COVID-19 Bulletin: March 17

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Crude futures were lower in mid-day trading today, with the WTI down 1.1% at $64.06/bbl and Brent 1.1% lower at $67.62/bbl. Natural gas was 1.6% lower at $2.52/MMBtu.

- U.S. import prices rose by 1.3% in February, the second month of gains largely due to higher energy prices.

- With the addition of four new natural gas pipelines in the past three months, the U.S. has increased its natural gas transportation capacity by around 4.4 billion cubic feet per day.

- Rebounding oil demand is freeing some supertankers that were booked as floating storage last year, but production cutbacks from Saudi Arabia and others threaten to keep prices for very large crude carriers at historic lows.

- Indian refineries plan steep cuts in oil purchases from Saudi Arabia in favor of more attractive North American crude.

- Oil production in the U.K. declined by 5% last year and is expected to drop even more as spending on development and operations fall to their lowest levels in more than two decades.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Traffic at gateway ports in Los Angeles and Long Beach showed a 50% increase in volume in February, driving revenue growth that’s expected to continue through the first half of 2021.

- Ocean carriers likely rejected at least $1.3 billion in U.S. agricultural exports between July and December.

- The number of trucks leaving the U.K. empty after delivery has doubled due to post-Brexit red tape, an industry group says.

- Toyota said shortages of unspecified petrochemicals will disrupt production at plants in Alabama, Kentucky and Mexico, while Honda said all of its U.S. and Canadian plants will see production curtailed next week due to a number of supply chain issues, including port congestion and computer chip shortages.

- Electronics giant Samsung warned that the computer chip shortage is spreading beyond the automotive industry; it expects the shortage to begin impacting operations next month and may suspend the introduction of its latest Galaxy Note smartphone.

- Prices for battery-grade lithium, a vital ingredient in batteries for electric vehicles and devices, are up 88% this year in China, which controls 60% of the world’s lithium supply.

- Manufacturers of shipping containers, who saw no new orders for the first five months of the pandemic, now can’t keep up with demand.

- A growing demand for equipment needed to automate packaging is leading to a backlog that’s threatening supply chains as e-commerce continues to surge.

- Port congestion is affecting nearly 20% of retailer Tilly’s inventory receipts, the company said.

- Rising e-commerce demand is fueling increasing competition for long-haul truck drivers.

- Uber is granting U.K. employees vacation pay and pension contributions, a major shift in the reclassification of drivers from independent contractors to “workers.”

- Plastic resin production and inventories could take months to recover from February’s winter storm that shut down most Gulf Coast petrochemicals production, as material scarcity and soaring prices disrupt a wide swath of manufacturing industries.

- Griddy Energy is the third Texas power company to file for bankruptcy resulting from the cold freeze last month. The company has ceased operations and is providing releases to former customers who were hit with enormous electricity bills during the storm.

- A shortage of corrugated material is requiring some suppliers to ship in boxes that may not be stackable. Such unstackable packaging should be clearly marked. In the interest of safety, we urge clients and our fulfillment partners to notify anyone involved in logistics operations to be mindful of the shortage and careful to heed warning labels that may appear on resin containers.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- There were 53,579 new COVID-19 cases and 1,286 deaths in the U.S. yesterday. Over 110 million vaccine doses have been administered, with 11.46% of the population fully vaccinated.

- Eighteen U.S. states are experiencing rising COVID-19 infection rates this week, prompting warnings about a growing number of emerging hotspots.

- The CDC said up to 30% of U.S. COVID-19 infections are now of the more virulent U.K. variant.

- Ohio joined a handful of states with plans to open up COVID-19 vaccine eligibility to those aged 16 and older this month.

- Federal health officials are reporting that approximately 9 in 10 Americans who received their first dose of a two-dose COVID-19 vaccine received their second shot, most within the recommended time frame.

- Scientists can’t explain why some COVID-19 long haulers are fully recovering within days of receiving vaccines, potential good news for those suffering prolonged symptoms of the virus.

- Pregnant women vaccinated against COVID-19 could pass along immunization to their babies, results of a new Israeli study show.

- BioNTech is partnering with rivals Novartis and Merck to make 2 billion doses of COVID-19 vaccines this year.

