COVID-19 Bulletin: March 22

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- More oil news related to the war in Europe:

- Oil prices rose more than 7% Monday on news that the EU may join the U.S. in a Russian oil embargo, a measure with rising support from member nations.

- In mid-morning trading today, WTI futures were down 2.0% at $109.90/bbl, Brent was down 1.0% at $114.50/bbl and U.S. natural gas was 3.1% higher at $5.05/MMBtu.

- German officials are intensifying calls for OPEC to boost production.

- Russian natural gas transit to Europe via Ukraine continues on schedule, officials say.

- The U.K. is preparing to step in and temporarily run the British supply arm of Russia’s Gazprom, which supplies more than 20% of the nation’s commercial gas volume.

- Roughly 9 million barrels of Russian oil will offload in the U.S. this month, the most since July, ahead of an import ban that begins in April.

- Albanian cities should turn off lights in public buildings and on streets wherever possible, authorities said, as the tiny European nation struggles with surging power prices.

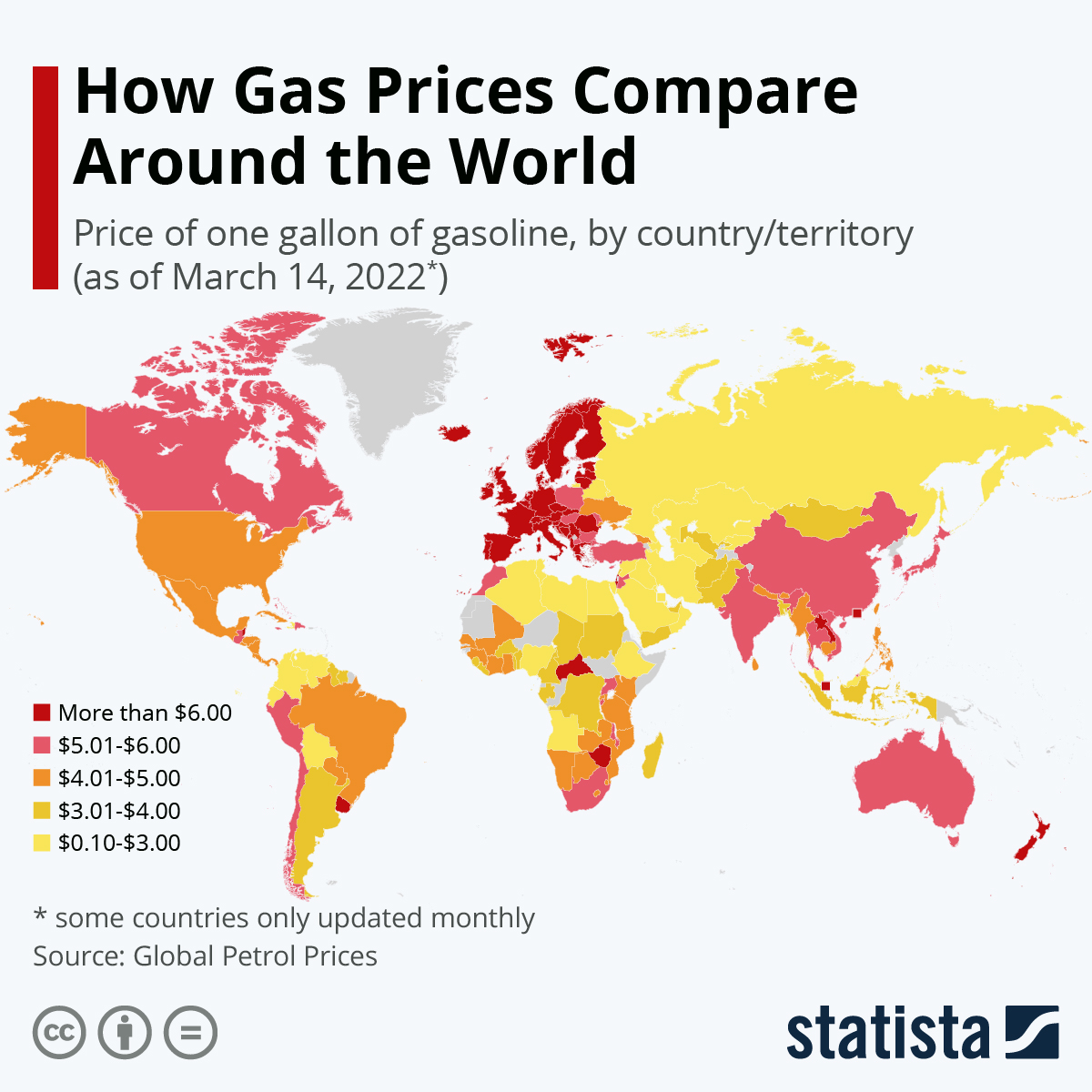

- Europe has some of the highest gasoline prices in the world, with much of the continent paying upward of $6 a gallon as of last week.

