COVID-19 Bulletin: March 21

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices settled higher Friday but fell around 4% for the week, their second straight weekly loss. In late-morning trading today, WTI futures were up 5.9% at $110.90/bbl, Brent was up 6.6% at $115.00/bbl and U.S. natural gas was up 0.6% at $4.90/MMBtu.

- OPEC+ production fell short of targets by 1 million bpd last month, even greater than January’s underproduction.

- A group of Yemeni rebels barraged Saudi Aramco’s energy facilities with missile strikes Sunday, sparking a fire at one site and temporarily cutting output at another, officials say.

- The global oil market is set for a 700,000-bpd supply deficit in the second quarter, the International Energy Agency said. The group cut its demand forecast by over 1 million bpd for the rest of the year and said consumers in advanced economies should travel less, drive slower and use more public transport to cut down on usage.

- More oil news related to the war in Europe:

- Halliburton, the world’s second largest oilfield-services company, halted shipments of sanctioned parts and products to Russia and suspended all future business in the nation.

- Russia’s top gas supplier Gazprom has not booked any space to send natural gas to Germany via the Yamal-Europe pipeline for the month. The supplier is also keeping its current gas transit volumes through Ukraine for April, failing to offer any additional capacity for the nation.

- Germany could replace half its natural gas imports from Russia this year in the event of a complete delivery stoppage, an industry association said.

- Germany inked a new long-term LNG supply deal with Qatar, hoping to reduce its reliance on Russian supply.

- Italy will impose a windfall profit tax of 10% on some energy companies to finance a $5 billion package to protect consumers and businesses from soaring prices.

- Bulgaria will not renew a natural gas supply contract with Russia’s Gazprom set to expire at the end of the year that provides roughly half the nation’s supply.

- Australia is donating at least 70,000 tonnes of thermal coal to help meet Ukraine’s energy needs.

- Russian crude shipments to China dropped by 9% in the first two months of 2022, as Saudi Arabia regained its spot as China’s top crude supplier.

- U.S. gasoline prices averaged $4.27 a gallon Friday, down from a peak of $4.33 a week earlier, according to AAA.

- Maryland and Georgia suspended state gas taxes.

- The White House will resume plans for oil and gas drilling on federal lands following judicial approval of its request to use a revamped metric for calculating the cost of emissions.

- The U.S. Gulf Coast will see LNG plant construction accelerate in the coming months, with five projects approved in Louisiana and another seven in Texas and Mississippi.

- American energy producer Venture Global LNG struck supply deals that will make it one of China’s largest sources of LNG.

- U.S. oil exports to India are expected to rise some 11% this year, reports say.

- Saudi Aramco’s net profit more than doubled to $110 billion in 2021, the highest since its shares began trading publicly in 2019. The company pledged to hike investments by around 50% this year toward sharply increasing crude and gas production by the end of the decade.

- Canadian oil sands producers are set to increase free cash flow by over 60% this year as high oil prices offset heavy upfront investments made years ago.

- Sri Lanka ran out of crude stocks for its only refinery over the weekend. At least two people died while waiting in massive lines to get fuel.

- Shell is taking a second go at gaining approval from British regulators for a large North Sea gas field after the producer’s first plan was rejected over environmental concerns.

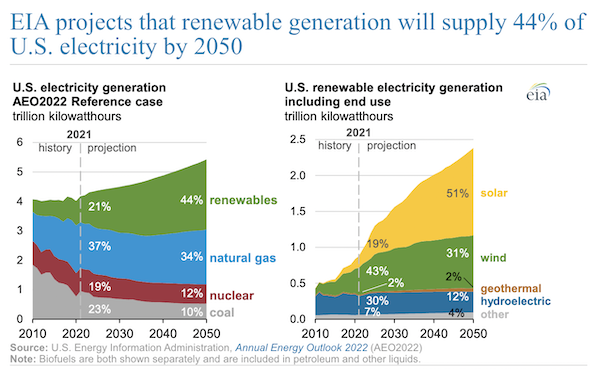

- The share of U.S. power generation from renewables will more than double from the current 21% to 44% by 2050, the Energy Information Administration predicts.

- Equinor expects renewable energy to account for at least 10% of its energy output by 2030.

- Occidental Petroleum’s new agreement to sell carbon credits to Airbus could justify the producer to go forward with building the world’s largest carbon capture plant, a key part of its budding energy transition business.

Supply Chain

- A strike by more than 3,000 Canadian Pacific (CP) Railway workers over the weekend halted all CP operations Sunday, stalling shipments of key manufactured goods and commodities.

- With labor talks for West Coast dockworkers set to begin in the coming months, shippers are preemptively pulling forward holiday-season orders and diverting more cargo to East Coast and Gulf Coast ports.

- Throughput at the Port of Los Angeles hit a record 857,764 TEUs in February, up 7.3% from the same time last year. February volumes at the Port of Long Beach rose 3.2% from last year after hitting an all-time high the previous month.

- More than 35 ships are waiting to dock in Shenzhen and another 30 are waiting further north in Qingdao, as on-land backups — including warehouse closures and frequent COVID-19 screenings for truckers — slow the movement of cargo in major trade hubs.

- U.S. diesel prices averaged a record-high $5.25 per gallon last week, up 40¢ from the previous week and $1 from two weeks earlier.

- U.S. rail carloads were up an annual 3.2% and intermodal units were down an annual 7.2% for the first 10 weeks of the year, according to the Association of American Railroads.

- Retailers and wholesalers traded more warehouse space than ever before last year while vacancy rates hit a record-low 3.4% across-the-board. Four markets had vacancy rates below 1%, including Los Angeles (0.2%).

- Snowplow driver shortages were rampant this winter as state transportation agencies faced greater competition for drivers from private sector driving services.

