COVID-19 Bulletin: March 3

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

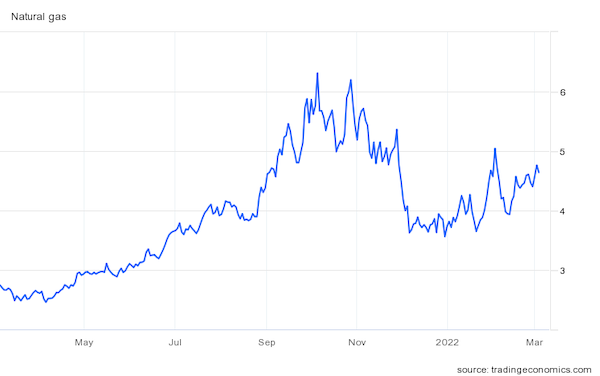

- War in Eastern Europe continues to impact global energy markets:

- WTI futures jumped 7% yesterday to close above $110/bbl, the highest price in over a decade. Brent settled the day at $112.93/bbl, up 7.6%.

- European gas futures surged to a new all-time high Wednesday before easing slightly. U.S. natural gas futures rose to a four-week high:

- Energy futures fell in mid-day trading today, with WTI down 0.6% at $109.90/bbl, Brent down 0.2% at $112.70/bbl and U.S. natural gas 1.6% lower at $4.69/MMBtu.

- Despite the dramatic rise in oil prices, OPEC+ decided on Wednesday to stick with a modest 400,000-bpd monthly output increase for April.

- Exxon Mobil is the latest Western oil company to exit investments in Russia.

- The White House took aim at Russian refiners with new export curbs on technology used to modernize facilities, the first meaningful step to target the nation’s oil and gas industry. More direct sanctions could be forthcoming on the source of roughly 8% of the U.S.’s liquefied fuel imports.

- Oil tankers continue to reject Russian crude loads due to dangers in the region and sanctions.

- Wintershall Dea, a backer of the failed Nord Stream 2 gas pipeline from Russia to Germany, will write down its investment in the pipeline and refuse to pursue new energy ventures in Russia.

- International commodities trader Trafigura, one of the largest traders in Russian oil, halted all investments in the nation and indicated it may pull out of current projects.

- Russia’s London-listed oil and gas firms have lost 95% of their market value.

- U.S. crude stocks dropped 2.6 million barrels last week, driving key storage hubs to multi-year lows. Meanwhile, the nation’s strategic reserves fell to the lowest level since 2002, even before the White House unveiled a plan to release 30 million barrels to help cool prices.

- Chicago futures for ultra-low sulfur diesel spiked nearly 22 cents to $3.15/gallon yesterday, the largest single-day rise in 14 years.

- U.S. drillers are struggling with a fracking sand shortage as they try to scale up crude output.

- Mergers and acquisitions activity is running high for Western Canada gas processing assets.

- Marathon is taking steps to convert a refinery in Martinez, California, into a renewable diesel facility with 2.1 million tons of production capacity by 2023.

Supply Chain

- The logistics fallout from the Russia-Ukraine crisis continues to spread:

- Air and seaborne cargo rates between Europe and Asia are rising sharply. The EU and U.S. are considering blocking all Russian ships from entering their ports.

- Japanese automakers pulled out of Russia in a wave on Wednesday, with Toyota and possibly Mitsubishi halting production and sales in the country; Honda suspending exports; and Mazda ending car part sales. Autos and auto parts made up more than half of Japan’s exports to Russia in 2020.

- Farmers across the globe will see higher fertilizer prices due to lost production from Russia, a major supplier. Prices for staples such as corn and wheat are surging.

- Boeing may be forced to shut down some production as Russian cargo jets chartered to transport its massive bulk loads can no longer fly in U.S. airspace, with no immediately available alternatives.

- Existing Russian orders for oil tankers and new container ships could be delayed indefinitely.

- Sixty-six ships waited to enter the Ports of Los Angeles and Long Beach late last week, down from a peak of 109 in early January.

- South Carolina’s Port of Charleston placed a temporary embargo on some export cargo as it copes with a backlog of more than 30 container ships.

- Georgia’s Port of Savannah plans to expand yearly capacity by 60% to 9.5 million TEUs within the next three years.

- The White House more than doubled the grant program for U.S. port projects this year to $450 million.

- Ocean Network Express is shifting intra-Asia container ships to trans-Pacific lanes.

- The average refrigerated spot trucking rate hit a record $3.59 per mile in January, up 12 cents from December and almost a full dollar from the same time last year.