- The number of active U.S. oil rigs is up by 20% over the past six months.

- Five hundred workers at a Chevron refinery in California went on strike Monday over a contract dispute.

- A refinery operated by Norway’s Equinor was evacuated Monday after a fire broke out near the facility. Separately, an earthquake temporarily shut down one of the producer’s North Sea platforms.

- Japanese coal plants are struggling to return online following last week’s earthquake, as officials warn of blackouts this week due to low power supplies.

- Some Indian coal buyers are paying a premium of 340% above baseline prices at auction due to a supply crunch.

- Vitol Group, the world’s largest independent oil trader, says global oil demand will surpass pre-pandemic levels this year and rise for the next decade before gradually declining.

- A joint venture between Exxon Mobil and Qatar Petroleum reaffirmed the discovery of a new reservoir of high-quality gas offshore Cyprus.

- Honda will test mass production of biofuels and plastics from its carbon-capture algae farms this fall and may, if successful, commercialize the technology.

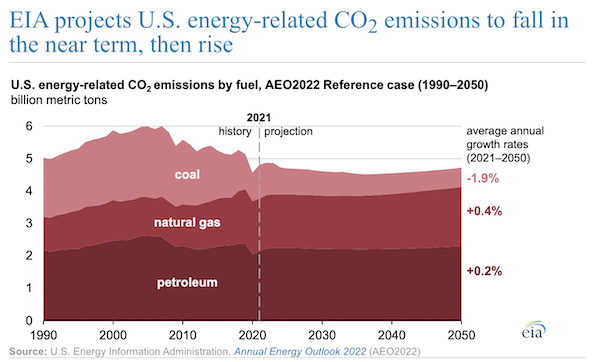

- The U.S. government expects a rise in emissions from higher natural gas and petroleum use to offset gains from the long-term phaseout of coal power:

Supply Chain

- Severe weather will hit Texas this week, with wildfires growing in the western part of the state and floods threatening the Houston area.

- An index of U.S. warehouse inventory levels grew last month at its fastest recorded pace since data collection began six years ago, with retailers finally making headway in restocking.

- The cost of goods imported into the U.S. rose 1.4% from January to February and 10.9% from a year earlier.

- Shenzhen launched a six-times-weekly air freight service to Hong Kong to help make up for losses in trucking capacity due to recent lockdowns. In separate news, Apple supplier Foxconn resumed full operations in Shenzhen after a week of shutdowns.

- J.B. Hunt plans to grow its intermodal fleet to as many as 150,000 containers in the next five years, a 40% increase in concert with capacity growth at BNSF Railway.

- Crews are still trying to free an Evergreen container ship that ran aground near the Port of Baltimore last week.

- China’s CATL, the world’s biggest maker of batteries for electric vehicles, is raising prices for its products by an unspecified amount to reflect higher raw material costs. The company expects carmakers to raise prices in tow.

- Chinese smartphone shipments dropped more than 30% in February from a year earlier due to semiconductor shortages.

- After quadrupling last year, prices for lithium are up nearly 95% since the start of 2022, with the global energy transition driving higher demand for the key battery component.

- More supply chain news related to the war in Europe:

- Ford is slowing production in Germany and Spain this week due to parts shortages from Eastern Europe.

- British steel maker Evraz said its $18.9 million interest payment due yesterday was blocked by sanctions on one of its large Russian shareholders.

- Russia’s AvtoVAZ, the maker of Lada cars, is extending month-long production shutdowns due to a shortage of electronics.

- Banks and exchanges are requesting significant cash up front to trade oil and other commodities, straining markets and hindering the movement of materials well beyond Russia and Ukraine.

- The EU is likely to tap its $551 million agricultural crisis fund for the first time ever to support farmers and ensure food supplies.

