COVID-19 Bulletin: June 25

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Energy futures were higher in mid-day trading, with WTI up 0.8% to $73.87/bbl and Brent up 0.4% to $75.88/bbl. Natural gas was 2.4% higher at $3.50/MMBtu.

- India, the world’s third-biggest oil consumer, is asking OPEC to increase its production amid concern over rising oil prices.

- Oil output in New Mexico hit record highs in March, making it the first oil-producing state to reach pre-pandemic levels of production.

- Canada’s oil sands production has returned to pre-pandemic levels and is expected to reach 3.6 million bpd by 2030.

- The value of Saudi Arabia’s oil exports rose 109% year over year in April to $13.8 billion.

- The price of thermal coal has doubled over the past year as tight supplies of natural gas and rising electricity costs drive demand from global power companies.

- Despite plans to invest $3 billion into lowering its emissions by 2028, Chevron says it has no plans to shrink its oil and gas business in exchange for wind and solar energy.

- Electric vehicle (EV) sales in Europe rose 142% to 1.4 million in 2020, with analysts expecting EVs to account for nearly 10% of the continent’s road-fuel demand by 2030, offsetting the equivalent of five oil refineries.

- India’s Reliance Industries, which operates the world’s biggest refining complex, is planning to invest $10 billion into clean energy over the next three years in hopes of achieving net-zero carbon emissions by 2035.

- The European Parliament voted to make the bloc’s emissions-reductions targets legally binding, a landmark decision in the region’s shift to cleaner energy.

- The UAE is mulling a 2050 target of achieving net-zero emissions, which if adopted would make it the first OPEC nation to set a net-zero goal.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Over 90% of land in 11 Western states is covered by some category of drought, the region’s largest amount in 21 years. A record-breaking heat wave is expected to begin today in some parts of the Pacific Northwest, bringing an increased risk of wildfires.

- Water levels in Lake Mead, the reservoir created by the Hoover Dam that supplies water to 25 million people, fell to just 1,071 feet above sea level recently, a record-low amid early seasonal droughts in the West.

- Due to the global chip shortage:

- The week of July 5, Stellantis will idle production at plants in Illinois and Mexico and simultaneously resume production at its Ontario plant.

- Despite increases in May compared to the same month last year, car production in the U.K. is still down by roughly half from the same time in 2019. The nation produced just 55,000 new vehicles last month.

- Samsung postponed the launch of its Galaxy S21 FE phone by several months.

- Citing persistent high demand, UPS will increase handling surcharges on some domestic and large parcel shipments.

- Bulker owners expressed confidence that the market should retain its strength over the next two to three years.

- Futures for lumber deliveries in July fell 41% from record-highs reached in May, declining 14 out of 16 trading days through June 15.

- Canadian airline WestJet is preparing to enter the freighter business, creating an all-cargo fleet to take part in surging e-commerce activity.

- Our logistics team reports that bulk trucking firms are often declining to book long-haul, out of network loads due to extreme capacity constraints.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports primarily due to increased volume of ships and containers. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- The seven-day average of U.S. COVID-19 cases stands around 11,310, significantly down from 250,000 earlier this year. In addition, nearly all virus deaths now come from unvaccinated people.

- The U.S. reported 12,830 new COVID-19 cases and 341 deaths Thursday.

- Missouri now has the highest rate of new COVID-19 infections in the U.S., a result of vaccine hesitancy and the spread of highly transmissible virus mutations.

- Missouri has the largest number of Delta variant infections in the U.S., followed closely by Colorado

- Pfizer says its COVID-19 vaccine is highly effective against the worrying Delta variant. Antibodies from two Chinese vaccines are proving less effective against the Delta variant than other variants.

- South Carolina’s governor signed a new bill shielding businesses and other groups from lawsuits over COVID-19 safety protocols.

- New York City is set to begin offering free at-home COVID-19 vaccinations, a bid to boost inoculations.

- JPMorgan will require all U.S. employees to log their COVID-19 vaccination status by June 30.

