COVID-19 Bulletin: March 19

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices fell nearly 8% Thursday, the largest daily percentage loss since last summer amid new concerns about the pace of the global economic recovery. Crude futures were higher in mid-day trading today, with the WTI up 1.2% at $61.17/bbl and Brent 1.7% higher at $64.36/bbl. Natural gas was 1.8% higher at $2.53/MMBtu.

- Spot rates for physical crude in Asia are dropping on lower demand from Chinese buyers.

- Global oil demand is set to continue increasing until at least 2026, according to the International Energy Agency.

- Oil major BP plans to build the U.K.’s largest hydrogen project, which could produce up to a gigawatt of blue (natural gas-based) hydrogen by 2030.

- China’s planned investments in green energy over the next few decades could cost up to $6.4 trillion.

- New Texas bills would require power plants to winterize their facilities and ban electricity providers from offering plans tied to the wholesale market, an effort to prevent repeats of last month’s energy crisis.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Ford is idling plants in Louisville, Kentucky, and Cologne, Germany, and will begin partially building F-150 trucks for final assembly later due to the global shortage of computer chips and other supply shortfalls following Winter Storm Uri.

- Nissan is curtailing production at auto plants in Mississippi, Tennessee and Mexico due to a shortage of computer chips.

- Honda, which yesterday announced it is suspending production at plants in the U.S. and Canada, said it also will suspend production in Mexico due to supply chain issues.