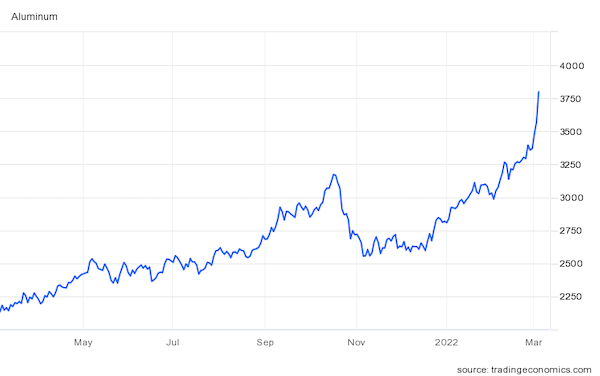

- The price of aluminum rose to an all-time high of $3,552 per tonne Wednesday. Steel prices are also on the rise.

- Colorado’s Ball, the world’s largest manufacturer of aluminum cans, is dropping smaller customers as it struggles to fill orders from large brewers.

- Per-mile insurance premiums for U.S. trucking companies are up 47% the past decade, industry experts say.

- The U.S. Federal Maritime Commission and the Department of Transportation are pooling resources to bolster enforcement of competition rules in maritime shipping.

- About 3,000 workers at Canadian Pacific Railway voted for a plan to strike on March 16, if necessary, threatening the movement of commodities within the Canadian supply chain.

- CMA CGM is testing the use of different biofuels on 32 of its vessels, with expectations that alternative fuels will account for 10% of its energy mix by next year.

Domestic Markets

- The U.S. reported 52,355 new COVID-19 infections and 2,095 virus fatalities Wednesday. Total hospitalizations have fallen 70% over the past month, while healthcare staffing shortages remain high.

- New York City will end its COVID-19 contact-tracing program next month, while day cares in the city are starting to drop mask mandates.

- Delaware ended its mask mandate for public schools Tuesday.

- Full and unrestricted attendance is once again permitted at Mardi Gras.

- Starting next week, American households can order another round of free at-home COVID-19 tests supplied by the federal government. Free anti-viral pills will be available at pharmacies later this month.

- COVID-19 vaccines tailored to specific strains could be developed, approved and mass-produced within 100 days, health officials say.

- Google will recall Bay Area workers to the office next month.

- U.S. stock indexes rose Wednesday following indications the Federal Reserve will stay on track with a 0.25% increase in interest rates when it meets in two weeks.

- Payroll giant ADP said the U.S. added a larger-than-expected 475,000 jobs in February, one of the strongest readings since the early days of the pandemic.

- New jobless claims in the U.S. fell for a second consecutive week for the week ending Feb. 26, dropping by 18,000 to a seasonally adjusted 215,000.

- On Wednesday, Ford announced a major restructuring that will separate the electric-vehicle (“Ford Model E”) and combustion-engine (“Ford Blue”) sides of its business, as the automaker projects electric vehicles to account for one-third of global sales by 2026 and half of global sales by 2030.

- Amazon said it will shut down all its physical bookstores and “Pop Up” shops to focus on grocery and fashion retail.

- Net sales at Nordstrom rose 23% last quarter, beating market expectations as demand grows for upscale goods.

- ONE, an electric-vehicle startup based in Michigan, claims a new battery it developed can deliver more than 750 miles on a single charge.

- Amazon-backed electric-vehicle startup Rivian raised its selling prices by 20% — including on existing pre-orders — citing inflation and higher component costs.

- Coors Light will move away from single-use plastic rings on its six packs in favor of recyclable cardboard-wrap carriers starting later this year.

- Circular SynTech is building a waste-to-renewable chemicals plant in New Madrid, Missouri, to be served by Union Pacific.

International Markets

- More news related to the war in Europe:

- Russia’s largest bank is quitting almost all European markets as it is no longer able to supply liquidity to European subsidiaries. The nation’s central bank has cut reserve requirements in a bid to free up lending, while major international stock indexes, including the S&P 500, remove or consider removing Russian equities.

- The Moscow Exchange is shuttered for a fourth straight day today, while Russia’s currency reached an all-time low of 118 rubles per U.S. dollar.

- The Russia-Ukraine conflict could cut $1 trillion from global GDP and add about 3% to inflation this year, British economists say.