- The White House is planning to send 3 million doses of Johnson & Johnson’s single-shot COVID-19 vaccine to Brazil and an additional 3 million doses to Afghanistan.

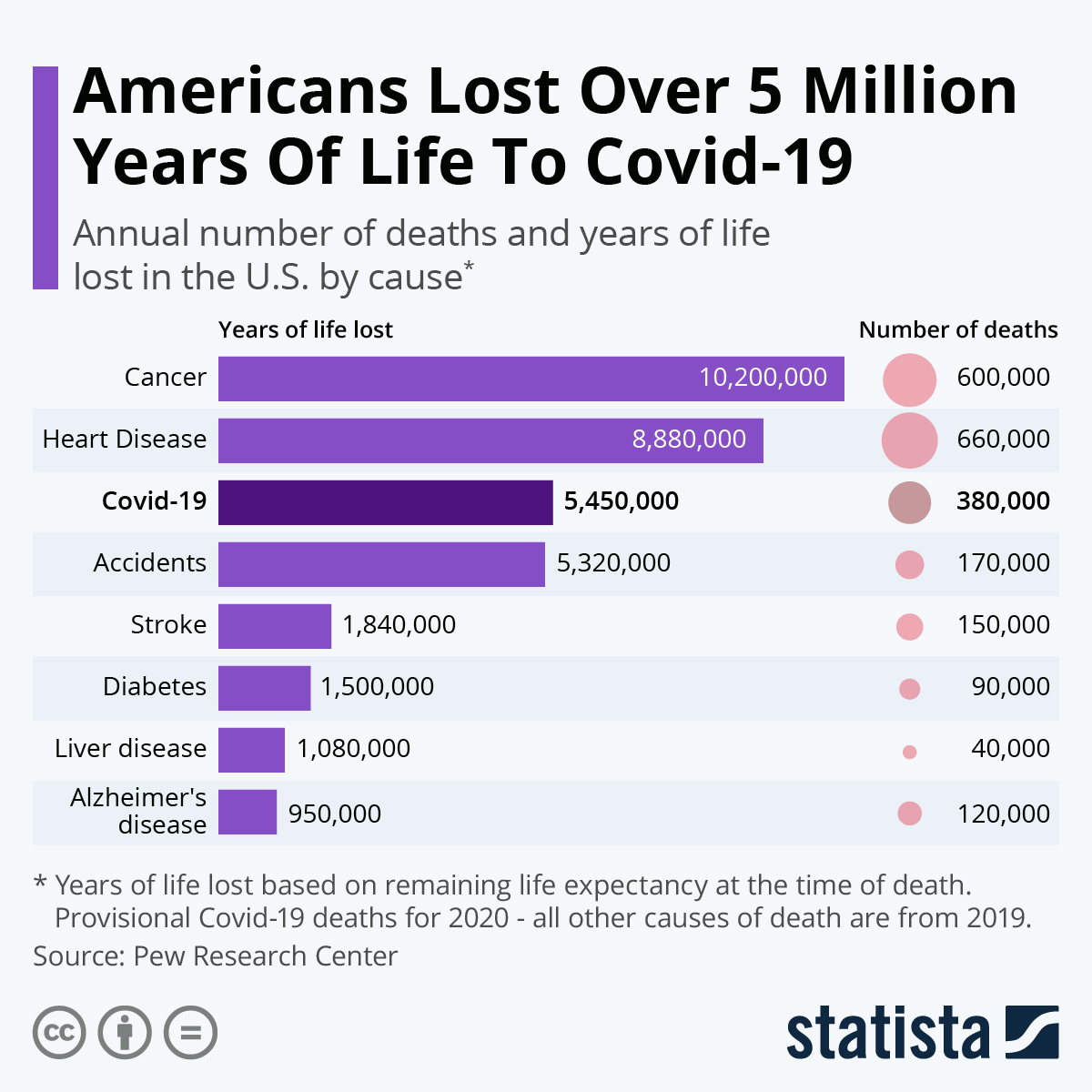

- The average U.S. life expectancy dropped by almost two years between 2018 and 2020, the largest decline since World War II, largely caused by the pandemic.