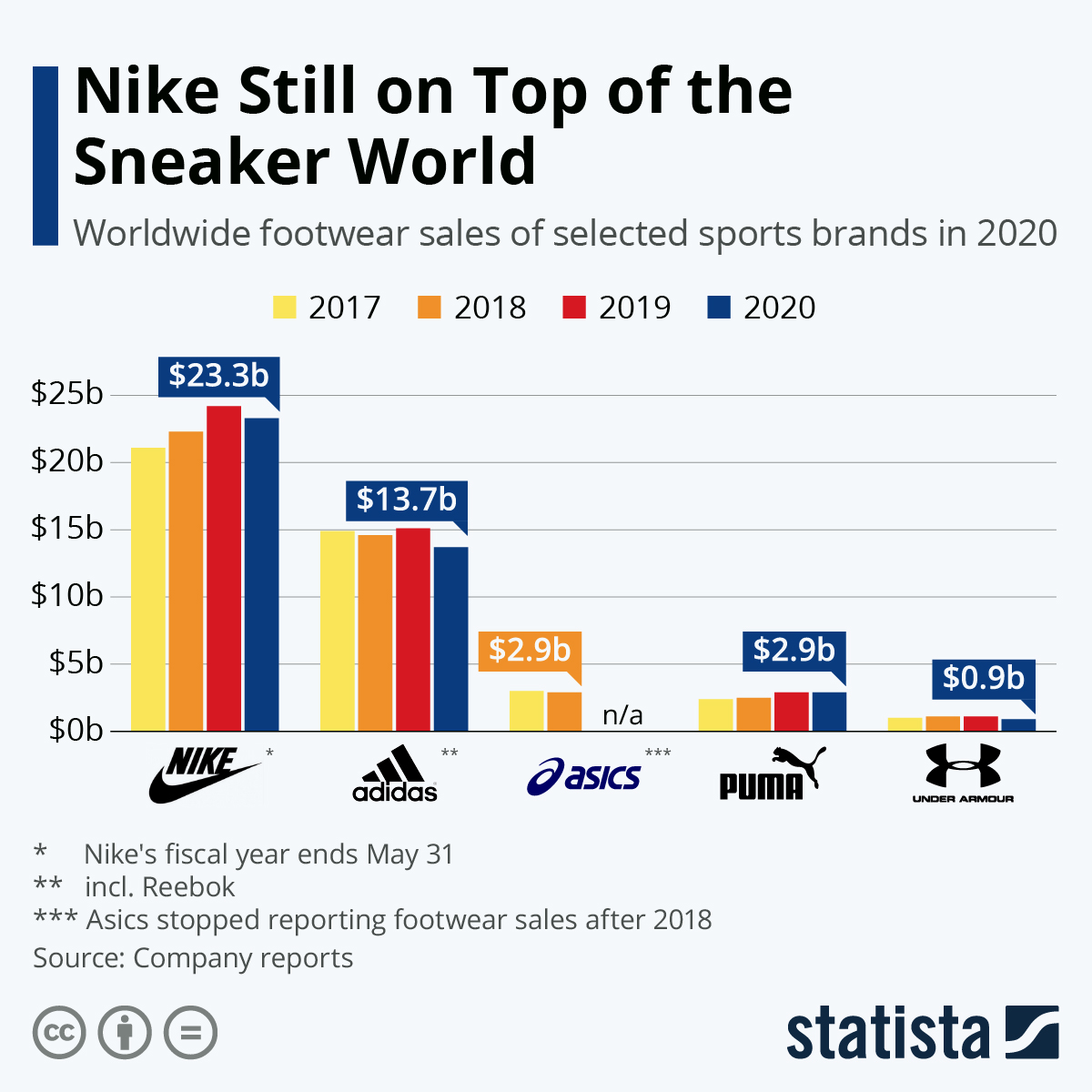

- Although Nike is still selling the most sneakers globally, the company blamed port congestion and supply chain challenges for an 11% drop in North American revenues in its most recent quarter.

- Officials are projecting the backup at U.S. ports, particularly Los Angeles and Long Beach, to continue into the summer. Imports at those ports surged 52% in February from the year-ago period while exports were down 15%, a historic trade imbalance.

- Seaborne trade volumes are estimated to end above pre-pandemic levels in 2021, with the average price of containers expected to remain high while tanker rates are expected to remain low.

- Online styling service Stitch Fix is diversifying its parcel carriers to combat clogged logistics networks.

- A record holiday shopping season led FedEx to higher-than-expected earnings in its most recent quarter.

- Amazon’s industrial supply unit surpassed $25 billion in annualized gross merchandise sales, a sign the young operation could dominate business procurement solutions in the coming years.

- Members of the new U.S. administration and China representatives sparred at their first face-to-face meeting in Alaska yesterday, with American officials espousing continued “stiff competition” with their primary economic competitor.

- Delta Electronics is cutting its workforce in China by 90% as it moves production to other Asian nations to avoid rising labor costs and U.S.-China trade tensions.

- The U.S. government is helping American miners and battery makers expand into Canada, part of a strategy to boost regional production of minerals used in electric vehicles and to counter Chinese dominance.

- The trucking industry is coalescing in opposition to a potential miles-driven tax being floated by some lawmakers to pay for new infrastructure spending.

- CSX faces an anti-trust challenge to its planned acquisition of Pan Am Railways, a regional carrier in New England.

- A shortage of corrugated material is requiring some suppliers to ship in boxes that may not be stackable. Such unstackable packaging should be clearly marked. In the interest of safety, we urge clients and our fulfillment partners to notify anyone involved in logistics operations to be mindful of the shortage and careful to heed warning labels that may appear on resin containers.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- There were 59,822 new COVID-19 cases and 1,611 deaths in the U.S. yesterday. Over 115 million vaccine doses have been administered, with 12% of the population fully vaccinated.

- The U.S. is set to administer its 100-millionth COVID-19 vaccine dose today, a milestone.

- New York’s concert venues and baseball stadiums will reopen at limited capacity in April as COVID-19 rates drop and vaccinations increase across the state.

- Johnson & Johnson is already working on the next round of COVID-19 vaccines that will target highly infectious strains of the virus.

- Walmart is the latest U.S. vaccine provider to push for an international, digital passport that would verify a person’s COVID-19 vaccination status at airports, schools and other locations.

- Those over age 65 are significantly more likely than younger populations to become reinfected with COVID-19.

- State and local governments are on the cusp of receiving $350 billion in pandemic aid as part of the recently passed $1.9 trillion stimulus bill, funds that will go toward reducing budget shortfalls caused by the pandemic.

- The U.S. government has issued nearly 90 million stimulus payments worth $242 billion so far, more than half the estimated total under the latest stimulus package.

- U.S. factory activity in the mid-Atlantic region reached its highest level in nearly 50 years in March, boosting optimism about the jobs market.

- With the crash of the leisure and hospitality sector, Las Vegas suffered some of the worst unemployment rates of any major metropolitan area last year.

- The U.S. dollar has risen nearly 2.5% against the currencies of major trading partners since early January, a positive sign for economic recovery that also portends higher inflation risk.