- Nine counties in the San Francisco Bay Area issued a statement dispelling public concerns that Johnson & Johnson’s one-shot vaccine is less effective than competing vaccines, noting that all approved vaccines are 100% effective in preventing deaths.

- Major U.S. banks will begin distributing the latest round of COVID-19 stimulus checks today.

- Small businesses have two more months to apply for loans from the Paycheck Protection Program with $93 billion in funds still available.

- The Federal Reserve is set to release updated data on an improved U.S. economic outlook today. Analysts also expect the central bank to hold to its policy of low interest rates and bond purchases.

- Nokia will cut up to 10,000 jobs over the next two years to offset the costs of research and development in emerging 5G network technology.

- Soaring prices for building materials have not slowed the boom in housing construction.

- Electronics manufacturer Foxconn may convert a much touted but troubled widescreen TV facility in Wisconsin to make electric vehicles. Delta Electronics, another Taiwanese electronics maker, also is looking to electric vehicles as an avenue for growth.

- Nearly half of the 3 million jobs in U.S. health clubs disappeared last year along with more than half of the industry’s revenue.

- The pandemic has fueled unprecedented demand and pricing for new and used musical instruments as sequestered consumers succumb to “gear acquisition syndrome.”

- One year after shutting down, small cruise ship operators in the U.S. are beginning to reopen.

- Smithfield Foods announced plans to cut its use of petroleum-based plastic by 50% and transition to packaging that is 90% recyclable or compostable by 2030.

- Candy manufacturer Mars Wrigley announced a partnership with a biodegradable material manufacturer to develop compostable packaging for some of its candy, starting with packaging for Skittles in late 2021 or early 2022.

- MIT engineers are working on a new technology that would allow recycled polyethylene, commonly used in plastic wraps and grocery bags, to be used in fabrics and wearable textiles.

International

- Brazil is quickly approaching 3,000 COVID-19 fatalities per day, with 2,841 reported yesterday, a record.

- France’s capital is headed for more coronavirus restrictions as officials say the country is entering a third wave of the pandemic. A new COVID-19 variant discovered in the country appears undetectable using “gold standard” PCR tests.

- COVID-19 cases are rising sharply in Germany, making it unlikely that lawmakers will lift months-long lockdowns in a bid to revive the economy. The spike in cases prompted economists to revise their projection for 2021 economic growth to 3.1% from 3.7%.

- Daily COVID-19 deaths and hospitalizations set records yesterday in Hungary.

- Britain’s business minister says that half of the adult population in the country will have received at least one dose of the COVID-19 vaccine by the end of the week.

