COVID-19 Bulletin: March 4

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- War in Eastern Europe continues to impact global energy markets:

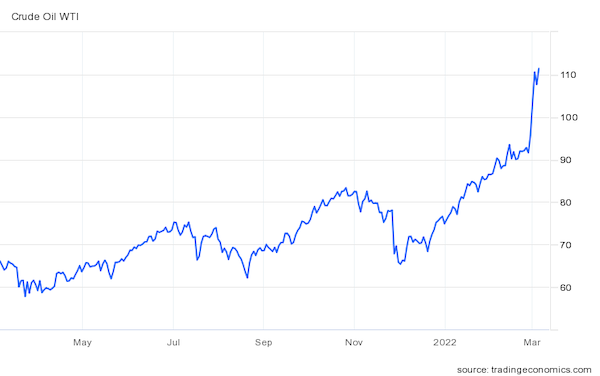

- War in Eastern Europe continues to impact global energy markets:Oil futures settled 2% lower in volatile trading on Thursday, buoyed by hopes that Iranian oil could soon help replace disrupted supplies from Russia.

- In late-morning trading today, WTI futures were up 4.0% at $111.70/bbl, Brent was up 3.6% at $114.40/bbl, and U.S. natural gas was 3.8% higher at $4.90/MMBtu.

- Traders remain wary of Russian oil, with at least 10 tankers failing to find buyers mid-week, as transport prices increase threefold on some routes.

- Benchmark international coal prices are at a 24-year high.

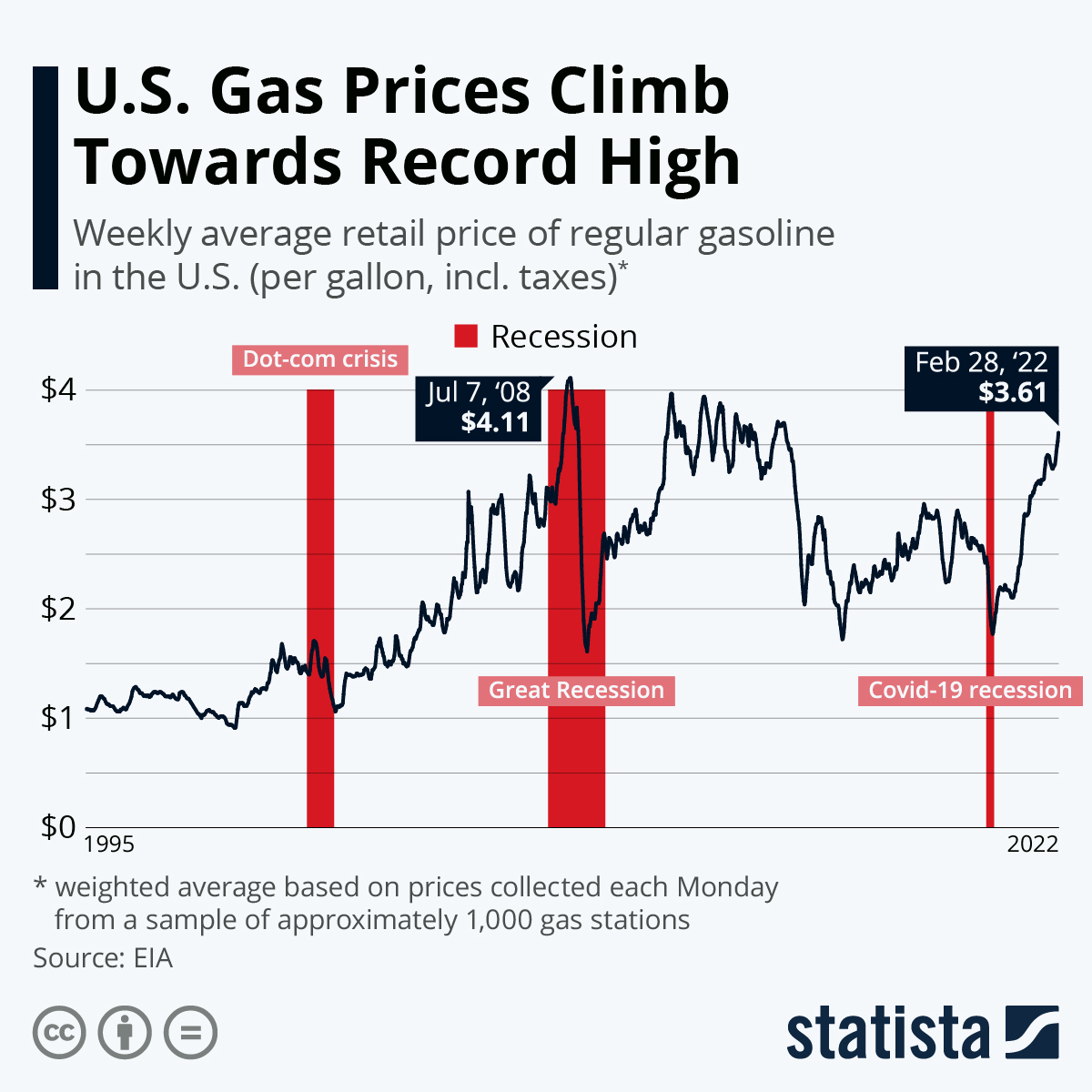

- Industry analysts say U.S. consumers could see gas prices spike to $5 a gallon in the coming weeks.

