COVID-19 Bulletin: March 1

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Brent rose 3.1% Monday to $100.99/bbl, while WTI spiked 4.5% to settle at $95.72/bbl, as severe new sanctions on Russia raised fears of tighter global supplies. By the end of yesterday’s session, WTI had notched its third consecutive monthly gain.

- In mid-morning trading today, Brent futures were up another 7.8% at $103.22/bbl, WTI was up 6.8% at $104.81/bbl, and U.S. natural gas was 3.4% higher at $4.55/MMBtu.

- War in Eastern Europe continues to impact global energy markets:

- The U.S. and other major oil consumers are considering a release of 70 million barrels of oil from emergency stockpiles as crude prices surge.

- Taking BP’s lead, Shell and Norwegian major Equinor announced plans to exit investments in Russia’s energy industry. France’s TotalEnergies took a more modest stance and said it would no longer provide capital for new developments in the country.

- Danish energy firm Orsted halted sourcing Russian coal and biomass for its power plants.

- Freight costs for Russian oil delivery are up fivefold over the past week, as some firms, including BP, refuse to load Russian fuel oil and Russian domestic producers receive little to no bids on spot tenders.

- London-listed shares of Gazprom (-53%) and Rosneft (-42%) fell sharply Monday, even as Gazprom continues to transport gas via Ukraine.

- Ukraine has disconnected from Russia’s electric grid and will link into the EU’s grid, a move originally planned to gradually take place over the next year.

- New legislation in Germany will require the country’s gas storage facilities to be full at the beginning of winter, while officials ramp up investment in wind and solar projects in a bid to reduce reliance on Russian gas.

- The delayed start of a new nuclear reactor in Finland is limiting the nation’s ability to cut off Russian gas supplies.

- The Yamal-Europe gas pipeline from Russia to Germany briefly flowed westward for a few hours on Saturday, the first time since December.

- U.S. oil demand rose an annual 10% to 20.8 million bpd in December, the highest level of the pandemic.

- Petrobras capitalized on surging crude prices to rake in $21.3 billion in profits last year, more than double the previous record from 2019.

- Pemex reported a $6.1 billion loss last quarter, the largest in seven quarters, even as output rose 4.5%.

- Exxon Mobil is shuttering over one-fifth of production at its 502,500-bpd Baton Rouge refinery until April for repairs and maintenance.

- Exxon Mobil made its first sale of certified circular polymer made at its Baytown, Texas, advanced recycling site.

- Chevron announced a $3.15 billion acquisition of sustainable fuels producer Renewable Energy Group, a bid to accelerate its transition to cleaner energy.

Supply Chain

- War in Eastern Europe continues to impact global supply chains:

- Russia’s invasion of Ukraine has left hundreds of ships stranded at ports and is disrupting global supply chains.

- Fears of violating new Russian sanctions have prompted Volvo, Harley-Davidson and GM to indefinitely suspend car shipments to the Russian market, while Daimler is halting component shipments to its Russian partner.

- South Korea is banning some shipments of critical technology to Russia.

- Freight disruption related to Russia’s invasion of Ukraine is growing on a key overland rail link that connects China to parts of Europe and Asia.

- Major aircraft lessors are terminating contracts for hundreds of planes with Russian airlines to comply with sanctions on the country.

- Maersk is prepared to suspend all deliveries to and from Russia but has held off on imposing the measure so far.

- The U.K.’s transport chief has banned all Russian vessels from entering the nation’s ports.

- The Russia-Ukraine conflict is throwing off contracted orders for vessel newbuilds.

- The world’s biggest commercially operated aircraft — a six-engine cargo jet with a wingspan just shy of a football field — was heavily damaged in fighting in Ukraine.

- Chicago wheat futures rose above $9.5/bushel for the first time in 14 years on supply shortages from major exporters Russia and Ukraine.

- Alabama’s Port of Mobile moved 47,768 TEUs in January, a 17.5% increase year-over-year.

- The Suez Canal raised tolls by up to 10% for all vessels besides LNG and cruise ships.

- Construction on an underground rail tunnel linking New York City and New Jersey is expected to begin as early as 2023, officials say.