- In a move that could roil credit markets, the Federal Reserve said today it will not extend a pandemic rule that eased capital requirements for banks.

- Parents of children in remote classes are more likely to report poorer well-being for themselves and their kids, the CDC said.

- Roughly 15% of parents of public-school students nationally have organized their children into “learning pods,” where groups of remote-learning students gather to attend online classes.

- Google will spend $7 billion this year on expanding offices and data centers across the U.S., bucking the trend of other companies making permanent shifts toward remote work or reducing their real estate holdings.

- Established car makers are pulling in significant new investment dollars amid the industry’s accelerating shift into electric vehicle production.

- Shares of two much-hyped electric vehicle startups — Nikola and Lordstown — are down roughly 50% from highs this year as a number of large investors reduced their stakes.

- New research from the Independent Data Corporation shows that shipments of wearable electronics reached 445 million in the fourth quarter of 2020, a 28% increase from 2019.

- Facebook unveiled two prototypes for a wearable wristband that allows the user to interact with virtual reality by moving their fingers.

- Global video streaming subscriptions surpassed 1 billion worldwide last year, while box-office revenues plunged more than 70%.

- Colgate-Palmolive is relaunching its most popular dish soap, Palmolive Ultra, with new biodegradable ingredients and a bottle made from 100% recycled-content PET.

International

- The number of COVID-19 patients in French ICUs reached 4,246 yesterday, a high for 2021. The resurging virus has prompted a month-long lockdown in Paris, which will affect 42% of the economy and delay the consumer-led recovery there.

- Hospitals in Italy are again postponing elective surgeries as hospitalizations soar from a third COVID-19 wave, one year after becoming the first Western nation to enter lockdown.

- With Brazil experiencing record COVID-19 infections, Sao Paulo, the nation’s largest city, is pulling forward national holidays through November 2022 to create a holiday week surrounding Easter to discourage travel and circulation.

- Mexico is curbing travel on its southern border with Guatemala to help contain the spread of COVID-19.

- The U.S. will donate 4 million doses of AstraZeneca’s COVID-19 vaccine to Mexico and Canada.

- AstraZeneca’s COVID-19 vaccine is “safe and effective” and doesn’t increase the risk of blood clots, the European Union’s health agency said yesterday. Germany, France, Italy, Portugal and Spain said they would resume administering the shots, while other European nations are expected to follow.

- More than half of all adults in England have received their first COVID-19 vaccine. However, the nation will be forced to slow its rollout next month due to delayed shipments of AstraZeneca shots from India.

- Germans over age 80 have seen COVID-19 infection rates plummet by 80% since December, the first positive sign of the nation’s otherwise slow immunization campaign.

- AstraZeneca’s and Pfizer’s COVID-19 vaccines help protect patients from the highly infectious Brazilian variant, a study shows.

- Competition for COVID-19 vaccines has left developing countries in Latin America, Asia and Africa far behind rich nations in inoculating their citizens, leaving health professionals there particularly vulnerable to infections.

- More than 60% of Israelis have received at least one shot of a COVID-19 vaccine, thanks to the country’s wealth, small size and competitive universal healthcare system.

- The Philippines cleared Russia’s Sputnik V COVID-19 vaccine for emergency use.

- Greece has made its second early repayment of IMF loans worth nearly $4 billion, a positive sign after the nation’s faltering economy required three international bailouts since 2010.

- Canada’s national debt jumped to nearly 50% of GDP in 2020 from 23.4% the previous year.

- India’s rupee is the only major currency in Asia to strengthen this month amid a rout in risk assets.

- A United Nations-backed CO2-trading plan to reduce emissions from global airlines is expected to fall far short of European Union climate goals.

- Methane gas leaks from new coal mines could be just as polluting as the emissions resulting from burning the fuel for energy, a new study shows.

- German meal-kit company HelloFresh plans to slash CO2 emissions by 60% across its global operations by 2022.

Our Operations

- M. Holland is proud to be named among the Plastics News Best Places to Work again this year. We also were recently named among the Best Places to Work by Crain’s Chicago Business.

- Visit our new 3D Printing e-commerce site.

- Listen to M. Holland’s 2021 Market Trends Podcast Series episodes featuring insight from our Market Managers.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.