- A bipartisan group of U.S. lawmakers introduced legislation to ban all Russian oil imports, an embargo already in effect at some of the U.S.’s largest refiners. The White House has indicated it would oppose a formal ban.

- While Japan has offered aid to Ukraine and levied some sanctions on Russia, Tokyo has so far maintained its Russian energy supply contracts.

- Russian forces seized Europe’s largest nuclear plant in Ukraine in a fire fight that threatened a radioactive catastrophe. Commodity prices spiked and equities dipped overnight on the news.

- Smaller energy firms are sacrificing large portions of income to pull investments from Russia.

- Equinor and BP will partner to turn Brooklyn’s historic marine terminal into a regional hub for the staging and assembly of components for offshore wind farms on the East Coast.

- At the United Nations, 175 countries signed a resolution committing to create a legally binding agreement by 2024 to address global plastics pollution.

- Waste management company Republic Services announced plans to build the first of a nationwide network of “integrated” plastic recycling facilities in Las Vegas, scaled to handle 100 million pounds a year.

Supply Chain

- The logistics fallout from the Russia-Ukraine crisis continues to spread:

- Russian forces are laying siege to Black Sea port cities. In Mykolaiv in southern Ukraine, one person died after a Bangladeshi bulk carrier was struck by a Russian missile. Near the western trade hub of Odessa, an Estonian cargo ship sank after hitting a Russian sea mine.

- Several of the world’s largest freight forwarders, including Switzerland’s Kuehne + Nagel and Germany’s DB Schenker, have suspended services to Russia by air, land and sea.

- Airline fuel costs are rising sharply as flights between Europe and Asia are forced to add several hours to avoid Russian and Ukrainian airspace.

- Analysts say the war could lower global vehicle production by an estimated 1.5 million vehicles this year, roughly 2% of expected output. Volkswagen and Mercedes-Benz pulled out of Russia on Thursday, while new production shutdowns were announced by Porsche and Russia’s largest carmakers.

- Sovcomflot, Russia’s largest maritime and freight shipping company, is among U.S.-sanctioned firms.

- E-commerce sales in Russia and Ukraine are down a respective 53% and 96% since Feb. 1.

- Pittsburgh-based Alcoa will stop buying materials from Russia that it uses to produce aluminum, furthering upward price pressure on the metal.

- A giant Ukrainian steel mill owned by ArcelorMittal, among the nation’s largest industrial complexes, closed on Thursday.

- Canada’s Kinross Gold Corp., the only large western miner in Russia, will suspend operations in Russia’s Far East.

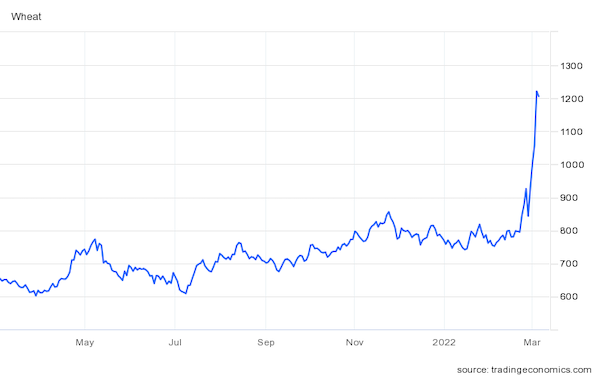

- U.S. grains giant Archer Daniels Midland and Missouri-based Bunge began closing Russian operations.

- Chicago wheat futures maxed out their daily trading swing for the third day in a row yesterday and are up 22% on the week to an all-time high.

- Russia is halting deliveries of rocket engines to the United Launch Alliance, a launch company owned by Boeing and Lockheed Martin.

- California’s Port of Hueneme — situated about 60 miles north of the Port of Los Angeles — saw 102,892 loaded container imports last year, a 108.8% increase from 2020.

- Old Dominion Freight Line is suspending northbound shipments to Ontario due to bad weather and a backlog at the Canadian border.

- Hyundai Heavy Industries is reopening a shuttered shipyard to handle its growing backlog of ship orders.

- La-Z-Boy is sending specialized teams of industry veterans to help quickly boost production at owned and supplier factories.

- Shipping surcharges accounted for almost 6% of Macy’s sales in the fourth quarter, up from nearly zero pre-pandemic.

- Target is planning up to $5 billion in annual capital spending over the next few years to bolster its logistics network across 23 states.