- A British internet-from-space provider will launch its technology on rival SpaceX’s rockets after Russia refused to provide more launching services.

- Germany is looking to kickstart European free-trade talks with the U.S. after negotiations were halted during the prior U.S. administration.

- Taiwanese regional container carrier Wan Hai Lines will issue $2 billion in bonds to fund a fleet expansion.

- Maserati said it plans to revamp its distribution strategy by fulfilling specific dealer orders instead of maintaining dealer inventories.

- South Dakota culled 85,000 birds across two state facilities following an outbreak of bird flu, the first since 2015.

Domestic Markets

- The U.S. reported 44,101 new COVID-19 infections and 1,472 virus fatalities Monday.

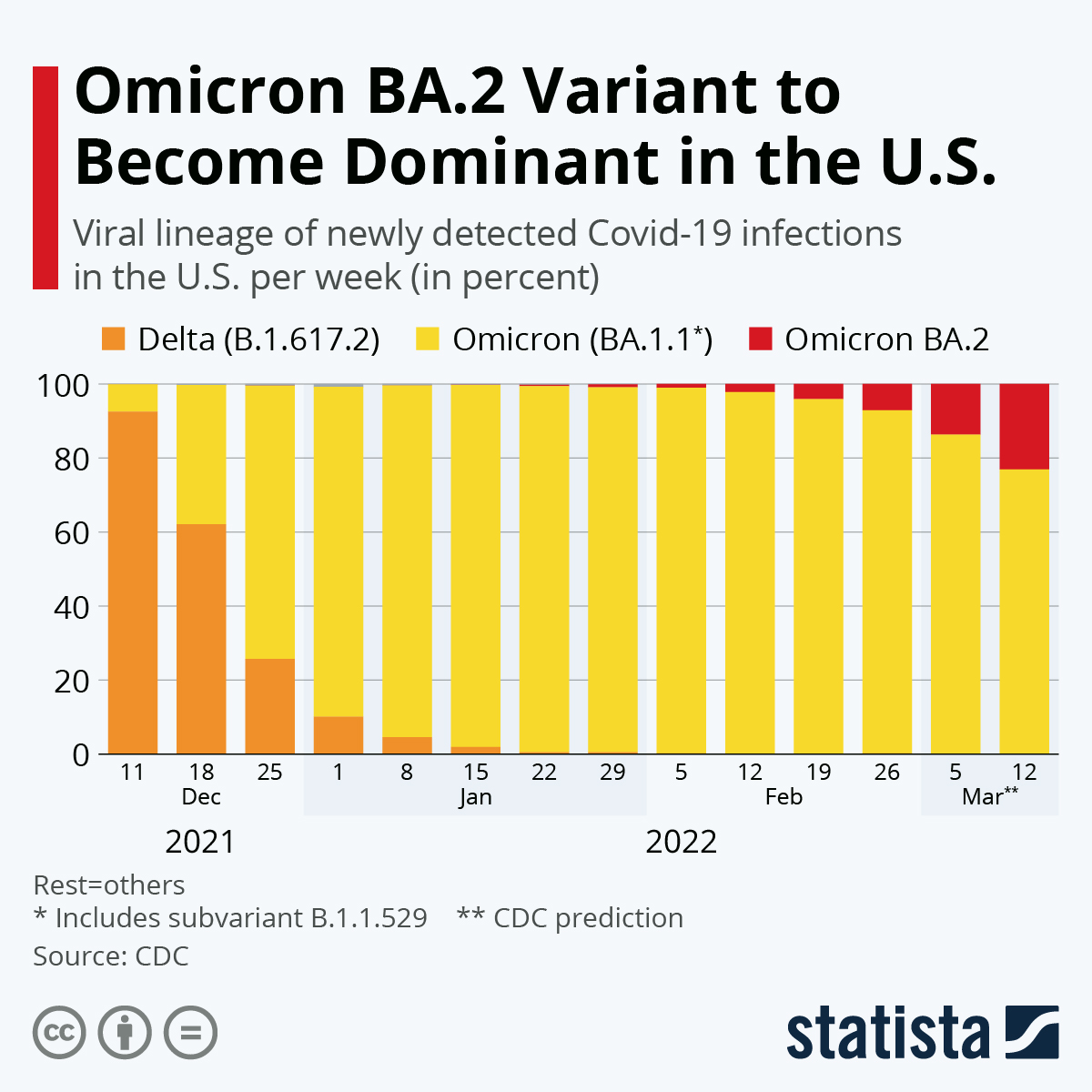

- The CDC predicts that the BA.2 “stealth” subvariant of Omicron will soon become dominant in the U.S., while independent research suggests it already accounts for over 50% of cases:

- The Omicron variant led to the highest rates of hospitalization for children under age 5 during the pandemic, new data shows.

