COVID-19 Bulletin: June 28

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices ended a fifth straight week of gains Friday, closing roughly 1% higher for the day amid expectations that OPEC+ will not significantly boost its output from August.

- Oil prices were lower in mid-day trading today, with the WTI down 1.2% to $73.15/bbl and Brent up 1.3% to $76.05/bbl. Natural gas was up 3.5% to $3.62/MMBtu.

- Natural gas prices rose over 2% to a 29-month high Friday on forecasts for hotter weather and higher air conditioning and export demand this week.

- Russia is limiting natural gas sales to European customers as the short supply pushes prices to a 13-year high.

- Liquefied natural gas spot prices rose to $12.50/MMBtu in Asia last week as warmer weather increased electricity usage for air conditioning.

- Middle-U.S. states are passing legislation to help consumers pay for billions of dollars in natural gas bills racked up during February’s freeze, when some prices surged from around $2/MMBtu to as much as $1,200/MMBtu.

- Electricity demand in Texas late last week broke records for the month of June, as the state battled an intense heat wave.

- Active U.S. oil and gas rigs remained unchanged at 470 week over week, a 77% increase from the 205 active rigs at this time last year.

- U.S. refining capacity fell 4.5% last year from a 2019 record of 19 million bpd, the largest annual decline since 2012 as pandemic lockdowns prompted weak demand for motor fuel.

- U.S. and German officials expect to resolve a dispute over Russia’s Nord Stream 2 pipeline, which would double Russian gas exports to Europe across the Baltic Sea, by the end of August.

- The Federal Trade Commission ordered 7-Eleven to divest more than 200 retail outlets following the company’s $21 billion acquisition of Speedway, labeling parts of the deal anticompetitive.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- A blistering heat wave hit the Pacific Northwest over the weekend, with Seattle and Portland both hitting record high temperatures for June, as electric grids across the West strained to keep up with surging demand. In total, 23 regional temperature records were broken Saturday, while effects of the weather have spread to Chicago and Detroit.

- Record-high temperatures are blanketing parts of Eastern Europe and Siberia, potentially sourced from the same climate effect that has led to unusually early drought and heat in the Western U.S.

- U.S. logistics spending fell 4% to $1.6 trillion last year amid the “chaos” of the pandemic, accounting for a near-record-low of 7.4% of the nation’s GDP.

- Supply chain disruptions such as the Suez Canal shutdown and port congestion are costing large U.S. and EU companies $184 million annually, new data suggests.

- Regional parcel carriers are expanding their operations to meet persistently high e-commerce demand.

- Brexit and the pandemic have combined to create a shortage of 100,000 U.K. truck drivers, with industry leaders calling for emergency visa rules that would allow access to European drivers.

- Commodities prices have dropped in recent weeks from record pandemic highs, including a 10% decline for copper, 13% for corn, 19% for soybeans and 17% for pork. Lumber remains twice the typical price for this time of year.

- Small U.S. contractors are losing out on the U.S. housing boom due to the relatively outsized effects of labor and supply shortages.

- Russia will introduce new export taxes for steel products including nickel, aluminum and copper from August to December, expecting to reap $2.3 billion in revenue from the country’s producers amid record-high commodity prices.

- Hapag-Lloyd is cutting calls at Europe’s Port of Rotterdam for seven weeks, citing growing port congestion and schedule disruptions. Congestion at Rotterdam and other coastal ports is spreading to Europe’s inland waterways.

- FedEx will add 16 automated facilities to its network this year, hoping to be prepared for the approaching peak season.

- AB InBev, the world’s largest brewer, has employed advanced forecasting and data analytics to quickly adjust and pivot in response to the shifting challenges of the pandemic.

- Our logistics team reports that bulk trucking firms are often declining to book long-haul, out of network loads due to extreme capacity constraints.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports primarily due to increased volume of ships and containers. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- The U.S. reported 7,303 new COVID-19 cases and 147 deaths Saturday and just 3,484 cases and 75 fatalities Sunday.

- The highly transmissible Delta variant of COVID-19 accounts for more than 10% of infections in New York City, nearly double the amount from one week prior.

- Averaging roughly 1,500 new COVID-19 cases per day, Florida now has the most daily infections in the country.

- Texas officials are warning that the Delta variant of COVID-19 will likely become the state’s dominant virus strain by the end of the summer, as several counties report low vaccination numbers.

- With only 34% of its population fully vaccinated against COVID-19, Louisiana is the latest state to hold a lottery to boost inoculations.