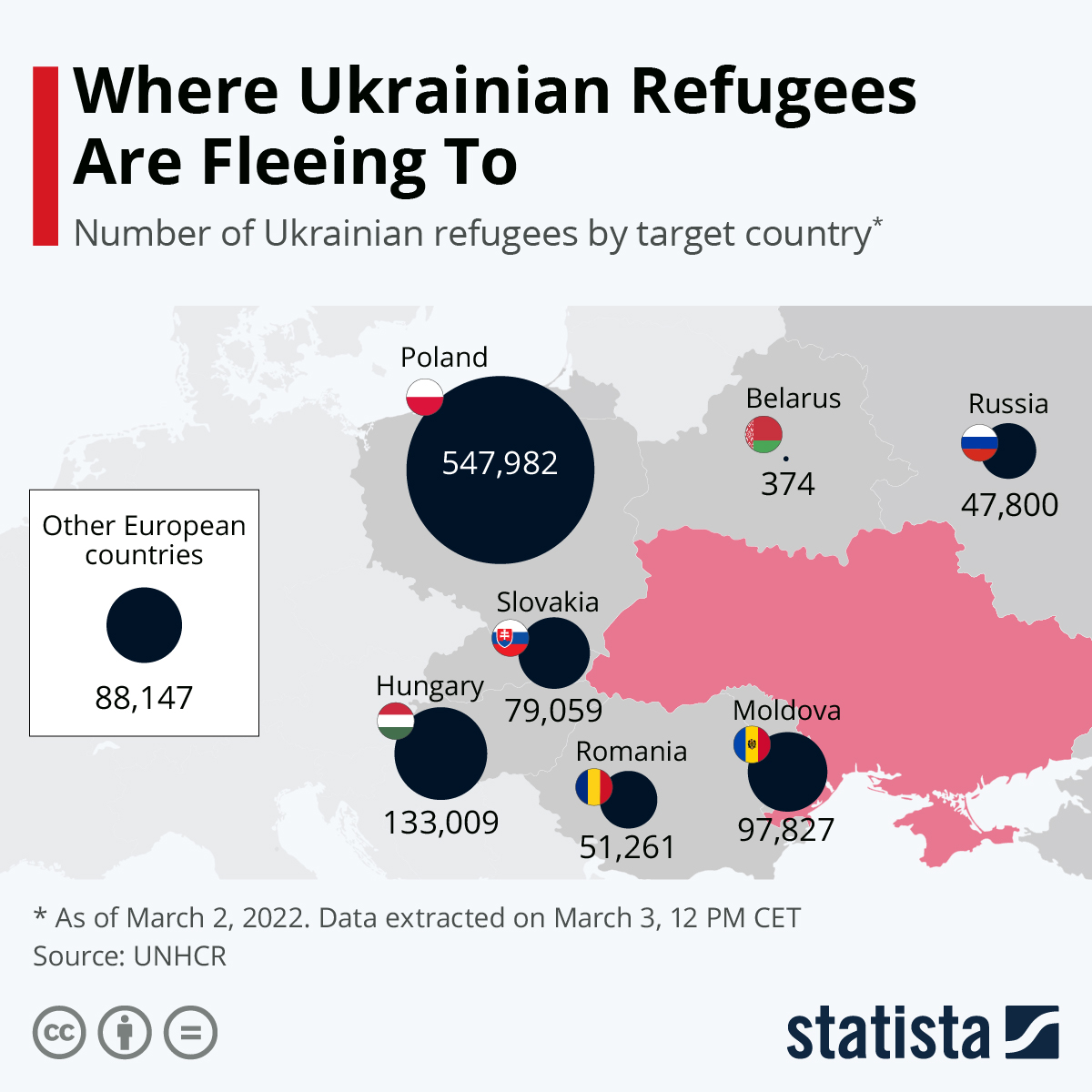

- More than 1 million people have been displaced by the Russia-Ukraine conflict in less than a week.

- Hong Kong reported over 55,000 new COVID-19 cases Wednesday, the latest in a string of daily records. Key services on the island, including transport and supermarket retail, are curtailing operations.

- Yesterday, single-day COVID-19 cases in South Korea topped 200,000 for the first time during the pandemic.

- China’s ultrastrict COVID-19 controls may not be eased until next spring, although some cities could see loosened restrictions starting this summer, new reports say. Economic consequences of the nation’s zero-COVID approach are growing, with services activity falling to a six-month low in February.

- Italy saw 178,000 excess deaths since the start of the pandemic, suggesting official COVID-19 fatality counts are too low.

- Skyrocketing energy prices pushed European inflation to 5.8% year over year in February, the fourth straight month of record highs.

- Canada’s central bank raised its benchmark interest rate a quarter-percentage point to 0.5% yesterday, its first rate hike in over three years.

- Stellantis unveiled plans for its first battery-electric Jeep vehicle and announced it will build a hydrogen-powered heavy pickup truck in the coming years.

- Hyundai is ramping up its electric vehicle plans and will invest $16 billion to create 17 new all-electric models by 2030.

- Toyota is selling a year of free charging to buyers of its new all-electric SUV.

- Panasonic will become a key Tesla battery supplier in about two years, the firm said.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.