- Shoppers are turning to niche online marketplaces, including Etsy, to buy from smaller sellers amid supply chain challenges at large corporate retailers.

- Old Dominion Freight Line saw a 38.3% annual rise in daily revenue last month on higher less-than-truckload shipments.

- BNSF Railway’s operating profit rose 13.7% to $8.8 billion last year as revenue expanded 11.6% to $22.5 billion.

- Taiwan Semiconductor Manufacturing Co. is boosting new capacity investment to $44 billion this year from $30 billion last year.

- Ford will idle SUV and pickup production in Kentucky and Ohio next week due to a shortage of semiconductors.

- Legislation aimed at helping the U.S. Postal Service become more financially viable has passed the House by an overwhelming majority and is on the verge of clearing the Senate.

- Major shippers are urging U.S. regulators to create a single national portal for ocean freight information.

Domestic Markets

- The U.S. reported 52,292 new COVID-19 infections and 1,743 virus fatalities Thursday.

- New York City will drop proof-of-vaccination requirements for restaurants, gyms and entertainment venues Monday.

- Los Angeles County, Philadelphia and New Orleans dropped their indoor mask mandates.

- Apple will drop mask mandates for most employees today.

- The National Football League and its union agreed to drop all COVID-19 protocols.

- Expired COVID-19 vaccine stockpiles are building in states where demand for shots is low.

- COVID-19 has led to a rapidly expanding market for self-diagnostic medical products.

- The economy created a better-than-expected 678,000 jobs last month as the unemployment rate fell to 3.8%.

- U.S. worker productivity rebounded 6.6% year over year last quarter, curbing some growth in the cost of labor.

- The chairman of the Federal Reserve told lawmakers Thursday that Russia’s invasion of Ukraine was likely to push up U.S. inflation.

- The median U.S. home listing hit a record $392,000 in February, up 12.9% year over year and 26.6% compared to February 2020.

- Despite higher gas prices and surging hotel room rates, roughly 40% of Americans have plans to travel this year over spring break, up from 29% who traveled last year.

- Grocery retailer Kroger continued a streak of strong sales and profits last quarter as U.S. consumers continue eating more at home.

- Best Buy’s quarterly earnings fell below market expectations as supply chain disruptions shrank inventories. The retailer expects revenue to dip further this year before rebounding almost 10% by 2024.

- Shortages of Nike products damaged Foot Locker’s earnings last quarter, causing shares to drop as much as 30% late last week.

- Amazon-backed electric-vehicle startup Rivian apologized and walked back a 20% price increase on existing pre-orders imposed earlier this week.

- Google is developing radar technology that can sense a person’s movements and control their digital devices accordingly.

International Markets

- More news related to the war in Europe:

- The Chinese equivalent of the World Bank and International Monetary Fund has suspended all operations in Russia and Belarus, a rare example of a Beijing-based multilateral lender citing geopolitical factors in its decisions.

- The Russian state is set to miss its interest payment to foreign bondholders for the first time since 1998.

- Russia’s credit ratings were downgraded deep into junk territory by Moody’s Investors Service and Fitch Ratings, raising doubts about whether Moscow will honor its debts.

- London Stock Exchange Group suspended trading in 27 Russian stocks, including the nation’s largest bank.

- Russian aviation firms are banned from getting insurance at Lloyd’s of London, the world’s largest commercial and specialty insurance hub.

- Wall Street investment giant BlackRock halted purchases of Russian equities.

- IKEA closed all its Russian stores, halted production in the country and banned all exports and imports with Russia and Belarus.

- Nike is temporarily closing all its Russian stores.

- The EU is looking to remove Russia’s most-favored nation status at the World Trade Organization, potentially unleashing tariffs on $105 billion in Moscow exports to the bloc. Canada removed Russia as a favored trading partner.

- Russia’s wealthiest businesspeople are warning of a prolonged economic crisis due to Western sanctions.

- Calls are growing for Europe to remove Russian ally Belarus, a nation of almost 10 million people, from the SWIFT global payment system.

- Average COVID-19 cases across the globe are down to about 1.5 million per day, a 27% decline from two weeks ago.

- New Zealand’s worst-ever COVID-19 wave is raging, with a record 23,194 new cases reported Thursday in the island nation of just over 5 million.

- Hong Kong reported a record 56,827 new COVID-19 cases Thursday, as public transit systems began cutting more services.

- Western Australia opened its borders Thursday for the first time in 697 days, ending one of the world’s longest border closures linked to COVID-19.

- Nations reopening to tourism are frustrated by China’s effective lockdown of citizens to cross-border travel, which costs the industry nearly $280 billion annually.

- South Korean consumer prices rose 3.7% in February, a near-decade high.

- Kia announced new goals to have 14 fully electric models by 2027 and sales of 1.2 million electric vehicles per year by the end of the decade.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.