- Over 90% of long-haul truckers — roughly 500,000 U.S. workers — could eventually be replaced by self-driving technology, a new study from the University of Michigan suggests.

- CMA CGM is expanding its fleet with orders for a 23,000-TEU megaship, a 7,400-TEU mid-size vessel and charters for at least three under-construction neo-panamax boxships.

- Despite a $1 billion revenue gain last quarter, FedEx’s ground parcel unit suffered a $61 billion profit decline due to inefficiencies caused by labor shortages.

- Amazon Air more than doubled flights in Europe over the past six months as it rapidly expands its cargo fleet.

- Lufthansa is restarting intra-Europe short- and medium-haul freighter routes for the first time since the early 2000s.

- Google launched two new cloud services aimed at helping logistics operators optimize last-mile delivery.

- More supply chain news related to the war in Europe:

- The London Metal Exchange rejected a proposal to ban new supplies of Russian copper from its market.

- Demand for smaller bulk-size carriers could drop after Russia’s ban on certain exports punctures 15% of global trade in fertilizers, among other implications. The Green Markets North American Fertilizer Price Index has doubled in the last 12 months to a new record.

- Russia’s largest cargo airline, Volga-Dnepr Group, suspended flights with Boeing 747s and 737s, a response to sanctions that promises to remove capacity from the already stretched global air-freight fleet. The airline is also considering major staff cuts.

- Australia banned aluminum exports to Russia with immediate effect, a move likely to hamper Russia’s ability to profit on components exports.

- Turkey is stepping in to replace Russian exports of steel to Europe.

- The loss of Eastern European farm exports will hit the Middle East and North Africa the hardest, analysts say, with some countries already banning their own wheat exports and imposing ceilings on food-price increases. Ukraine, the world’s fifth-largest wheat exporter, may be forced to halt all shipments this year as its food supply chain falls apart.

Domestic Markets

- The U.S. reported 6,623 new COVID-19 infections and 75 virus fatalities Sunday.

- Over 50% of small business owners said that higher energy prices were affecting their business, according to a new survey.

- Delta Air Lines is raising U.S. ticket prices by up to 10% to reflect higher fuel prices, a trend adopted across the airline industry.

- U.S. existing home sales fell 7.2% to a six-month low in February, reflecting rising mortgage rates and continued short supply.

- China’s CATL, the world’s biggest maker of batteries for electric vehicles, is considering sites across North America for a massive $5 billion plant to supply customers, including Tesla.

- A Boeing 737-800 plane operated by China Eastern Airlines crashed in southern China Monday with over 130 people on board. The airline will ground all passenger flights for the model starting Tuesday as it investigates the incident.

- GM invested another $3.5 billion in its self-driving Cruise unit after Japan’s SoftBank Group pulled its investment over questions about the unit’s ability to generate revenue.

- The U.S.’s largest credit-reporting firms agreed to cut around 70% of medical debt in collections accounts from credit reports, a significant constraint for many consumers seeking to borrow.

- Investors poured over $90 billion last year into companies tied to sustainability efforts.

International Markets

- More news related to the war in Europe:

- Russia’s invasion of Ukraine has forced more than 10 million residents to flee their homes to other parts of the nation or abroad.

- More than 400 companies have announced plans to suspend or scale back their Russian operations since late February, as some 80 others draw criticism for remaining in the nation.

- Agricultural firms, such as Cargill Inc., Bayer AG and Archer Daniels Midland, have opted to continue their operations in Russia due to humanitarian concerns regarding food availability for residents of the nation and other countries.

- S&P Global cut Russia’s credit rating to “CC,” meaning “default imminent with little prospect for recovery,” while at least 30 companies’ credit ratings hit junk status over their ties to the nation.

- Over 30% of Ukraine’s economy has come to a complete halt since Russia’s invasion, officials say.

- The Ukrainian refugee exodus surpassed 3.5 million people Friday.

- Over 4,000 new COVID-19 infections were reported across China on Sunday, with strict lockdowns going into effect on millions more people in the country’s northeast starting tonight. The nation reported its first mainland virus deaths in more than a year.

- Disney closed its theme park in Shanghai, while Shenzhen allowed some businesses and shops to reopen after a weeklong lockdown.

- Tesla resumed production at its Shanghai factory Friday following a two-day shutdown that resulted from strict pandemic protocols in China.

- Hong Kong is easing its zero-tolerance stance against COVID-19, restoring some flights, and reducing quarantine requirements and other restrictions in the face of stiff opposition from businesses and citizens. Nearly 23,000 residents left the city last week to escape the lockdown.

- South Korea reported 209,169 new COVID-19 infections Monday, down from a record 621,281 reported Thursday, though the fall in cases is likely attributed to less testing over the weekend, sparking concerns that infections rates could quickly rise again.

- Vietnam announced plans to reopen its borders with minimal restrictions compared with the rest of Southeast Asia, requiring air travelers to provide a negative COVID-19 test but not quarantine or show proof of vaccination.

- Japan is ending all remaining pandemic restrictions today.

- Austria will reintroduce its indoor mask mandate Wednesday, just weeks after ending it, due to a surge of the Omicron subvariant in Europe.

- A fourth COVID-19 vaccine dose provided moderate protection against symptomatic infection than those with only three doses, an Israeli study suggests.

- Canadian retail sales are thought to have slumped in February following a 3.2% rise the previous month, economists say.

- Canada’s population returned to pre-pandemic levels of growth last year, new data shows.

- Japan will invest $42 billion in India over the next five years. Suzuki is putting $1.4 billion into an Indian factory to produce electric vehicles and batteries.

- Rising commodity prices paired with ongoing supply chain disruptions have prompted Egypt’s central bank to raise its key interest rates by 100 basis points, its first rate hike since 2017.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.