- The White House and a group of centrist U.S. senators agreed to the outline of a $1 trillion infrastructure plan, as the House continues negotiations over its own proposal.

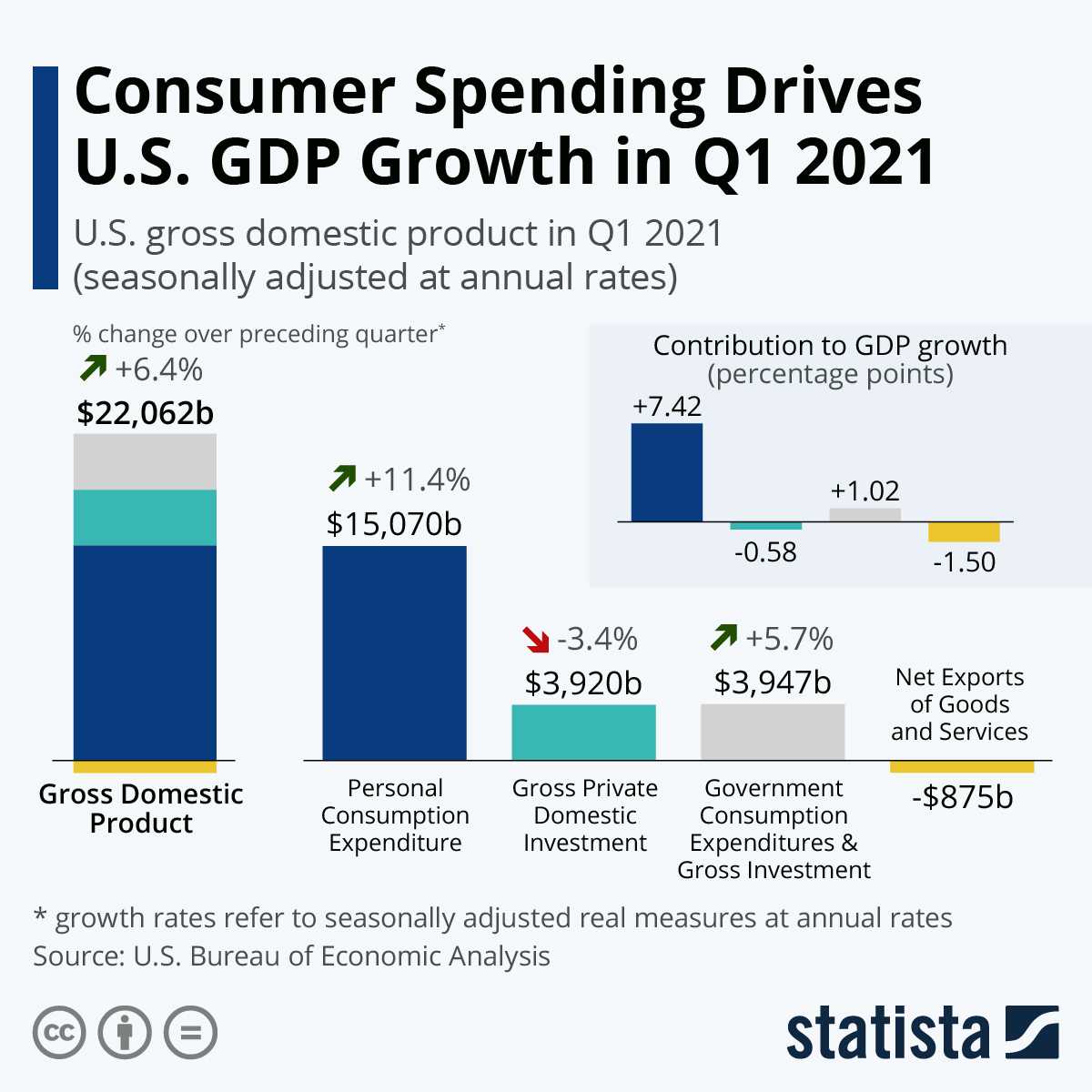

- Early forecasts show a 0.4% rise in consumer spending in May, as customers went out more to spend on services they shunned earlier in the pandemic.