- New Jersey reported zero new COVID-19 deaths Thursday, the first time since July 30, 2020.

- Misinformation surrounding COVID-19 vaccines poses the greatest threat to the U.S.’s so-far successful vaccination drive, officials warn.

- A new resilience report by Bloomberg ranks the U.S. number one in its recovery from the pandemic, citing its vaccine rollout and progress in reopening.

- Two unvaccinated children on a Royal Caribbean Cruise tested positive for COVID-19 after undergoing routine tests required by the cruise line before returning home.

- An inflation indicator that the Federal Reserve uses to set policy rose 3.4% in May, its fastest increase since 1992, as June consumer spending stayed relatively flat while personal income declined less than expected.

- The S&P 500 hit a record high Friday on news that fears of inflation may be overexaggerated.

- U.S. households added $13.5 trillion in wealth last year, the biggest increase in nearly three decades with the stock market accounting for roughly half the rise. U.S. stocks have already gained $6 trillion in value in 2021.

- A measure of business spending rose 11% in the first quarter of 2021, bolstering predictions that the U.S. will see a record-fast rebound in capital spending compared to previous economic downturns.

- A measure of U.S. consumer sentiment reached 85.5 in June, a smaller-than-expected rise from 82.9 in May as long-term inflation forecasts dampened consumer optimism.

- Ten states stopped sending out an extra $300 in weekly federal unemployment benefits last week, with early data suggesting the suspensions have succeeded in dampening the U.S. labor shortage.

- Kentucky will give a $1,500 bonus to people who re-enter the workforce between June 24 and July 30.

- American young adults are remaining idle at increasing rates, with roughly 1 in 5 people between age 20-24 neither working nor studying in the first quarter of 2021.

- Roughly 9 million Americans did not receive pandemic unemployment benefits despite qualifying to receive them.

- Emergency room visits for overdoses and suicide attempts rose 36% and 26% last year, respectively, as health officials predict the psychological fallout from pandemic lockdowns to last for years.

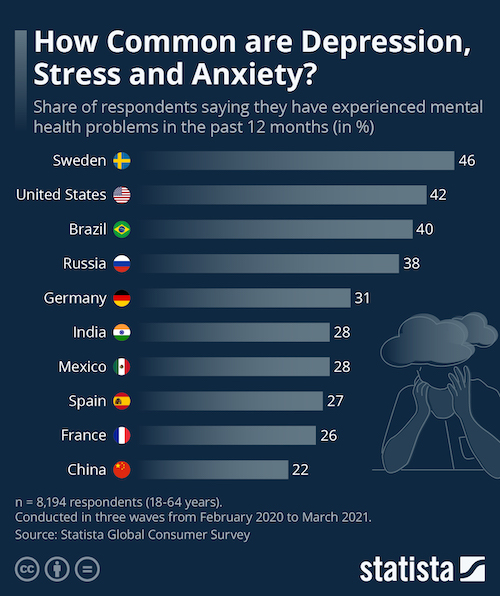

- The U.S. posted one of the highest rates of mental health problems from February 2020 to March 2021:

- New York stopped allowing takeout diners to purchase cocktails along with their meals, which was a lifeline to bars and restaurants during lockdowns.

- Two new budget airlines, Avelo and Breeze, the first new U.S. air carriers in 14 years, hope to capitalize on resurging air travel.

International

- Computer modeling suggests India’s COVID-19 death toll exceeds 1.1 million, more than double the official count of 390,000. The nation reported 46,148 new COVID-19 cases and 979 deaths Sunday, as it quickly ramps up its vaccination efforts, administering more than 8 million shots in a single day last week.

- Australia imposed more lockdowns as authorities search for contacts of five COVID-19 patients infected with the virulent Delta strain. Sydney, the nation’s largest city, went into a strict two-week lockdown.

- Thailand is imposing stricter pandemic restrictions for a month amid the country’s worst virus outbreak so far, stemming from 37 virus clusters in Bangkok.

- Singapore reported nine new cases of COVID-19 Monday, its lowest since June 9.

- Russia reported 20,393 new COVID-19 cases Friday, the most since Jan. 24 as the nation’s vaccination drive continues to falter.

- South Africa, Africa’s worst hit country for COVID-19, is aiming to double the number of vaccines it administers starting in July as new infections with the Delta variant of COVID-19 now account for more than a third of infections and 40% of deaths.

- Iceland became the first EU country to lift all its pandemic restrictions.

- Spain dropped its outdoor mask-wearing mandate over the weekend.