- Air Canada saw record cargo volumes last year and will add three freighters to its fleet to boost cargo revenue this year, the airline said.

- Freight forwarders are sharply ramping up the use of chartered aircraft on Asia-U.S. routes, with a particular focus on Vietnam.

- Toyota is shutting down all 14 of its Japanese factories today due to a cyberattack on one of its suppliers.

- Virginia lawmakers are advancing a bill that would restrict truckers to the right-hand lane during winter storms, a response to truck buildups that stranded hundreds of drivers on a 40-mile stretch of I-95 in Virginia for over 24 hours in January.

- The value of M&A activity of venture-backed logistics startups in the U.S. reached $2.7 billion in both 2020 and 2021, up nearly 69% from 2019, as the drive to solve logistics snarls coincides with cooling valuations for some private firms in 2022.

- Rising prices in the ship-scrapping market are drawing more vessels to demolition yards.

- Airbus plans to test hydrogen-powered jet engines on its A380 aircraft.

Domestic Markets

- The U.S. reported 105,840 new COVID-19 infections and 2,093 virus fatalities Monday. Up to 43% of the population has now been infected with the virus, the CDC says.

- California will lift its masking requirement for unvaccinated people starting today and allow public schools to relax their mask policies in early March. Oregon and Washington also plan to drop school mask mandates in early March.

- The U.S. House of Representatives and the White House have lifted mask mandates for fully vaccinated people.

- The CDC dropped mask mandates for public-school transportation systems.

- Amazon dropped mask mandates for all U.S. employees, regardless of vaccination status.

- People who have been infected with COVID-19 Omicron are likely immune to infection with the BA.2 subvariant, new research suggests.

- Over 75% of the increase in remote work during the pandemic could become permanent, new studies show.

- U.S. pension plans are reeling amid requirements to raise payouts to match skyrocketing inflation.

- Wages for people aged 16-24 jumped 10.6% in January from a year earlier, more than doubling the 4% gain for all other age groups.

- Target said it is putting an extra $300 million into starting wages as high as $24/hour this year in a bid to attract and retain talent.

- Quarterly sales at Zoom Video Communications are slowing, signaling less demand for the firm’s videoconferencing application.

- Shares of Ohio electric-truck startup Lordstown Motors fell 16% on Monday after the firm said it would sell only 500 vehicles this year, less than a quarter of market expectations. California-based luxury electric-vehicle maker Lucid dropped its vehicle production targets, citing component shortages and supply chain snarls.

International Markets

- The international fallout of war in Eastern Europe continues to spread:

- In less than a week, the Russia-Ukraine conflict has displaced over half a million people.