- More consumer spending led to strong GDP growth in the first quarter:

- The White House extended a national moratorium on evictions through July, allowing more time to distribute billions of dollars in pandemic housing aid.

- The head of the Federal Reserve reiterated his confidence that the current 3.8% inflation rate, a 30-year high, is largely transitory and expected to drop to 2.1% by the end of next year. The central bank also indicated that large U.S. banks are healthy and able to withstand stress-scenarios as they emerge from the pandemic.

- Recent auto auctions suggest that the record rise in prices for used cars, the biggest single driver of overall U.S. inflation, may have peaked.

- U.S. orders for durable goods rose 2.3% in May following a 0.8% drop in April, while orders for non-defense capital goods dropped by 0.1% after rising 2.7% in April.

- U.S. alcohol consumption increased significantly during the pandemic, particularly among parents, adult women and Black adults.

- Nike posted $12 billion in sales in its most recent quarter, a company record spurred by significant jumps in online ordering.

- Boeing’s 737 MAX jet has been granted approval from New Zealand regulators to return to service, furthering the company’s recovery after the model was grounded following two fatal crashes in 2018 and 2019.

- Carnival reported an additional $2.1 billion in losses for the second quarter, bringing its total losses to over $14 billion since the start of the pandemic, with hopes that a phased restart of cruise operations can help the company recover fully by next spring.

- Electric truck maker Nikola is planning to invest $50 million into a hydrogen production plant and carbon capture project in Indiana.

International

- Brazil reported 73,602 new COVID-19 cases and 2,032 virus deaths yesterday.

- Doctors in India are closely monitoring the “Delta Plus” version of the Delta variant of COVID-19, which could eventually become the globally dominant strain. India reported 51,667 new COVID-19 cases and 1,329 deaths yesterday.

- WHO officials are warning of a rising wave of COVID-19 across Africa spurred by the Delta variant’s presence in at least 14 nations.

- South Africa’s economic hub of Gauteng will likely hit the peak of a third wave of COVID-19 infections during the first week of July.

- State-run hospitals in Bangkok have run out of beds for COVID-19 patients as Thailand reported more than 4,000 new infections Thursday, its highest tally in more than three weeks. Stricter pandemic curbs are likely to take effect.

- Tokyo is showing early signs of a rebound in COVID-19 cases just days after the capital’s state of emergency was lifted.