- On Monday, New York City’s seven-day average rate of new COVID-19 cases was up 10% from the prior week, while the virus transmission rate rose 17%.

- Los Angeles County will lift its pandemic restrictions for large sporting and entertainment events on April 1.

- South Dakota ended its daily COVID-19 reports last week as infection numbers decline statewide.

- The first of many expiring rounds of federal pandemic funding ends today, impacting mostly uninsured Americans and their ability to submit claims for viral testing and treatment. Yesterday, the White House renewed a push for Congressional approval for $22.5 billion in additional funding for pandemic programs.

- New research suggests people infected with COVID-19 are 40% more likely than uninfected people to be diagnosed with diabetes after recovering.

- The FDA is ramping up activity to pre-pandemic levels after new data shows facility inspections fell by over 50% in 2021 because of pandemic disruptions.

- The Federal Reserve indicated it could raise rates by a half percentage point at its next meeting, a more aggressive pace than originally forecast.

- California’s most expensive technology hubs saw some of the smallest gains in rental prices during the pandemic, according to the latest housing data.

- A greater focus on flexible work arrangements has led to a significant rise in phased retirement programs, where workers reduce hours but keep parts of their salary and benefits.

- Grocery store prices are up 8.6% from the same time last year, while most standard lunch items are up by double-digit percentages, according to payments company Square.

- An unexplained outage shut down many of Apple’s most used services Monday, including digital applications, intra-company communications and some retail operations.

- The SEC unveiled its latest proposal to require public firms to report emissions and climate data in their annual filings. The measure heads to a two-month comment period before regulators work on a final set of rules.

- The first much-awaited Cadillac Lyriq, an electric crossover, rolled off the production line Monday as the automaker preps to build 200,000 of the vehicles per year.

- Volkswagen is investing $7.1 billion to bring 25 new electric vehicles to the North American market by 2025, including a potential electric truck.

- Mercedes says operations at its Alabama facility will be carbon-free by 2024.

- Ford’s F-150 Lightning electric pickup has even greater mileage than previously thought, according to tests run by the U.S. government.

- The International Recycling Group announced plans to build a 25.5-acre site in Erie, Pennsylvania, that will sort mixed plastics and produce recycled HDPE, PET and PP pellets and flakes.

- A territorial dispute over waters between Nebraska and Colorado is ratcheting up as resource-heavy development grows in nearby Denver.

International Markets

- More news related to the war in Europe:

- The Moscow Exchange resumed limited trading of federal loan bonds yesterday but kept its stock market closed alongside other restrictions.

- Goldman Sachs and Barclays economists predict a double-digit contraction in Russia’s economy this year due to sanctions.

- Russia’s largest airport furloughed over one-fifth of its staff after demand dropped off by 70%.

- The U.K. reported over 226,000 new COVID-19 cases Monday, a record and some 37% higher than a week ago.

- France is averaging 89,000 new COVID-19 cases per day, up from 60,000 a week ago after the nation eased all pandemic restrictions.

- China reported over 2,281 locally transmitted COVID-19 cases yesterday, with the financial hub of Shanghai posting a record daily surge for the fifth day in a row.

- Indonesia is scrapping all restrictions for vaccinated travelers as daily virus cases are down 90% since a mid-February peak.

- South Koreans are turning to telemedicine, technically illegal in the country, as an alternative to overwhelmed hospitals, forcing the government to reconsider its healthcare policy.

- Japan’s imports surged 34% in February on rising energy shipments.

- Chanel is barring up to one-third of South Korean shoppers in a bid to stop bulk buyers from reselling its goods at double-digit markups.

- India is banking on battery swapping stations rather than battery charging stations to boost uptake of electric-vehicle use.

- Autonomous trucking startup TuSimple is prepping to sell its business in China to focus on the U.S. market.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.