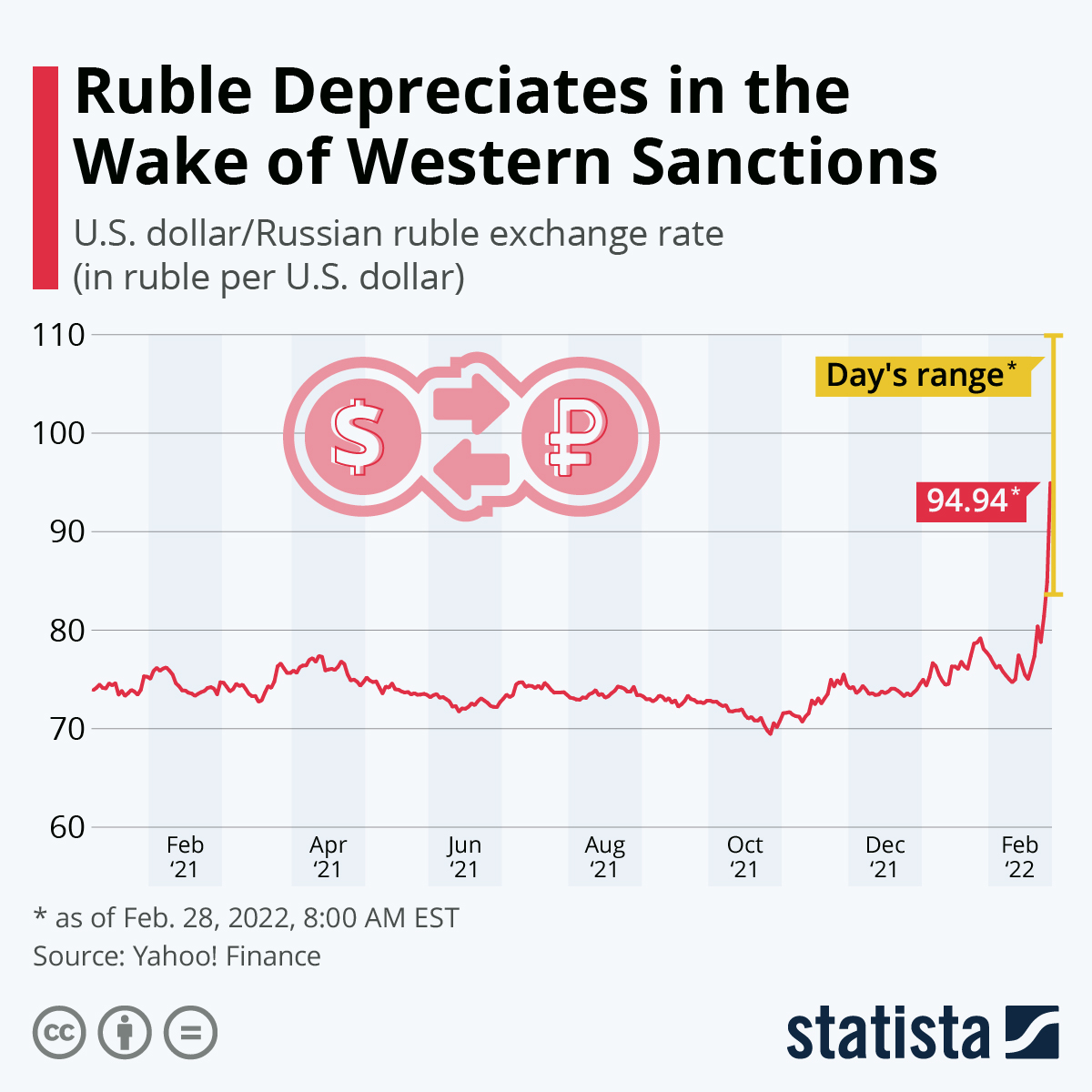

- Russian banks are facing runs on deposits and a sharp deterioration in their financial health from sanctions and a falling ruble, analysts say. The nation’s central bank — whose U.S. assets were effectively frozen on Monday — doubled interest rates, banned foreign securities trading and shuttered the country’s stock market yesterday and today.

- Russia’s central bank chief warned of a liquidity crisis Monday. A European subsidiary of Russia’s largest bank is one of the first to fail.

- Switzerland bucked its deeply rooted tradition of neutrality and announced a freeze of all Russian financial assets in the nation.

- U.S. lawmakers have introduced legislation that would end normal trade relations with Russia. Separately, the New York Stock Exchange and the Nasdaq MarketSite have halted trading in Russia-based companies.

- Payment networks, including Mastercard and Visa, are blocking money transfers and other services to and from Russia, as the Russian government banned all transfers to foreign bank accounts, which could result in defaults on Russia debt and have years-long implications for the nation’s credit rating.

- Russia’s GDP could contract up to 10% this year due to sanctions, updated forecasts show.

- Economists say that the Russia-Ukraine conflict will likely have only modest effects on the U.S.’s economic rebound, although it could push inflation higher.

- Russia has now banned 38 countries from use of its airspace, a retaliatory measure that came after the EU and Canada said they would join the U.K. and others in banning Russian airlines.

- Hong Kong saw a record 34,466 new COVID-19 cases yesterday as residents emptied store shelves in a scramble to prepare for a lockdown of the city later this month, when officials will carry out a mandatory, island-wide testing drive.

- Amid a 160% rise in COVID-19 cases the past two weeks, South Korea has started relaxing pandemic restrictions in a bid to keep its economy moving.

- New Zealand, for years a model of COVID resistance, now has one of the world’s highest transmission rates.

- Samsung’s 100,000 professional employees are asking for a 16% raise, the largest ask ever.

- China’s Envision group plans to start producing batteries for electric vehicles with a range of at least 620 miles.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.