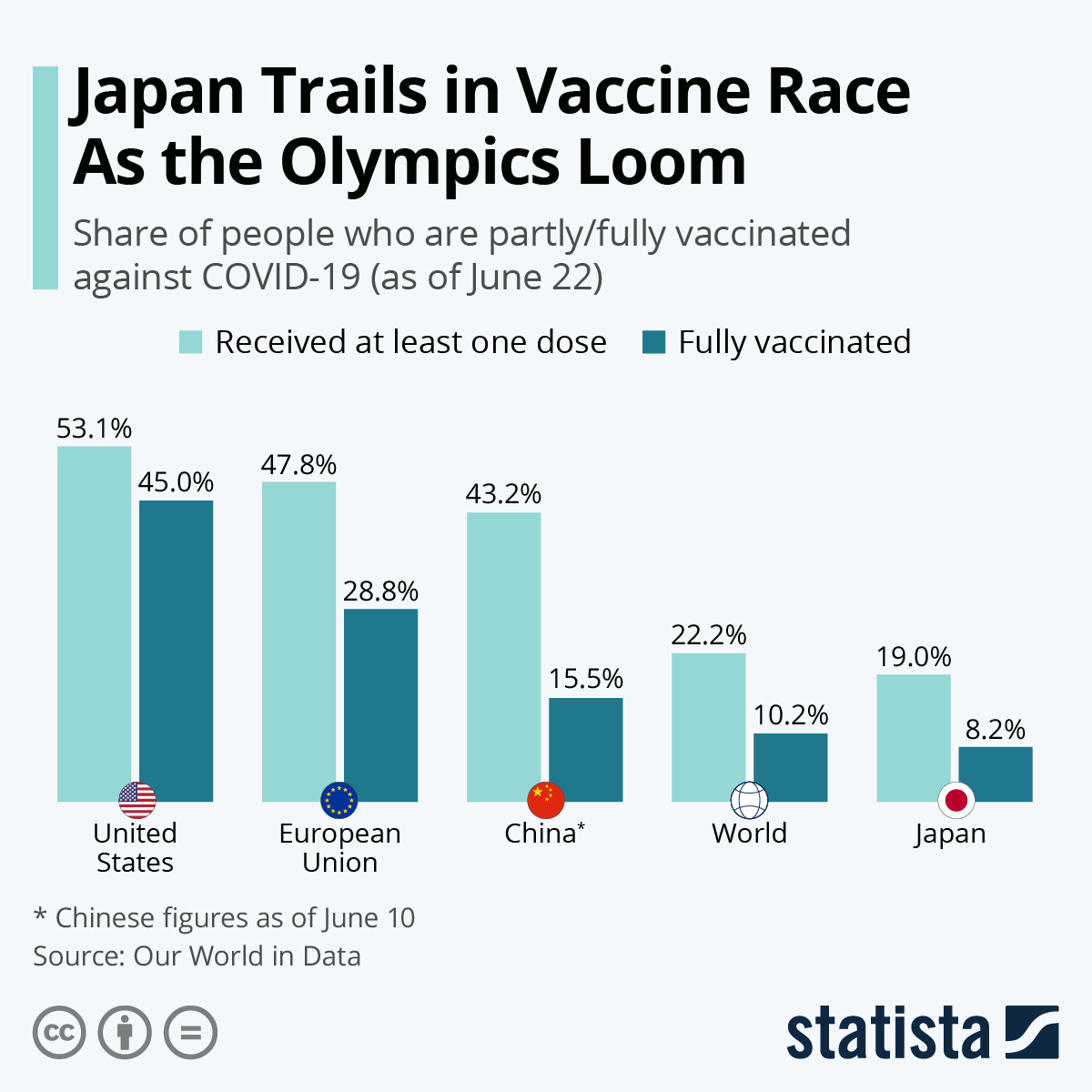

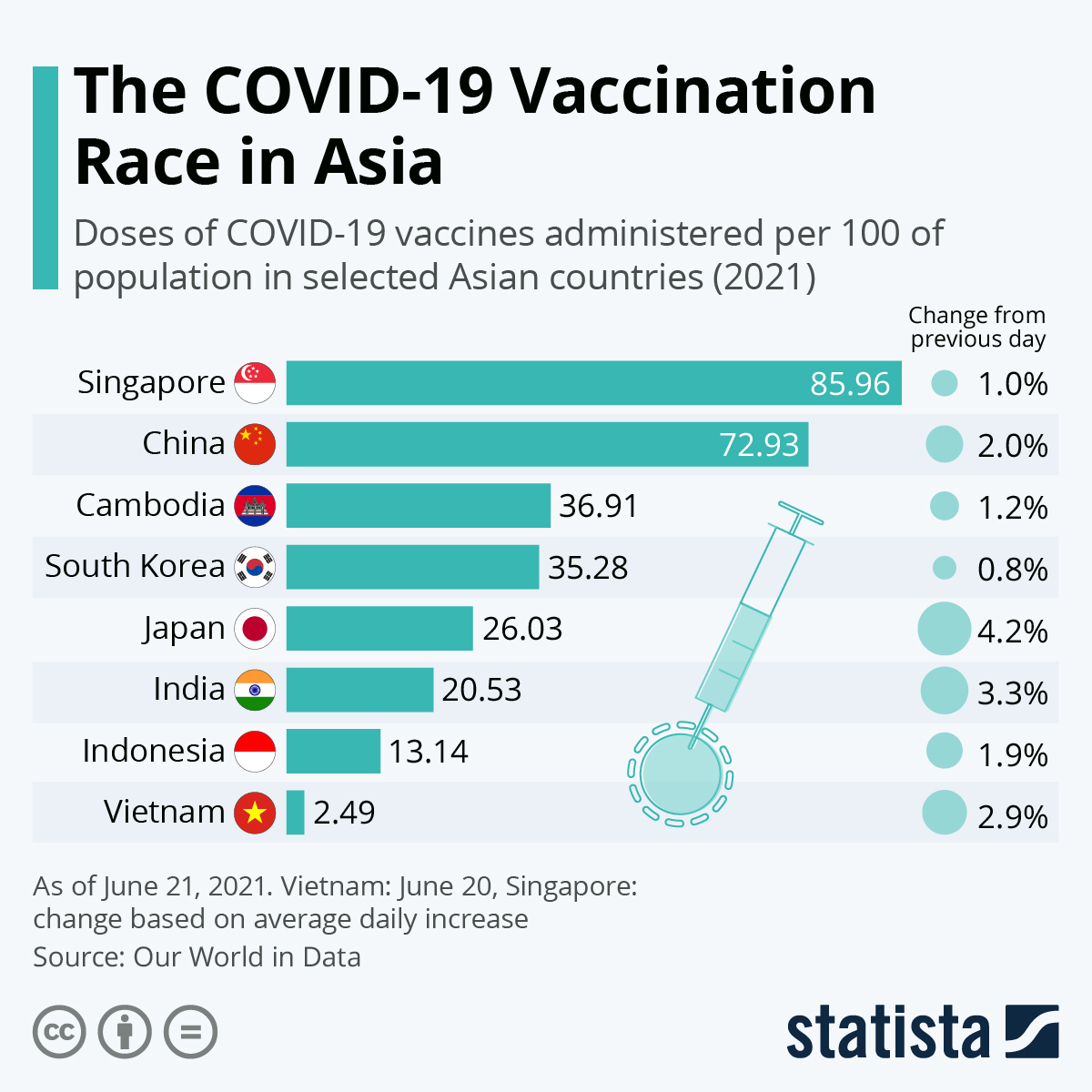

The persistence of COVID-19 in Asia stems from relatively low vaccination rates:

- The Delta variant of COVID-19 is continuing to spread in Australia, as New South Wales, the country’s most populous state, saw a double digit increase in virus infections for the third consecutive day. Parts of Sydney will go into lockdown for a week.

- Israel will delay reopening its borders and reinstate an indoor mask mandate next week due to rising cases of the Delta variant of COVID-19.

- Lisbon, Portugal, is tightening its travel restrictions and domestic curbs amid a new COVID-19 outbreak.

- The Gamma variant of COVID-19 first identified in Brazil now makes up 41% of new cases in Argentina.

- Hong Kong will suspend passenger flights from Indonesia over fears of spreading COVID-19.

- Spain is ending its year-long outdoor mask mandate effective Saturday, while Greece also lifted its outdoor mask mandate and plans to end its nighttime curfew Monday.

- Only 200 of the last 180,000 COVID-19 infections in Switzerland came from fully vaccinated people.

- The U.K. is ending its 10-day quarantine requirement for fully vaccinated citizens who return from medium-risk COVID-19 countries.

- The world’s first case of COVID-19 likely surfaced in China between October and November 2019, more than a month before the first official recording of an infection.

- S&P Global Ratings affirmed China’s financial ratings of A+/A-1 with a stable outlook, predicting the country will see above-average economic growth in the next few years.

- Manufacturing activity in Singapore rose 30% year over year in May, the fastest pace in 10 years, while Japan’s factory output likely fell in the same period.

- The U.S. expressed support for an International Monetary Fund program that would encourage rich nations to send reserves to low- and middle-income countries hit hard by the pandemic and climate change.

Our Operations

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.