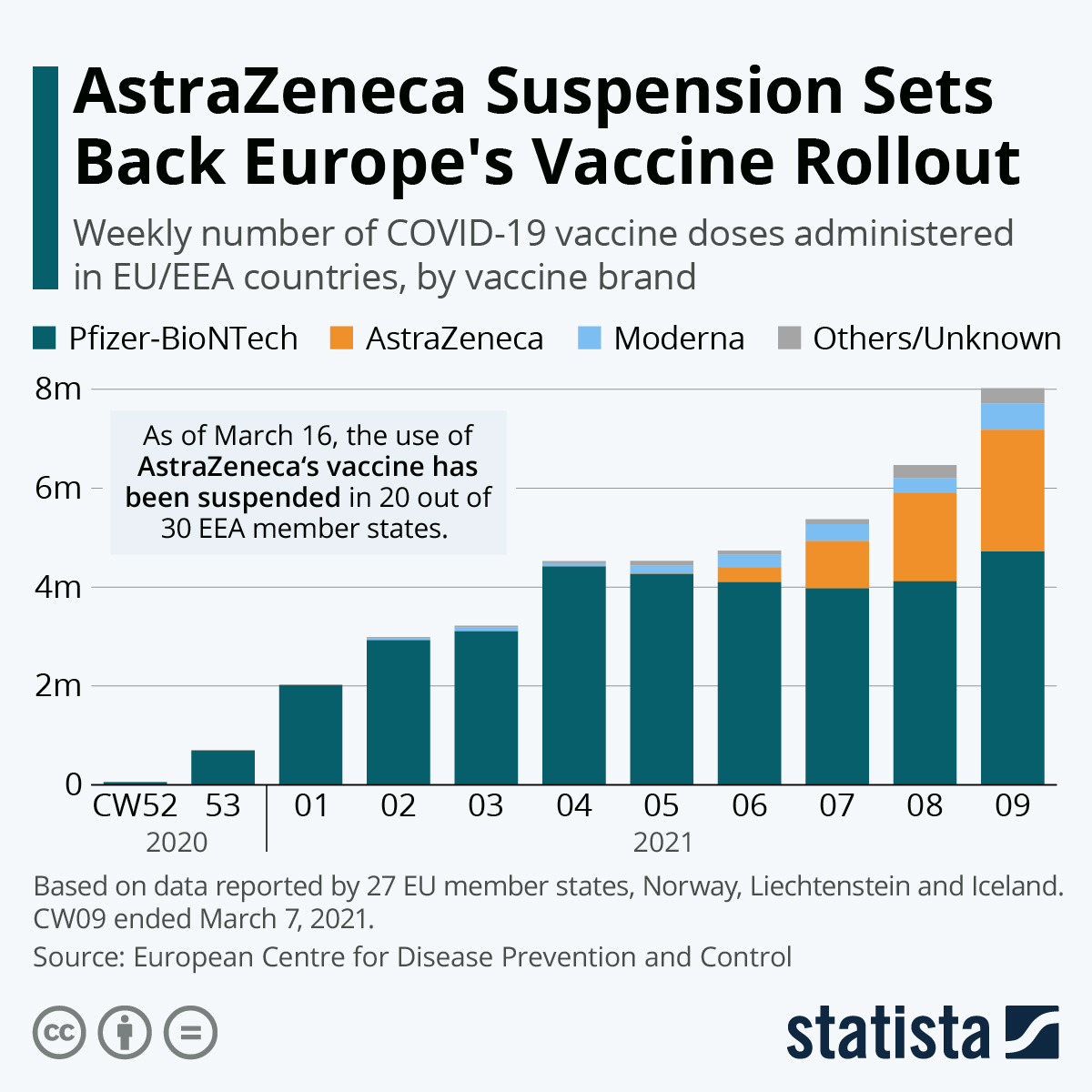

- Most European nations have suspended use of AstraZeneca’s COVID-19 vaccine after some recipients developed blood clots.

- Australia is urging the European Union to divert 1 million doses of AstraZeneca’s vaccine shipments to Papua New Guinea, where a wave of COVID-19 infections is threatening the island nation’s health supplies.

- The European Union’s medicines regulator said the benefits of AstraZeneca’s COVID-19 vaccine outweigh its possible risks.

- Mexico and Canada will learn by the end of the week whether the U.S. will share supplies of AstraZeneca’s COVID-19 vaccine. Mexico’s health minister laid out plans to vaccinate 600,000 people a day starting in April.

- An Italian company is expanding production of Johnson & Johnson’s one-shot COVID-19 vaccine for use in Europe.

- Nicaragua received its first batch of COVID-19 vaccines yesterday thanks to the COVAX international effort to donate shots to low-income countries.

- Israel is facing increasing opposition from the few remaining groups left to receive COVID-19 vaccines, as the government warns that holdouts could increase the risk of spreading highly infectious variants.

- “Vaccine nationalism” could derail the planned shipments of about 2 billion doses to low-income countries, the world’s largest vaccine maker says.

- China’s government eased restrictions on foreign citizens entering the country, but only for those who have received a China-made COVID-19 vaccine.

- Vietnam, among the nations least impacted by COVID-19, is considering vaccine passports and reopening the country to international travel.

- The Philippines is blocking the arrival of some foreigners and returning citizens as COVID-19 cases begin another surge, mostly tied to variants of the disease.

- Japanese exports fell 4.5% year-over-year in February, faster than expected as U.S. and China-bound shipments weakened. Meanwhile, confidence among Japanese manufacturers strengthened in March.

- Japanese companies are set to offer the lowest wage increases in nearly a decade this year, a sign the pandemic is ending the government’s previously generous policies to combat deflation.

- Audi said it will stop development of new internal combustion engines.

- More than $130 trillion of investment in clean energy will be needed by 2050 to limit the globe’s warming to 1.5 degrees Celsius, the benchmark measure of the Paris climate agreement.

Our Operations

- Visit our new 3D Printing e-commerce site.

- Listen to M. Holland’s 2021 Market Trends Podcast Series episodes featuring insight from our Market Managers.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.