such as expanding tax credits for employers and providing funding for hiring bonuses.

- Several signs indicate the U.S. economy is recovering from its pandemic downturn faster than any time in history, with record new business startups, soaring stock market and home values, decades-low household debt-service obligations, and employees switching jobs at the highest rate since 2000.

- Remote work is driving a boom in U.S. luxury home sales, with purchases of high-end homes increasing by 26% in the three months through April compared to a year earlier.

- The rate of availability for office space in Manhattan rose for a 12th consecutive month to 17% in May, despite an increasing number of workers returning to their desks.

- In contrast to the languishing office real estate market, space is in high demand for life sciences and research, with investors pumping $10 billion into such facilities this year, accounting for 4% of all global commercial real estate transactions through May.

- U.S. mortgage applications fell by 4% last week compared to the week prior, one of the first signs that a current housing boom may be cooling.

International

- India recorded 134,154 new COVID-19 infections and 2,887 virus deaths in the past 24 hours.

- The Delta variant of COVID-19 first discovered in India has now spread to 62 countries.

- A group of airline passengers on a flight from India to Israel tested positive for COVID-19, sparking fears of the “Delta” variant gaining traction in the country.

- Japan’s COVID-19 vaccine rollout is starting to pick up pace, with the seven-day average of administered doses quadrupling over the last two weeks.

- The U.K. reported 4,330 new COVID-19 cases and 12 deaths Wednesday prompting the country’s prime minister to indicate potential delays before a planned lifting of pandemic restrictions on June 21. More than 75% of Britons have now received a first vaccine dose.

- A significant drop in COVID-19 cases and an improved vaccine rollout has prompted Portugal to lift its work-from-home mandate.

- The cumulative number of COVID-19 vaccines given around the world is nearing 2 billion, led by more than 680 million shots administered in China. India administered more than 200 million doses in just 130 days, the second country to do so behind the U.S.

- Except for Canada, Mexico and the U.S., COVID-19 cases are back on the rise in the Americas after weeks of plateauing and decreasing infections, the Pan American Health Organization said.

- Canada’s one-day count of 1,638 new COVID-19 infections was the lowest since October 18, 2020, as the country recovers from a severe third wave of the virus. In a bid to restore travel with the U.S., some provinces are working toward setting up COVID-19 vaccinations during border crossings.

- Colombia reopened its border with Venezuela yesterday following a 14-month closure to curb the spread of COVID-19.

- China’s Sinopharm says that it has enough capacity to supply over 1 billion COVID-19 vaccines to foreign countries in the second half of this year.

- Singapore has authorized use of China’s Sinovac COVID-19 vaccine after the World Health Organization approved the drug for emergency use.

- France announced plans to begin administering COVID-19 vaccines to children aged 12 and older beginning June 15.

- China’s CanSino Biologics has begun Phase II testing of an inhalant version of its COVID-19 vaccine, while an Australian company showed promising results for a needleless patch vaccination.

- Germany announced plans to pay vaccine manufacturers an annual reservation fee so it can build a stockpile of doses, hoping to be better prepared for future pandemics and less reliant on the EU for doses.

- Dozens of countries are pledging a combined $2.4 billion to the COVAX vaccine-sharing initiative to help supply COVID-19 vaccines to lower-income nations.

- Inflation in wealthy countries climbed at the fastest pace in 12 years in April, leaving central banks questioning whether the rise is transitory.

- Global airlines are pushing G7 nations to ease blanket curbs on air travel in favor of more flexible restrictions that could help restore vital tourism.

- South Korean exports rose 45.6% in May from a year earlier, the strongest growth in 32 years.

- Airbus is set to report a slight increase in jet deliveries in May, up to 50 from 45 in April, bringing total deliveries for the year to 220, up from 160 at this time last year.

- Coca-Cola is partnering with the Netherlands-based nonprofit group The Ocean Cleanup project to help collect plastic waste from some of the world’s worst polluting rivers and recycle them into new bottles.

- A team of researchers at Germany’s Fraunhofer Institute has figured out a way to embed active enzymes into plastic material that will allow them to self-destruct in the environment.

Our Operations

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.