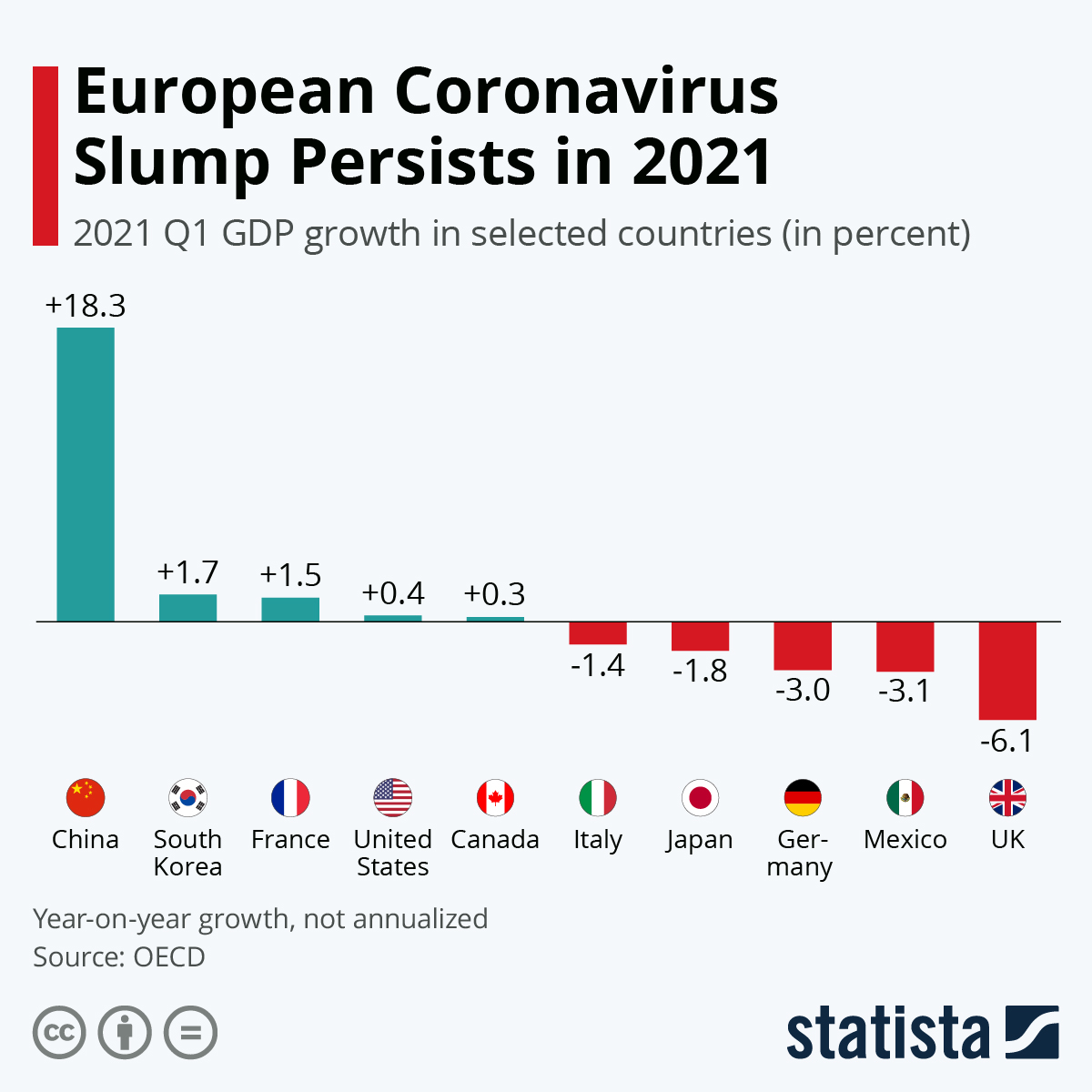

- Europe’s economic recovery is trailing other developed regions:

- Rising cases of the Delta COVID-19 variant in Europe are prompting fears over a second summer of lockdowns restricting the bloc’s usually thriving tourism industry.

- China’s industrial profit growth slowed in May, likely reflecting higher raw materials prices.

- Tesla recalled more than 90% of its locally made vehicles in China over a safety issue in the cruise control system.

- German carmaker Daimler is set to spin off Daimler Truck, the world’s largest truck and bus maker, by the end of the year.

- Volkswagen said it will stop selling combustion-engine cars in Europe by 2035.

- Brussels will ban diesel cars in the region by 2030 and gas cars by 2035, hoping to help hit the EU’s goal of becoming carbon neutral by 2050.

Our Operations

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.